Accident Year Vs Calendar Year

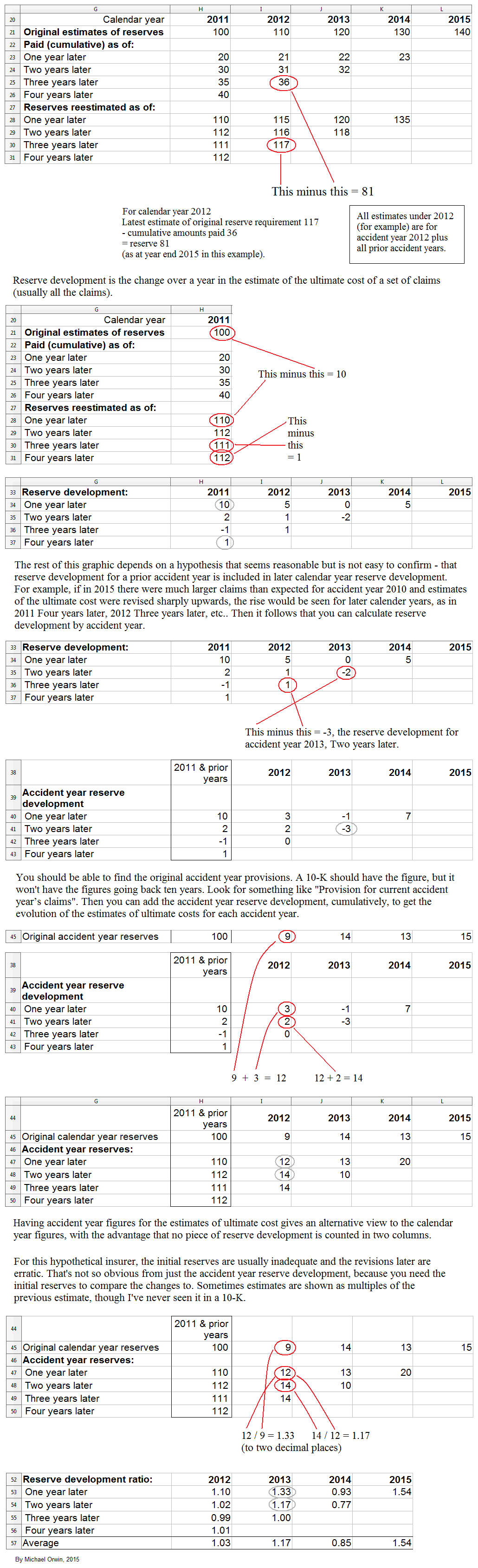

Accident Year Vs Calendar Year - Join us to learn the difference between calendar year, accident year, exposure year and underwriting year. Two basic methods exist for calculating calendar year loss ratios. Accident year experience shows pure premiums and claim frequencies for on ecutive calendar or fiscal year periods; Hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will then match the accident year loss ratio exactly. They are the standard calendar year loss ratio and the calendar year loss ratio by policy year contribution. Accident year data tracks claims paid and reserves on accidents occurring within a particular year, regardless of when the claim occurred or when the policy was issued. Accident year and calendar year are common ways to o. What is calendar year experience? A calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. That all depends… what year is it? Accident year experience shows pure premiums and claim frequencies for on ecutive calendar or fiscal year periods; Policy year is based on effective dates, accident year is based on accident dates, and calendar year is based on transactions in a year. Accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year experience (cye). Accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve to get the year end factors. This video describes the difference between accident year and calendar year with the help of an example. Find out how these terms are used. Accident year data tracks claims paid and reserves on accidents occurring within a particular year, regardless of when the claim occurred or when the policy was issued. Accident year data is a method of comparing losses and premiums by calendar year. Calendar year experience — also known as underwriting year experience or accident year experience — is the insurance company’s underwriting income, and measures the premiums. Learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. This paper explores the reasons and methods for changing loss development patterns over time in reserving. This video describes the difference between accident year and calendar year with the help of an example. Accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve. Hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will then match the accident year loss ratio exactly. Two basic methods exist for calculating calendar year loss ratios. Accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year. Hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will then match the accident year loss ratio exactly. Calendar year experience — also known as underwriting year experience or accident year experience — is the insurance company’s underwriting income, and measures the premiums. What is an accident year? Accident. Accident year data is a method of comparing losses and premiums by calendar year. Accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve to get the year end factors. That all depends… what year is it? This paper explores the reasons and. What is an accident year? Policy year is based on effective dates, accident year is based on accident dates, and calendar year is based on transactions in a year. Learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Accident year experience shows pure premiums and claim. Learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Policy year is based on effective dates, accident year is based on accident dates, and calendar year is based on transactions in a year. Join us to learn the difference between calendar year, accident year, exposure year. Calendar year experience — also known as underwriting year experience or accident year experience — is the insurance company’s underwriting income, and measures the premiums. Accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve to get the year end factors. Find out. This video describes the difference between accident year and calendar year with the help of an example. Learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Accident year data is a method of comparing losses and premiums by calendar year. Policy year is based on effective. They are the standard calendar year loss ratio and the calendar year loss ratio by policy year contribution. Learn the differences among these types of data for workers compensation insurance. This video describes the difference between accident year and calendar year with the help of an example. What is calendar year experience? Policy year is based on effective dates, accident. Find out how these terms are used. This paper explores the reasons and methods for changing loss development patterns over time in reserving. A calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. Accident year data tracks claims paid and reserves on accidents occurring within a. Learn the differences among these types of data for workers compensation insurance. It discusses internal and external factors, diagnostics, practical and advanced. Policy year is based on effective dates, accident year is based on accident dates, and calendar year is based on transactions in a year. Calendar year experience — also known as underwriting year experience or accident year experience — is the insurance company’s underwriting income, and measures the premiums. Accident year data tracks claims paid and reserves on accidents occurring within a particular year, regardless of when the claim occurred or when the policy was issued. Accident year data is a method of comparing losses and premiums by calendar year. What is calendar year experience? Join us to learn the difference between calendar year, accident year, exposure year and underwriting year. Two basic methods exist for calculating calendar year loss ratios. This paper explores the reasons and methods for changing loss development patterns over time in reserving. What is an accident year? That all depends… what year is it? Accident year and calendar year are common ways to o. A calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. Find out how these terms are used. Accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year experience (cye).Accident Year Vs Calendar Year

PPT ISO Study of Industry Loss and Loss Adjustment Expense Reserve s

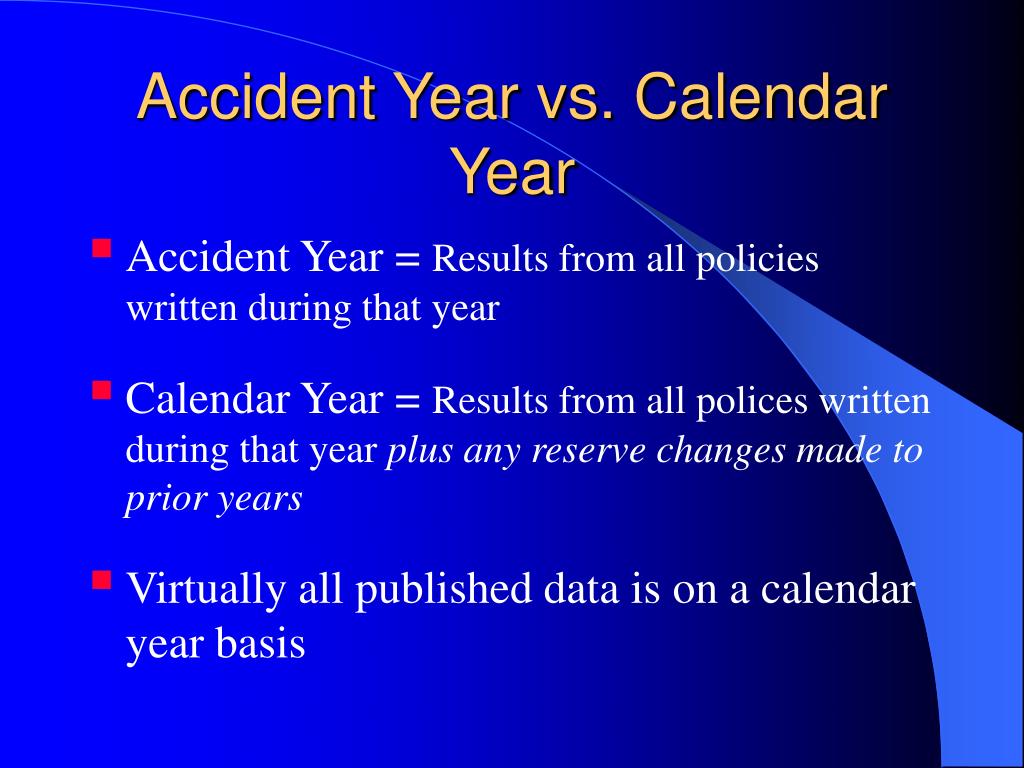

Policy Year, Calendar Year, & Accident Year Insurance Terminology

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Accident Year Vs Calendar Year Month Calendar Printable

Trends ASAP by Actuarial Services and Programs Evaluating Changes in

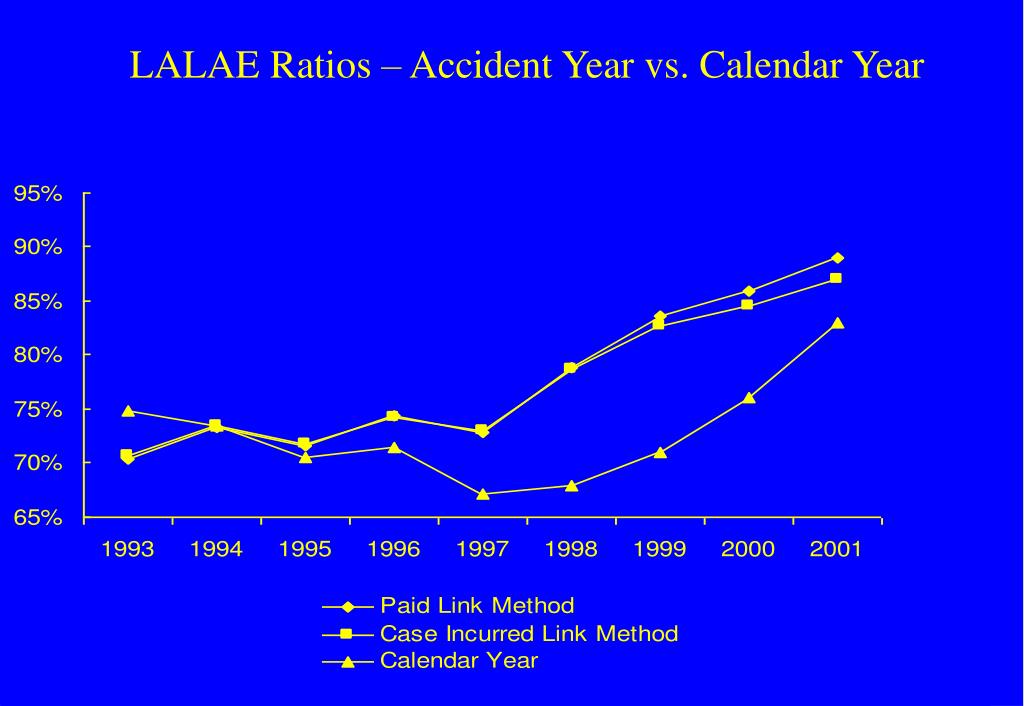

PPT Malpractice Loss Trends 2007 Update DRI, March 15, 2007

Combined Ratio Difference Debate Calendar vs. Accident Year

Accident Year Vs Calendar Year Month Calendar Printable

Accident Year Vs Calendar Year Calendar Printables Free Templates

Hence, The Standard Calendar Year Approach Is Superior When The Amount Of Incurred Loss Adequacy Has Not Changed Because It Will Then Match The Accident Year Loss Ratio Exactly.

Accident Year Experience Shows Pure Premiums And Claim Frequencies For On Ecutive Calendar Or Fiscal Year Periods;

This Video Describes The Difference Between Accident Year And Calendar Year With The Help Of An Example.

They Are The Standard Calendar Year Loss Ratio And The Calendar Year Loss Ratio By Policy Year Contribution.

Related Post: