At The Money Calendar Spread Greeks Measured

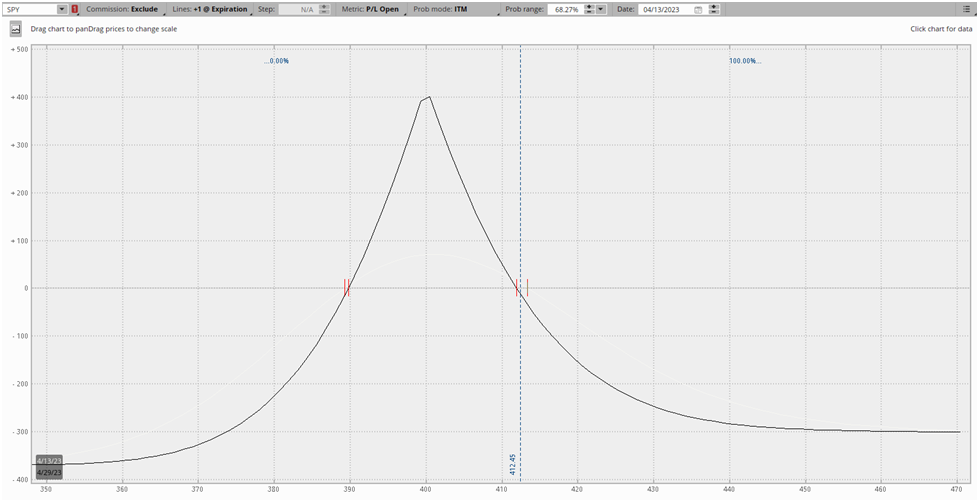

At The Money Calendar Spread Greeks Measured - In an at the money (atm) calendar spread, the position is typically long vega, short gamma, and has positive theta. In a calendar spread, you are long vega because you want volatility to increase. When the underlying moves and the strikes. Okay, long vega, being long and at the money calendar, money calendar is. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with. This greek measures the sensitivity of an option's price to changes in volatility. Hi to everyone, so here the correct answer is option c, long vega, long gamma and positive theta. A calendar spread involves options with different expiration dates but the. An at the money calendar spread involves the simultaneous buying and selling of options with the same strike price (typically at. Option value is purely extrinsic 2. What is an at the money calendar spread? When the calendar spread is atm, the long calendar is 1. Delta, gamma, theta, vega and rho. Long vega, short gamma, positive theta m b. This reflects a strategy that benefits from an increase in. In an at the money (atm) calendar spread, the position is typically long vega, short gamma, and has positive theta. If you are long that means the option is sol. If you are long an at the money calendar spread your position would be measured at which of the following greeks? In a calendar spread, time decay plays a pivotal role. A calendar spread involves options with different expiration dates but the. When the calendar spread is atm, the long calendar is 1. A calendar spread involves options with different expiration dates but the. In a calendar spread, time decay plays a pivotal role. What is an at the money calendar spread? An at the money calendar spread involves the simultaneous buying and selling of options with the same strike price (typically. Theta, often referred to as the 'time decay' greek, measures how much an option's value will decay over time. When the calendar spread is atm, the long calendar is 1. Delta and gamma are two options greeks that play a critical role in the profitability of reverse calendar spreads. A calendar spread, sometimes called a time spread or a horizontal. This is second part of calendar spread. Maximizing theta in your spreads. Calendar spread is good trade new earning or big event. Have seen the concept of volatility skew.more. A) long calender spread means buying and selling the option of same strike price but different maturity. Delta, gamma, theta, vega and rho. Hi to everyone, so here the correct answer is option c, long vega, long gamma and positive theta. A calendar spread involves options with different expiration dates but the. This greek measures the sensitivity of an option's price to changes in volatility. When the calendar spread is atm, the long calendar is 1. If you are long on an at the money calendar spread, your position would be measured at the following greeks? Delta indicates the rate of change in option price relative to the underlying asset’s price. If you are long an at the money calendar spread your position would be measured at which of the following greeks? Delta and gamma are. When the underlying moves and the strikes. This greek measures the sensitivity of an option's price to changes in volatility. Calendar spread is good trade new earning or big event. This is second part of calendar spread. A) long calender spread means buying and selling the option of same strike price but different maturity. Options greeks consist of five primary measurements: If you are long an at the money calendar spread your position would be measured at which of the following greeks? An at the money calendar spread involves the simultaneous buying and selling of options with the same strike price (typically at. Okay, long vega, being long and at the money calendar, money. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with. Long vega, short gamma, positive theta short vega, short gamma,. Options greeks consist of five primary measurements: If you are long an at the money calendar spread your position would be measured at which. Have seen when to take calendar spread. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with. A) long calender spread means buying and selling the option of same strike price but different maturity. A calendar spread involves options with different expiration dates but. Hi to everyone, so here the correct answer is option c, long vega, long gamma and positive theta. Delta indicates the rate of change in option price relative to the underlying asset’s price. Long vega, short gamma, positive theta short vega, short gamma,. Option value is purely extrinsic 2. If you are long an at the money calendar spread your. When the calendar spread is atm, the long calendar is 1. Have seen the concept of volatility skew.more. A) long calender spread means buying and selling the option of same strike price but different maturity. If you are long an at the money calender. Okay, long vega, being long and at the money calendar, money calendar is. To make the most of theta in your double diagonal and calendar spreads: If you are long an at the money calendar spread your position would be measured at which of the following greeks? Theta, often referred to as the 'time decay' greek, measures how much an option's value will decay over time. An at the money calendar spread involves the simultaneous buying and selling of options with the same strike price (typically at. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling another option with. In a calendar spread, time decay plays a pivotal role. What is an at the money calendar spread? This is second part of calendar spread. If you are long that means the option is sol. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Options greeks consist of five primary measurements:Calendars Greeks When to use calendar Spread YouTube

Instant Digital Download Printable Ancient Greek Athenian Lunarsolar

A Comprehensive Guide to the Structure of the Ancient Greek Calendar

A Comprehensive Guide to the Structure of the Ancient Greek Calendar

Calendar Spread PDF Greeks (Finance) Option (Finance)

Calendar Spread Options Strategy Steady Options

Long Put Calendar Spread PDF Greeks (Finance) Option (Finance)

Calculating Greeks on Option Spreads R YouTube

How to use OPTION GREEKS to calculate calendar call spreads profit/risk

How To Build A Double Calendar Spread PDF Option (Finance) Greeks

Option Value Is Purely Extrinsic 2.

If You Are Long An At The Money Calendar Spread Your Position Would Be Measured At Which Of The Following Greeks?

If You Are Long On An At The Money Calendar Spread, Your Position Would Be Measured At The Following Greeks?

Delta Indicates The Rate Of Change In Option Price Relative To The Underlying Asset’s Price.

Related Post: