Calendar Spread Futures

Calendar Spread Futures - What is a calendar spread? Calculate the daily historic difference between the two. They consider it one of the safer ways to try and profit from the commodity market. In a calendar spread, an investor simultaneously opens one short and one. A calendar spread, also called an “intramarket spread,” is a more advanced trading strategy. You can go either long or. This strategy is sometimes also called a. It is beneficial only when a day trader expects the derivative to have a price trend ranging from neutral to medium rise. You think it’s going to stay roughly the. Calendar spreads combine buying and selling two contracts with different expiration dates. Many traders prefer futures spread trading as an arbitrage strategy. In a calendar spread, an investor simultaneously opens one short and one. With calendar spreads, time decay is your friend. You think it’s going to stay roughly the. A calendar spread, also called an “intramarket spread,” is a more advanced trading strategy. Since they maintain the same strike price and contract. A calendar spread is a trading strategy in. Let’s say that abc corp. Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts. Statements are usually scheduled for thursdays and are spaced relatively evenly throughout the calendar year in a similar fashion to the u.s. A calendar spread, also called an “intramarket spread,” is a more advanced trading strategy. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. You think it’s going to stay roughly the. A calendar spread is a strategy used in options and futures trading: Calendar spreads—also called intramarket. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. What is a calendar spread? Learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. Calendar spreads combine buying and selling two contracts with different expiration dates. Abc) is trading. What is a calendar spread? Calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Calculate the daily historic difference between the two. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. It is beneficial only when a. It is beneficial only when a day trader expects the derivative to have a price trend ranging from neutral to medium rise. A calendar spread, also called an “intramarket spread,” is a more advanced trading strategy. There are several tools used by traders in the options market to realise a profit from selling options before they reach expiration period. Calendar. Let’s say that abc corp. A calendar spread, also called an “intramarket spread,” is a more advanced trading strategy. They consider it one of the safer ways to try and profit from the commodity market. A calendar spread is a strategy used in options and futures trading: There are several tools used by traders in the options market to realise. Abc) is trading at $110 per share. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is a trading strategy in. A calendar spread, also called an “intramarket spread,” is. With calendar spreads, time decay is your friend. Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts. Statements are usually scheduled for thursdays and are spaced relatively evenly throughout the calendar year in a similar fashion to the u.s. A calendar spread involves purchasing and selling derivatives contracts with the. In a calendar spread, an investor simultaneously opens one short and one. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Many traders. Options and futures traders mostly use the calendar spread. One such tool used by seasoned options traders. Calculate the daily historic difference between the two. Abc) is trading at $110 per share. You think it’s going to stay roughly the. Abc) is trading at $110 per share. One such tool used by seasoned options traders. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry. Let’s say that abc corp. Statements are usually scheduled for thursdays and are spaced relatively evenly throughout the calendar year in a similar fashion to the u.s. You think it’s going to stay roughly the. They consider it one of the safer ways to try and profit from the commodity market. A calendar spread is a strategy used in options and futures trading: A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. With calendar spreads, time decay is your friend. Options and futures traders mostly use the calendar spread. Calendar spreads benefit companies when the underlying security is expected to have neutral to moderately rising price trends. Since they maintain the same strike price and contract. Abc) is trading at $110 per share. What is a calendar spread? You can go either long or. There are several tools used by traders in the options market to realise a profit from selling options before they reach expiration period. Learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more.NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

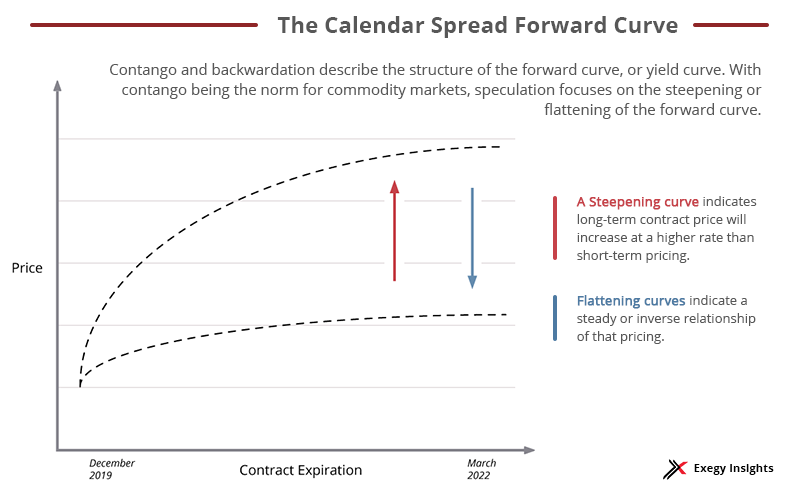

Futures Calendar Spread

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

CBOE Volatility Index Futures Reverse Calendar Spreads

Getting Started with Calendar Spreads in Futures Exegy

Calendar Spreads in Futures and Options Trading Explained

What is a calendar spread in futures trading? WalletInvestor Magazin

Futures Calendar Spread Trading Strategies Gizela Miriam

Futures Calendar Spread Trading Strategies Gizela Miriam

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

In A Calendar Spread, An Investor Simultaneously Opens One Short And One.

Many Traders Prefer Futures Spread Trading As An Arbitrage Strategy.

Calendar Spreads Combine Buying And Selling Two Contracts With Different Expiration Dates.

A Calendar Spread Is A Trading Strategy In.

Related Post:

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)