Are Leaps Calendar Spreads

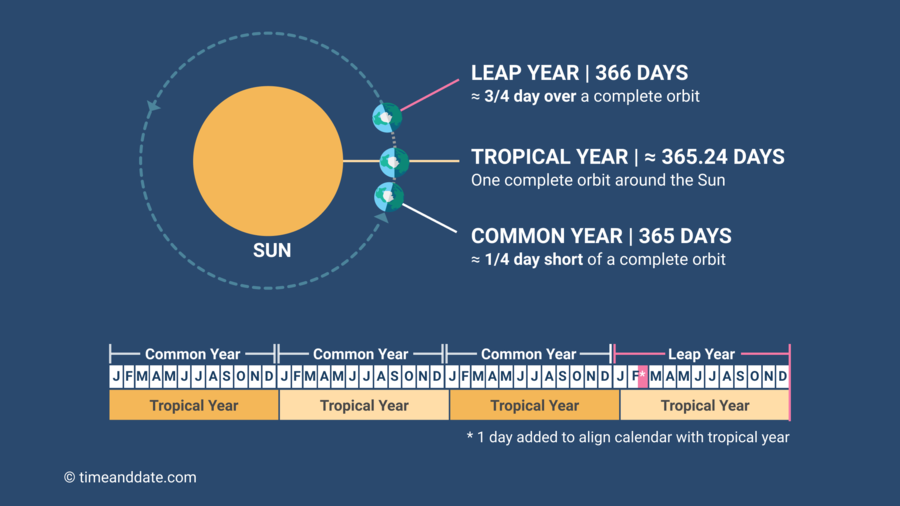

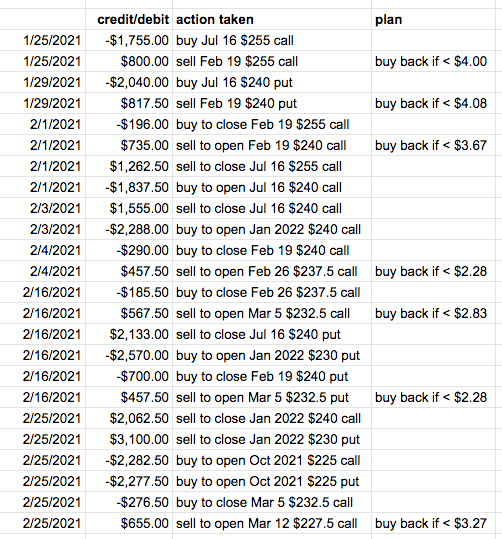

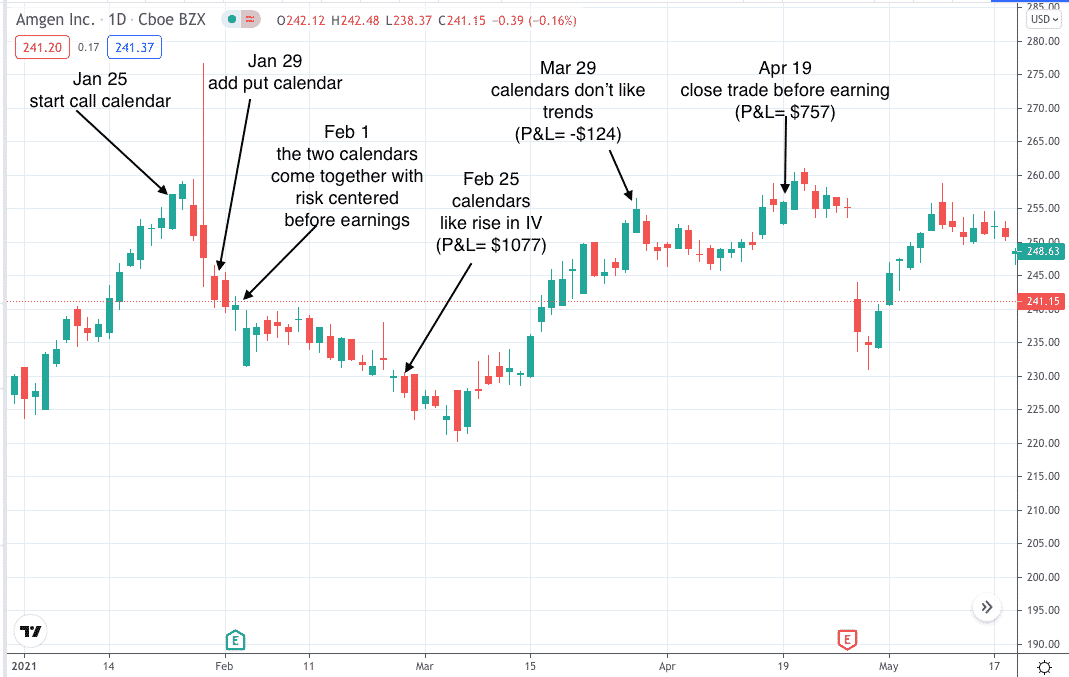

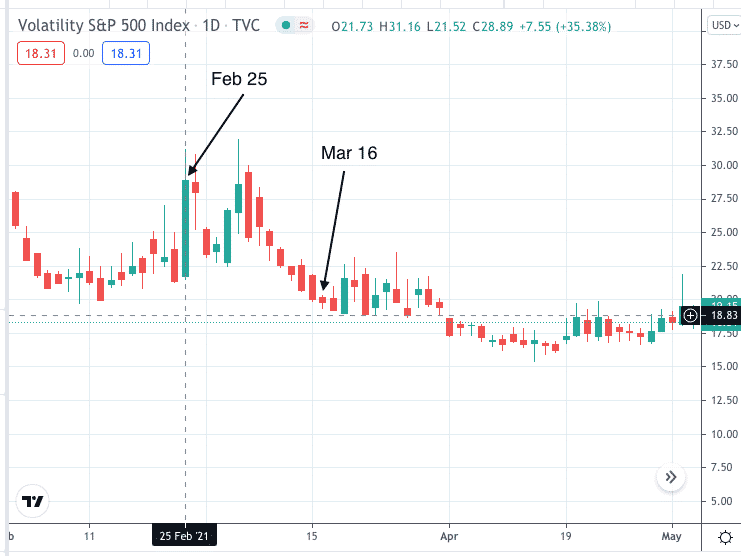

Are Leaps Calendar Spreads - Calendar spread examples long call calendar spread example. After analysing the stock's historical volatility. Option pro terry allen (whose options white paper i recommend) offers some very. The calendar spreads themselves can take various forms. Calendar calls are a bullish strategy. Additionally, we will review the factors that affect an option's price and provide examples of. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against the leaps. A person buys a leap which goes down very slowly in value and simultaneously sells someone. Once the expiration date is less than nine months away, leaps convert to conventional options. Take ownership of the stock. One of the most popular use of leaps is as the long side in a calendar spread. Here we take a look at the rationale for leaps based calendar spreads and. What are leaps calendar or time spreads and why should you care? You can go the leaps route and buy call options that expire in, say, 24 months and write near term call options against them each. When executed for a debit (i.e., cash comes out of. The calendar put spread (including leaps) is a bearish strategy. This video will cover the details of weeklys℠, monthlys and leaps® option contracts. Recently, i bought some 7m leaps to back. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against the leaps. In this article, we will learn methods #3 and #4 for adjustments involving leaps and double calendars. Calendar calls are a bullish strategy. Weeklys and leaps time spreads, also known as calendar or horizontal spreads, can be a great options strategy. Here we take a look at the rationale for leaps based calendar spreads and. Calendar spread examples long call calendar spread example. This video will cover the details of weeklys℠, monthlys and leaps® option contracts. There are two key structural advantages built. Take ownership of the stock. Weeklys and leaps time spreads, also known as calendar or horizontal spreads, can be a great options strategy. Calendar calls are a bullish strategy. Once the expiration date is less than nine months away, leaps convert to conventional options. This strategy is the reverse of the calendar call spread. Both diagonals and calendars are excellent tools for lowering the cost basis of a longer dated option. The calendar put spread (including leaps) is a bearish strategy. Option pro terry allen (whose options white paper i recommend) offers some very. Once the expiration date is less than nine months away,. The holiday is supposed to occur on the first sunday following the first full moon on or after the spring equinox.at the time, easter's date had moved by about 10 days. Take ownership of the stock. Additionally, we will review the factors that affect an option's price and provide examples of. In this article, we will learn methods #3 and. In this article, we will learn methods #3 and #4 for adjustments involving leaps and double calendars. Both diagonals and calendars are excellent tools for lowering the cost basis of a longer dated option. Weeklys and leaps time spreads, also known as calendar or horizontal spreads, can be a great options strategy. Instead of writing covered calls against shares of. Once the expiration date is less than nine months away, leaps convert to conventional options. By successfully selling enough near dated options, an efficient calendar. Calendar spread examples long call calendar spread example. Take ownership of the stock. Calendar calls are a bullish strategy. A person buys a leap which goes down very slowly in value and simultaneously sells someone. By successfully selling enough near dated options, an efficient calendar. Weeklys and leaps time spreads, also known as calendar or horizontal spreads, can be a great options strategy. The holiday is supposed to occur on the first sunday following the first full moon on. Many brokerages do not allow short stock positions in retirement accounts under any circumstances. Technically, these are calendar or diagonal calendar spreads but the principle is pretty much the same. After analysing the stock's historical volatility. Weeklys and leaps time spreads, also known as calendar or horizontal spreads, can be a great options strategy. When executed for a debit (i.e.,. One of the most popular use of leaps is as the long side in a calendar spread. Recently, i bought some 7m leaps to back. The holiday is supposed to occur on the first sunday following the first full moon on or after the spring equinox.at the time, easter's date had moved by about 10 days. Suppose apple inc (aapl). There are two key structural advantages built. Many brokerages do not allow short stock positions in retirement accounts under any circumstances. Here we take a look at the rationale for leaps based calendar spreads and. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against. Many brokerages do not allow short stock positions in retirement accounts under any circumstances. What are leaps calendar or time spreads and why should you care? What are leaps calendar spreads? There are two key structural advantages built. Calendar spread examples long call calendar spread example. Suppose apple inc (aapl) is currently trading at $145 per share. After analysing the stock's historical volatility. This strategy is the reverse of the calendar call spread. Once the expiration date is less than nine months away, leaps convert to conventional options. Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against the leaps. Option pro terry allen (whose options white paper i recommend) offers some very. Additionally, we will review the factors that affect an option's price and provide examples of. Recently, i bought some 7m leaps to back. You can go the leaps route and buy call options that expire in, say, 24 months and write near term call options against them each. The atm calendar spread has a neutral bias. Technically, these are calendar or diagonal calendar spreads but the principle is pretty much the same.Adjusting Calendar Spreads A guide using LEAPS

Weeklys and LEAPS

Adjusting Calendar Spreads A guide using LEAPS

Leaps 2024 Calendar Spread Live Trade Update YouTube

Adjusting Calendar Spreads A guide using LEAPS

Options Interest Group ppt download

Options Interest Group ppt download

DeepintheMoney LEAPS Put Calendar Spreads Options for the Beginner

Leap Day 2024 Calendar Printable Online

Constructing The LEAPS Perpetual Strategy

By Successfully Selling Enough Near Dated Options, An Efficient Calendar.

Weeklys And Leaps Time Spreads, Also Known As Calendar Or Horizontal Spreads, Can Be A Great Options Strategy.

The Holiday Is Supposed To Occur On The First Sunday Following The First Full Moon On Or After The Spring Equinox.at The Time, Easter's Date Had Moved By About 10 Days.

A Person Buys A Leap Which Goes Down Very Slowly In Value And Simultaneously Sells Someone.

Related Post:

.jpg)