Calendar Option Strategy

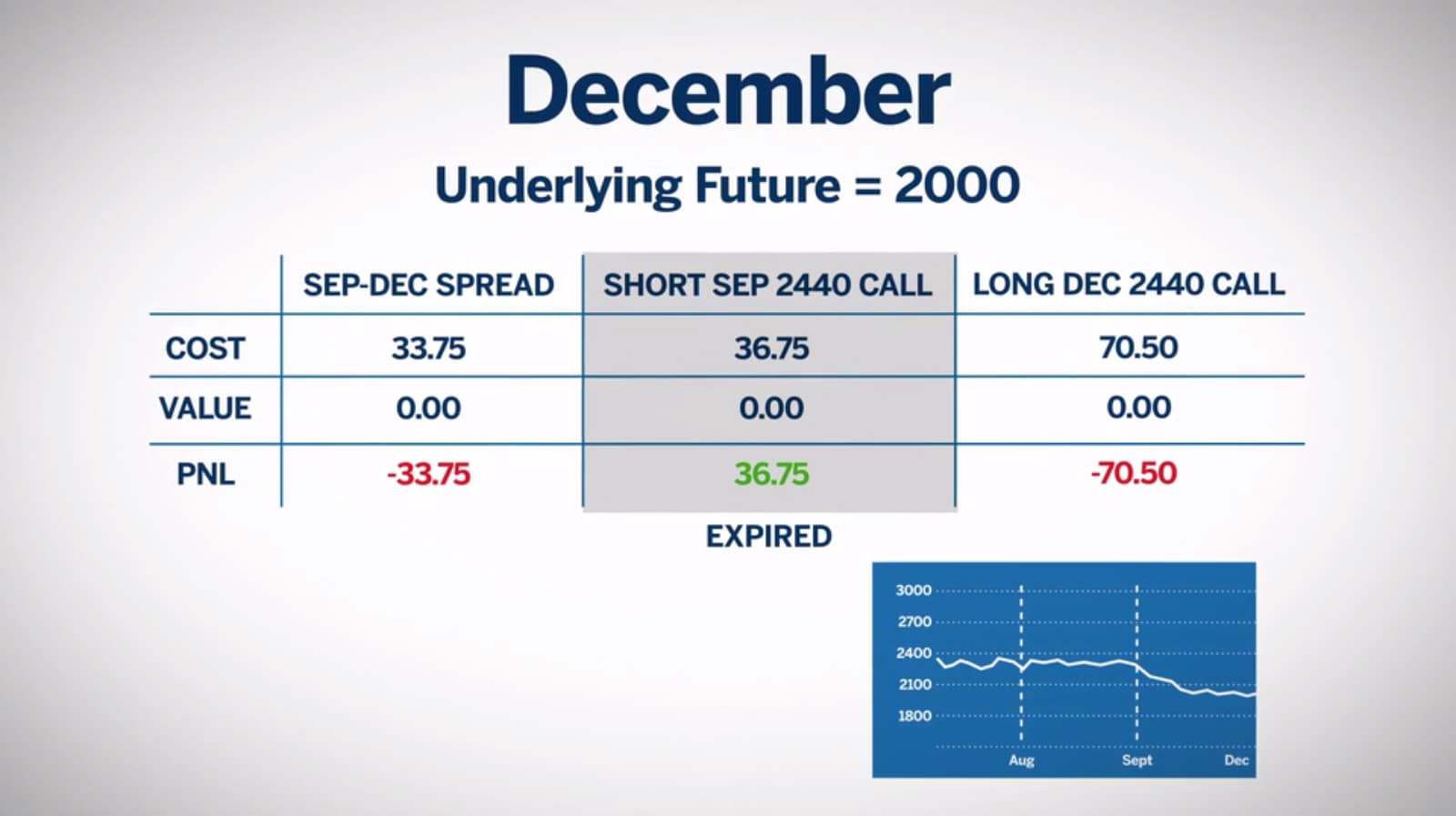

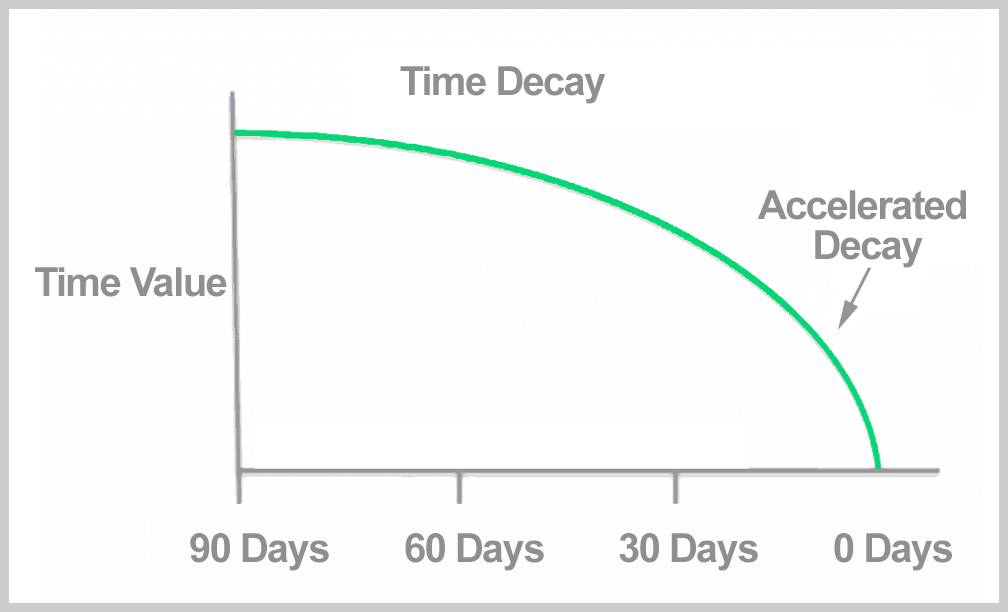

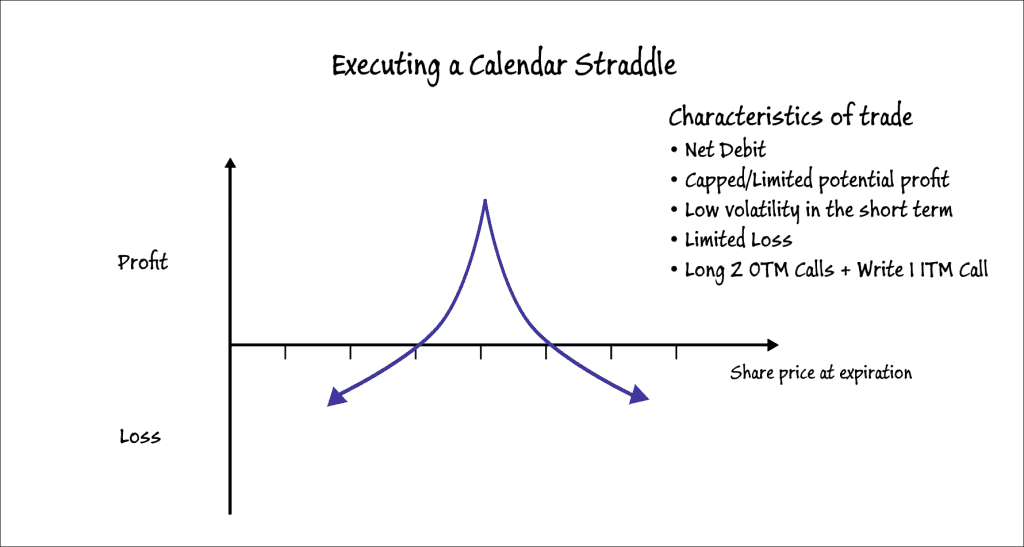

Calendar Option Strategy - A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Options trading strategies can enhance our profits in so many ways. To help you carve out time for preparation, strategy, collaboration, and critical thinking, we have listed some practical tips to optimize your calendar. A calendar spread offers limited risk and possibly limited return. It relies on time decay and implied volatility changes. Calendar spreads combine buying and selling two contracts with different expiration dates. A key distinction within this. The strategy can be adapted for slightly bullish or. With a calendar option strategy, traders aim to profit on the differences in time decay rates between contracts with different expiration dates. You can go either long or. Options trading strategies can enhance our profits in so many ways. One major strategy is the calendar spread. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread offers limited risk and possibly limited return. You can go either long or. Calendar spread compared to other options strategies. To help you carve out time for preparation, strategy, collaboration, and critical thinking, we have listed some practical tips to optimize your calendar. Itive to market direction and volatility in trending markets. A key distinction within this. Th the same strike price but with different. You can go either long or. It relies on time decay and implied volatility changes. One major strategy is the calendar spread. A key distinction within this. Calendar spread compared to other options strategies. Calendar spreads combine buying and selling two contracts with different expiration dates. It’s limited risk because the most that you can lose is. You can go either long or. Th the same strike price but with different. To help you carve out time for preparation, strategy, collaboration, and critical thinking, we have listed some practical tips to optimize your calendar. Calendar spreads combine buying and selling two contracts with different expiration dates. Itive to market direction and volatility in trending markets. Calendar spread compared to other options strategies. A key distinction within this. Th the same strike price but with different. The effectiveness of the strategy depends largely on the timing of price movements relative to the options' expiration dates; You can go either long or. Ideal market conditions include low implied volatility and a neutral market outlook. To help you carve out time for preparation, strategy, collaboration, and critical thinking, we have listed some practical tips to optimize your calendar.. It’s limited risk because the most that you can lose is. With calendar spreads, time decay is your friend. A calendar spread offers limited risk and possibly limited return. To help you carve out time for preparation, strategy, collaboration, and critical thinking, we have listed some practical tips to optimize your calendar. One major strategy is the calendar spread. A key distinction within this. A calendar spread offers limited risk and possibly limited return. The effectiveness of the strategy depends largely on the timing of price movements relative to the options' expiration dates; Here are some examples of how calendar spread options strategy can be used in trading: Calendar spreads combine buying and selling two contracts with different expiration. One major strategy is the calendar spread. The strategy can be adapted for slightly bullish or. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. With calendar spreads, time decay is your friend. A key distinction within this. Ideal market conditions include low implied volatility and a neutral market outlook. Here are some examples of how calendar spread options strategy can be used in trading: It’s limited risk because the most that you can lose is. Calendar spread compared to other options strategies. With a calendar option strategy, traders aim to profit on the differences in time decay. Here are some examples of how calendar spread options strategy can be used in trading: A key distinction within this. Options trading strategies can enhance our profits in so many ways. It’s limited risk because the most that you can lose is. One major strategy is the calendar spread. You can go either long or. Calendar spread compared to other options strategies. A calendar spread offers limited risk and possibly limited return. Here are some examples of how calendar spread options strategy can be used in trading: Ideal market conditions include low implied volatility and a neutral market outlook. Itive to market direction and volatility in trending markets. A calendar spread offers limited risk and possibly limited return. It’s limited risk because the most that you can lose is. Options trading strategies can enhance our profits in so many ways. To help you carve out time for preparation, strategy, collaboration, and critical thinking, we have listed some practical tips to optimize your calendar. The strategy can be adapted for slightly bullish or. Th the same strike price but with different. You can go either long or. The effectiveness of the strategy depends largely on the timing of price movements relative to the options' expiration dates; Here are some examples of how calendar spread options strategy can be used in trading: With a calendar option strategy, traders aim to profit on the differences in time decay rates between contracts with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Ideal market conditions include low implied volatility and a neutral market outlook. Calendar spread compared to other options strategies. It relies on time decay and implied volatility changes.Calendar Spread Options Strategy VantagePoint

Calendar Call Spread Strategy

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Calendar Spread Options Trading Strategy In Python

Calendar Spread Explained Nina Teresa

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

What Is Calendar Spread Option Strategy Manya Ruperta

Calendar Spread Margin Norah Annelise

How to Use the Calendar Spread 1 Options Strategies Center

Calendar Straddle An advanced Neutral Options Trading Strategy

A Key Distinction Within This.

One Major Strategy Is The Calendar Spread.

Calendar Spreads Combine Buying And Selling Two Contracts With Different Expiration Dates.

With Calendar Spreads, Time Decay Is Your Friend.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)