A Companys Fiscal Year Must Correspond With The Calendar Year

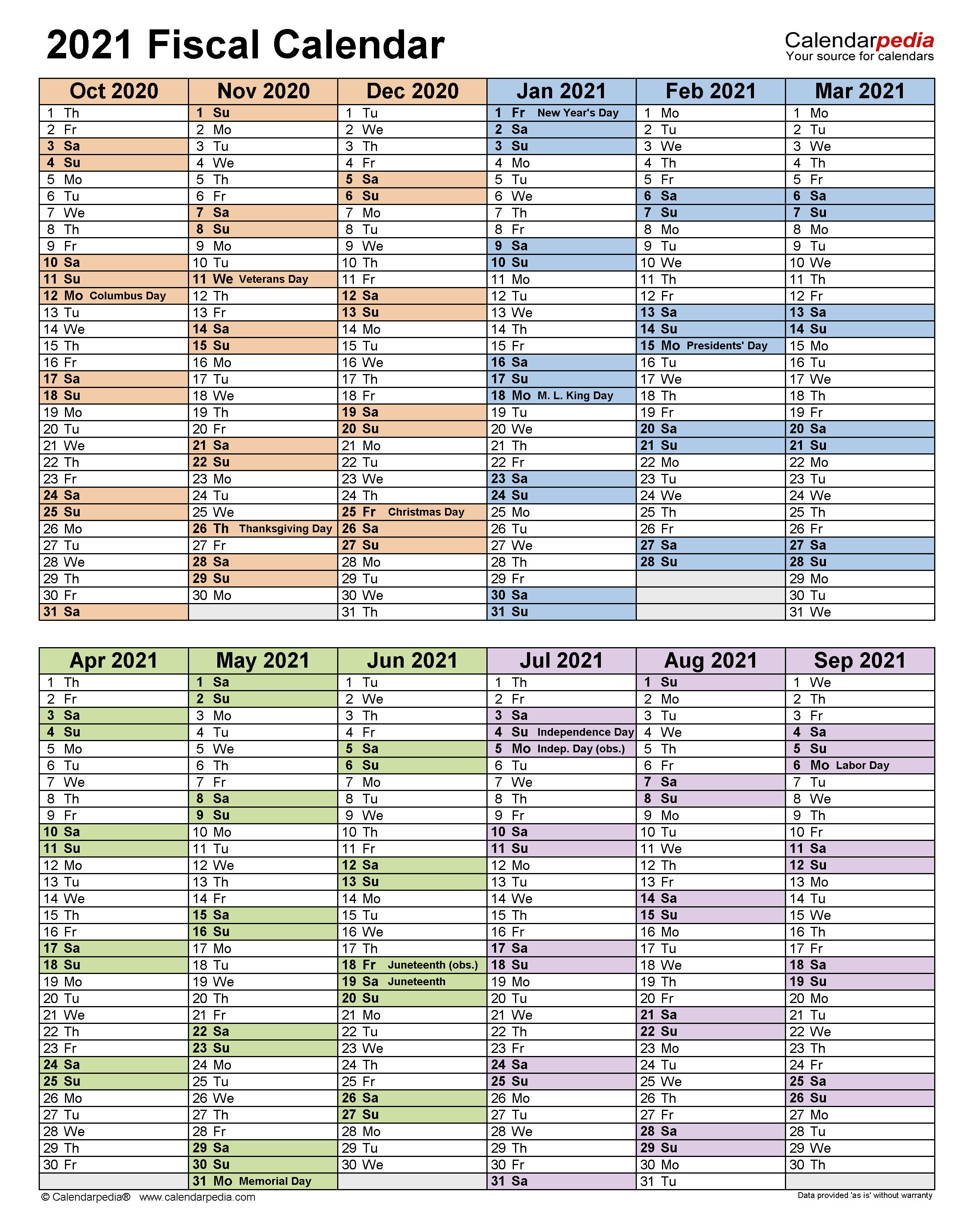

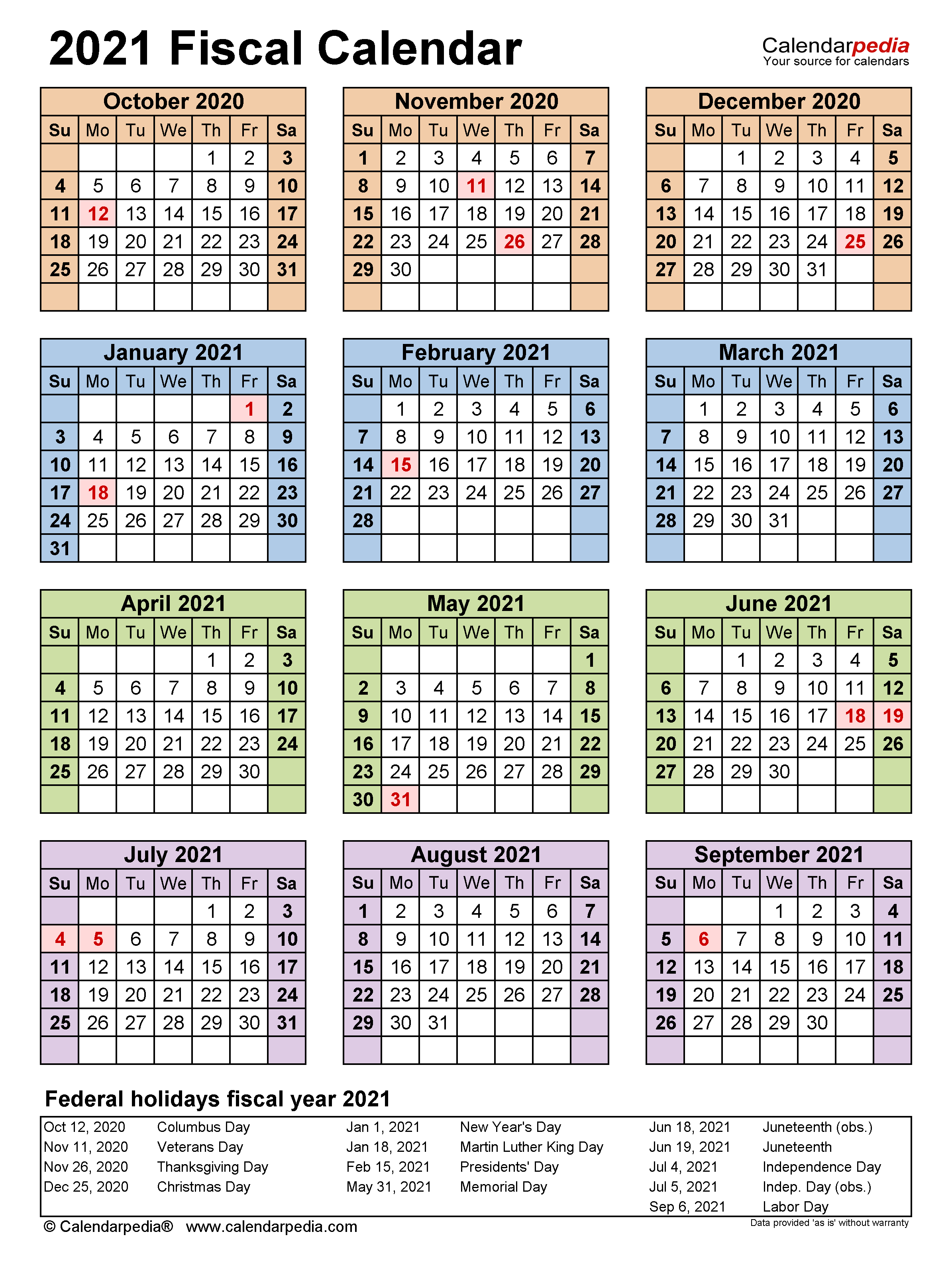

A Companys Fiscal Year Must Correspond With The Calendar Year - Many companies use a fiscal year that. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year. Typical nomenclature would be to refer to the calendar year of the last month of a company's fiscal year. When a company adopts a fiscal year, they also must. Business, corporate, government or individual fiscal year calendars and planners for the us fiscal year 2020 as defined by the us federal government, starting on october 1,. You must use a calendar year if any of the following are true: Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Statutory requirements and tax regulations also influence the determination of a fiscal year. Study with quizlet and memorize flashcards containing terms like a companys fiscal year must correspond with the calendar year, a fiscal year refers to an organizations accounting period. Study with quizlet and memorize flashcards containing terms like a companys fiscal year must correspond with the calendar year, a fiscal year refers to an organizations accounting period. T/f, accounts that appear in the balance sheet are called. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? Many companies use a fiscal year that. A calendar year, as you would expect, covers 12 consecutive months, beginning january 1 and ending december 31. C corporations that use a fiscal year calendar must file their return by the 15th day of the fourth month following the fiscal year close. A company's fiscal year must correspond with the calendar year. For tax, accounting, and even budgeting purposes, it's important to know the difference between a fiscal year vs calendar year. When a company adopts a fiscal year, they also must. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. That ends each fiscal year on a high note for the company and its. Many companies use a fiscal year that. Study with quizlet and memorize flashcards containing terms like a companies fiscal year must correspond with the calendar year. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and. Many companies use a fiscal year that. Study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year. That ends each fiscal year on a high note for the company and its. Business, corporate, government or individual fiscal year calendars and planners for the us fiscal year 2020 as defined by the. For tax, accounting, and even budgeting purposes, it's important to know the difference between a fiscal year vs calendar year. Up to 25% cash back the irs requires some businesses to use the calendar year as their tax year. (t/f), the revenue recognition principle is the basis for making adjusting entries that pertain to unearned and accrued revenues. Study with. When a company adopts a fiscal year, they also must. T/f, accounts that appear in the balance sheet are called. Statutory requirements and tax regulations also influence the determination of a fiscal year. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? For tax, accounting, and even budgeting. Fiscal year also consists of 12 — months period but that must be parallel or align with calendar year, starting from 1 january and ends on 31 december. C corporations that use a fiscal year calendar must file their return by the 15th day of the fourth month following the fiscal year close. That ends each fiscal year on a. Study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Study with quizlet and memorize flashcards containing terms like a companies fiscal year must correspond. When a company adopts a fiscal year, they also must. Study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year. Fiscal year vs calendar year: Statutory requirements and tax regulations also influence the determination of a fiscal year. Your solution’s ready to go! Fiscal year vs calendar year: A company with a year going from april 1 2021 to march 31 2022,. Up to 25% cash back the irs requires some businesses to use the calendar year as their tax year. Study with quizlet and memorize flashcards containing terms like a companys fiscal year must correspond with the calendar year, a fiscal year. You must use a calendar year if any of the following are true: Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Fiscal year vs calendar year: Business, corporate, government or individual fiscal year calendars and planners for the us fiscal year. Fiscal year also consists of 12 — months period but that must be parallel or align with calendar year, starting from 1 january and ends on 31 december. That ends each fiscal year on a high note for the company and its. Study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar. Fiscal year also consists of 12 — months period but that must be parallel or align with calendar year, starting from 1 january and ends on 31 december. A company with a year going from april 1 2021 to march 31 2022,. Up to 25% cash back the irs requires some businesses to use the calendar year as their tax year. In the united states, the irs allows businesses to choose a fiscal year or calendar. When a company adopts a fiscal year, they also must. Study with quizlet and memorize flashcards containing terms like a companies fiscal year must correspond with the calendar year. Fiscal year vs calendar year: That ends each fiscal year on a high note for the company and its. Study with quizlet and memorize flashcards containing terms like a companys fiscal year must correspond with the calendar year, a fiscal year refers to an organizations accounting period. Typical nomenclature would be to refer to the calendar year of the last month of a company's fiscal year. A company's fiscal year must correspond with the calendar year. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. You must use a calendar year if any of the following are true: Study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year. (t/f), the revenue recognition principle is the basis for making adjusting entries that pertain to unearned and accrued revenues. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates?A Company'S Fiscal Year Must Correspond With The Calendar Year Imelda

Fiscal Year (FY) Meaning, Examples, Why use Fiscal Year?

Fiscal Year Definition for Business Bookkeeping

What Is A Fiscal Year Vs Calendar Year Ryann Florence

What is the Difference Between Fiscal Year and Calendar Year

A Company'S Fiscal Year Must Correspond With The Calendar Year Imelda

What Is Fiscal Year And Calendar Year Cass Maryjo

What is a Fiscal Year? Your GoTo Guide

Fiscal Year Vs Calendar Year What's Best for Your Business?

A Company'S Fiscal Year Must Correspond With The Calendar Year Imelda

Business, Corporate, Government Or Individual Fiscal Year Calendars And Planners For The Us Fiscal Year 2020 As Defined By The Us Federal Government, Starting On October 1,.

A Calendar Year, As You Would Expect, Covers 12 Consecutive Months, Beginning January 1 And Ending December 31.

Many Companies Use A Fiscal Year That.

T/F, Accounts That Appear In The Balance Sheet Are Called.

Related Post: