Calendar Spread Option Strategy

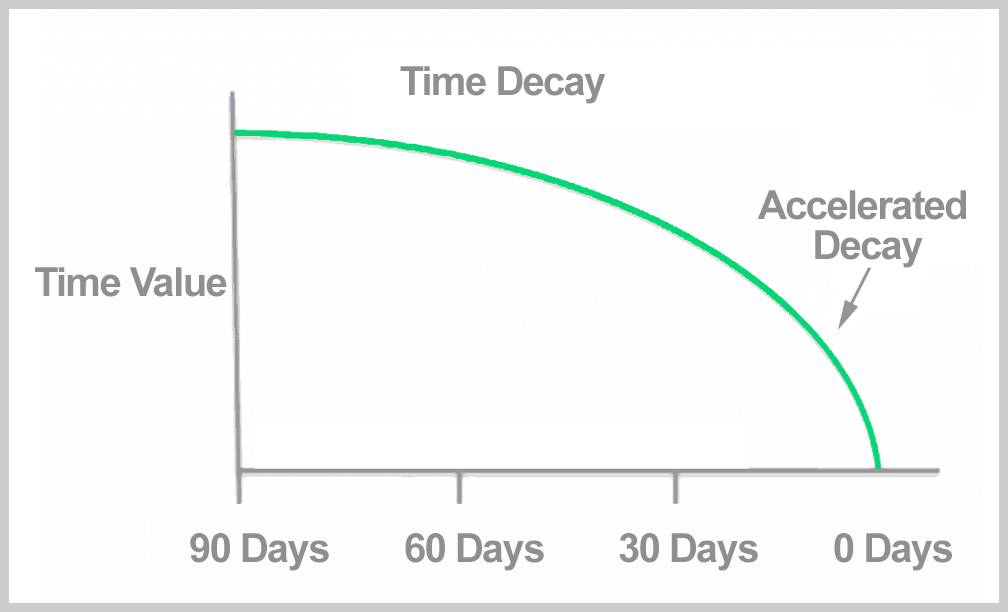

Calendar Spread Option Strategy - See how to plan, execute and manage a long calendar spread with a bearish outlook on the dia etf. Options trading strategies can enhance our profits in so many ways. One major strategy is the calendar spread. In this course, you'll learn how to buy and sell options, options assignment, vertical spreads, the most popular strategies, and how to prepare for live trading action. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. Here are 2 of the most common credit spread trading strategies: It aims to profit from time decay and volatility changes. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. Learn how to use calendar spreads, a derivatives strategy that involves buying and selling options on the same underlying asset but with different expiration dates. A calendar spread offers limited risk and possibly limited return. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. Calendar spread compared to other options strategies. Here are 2 of the most common credit spread trading strategies: A calendar spread offers limited risk and possibly limited return. Ideal market conditions include low implied volatility and a neutral. Here are some examples of how calendar spread options strategy can be used in trading: Compare different strike prices, payoff diagrams, and examples of atm and. With a calendar option strategy, traders aim to profit on the differences in time decay rates between contracts with different expiration dates. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other. A key distinction within this. Learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes in implied. It’s limited risk because the most that you can lose is. A bear call spread is an options trading strategy used when traders expect a moderate decline in a stock’s price. It. Learn how to use calendar spreads, a derivatives strategy that involves buying and selling options on the same underlying asset but with different expiration dates. What is a calendar spread? One major strategy is the calendar spread. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. In this course, you'll learn how. It aims to profit from time decay and volatility changes. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. Here are some examples of how calendar spread options strategy can be used in trading: A bear call spread is an options trading strategy used when. It’s limited risk because the most that you can lose is. Mortgage renewal tips tips for your next mortgage term; Here are 2 of the most common credit spread trading strategies: One major strategy is the calendar spread. A key distinction within this. It’s limited risk because the most that you can lose is. Ideal market conditions include low implied volatility and a neutral. What is a calendar spread? Options trading strategies can enhance our profits in so many ways. With a calendar option strategy, traders aim to profit on the differences in time decay rates between contracts with different expiration dates. Learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes in implied. A bear call spread is an options trading strategy used when traders expect a moderate decline in a stock’s price. The net cost of this spread is. Calendar spreads and diagonal spreads. Learn how to use calendar spreads to combine the advantages of spreads and directional options trades in the same position. A calendar spread offers limited risk and possibly limited return. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. It’s limited risk because the most that you can lose is. A key. A bear call spread is an options trading strategy used when traders expect a moderate decline in a stock’s price. Compare different strike prices, payoff diagrams, and examples of atm and. It’s limited risk because the most that you can lose is. Learn how to use calendar spreads, a derivatives strategy that involves buying and selling options on the same. What is a calendar spread? The net cost of this spread is. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other. One major strategy is the calendar spread. It’s limited risk because the most that you can lose is. Learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes in implied. Here are some examples of how calendar spread options strategy can be used in trading: With a calendar option strategy, traders aim to profit on the differences in time decay rates between. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. A bear call spread is an options trading strategy used when traders expect a moderate decline in a stock’s price. It relies on time decay and implied volatility changes. Learn how to use calendar spreads, a derivatives strategy that involves buying and selling options on the same underlying asset but with different expiration dates. With a calendar option strategy, traders aim to profit on the differences in time decay rates between contracts with different expiration dates. Mortgage renewal tips tips for your next mortgage term; It’s limited risk because the most that you can lose is. Calendar spread compared to other options strategies. Compare different strike prices, payoff diagrams, and examples of atm and. In this course, you'll learn how to buy and sell options, options assignment, vertical spreads, the most popular strategies, and how to prepare for live trading action. A calendar spread offers limited risk and possibly limited return. Here are 2 of the most common credit spread trading strategies: See how to plan, execute and manage a long calendar spread with a bearish outlook on the dia etf. Learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes in implied. What is a calendar spread? A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with.Calendar Call Spread Strategy

How to Use the Calendar Spread 1 Options Strategies Center

Calendar Spread Options Strategy VantagePoint

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

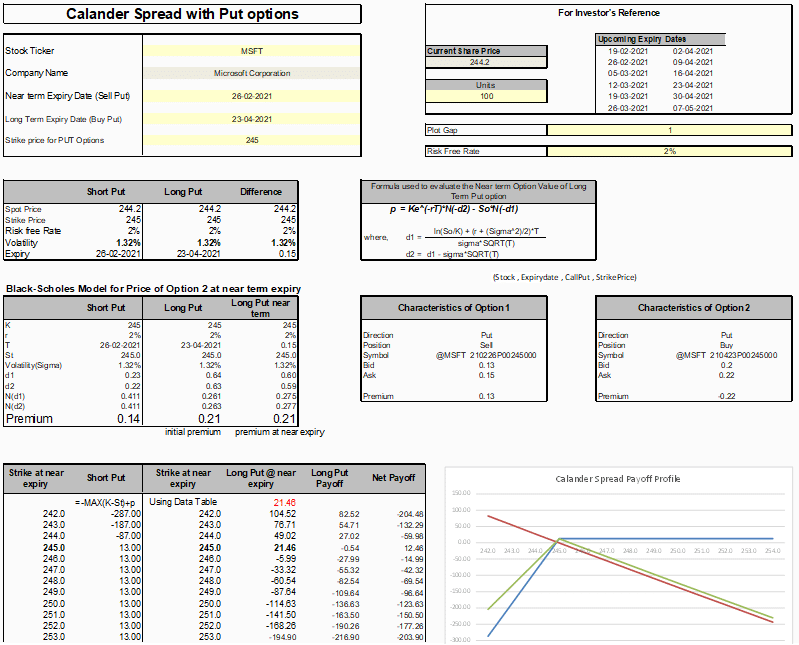

Option Strategy Long Calendar Spread (Excel Template) MarketXLS

Calendar Spread Options Trading Strategy In Python

Calendar Spread, stratégie d'options sur deux échéances différentes.

Calendar Spread Explained Nina Teresa

What is Calendar Spread Options Strategy ? Different types of Calendar

How Calendar Spreads Work (Best Explanation) projectoption

It Aims To Profit From Time Decay And Volatility Changes.

A Key Distinction Within This.

Options Trading Strategies Can Enhance Our Profits In So Many Ways.

Ideal Market Conditions Include Low Implied Volatility And A Neutral.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)