Broward Tax Deed Auction Calendar

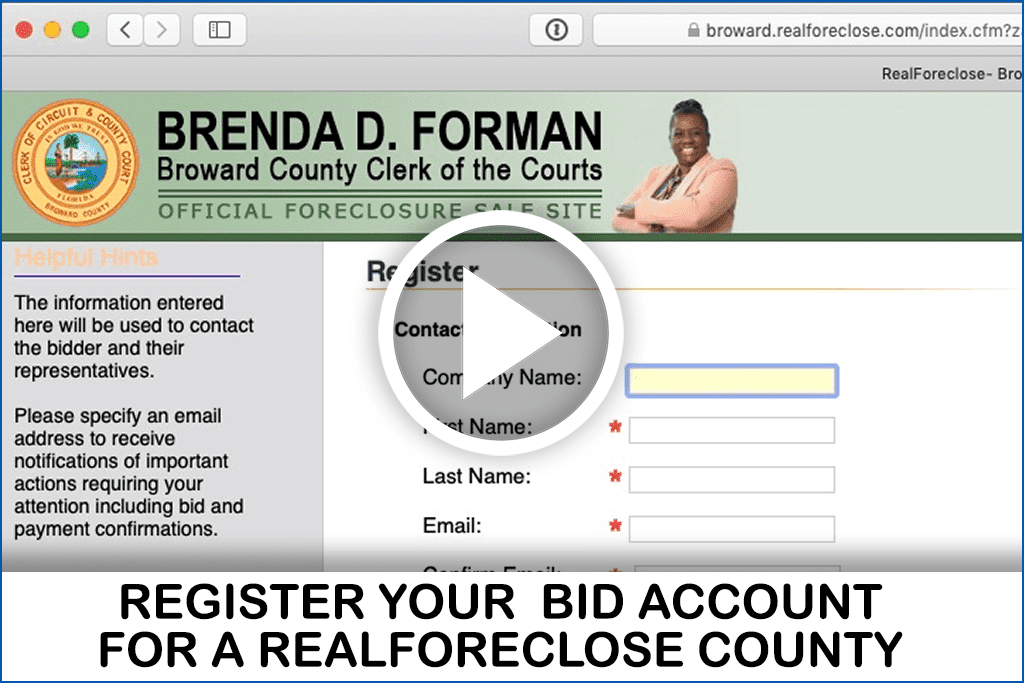

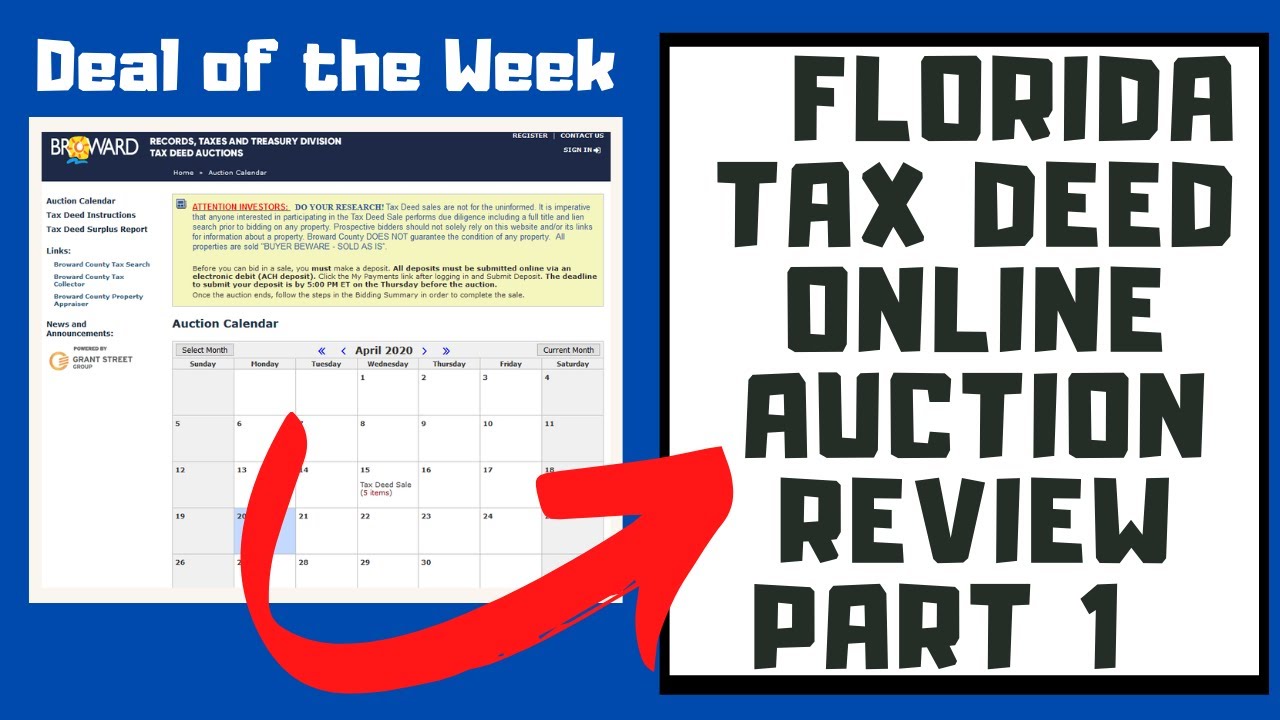

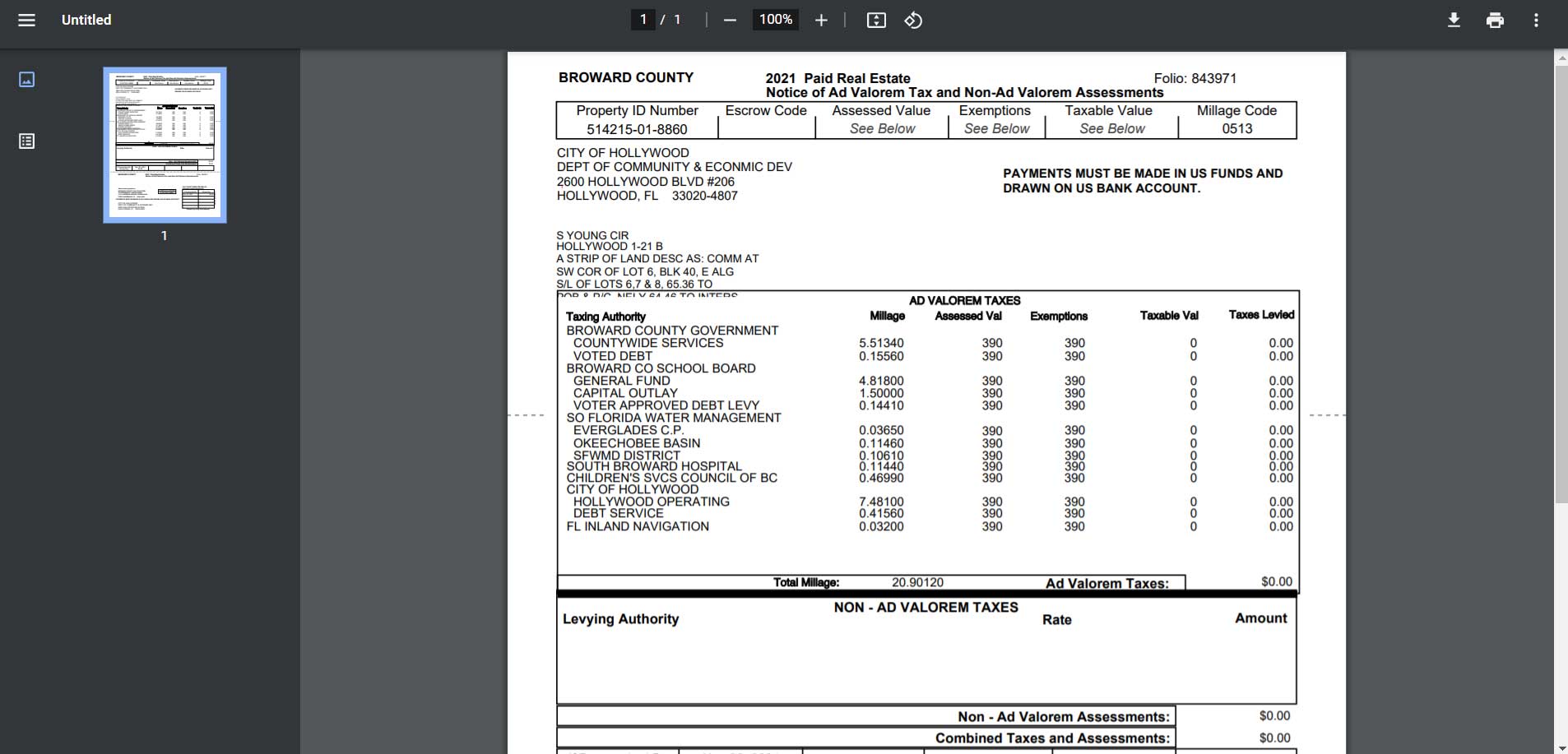

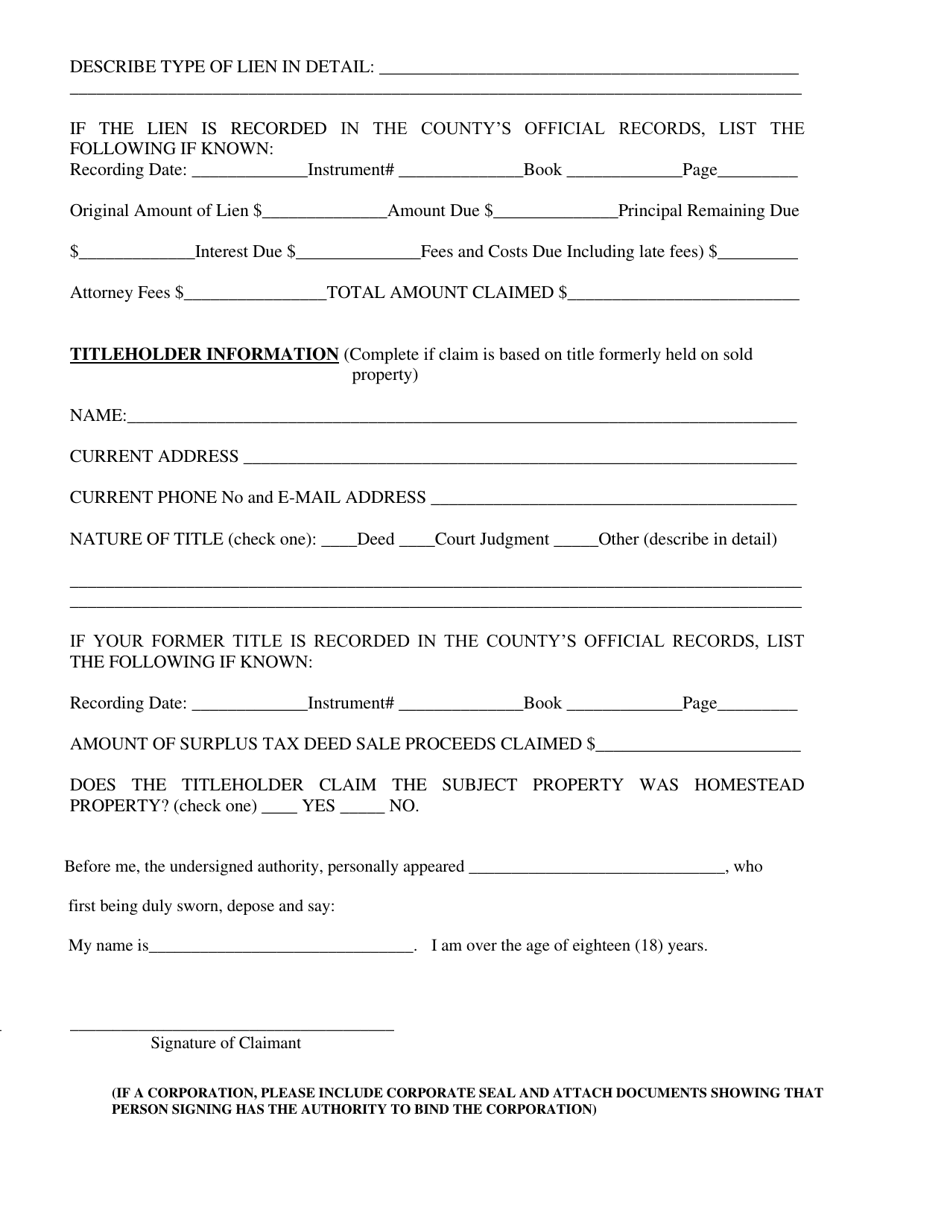

Broward Tax Deed Auction Calendar - Tax certificates are sold to the bidder who offers to purchase at the lowest rate of interest in the public auction of such certificates which is conducted on or before june 1 of each year. It is imperative that anyone interested in participating in the tax deed sale performs due diligence including a full title and lien search prior to bidding on any property. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal property. Bid now for broward county foreclosure & tax deeds! The online application can be found by clicking “property tax”, then search for your property account information by entering your property account number, name or address. Broward county records, taxes and treasury division performs only two functions in conjunction with foreclosure sales. We continually track the auction dates in all 67 counties in florida and upload a new calendar every 2 weeks. The tax certificate represents a lien on unpaid real estate properties. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal. Tax deed auction calendar (all 67 florida counties) update: We continually track the auction dates in all 67 counties in florida and upload a new calendar every 2 weeks. The deadline to submit your deposit is before 4:45 pm et on the thursday before the auction. Tax deed sales are scheduled once a month. Tax certificates are sold to the bidder who offers to purchase at the lowest rate of interest in the public auction of such certificates which is conducted on or before june 1 of each year. Interest accrues on the tax certificate from june 1 until the taxes are paid. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal property. To download the latest tax deed in formation >click here<. Broward county records, taxes and treasury division performs only two functions in conjunction with foreclosure sales. Bid now for broward county foreclosure & tax deeds! It is imperative that anyone interested in participating in the tax deed sale performs due diligence including a full title and lien search prior to bidding on any property. The online application can be found by clicking “property tax”, then search for your property account information by entering your property account number, name or address. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal property. To download the latest tax deed in formation >click. Tax deed auction calendar (all 67 florida counties) update: Bid now for broward county foreclosure & tax deeds! The deadline to submit your deposit is before 4:45 pm et on the thursday before the auction. Tax deed sales are scheduled once a month. Those functions are to accept payments for the documentary stamp. It is imperative that anyone interested in participating in the tax deed sale performs due diligence including a full title and lien search prior to bidding on any property. The amount of the certificate is the sum of the. Those functions are to accept payments for the documentary stamp. Browse our huge list of properties being foreclosed to find your. Sorted by auction date and sorted by county. To download the latest tax deed in formation >click here<. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal property. The amount of the certificate is the sum of the. Pursuant to 50.021 and 50.0311, florida statutes,. We continually track the auction dates in all 67 counties in florida and upload a new calendar every 2 weeks. Interest accrues on the tax certificate from june 1 until the taxes are paid. Or on broward.deedauction.net , click. To download the latest tax deed in formation >click here<. Those functions are to accept payments for the documentary stamp. Tax certificates are sold to the bidder who offers to purchase at the lowest rate of interest in the public auction of such certificates which is conducted on or before june 1 of each year. The deadline to submit your deposit is before 4:45 pm et on the thursday before the auction. The tax certificate represents a lien on unpaid. Or on broward.deedauction.net , click. Interest accrues on the tax certificate from june 1 until the taxes are paid. Browse our huge list of properties being foreclosed to find your next investment in broward county. The deadline to submit your deposit is before 4:45 pm et on the thursday before the auction. Tax deed sales are scheduled once a month. The deadline to submit your deposit is before 4:45 pm et on the thursday before the auction. Tax deed auction calendar (all 67 florida counties) update: These records are available online 24/7 and in most cases, when viewing your deed online, we provide links to related property appraiser and tax collector data relevant to that property.. Interest accrues on the. We continually track the auction dates in all 67 counties in florida and upload a new calendar every 2 weeks. Browse our huge list of properties being foreclosed to find your next investment in broward county. It is imperative that anyone interested in participating in the tax deed sale performs due diligence including a full title and lien search prior. Interest accrues on the tax certificate from june 1 until the taxes are paid. The online application can be found by clicking “property tax”, then search for your property account information by entering your property account number, name or address. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real. Or on broward.deedauction.net , click. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal property. Tax deed auction calendar (all 67 florida counties) update: Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal. We continually track the auction dates in all 67 counties in florida and upload a new calendar every 2 weeks. Bid now for broward county foreclosure & tax deeds! To download the latest tax deed in formation >click here<. Tax deed sales are scheduled once a month. Tax certificates are sold to the bidder who offers to purchase at the lowest rate of interest in the public auction of such certificates which is conducted on or before june 1 of each year. These records are available online 24/7 and in most cases, when viewing your deed online, we provide links to related property appraiser and tax collector data relevant to that property.. Browse our huge list of properties being foreclosed to find your next investment in broward county. To download the latest tax deed in formation >click here<. The amount of the certificate is the sum of the. Pursuant to 50.021 and 50.0311, florida statutes, future advertisements and legal notices required for tax deeds auctions and delinquent real estate and tangible personal property. The tax certificate represents a lien on unpaid real estate properties. See the auction calendar at broward.deedauction.net for the exact dates of upcoming sales.Broward County Foreclosure Calendar Printable Word Searches

Broward County Tax Deed Auction Calendar

Broward County Tax Deed Auction Calendar

Broward Tax Deed Auction Calendar Printable Word Searches

Broward County Tax Deed Auction Calendar Kelsy Mellisa

Broward County Tax Deed Auction Calendar Kelsy Mellisa

Broward County Tax Deed Auction Calendar

Broward County Tax Deed Auction Calendar

Broward Tax Deed Auction Calendar Printable Templates Free

Broward County Tax Deed Auction Calendar

It Is Imperative That Anyone Interested In Participating In The Tax Deed Sale Performs Due Diligence Including A Full Title And Lien Search Prior To Bidding On Any Property.

The Online Application Can Be Found By Clicking “Property Tax”, Then Search For Your Property Account Information By Entering Your Property Account Number, Name Or Address.

We Have Moved Our Auction Calendars Please Continue Here To View Calendar (Members Only)

Sorted By Auction Date And Sorted By County.

Related Post: