Calendar Spread Example

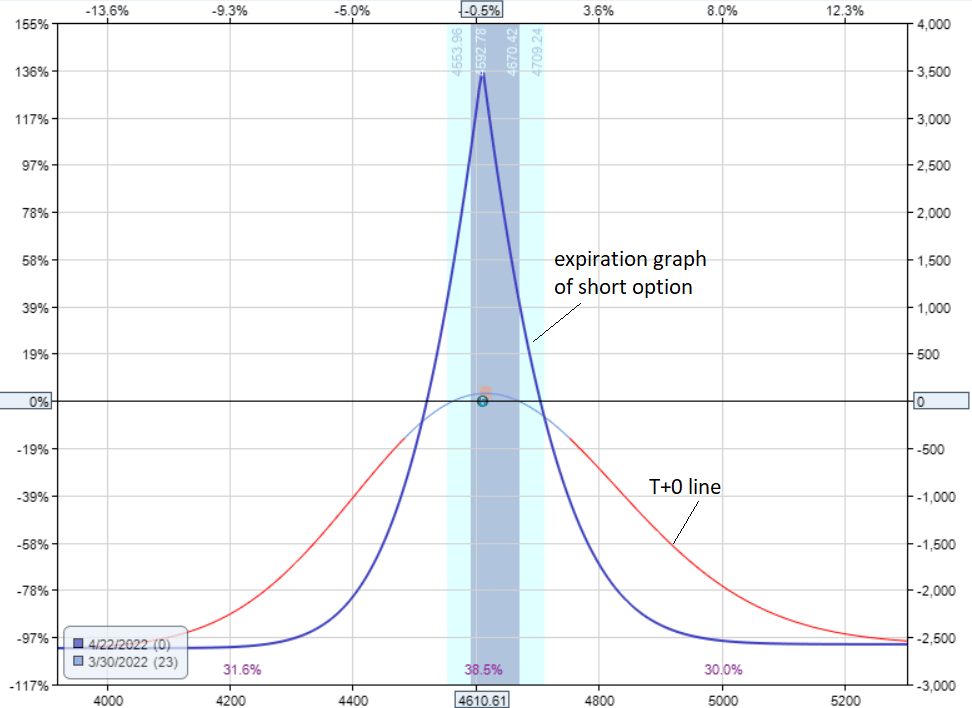

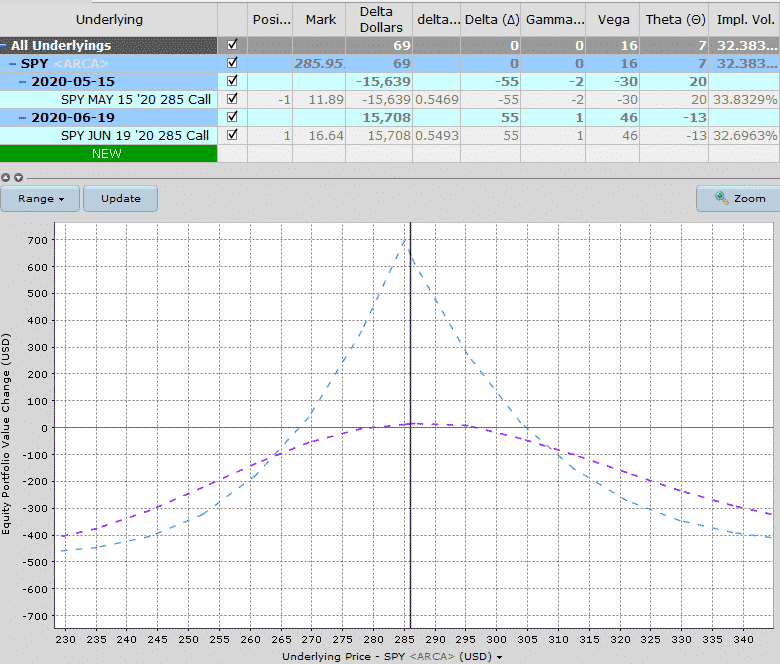

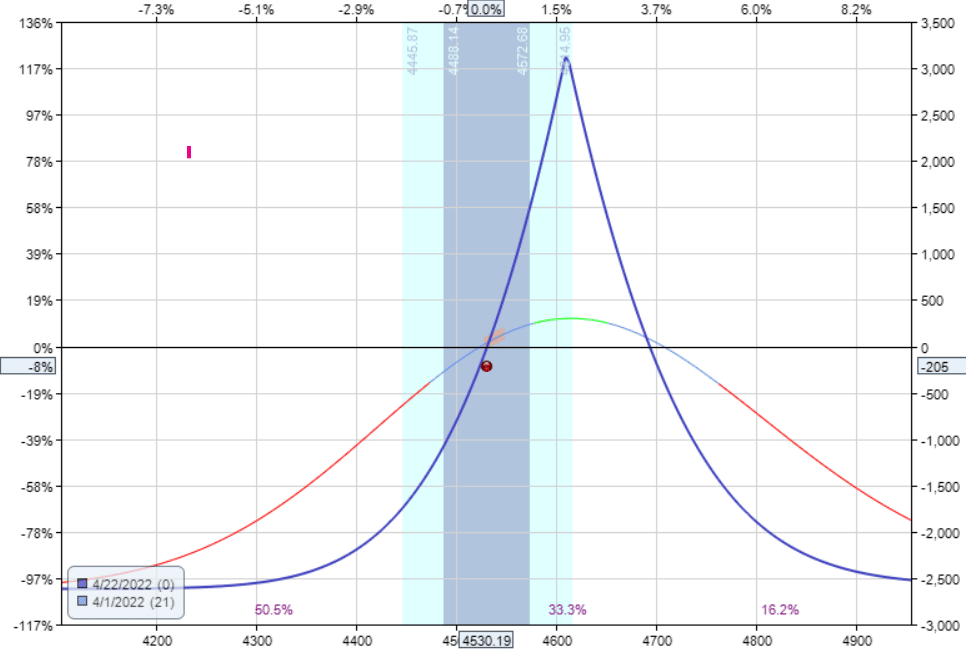

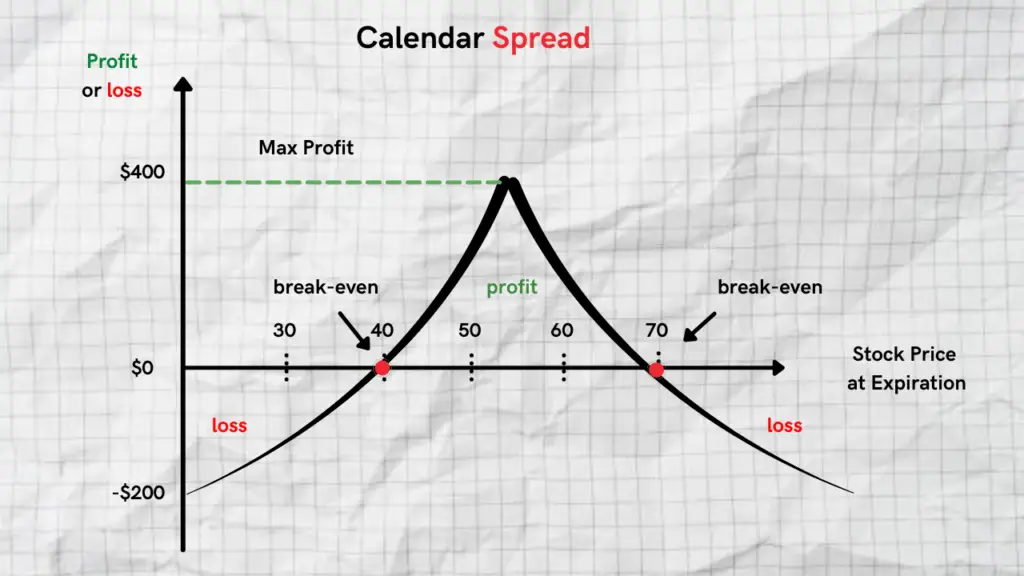

Calendar Spread Example - Calendar spread strategy is a popular trading technique used in the stock market. Trader a is interested in company x's stock, which is currently trading at rs. This part can get a bit tedious, but it’s where your calendar really starts to take shape. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. In this post we will focus on long calendar spreads. This strategy involves buying and selling options with different expiration dates, resulting in a. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. Now, let’s get into the meat of your calendar—adding the actual dates and details. Let us consider the following example to understand the calendar spread strategy. Selling the june 17 call option with a strike price of 145 will. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. An example of a long calendar spread. Trader a is interested in company x's stock, which is currently trading at rs. Selling the june 17 call option with a strike price of 145 will. Calendar spread strategy is a popular trading technique used in the stock market. This part can get a bit tedious, but it’s where your calendar really starts to take shape. Now, let’s get into the meat of your calendar—adding the actual dates and details. With apple stock trading around 144, setting up a calendar spread at 145 gives the trade a neutral outlook. A long calendar spread with calls is created by. This strategy involves buying and selling options with different expiration dates, resulting in a. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. Let us consider the following. This strategy involves buying and selling options with different expiration dates, resulting in a. Let us consider the following example to understand the calendar spread strategy. Now, let’s get into the meat of your calendar—adding the actual dates and details. It aims to profit from time decay and volatility changes. Calendar spread strategy is a popular trading technique used in. This strategy involves buying and selling options with different expiration dates, resulting in a. With apple stock trading around 144, setting up a calendar spread at 145 gives the trade a neutral outlook. Let us consider the following example to understand the calendar spread strategy. This part can get a bit tedious, but it’s where your calendar really starts to. Selling the june 17 call option with a strike price of 145 will. Let us consider the following example to understand the calendar spread strategy. Trader a is interested in company x's stock, which is currently trading at rs. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. It aims to profit from time decay and volatility changes. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. You make money when the stock price is at or just. This strategy involves buying and selling options with different expiration dates, resulting in a. With apple stock trading around 144, setting up. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different. Trader a is interested in company x's stock, which is currently trading at rs. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. You make money when the stock price is at or just. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. Calendar. You make money when the stock price is at or just. Trader a is interested in company x's stock, which is currently trading at rs. Now, let’s get into the meat of your calendar—adding the actual dates and details. It aims to profit from time decay and volatility changes. Selling the june 17 call option with a strike price of. You make money when the stock price is at or just. Calendar spread strategy is a popular trading technique used in the stock market. This strategy involves buying and selling options with different expiration dates, resulting in a. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Let us consider the following example to understand the calendar spread strategy. With apple stock trading around 144, setting up a calendar spread at 145 gives the trade a neutral outlook. It aims to profit from time decay and volatility changes. In this post we will focus on long calendar spreads. Selling the june 17 call option with a strike price of 145 will. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Here you buy and sell the futures of the same stock, but of contracts belonging to different expiries like showcased above. An example of a long calendar spread. Now, let’s get into the meat of your calendar—adding the actual dates and details.calendar spread example Options Trading IQ

Calendar Spreads 101 Everything You Need To Know

Calendar Spread Options Examples Mavra Sibella

Everything You Need to Know about Calendar Spreads

What Is Calendar Spread Option Strategy Manya Ruperta

Long Calendar Spread with Puts Strategy With Example

calendar spread example Options Trading IQ

Calendar Spread Options Strategy Forex Systems, Research, And Reviews

How Long Calendar Spreads Work (w/ Examples) Options Trading

Calendar Spread Explained InvestingFuse

To Profit From A Directional Stock Price Move To The Strike Price Of The Calendar Spread With Limited Risk If The Market Goes In The Other Direction.

This Part Can Get A Bit Tedious, But It’s Where Your Calendar Really Starts To Take Shape.

Trader A Is Interested In Company X's Stock, Which Is Currently Trading At Rs.

A Long Calendar Spread With Calls Is Created By.

Related Post: