Calendar Spread Calculator

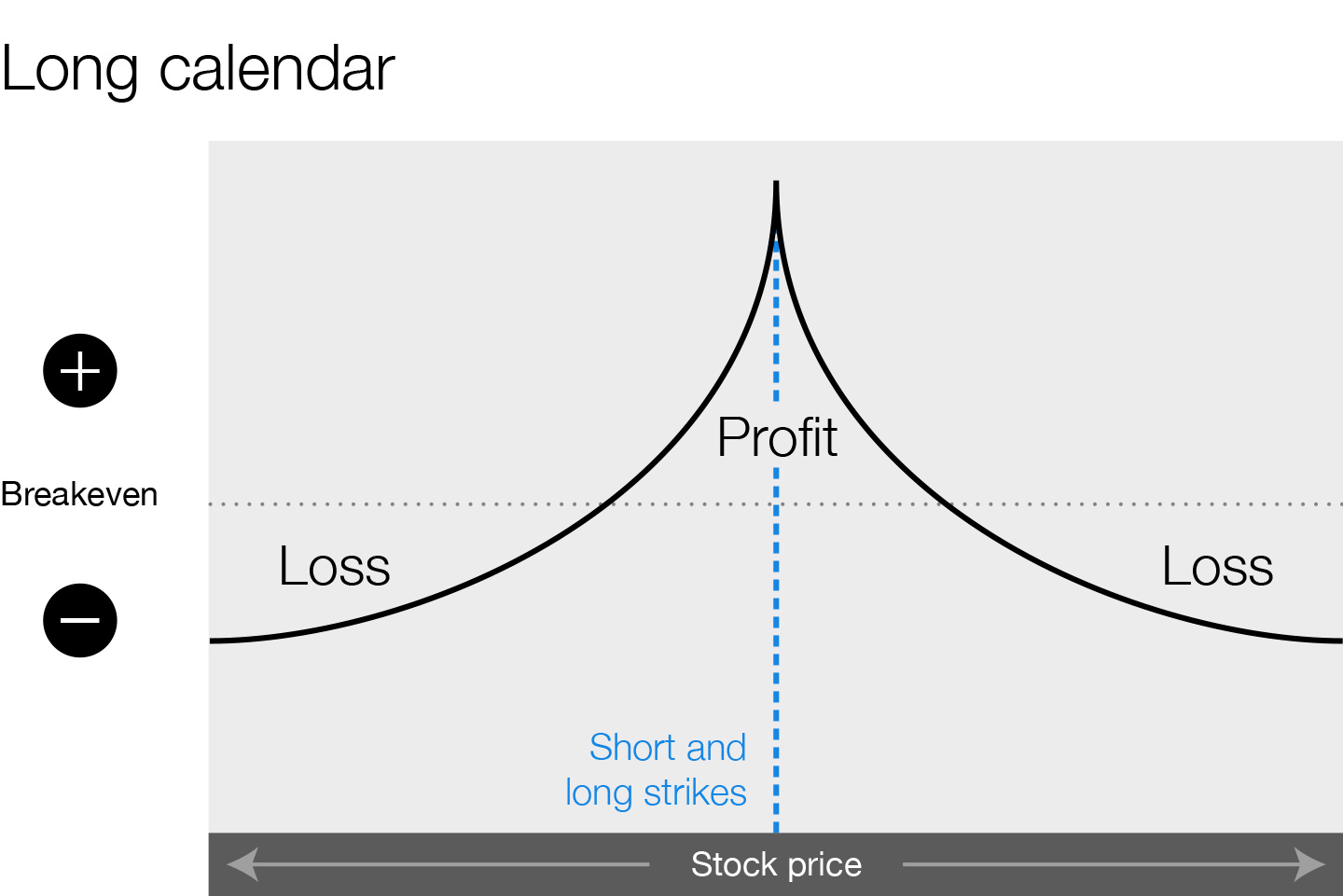

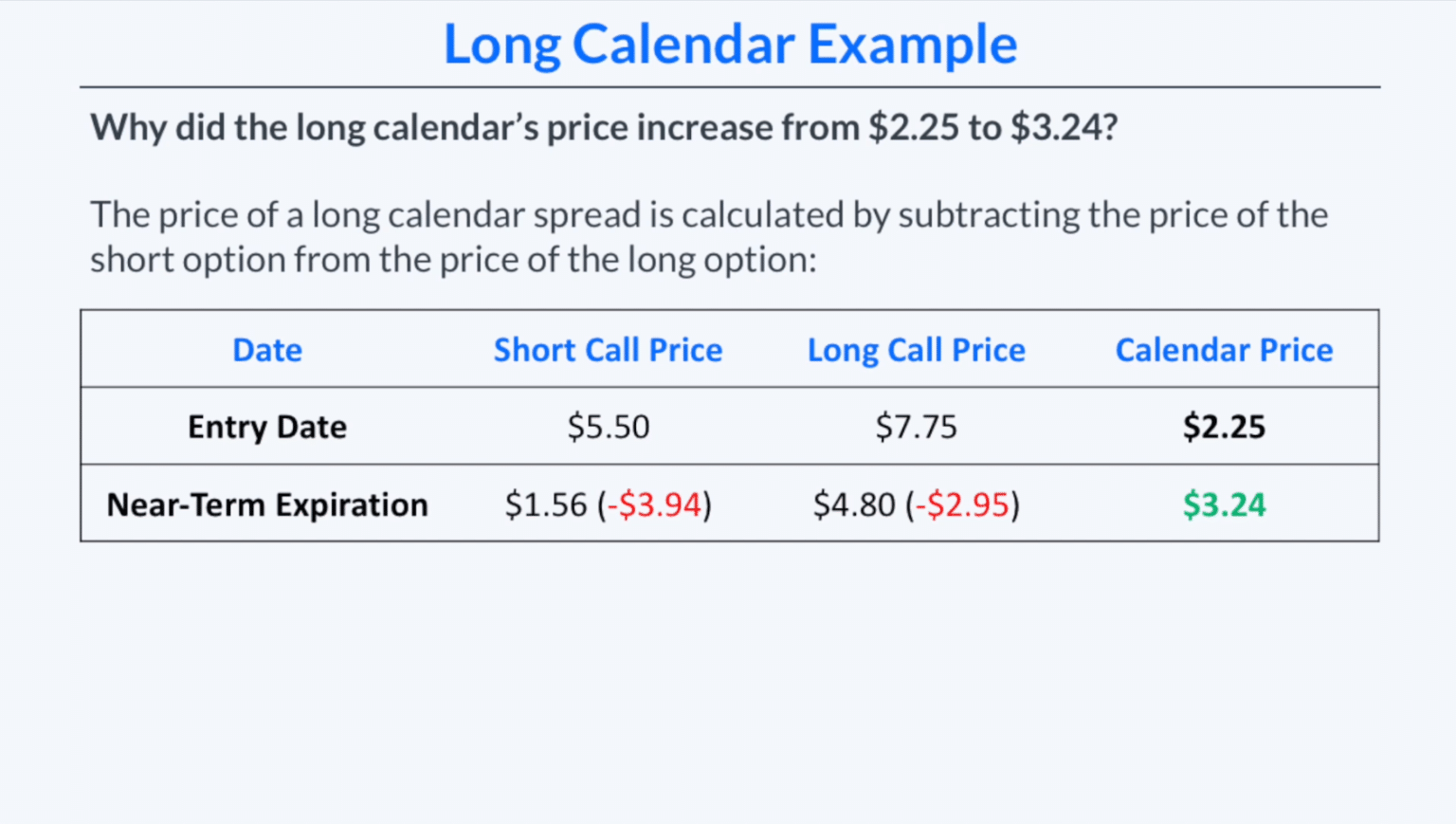

Calendar Spread Calculator - Suppose apple inc (aapl) is currently trading at $145 per share. Clicking on the chart icon on the calendar call spread screener loads. Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Enter a start date and add or subtract any number of days, months, or years. Credit spread calculator shows projected profit and loss over time. Let’s say that abc corp. They need the stock to either. The calendar call spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar call position. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts. They need the stock to either. The calendar call spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar call position. Just pick a strategy, a stock, and a contract. Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. View breakeven points, max profit, max risk, probability of profit and more. Maximum profit is realized if. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Clicking on the chart icon on the calendar call spread screener loads. A dedicated app to help investors build, evaluate, and study options calendar spread strategies easily and quickly. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Clicking on the chart icon on the calendar call spread screener loads. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. They are most profitable when the underlying asset does not change much until after the.. Abc) is trading at $110 per share. When traders implement a calendar spread, they are not betting on a swift movement in the stock. You think it’s going to stay roughly the. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Start with. They need the stock to either. Calendar spreads allow traders to construct a trade that minimizes the effects of time. When traders implement a calendar spread, they are not betting on a swift movement in the stock. Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts. Abc) is trading at. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Calendar spread examples long call calendar spread example. Maximum profit is realized if. Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. A. Find a specific business date and calculate. Suppose apple inc (aapl) is currently trading at $145 per share. They need the stock to either. After analysing the stock's historical volatility. Clicking on the chart icon on the calendar call spread screener loads. Let’s say that abc corp. A dedicated app to help investors build, evaluate, and study options calendar spread strategies easily and quickly. Calculate potential profit, max loss, chance of profit, and more for double calendar options and over 50 more strategies. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with. Find a specific business date and calculate. They need the stock to either. It can be used in both a bullish and bearish. They are most profitable when the underlying asset does not change much until after the. Maximum profit is realized if. A dedicated app to help investors build, evaluate, and study options calendar spread strategies easily and quickly. Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Suppose apple inc (aapl) is currently trading at $145 per share. They need the stock to either. A long calendar call spread is. Let’s say that abc corp. View breakeven points, max profit, max risk, probability of profit and more. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Clicking on the chart icon on the calendar call spread screener loads. A long call calendar spread involves buying and selling call options for the same underlying security at. It can be used in both a bullish and bearish. When traders implement a calendar spread, they are not betting on a swift movement in the stock. A dedicated app to help investors build, evaluate, and study options calendar spread strategies easily and quickly. Let’s say that abc corp. Add your company logo to our printable calendars. Just pick a strategy, a stock, and a contract. It can be used in both a bullish and bearish. After analysing the stock's historical volatility. You think it’s going to stay roughly the. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Suppose apple inc (aapl) is currently trading at $145 per share. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Calendar spread examples long call calendar spread example. A dedicated app to help investors build, evaluate, and study options calendar spread strategies easily and quickly. Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts. Calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. This strategy is known as a calendar spread or time spread. Maximum profit is realized if. They are most profitable when the underlying asset does not change much until after the. View breakeven points, max profit, max risk, probability of profit and more. Let’s say that abc corp.Calendar Spreads 101 Everything You Need To Know

Trading Guide on Calendar Call Spread AALAP

Top Forex Brokere Calculate Calendar Spread Options Strategy Post

Everything You Need to Know about Calendar Spreads

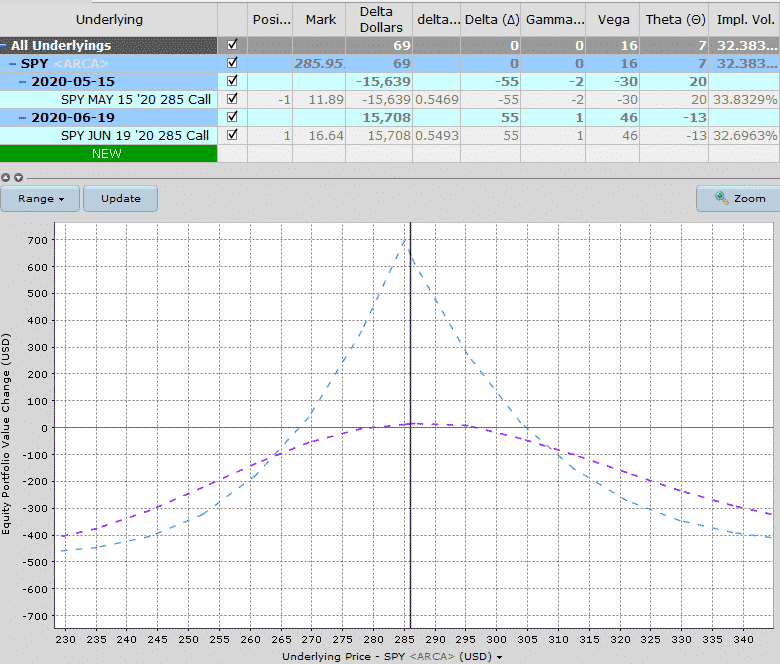

How to use OPTION GREEKS to calculate calendar call spreads profit/risk

Calendar Spread Calculator Printable Computer Tools

Calendar Spreads Varsity by Zerodha

Long Calendar Spreads for Beginner Options Traders projectfinance

Calendar Spread Option Calculator 2024 Calendar 2024 All Holidays

Long Calendar Spreads for Beginner Options Traders projectfinance

Abc) Is Trading At $110 Per Share.

Calculate The Daily Historic Difference Between The Two.

They Need The Stock To Either.

Enter A Start Date And Add Or Subtract Any Number Of Days, Months, Or Years.

Related Post: