Calendar Spread Options

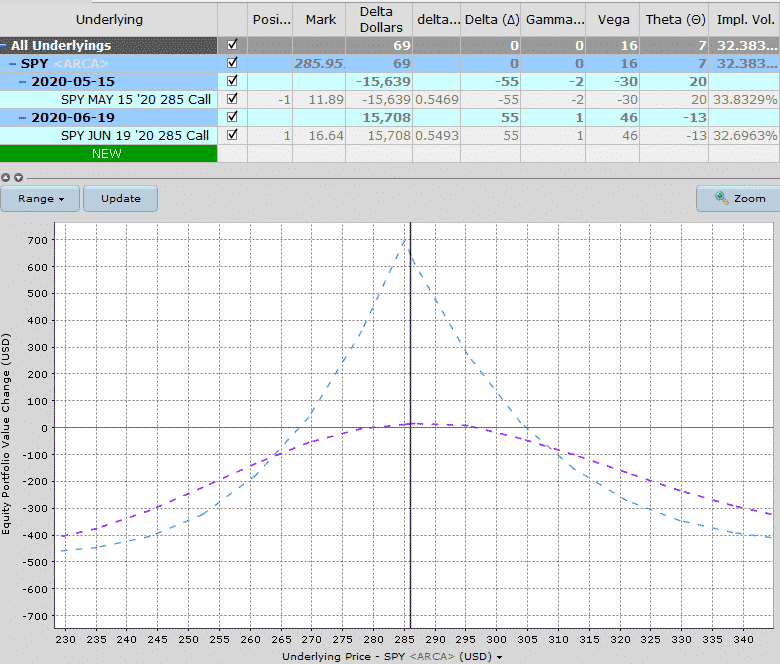

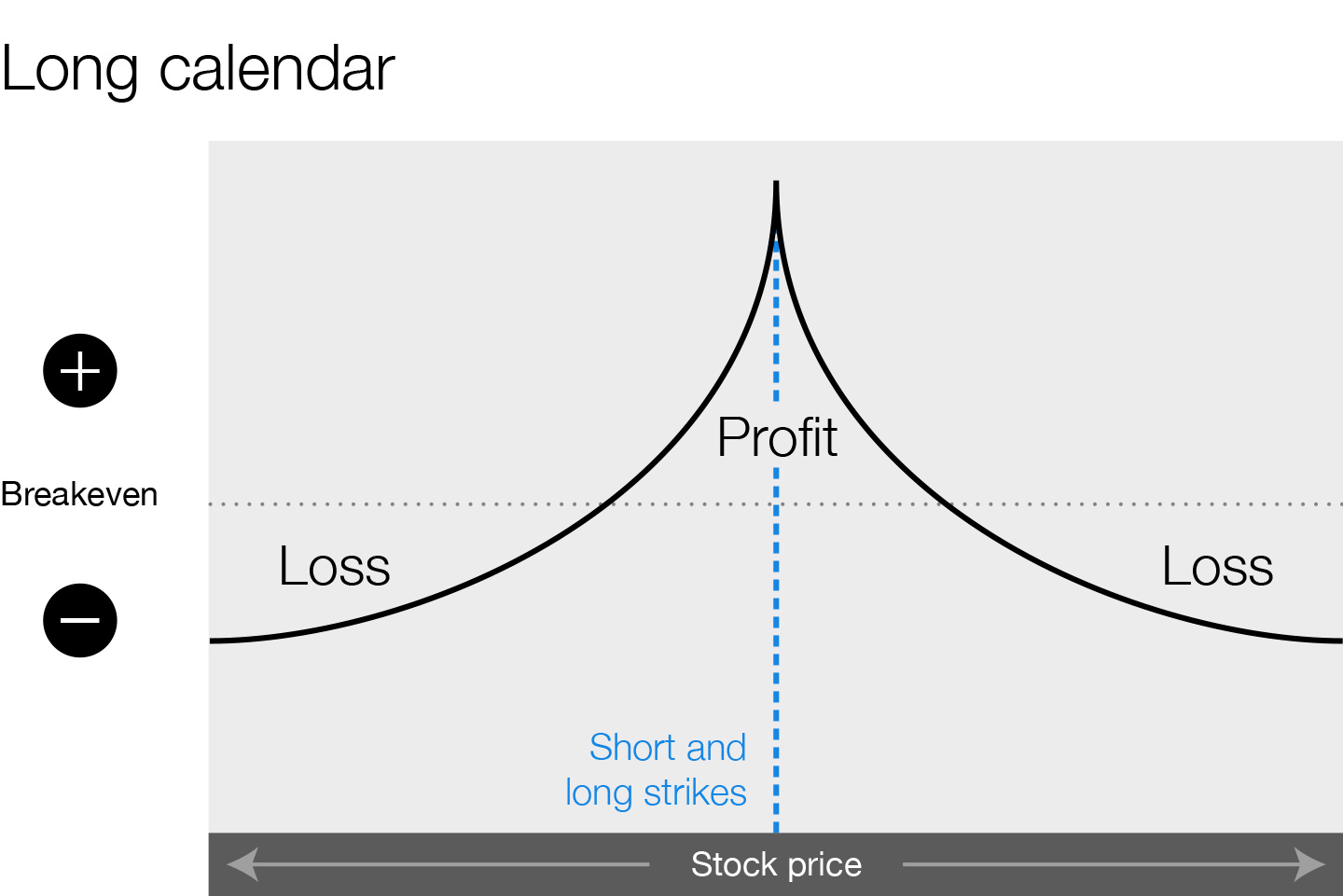

Calendar Spread Options - Calendar spreads can be used as a directionally neutral strategy in options trading. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other. After analysing the stock's historical volatility. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. It offers reduced risk compared to other strategies and potential lower initial investment costs. Suppose apple inc (aapl) is currently trading at $145 per share. A calendar spread offers limited risk and possibly limited return. Calendar spread examples long call calendar spread example. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar option strategy effectively. It aims to profit from time decay and volatility changes. Calendar spreads and diagonal spreads are two very similar trade structures, but there are distinct situations where one will outperform the other. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. After analysing the stock's historical volatility. The calendar spread options strategy is a trade. Not the most elegant solution, but it works if you need a one. Calendar spread examples long call calendar spread example. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. It aims to profit from time decay and volatility changes. It’s limited risk because the most that you can lose is. Suppose apple inc (aapl) is currently trading at $145 per share. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. Not the most elegant solution, but it works if you need a one. A calendar spread offers limited risk and possibly limited return. In this episode, i walk through setting up and building calendar spreads, the impact of implied. It aims to profit from time decay and volatility changes. Suppose apple inc (aapl) is currently trading at $145 per share. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Calendar spread examples long call calendar spread example. Calendar spreads are options trading strategies that involve simultaneously buying and selling options of. Suppose apple inc (aapl) is currently trading at $145 per share. It aims to profit from time decay and volatility changes. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. After analysing the stock's historical. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. It offers reduced risk compared to other strategies and potential lower initial investment costs. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar option strategy effectively. What is a calendar spread? Calendar spreads. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. Calendar spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset with identical strike prices but different expiration dates. In this guide, we’ll take a. Long call calendar spreads profit from a slightly higher move up in the underlying stock. A calendar spread offers limited risk and possibly limited return. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. Calendar spread examples long call calendar spread example. It aims to. It aims to profit from time decay and volatility changes. After analysing the stock's historical volatility. The calendar spread options strategy is a trade. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. Calendar spreads. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Calendar spreads and diagonal spreads are two very similar. Not the most elegant solution, but it works if you need a one. Calendar spread examples long call calendar spread example. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. What is. It aims to profit from time decay and volatility changes. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. Calendar spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset with identical strike prices but different expiration dates. It offers reduced risk compared to other strategies and potential lower initial investment costs. A calendar spread offers limited risk and possibly limited return. Suppose apple inc (aapl) is currently trading at $145 per share. After analysing the stock's historical volatility. Calendar spread examples long call calendar spread example. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. In this guide, we’ll take a look at the calendar spread definition and how you can use this calendar option strategy effectively. Calendar spread compared to other options strategies. It’s limited risk because the most that you can lose is. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. Learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Long call calendar spreads profit from a slightly higher move up in the underlying stock.Calendar Spreads 101 Everything You Need To Know

Calendar Call Spread Strategy

Calendar Spread and Long Calendar Option Strategies Market Taker

Top Forex Brokere Calculate Calendar Spread Options Strategy Post

How Calendar Spreads Work (Best Explanation) projectoption

Calendar Spread Options Kelsy Mellisa

Calendar Spread Options Strategy Forex Systems, Research, And Reviews

What Is Calendar Spread Option Strategy Manya Ruperta

Long Calendar Spread Strategy Ursa Adelaide

Calendar Call Spread Strategy

Calendar Spreads Can Be Used As A Directionally Neutral Strategy In Options Trading.

Calendar Spreads And Diagonal Spreads Are Two Very Similar Trade Structures, But There Are Distinct Situations Where One Will Outperform The Other.

Download Your Google Calendar Events As A Csv File And Import Them Into Your Sheets Calendar.

What Is A Calendar Spread?

Related Post: