Calendar Put Spread

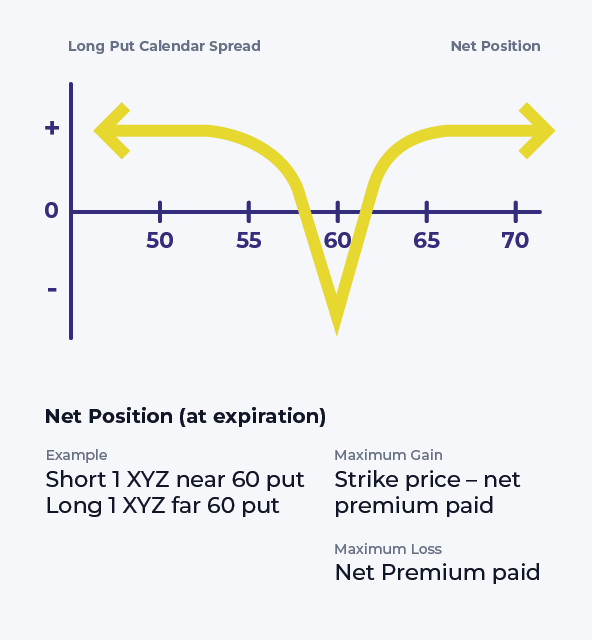

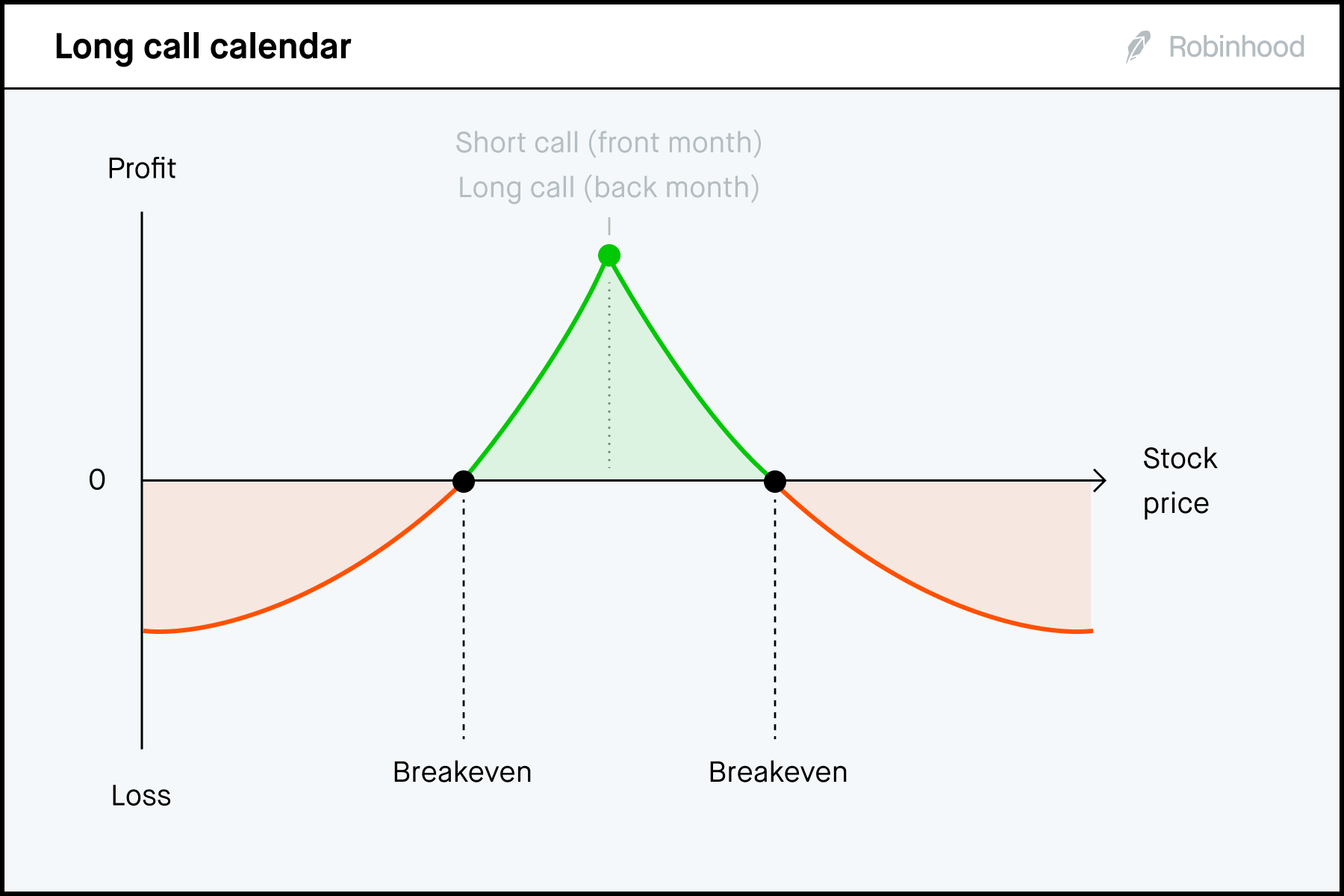

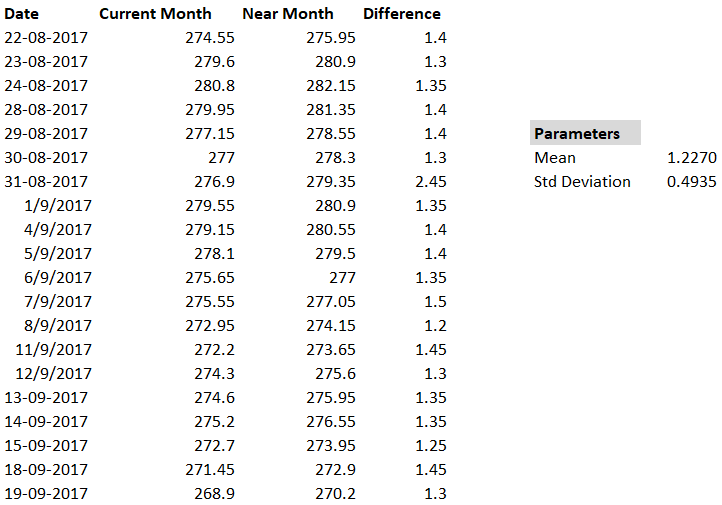

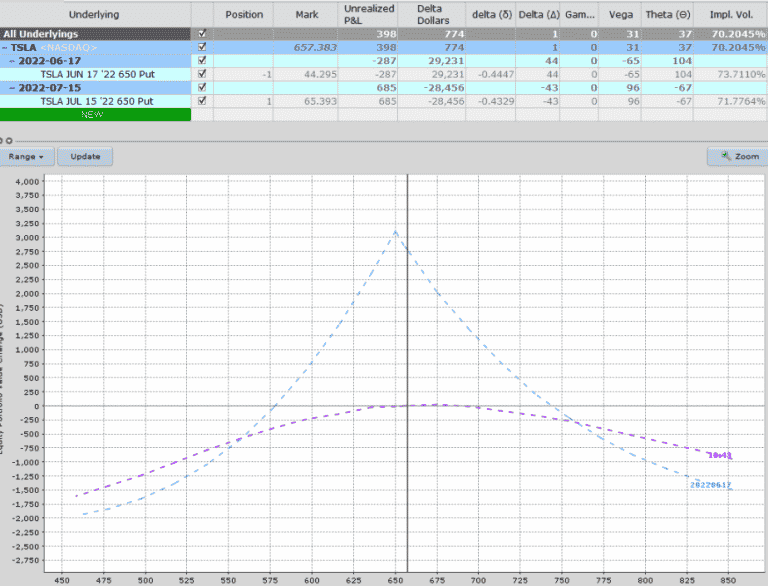

Calendar Put Spread - First you use the sell to open order to write puts based on the particular security that you believe won't move in price. A long calendar spread is a good strategy to. It is best suited for low to moderate volatility market. What is a put calendar spread & how to trade it? A short calendar spread with puts is created by. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. Buy 1 amzn $3,200 put expiring in 30 days for $55. The calendar put spread involves buying and selling put options with different expirations but the same strike price. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. The calendar put spread, also known as a time spread or horizontal put spread, is an options trading strategy that involves the simultaneous purchase of a put option and the sale of. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A short calendar spread with puts is created by. They are most profitable when the underlying asset does not change much until after the. The calendar put spread involves buying and selling put options with different expirations but the same strike price. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar put spread, also known as a time spread or horizontal put spread, is an options trading strategy that involves the simultaneous purchase of a put option and the sale of. You decide to implement a short put calendar spread with a strike price of $3,200. Buy 1 amzn $3,200 put expiring in 30 days for $55. What is a put calendar spread & how to trade it? This is a short volatility strategy. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. It is best suited for low to moderate volatility market. The complex options trading strategy, known as the. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. Buy 1 amzn $3,200 put expiring in 30 days for $55. First you use the sell to open order to write puts based on the particular security that. The calendar put spread involves buying and selling put options with different expirations but the same strike price. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. You decide to implement a short put calendar spread with a strike price of $3,200. They are most profitable when the underlying. You place the following trades: A short calendar spread with puts is created by. You will want the stock to hover around the strike. When you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the same underlying stock at identical strike prices but with different. A bull. You decide to implement a short put calendar spread with a strike price of $3,200. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. You place the. It is best suited for low to moderate volatility market. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. The calendar put spread, also known as a time spread or horizontal put spread, is an options trading. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. The calendar put spread, being one of the three popular. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Buy 1 amzn $3,200 put expiring in 30 days for $55. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. The complex options trading strategy, known as the put calendar spread, is a type of. You place the following trades: You will want the stock to hover around the strike. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. When you invest in a calendar spread, you buy and sell the same type of option (either. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. You will want the stock to hover around the strike. When you invest in a calendar spread, you buy and sell the same type of option (either a call or a put). The calendar put spread, also known as a time spread or horizontal put spread, is an options trading strategy that involves the simultaneous purchase of a put option and the sale of. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing. They are most profitable when the underlying asset does not change much until after the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to. You decide to implement a short put calendar spread with a strike price of $3,200. You place the following trades: Calendar spreads allow traders to construct a trade that minimizes the effects of time. This is a short volatility strategy. Buy 1 amzn $3,200 put expiring in 30 days for $55. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. First you use the sell to open order to write puts based on the particular security that you believe won't move in price. The calendar put spread involves buying and selling put options with different expirations but the same strike price. It is best suited for low to moderate volatility market.Advanced options strategies (Level 3) Robinhood

Calendar Put Spread — Options Edge India Dictionary

Bearish Put Calendar Spread Option Strategy Guide

Calendar Spread Margin Norah Annelise

Options Trading Made Easy Ratio Put Calendar Spread

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Long Calendar Spread with Puts Strategy With Example

Put Calendar Spread Printable Word Searches

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Long Put Calendar Spread (Put Horizontal) Options Strategy

When You Invest In A Calendar Spread, You Buy And Sell The Same Type Of Option (Either A Call Or A Put) For The Same Underlying Stock At Identical Strike Prices But With Different.

You Will Want The Stock To Hover Around The Strike.

What Is A Put Calendar Spread & How To Trade It?

A Short Calendar Spread With Puts Is Created By.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)