Calendar And Fiscal Year

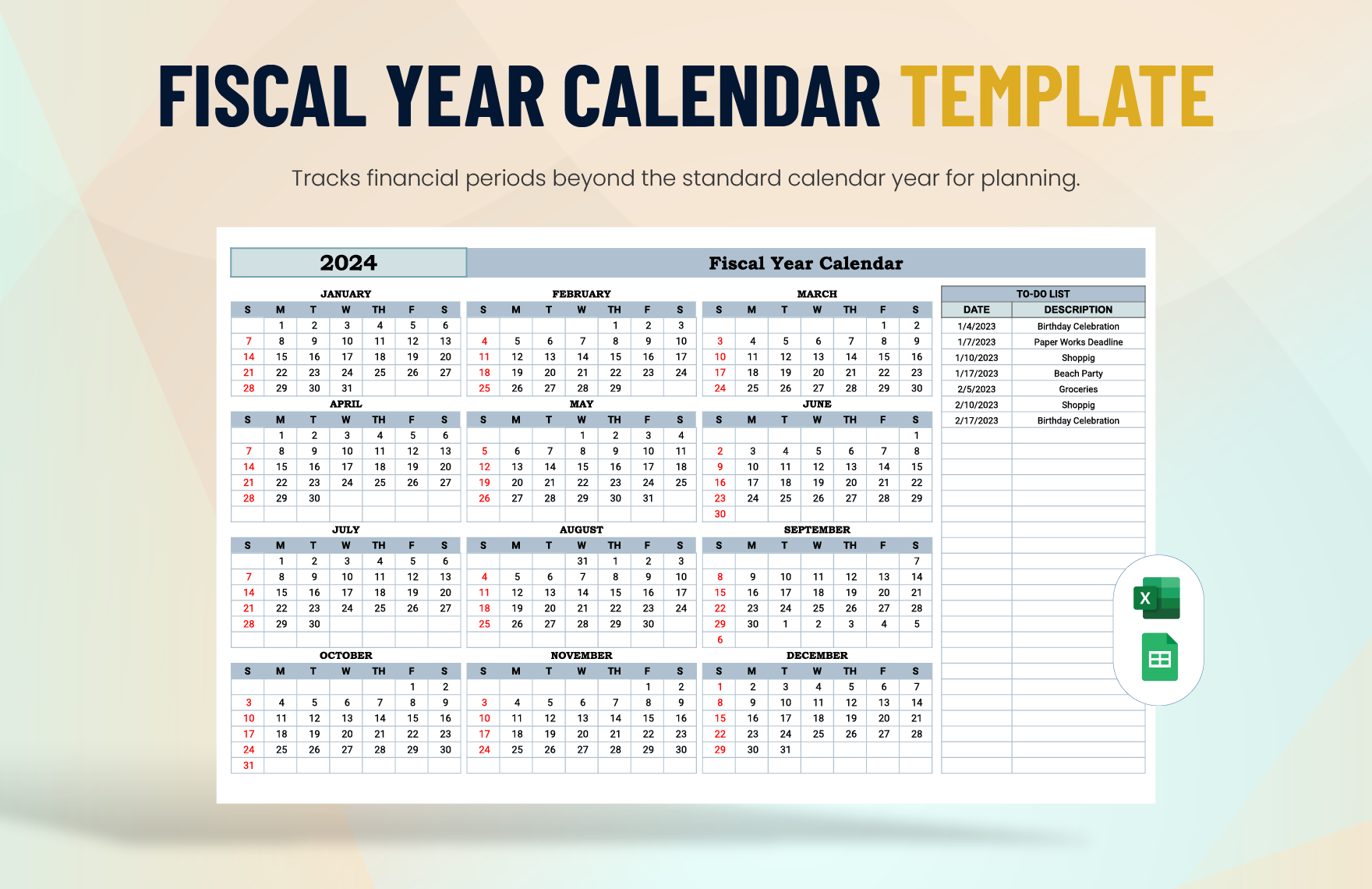

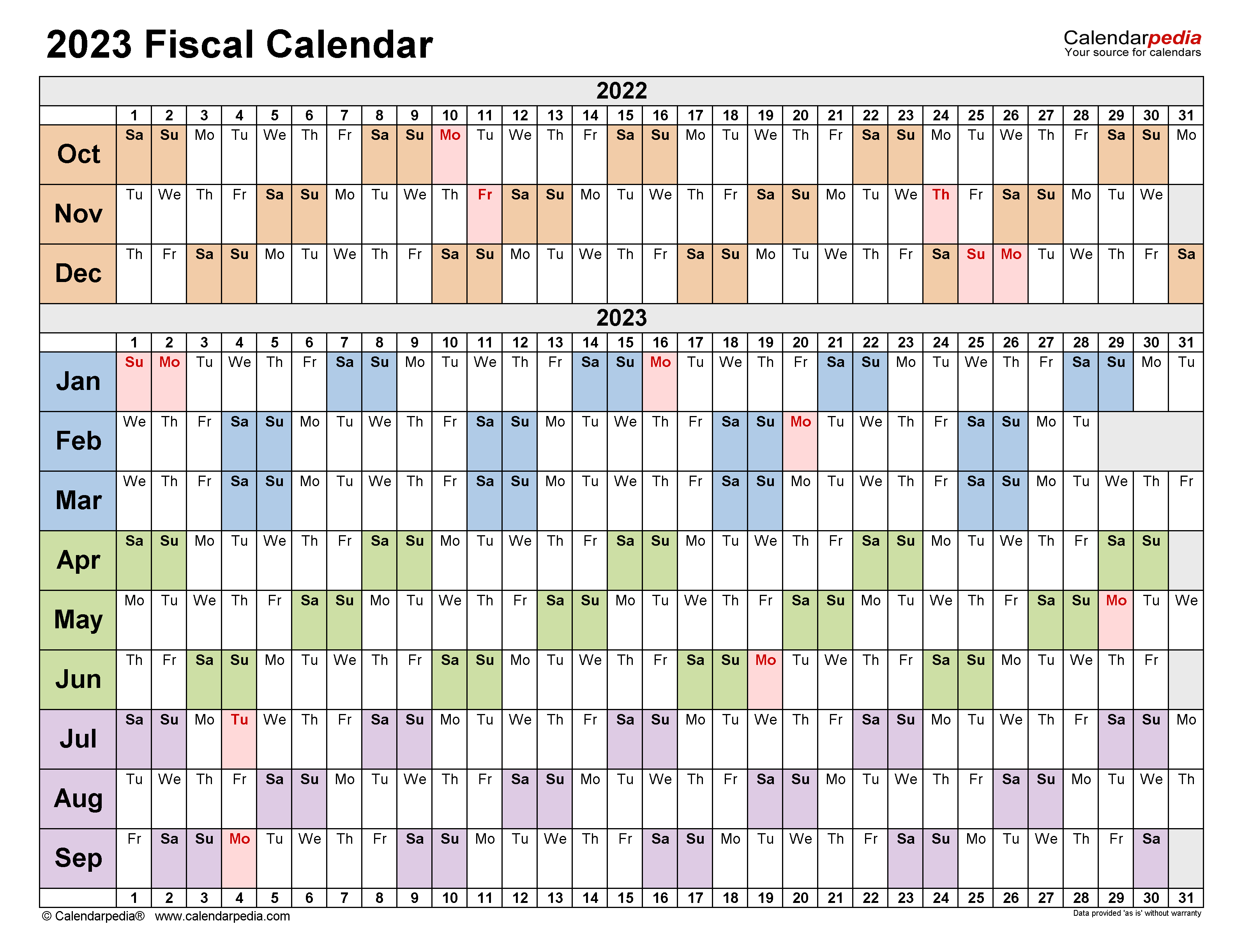

Calendar And Fiscal Year - Direct file available starting jan. 27 for taxpayers in 25 states. To engage in our ongoing support and. For the fiscal first quarter ended december 31, 2024, outlook therapeutics also reported an adjusted net loss attributable to common stockholders 1 of $21.6 million, or $0.89. What is a fiscal year? If you’re a c corporation, the irs lets you choose between the standard. One of the primary differences between fiscal years and calendar years lies in their duration and start dates. Trustees must submit form 1128, detailing the trust’s. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Free file program now open; Learn what they are and what sets them apart. What is a fiscal year? Learn more about a fiscal year and calendar year, their benefits, how they differ and how to determine which you should use. Direct file available starting jan. A fiscal year can cater to specific business needs, such as aligning. If you’re a c corporation, the irs lets you choose between the standard. What is the difference between a fiscal year and calendar year? The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. Washington — the internal revenue service today. One of the primary differences between fiscal years and calendar years lies in their duration and start dates. If you’re a c corporation, the irs lets you choose between the standard. Many small businesses first start thinking about the fiscal year when it comes time to file their first business tax return. 27 for taxpayers in 25 states. Direct file available starting jan. What is a fiscal year? A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Up to 3.2% cash back what is a fiscal year (fy)? For the fiscal first quarter ended december 31, 2024, outlook therapeutics also reported an adjusted net loss attributable to common. To engage in our ongoing support and. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. Direct file available starting jan. While calendar years always begin on january 1st and end on. What is a fiscal year? Learn more about a fiscal year and calendar year, their benefits, how they differ and how to determine which you should use. Direct file available starting jan. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. This year can differ from the traditional. The primary distinction between. What exactly is a fiscal year? One of the primary differences between fiscal years and calendar years lies in their duration and start dates. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. While the fiscal year is a 12 month period whereby businesses choose the preferred. To engage in our ongoing support and. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Many small businesses first start thinking about the fiscal year when it comes time to file their first business tax return. Direct file available starting jan. One of the primary differences between fiscal. If you’re a c corporation, the irs lets you choose between the standard. Free file program now open; Learn more about a fiscal year and calendar year, their benefits, how they differ and how to determine which you should use. While calendar years always begin on january 1st and end on. Trustees must submit form 1128, detailing the trust’s. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. 27 for taxpayers in 25 states. What is the difference between a fiscal year and calendar year? Direct file available starting jan. This period is designated by the calendar year in. Washington — the internal revenue service today. Direct file available starting jan. One of the primary differences between fiscal years and calendar years lies in their duration and start dates. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. A fiscal year is the 12 months that. Learn what they are and what sets them apart. Many small businesses first start thinking about the fiscal year when it comes time to file their first business tax return. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive.. This period is designated by the calendar year in. A fiscal year can cater to specific business needs, such as aligning. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. Trustees must submit form 1128, detailing the trust’s. What is a fiscal year? 27 for taxpayers in 25 states. One of the primary differences between fiscal years and calendar years lies in their duration and start dates. This year can differ from the traditional. Below is an overview of the fiscal year, including why and how it's used. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. What is the difference between a fiscal year and calendar year? Free file program now open; Direct file available starting jan. To engage in our ongoing support and. If you’re a c corporation, the irs lets you choose between the standard. What exactly is a fiscal year?Fiscal Year Calendar Template in Excel, Google Sheets Download

Download US Federal Fiscal Calendar 202021 Excel Template ExcelDataPro

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year Vs Calendar Year What's Best for Your Business?

2023 Fiscal Year Calendar Printable Calendars AT A GLANCE

Fiscal Year Definition for Business Bookkeeping

Download Printable Fiscal Year Calendar Template PDF

What is a Fiscal Year? Your GoTo Guide

Fiscal Calendars 2023 Free Printable Word templates

What Is A Fiscal Year Vs Calendar Year Ryann Florence

Up To 3.2% Cash Back What Is A Fiscal Year (Fy)?

Terms Such As Calendar Quarters And Fiscal (Or Financial) Quarters Are Often Used When Discussing Stocks And Financial Reports.

What Is A Fiscal Year?

A Fiscal Year Is 12 Months Chosen By A Business Or Organization For Accounting Purposes, While A Calendar Year Refers To The Standard January 1 To December 31 Period.

Related Post: