Calendar Option Spread

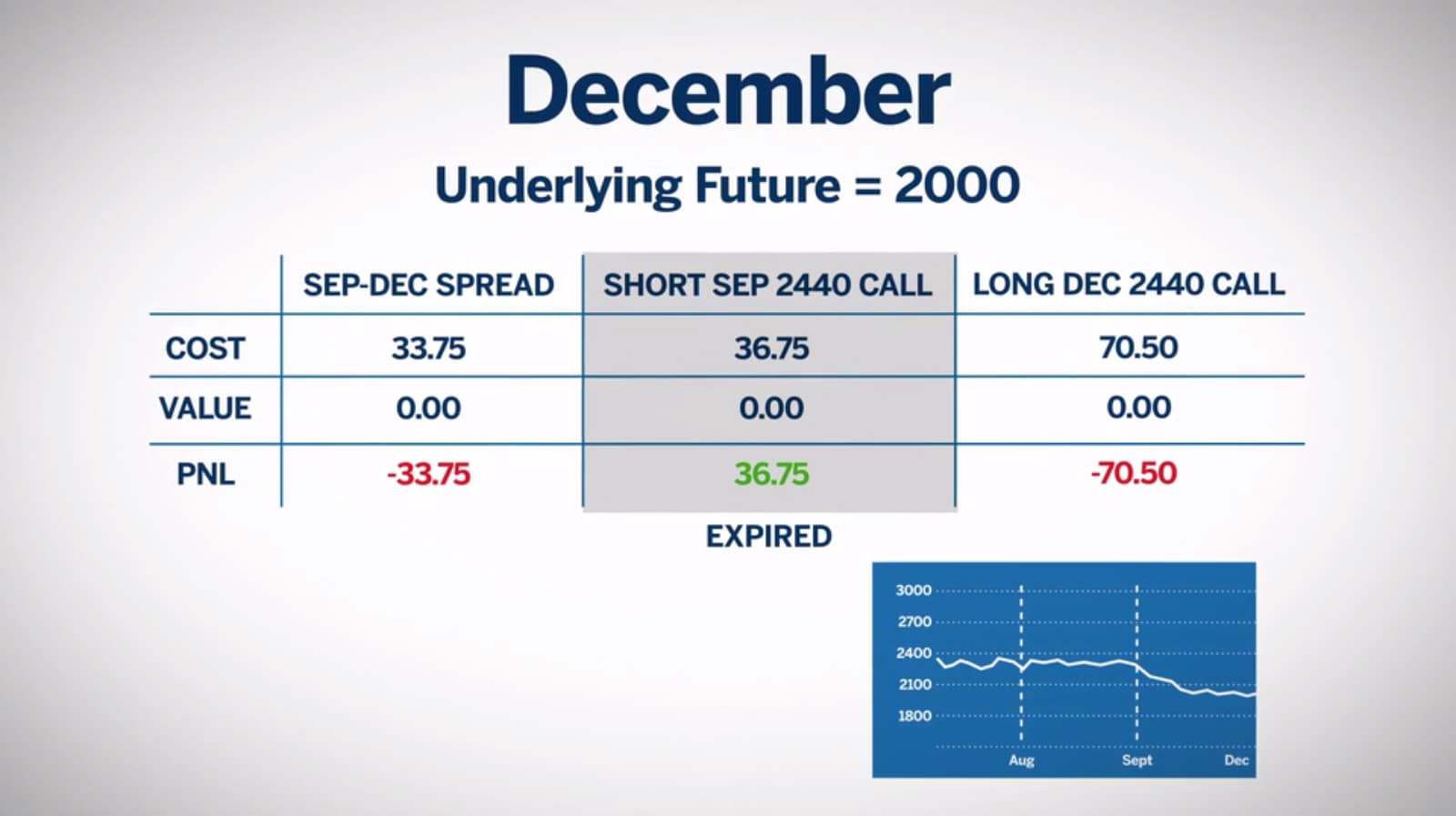

Calendar Option Spread - A calendar spread is a strategy used in options and futures trading: You can go either long or. After analysing the stock's historical volatility. Crm market price is below the. Calendar spreads combine buying and selling two contracts with different expiration dates. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. Considering the put debit spread, crm is above the short put option strike price of $240. There are several types, including horizontal. The calendar spread options strategy is a trade. Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. Suppose apple inc (aapl) is currently trading at $145 per share. Crm market price is below the. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. After analysing the stock's historical volatility. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar option strategy effectively. Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. A calendar spread is a strategy used in options and futures trading: The calendar spread options strategy is a trade. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. An option's premium is made up of 2 components:. With calendar spreads, time decay is your friend. Calendar spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset with identical strike prices but different expiration dates. After analysing the stock's historical volatility. In finance, a calendar spread (also called a time spread or. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. You can go either long or. Suppose apple inc (aapl) is currently trading at $145 per share. An option's premium is made up of 2 components:. Calendar spreads are options trading strategies. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the. An option's premium is made up of 2 components:. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar. Crm market price is below the. After analysing the stock's historical volatility. A calendar spread is a strategy used in options and futures trading: Considering the put debit spread, crm is above the short put option strike price of $240. With calendar spreads, time decay is your friend. Therefore, this second short put also expires worthless. Crm market price is below the. Considering the put debit spread, crm is above the short put option strike price of $240. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other. In this episode, i walk through setting up. There are several types, including horizontal. Suppose apple inc (aapl) is currently trading at $145 per share. A calendar spread is a strategy used in options and futures trading: Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. A calendar spread, also known as a time spread, is an options. Therefore, this second short put also expires worthless. Suppose apple inc (aapl) is currently trading at $145 per share. Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of. Benefits and risks of trading debit spread advantages of debit spreads: Crm market price is below the. Calendar spread examples long call calendar spread example. Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. Calendar spreads combine buying and selling two contracts with different expiration dates. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar option strategy effectively. After analysing the stock's historical volatility. Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. Horizontal spreads, or calendar spreads, consist of options with the same strike price. The calendar spread options strategy is a trade. Calendar spreads combine buying and selling two contracts with different expiration dates. After analysing the stock's historical volatility. Crm market price is below the. Therefore, this second short put also expires worthless. An option's premium is made up of 2 components:. Calendar spread examples long call calendar spread example. There are several types, including horizontal. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar option strategy effectively. Crm market price is below the. Therefore, this second short put also expires worthless. Suppose apple inc (aapl) is currently trading at $145 per share. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A calendar spread is a strategy used in options and futures trading: Benefits and risks of trading debit spread advantages of debit spreads: The calendar spread options strategy is a trade. You can go either long or. Options prices are influenced by changes in the underlying price, the passage of time, and fluctuations of implied volatility. A calendar spread is a strategy used in options and futures trading: Horizontal spreads, or calendar spreads, consist of options with the same strike price but different expiration dates. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other.Calendar Spread and Long Calendar Option Strategies Market Taker

Calendar Spread Options Trading Strategy In Python

Calendar Spread, stratégie d'options sur deux échéances différentes.

Calendar Spread Options Strategy VantagePoint

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Calendar Call Spread Strategy

Calendar Call Spread Option Strategy Heida Kristan

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

With Calendar Spreads, Time Decay Is Your Friend.

A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The Same Type (Either Calls Or Puts) With The Same.

Calendar Spreads Combine Buying And Selling Two Contracts With Different Expiration Dates.

Considering The Put Debit Spread, Crm Is Above The Short Put Option Strike Price Of $240.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)