Calendar Spread Strategy

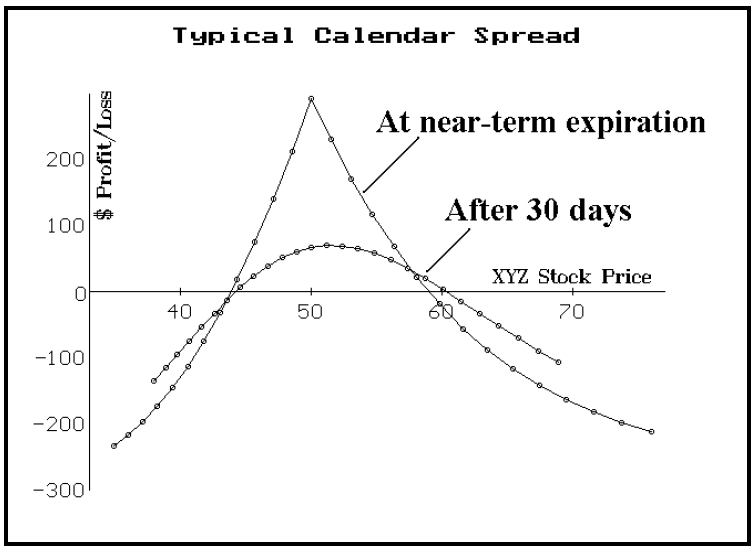

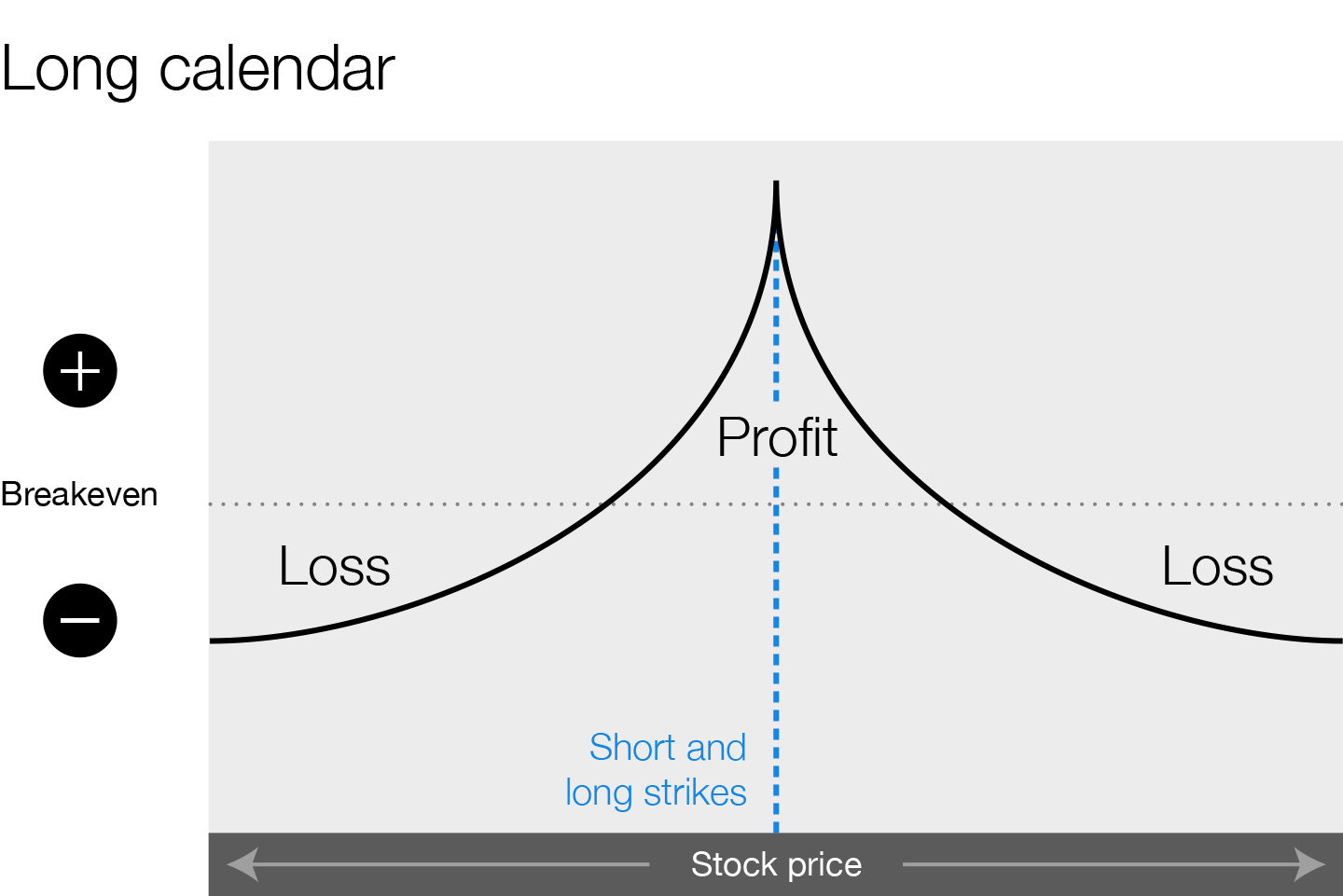

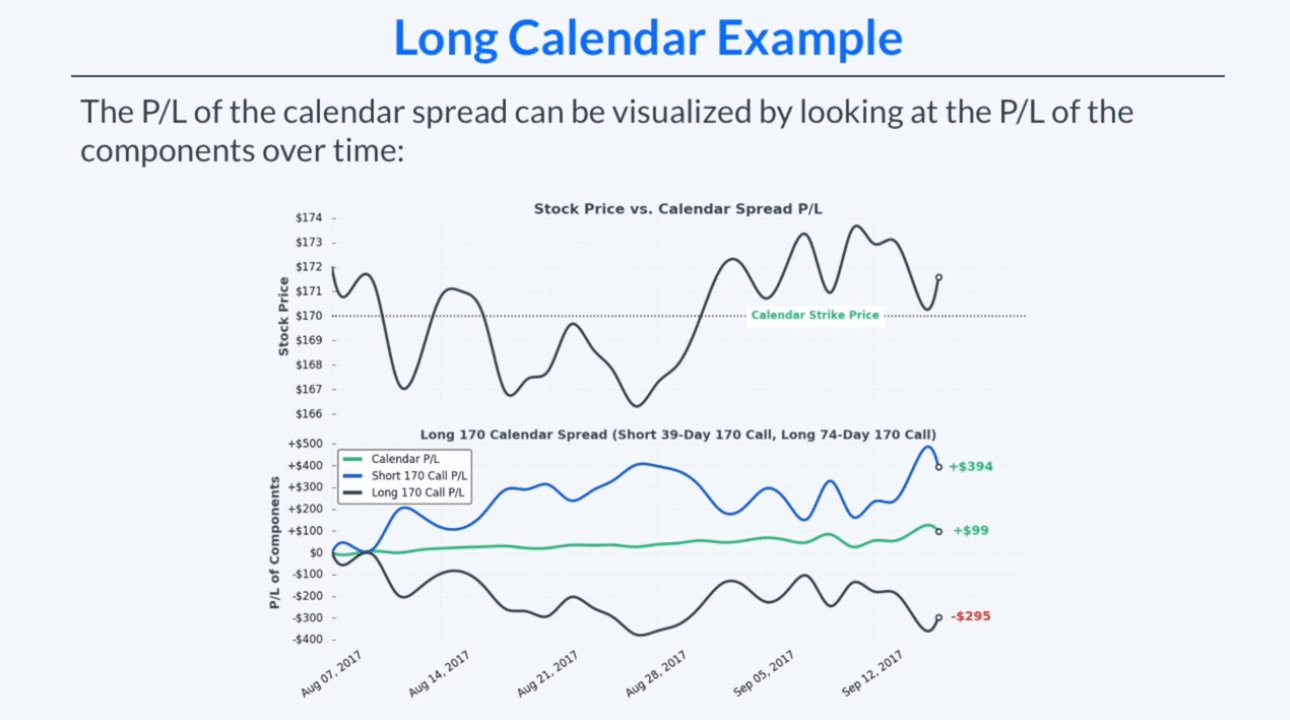

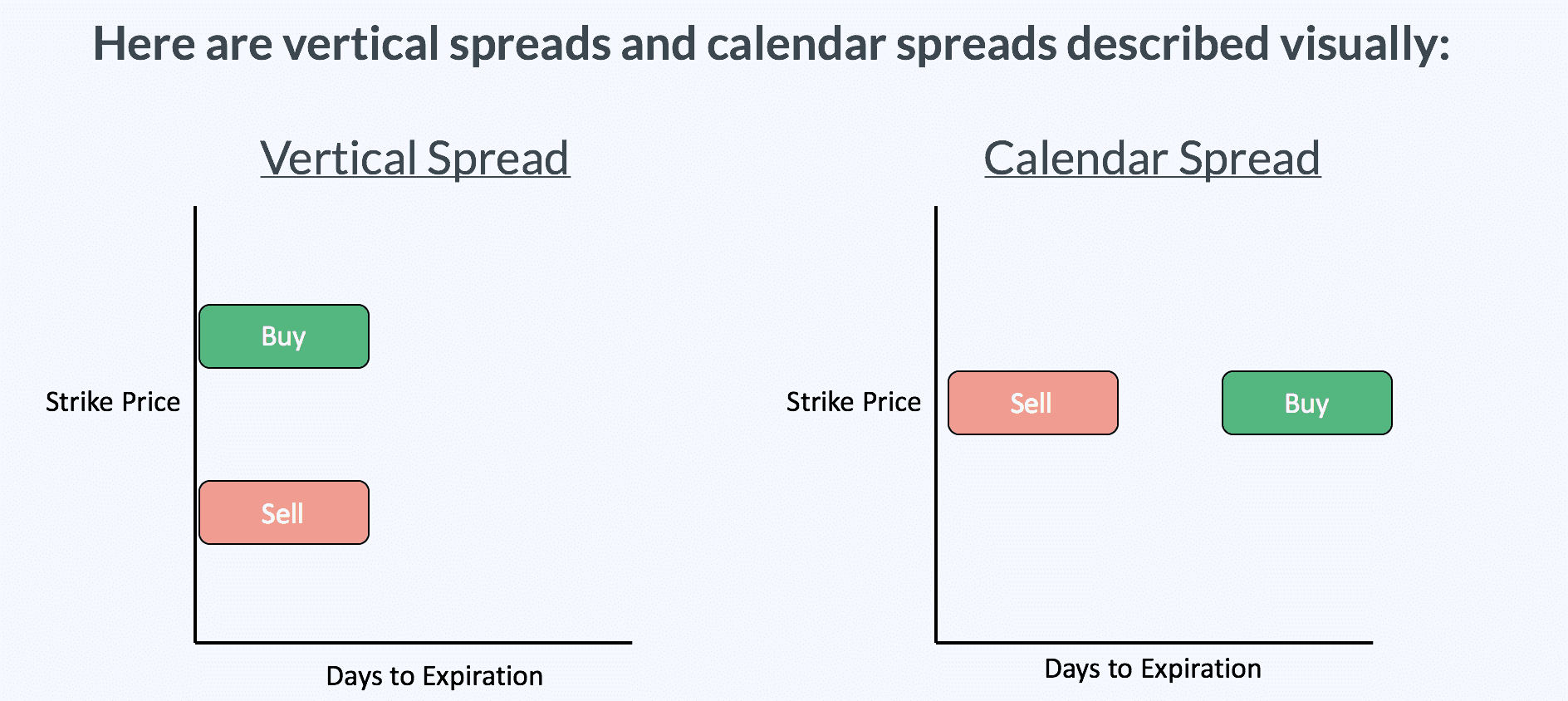

Calendar Spread Strategy - However many traders (including market rebellion’s aj. To execute a debit spread strategy, you’ll need to work with an options broker to simultaneously place orders for contracts on your chosen underlying asset. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. Calendar spread strategy is a popular trading technique used in the stock market. Learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. This strategy involves buying and selling options with different expiration dates, resulting in a. This is a similar p/l to the short iron butterfly. Many traders lack a deep understanding of calendar spreads’ dynamics. What is a calendar spread options strategy? After analysing the stock's historical volatility. Consequently, it’s uncommon to find retail. Calendar spreads are intricate financial structures. After analysing the stock's historical volatility. Learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. A calendar spread offers limited risk and possibly limited return. I implement these strategies through careful position structuring and precise. Calendar spread compared to other options strategies. What is a calendar spread options strategy? Calendar spreads combine buying and selling two contracts with different expiration dates. What is a calendar spread? Strategies, tips, and best practices. After analysing the stock's historical volatility. Typically, you’ll start by selecting. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. Calendar spreads are intricate financial structures. To execute a debit spread strategy, you’ll need to work with an options broker to simultaneously place orders. This strategy involves buying and selling options with different expiration dates, resulting in a. A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with.. Strategies, tips, and best practices. Learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. This is a similar p/l to the short iron butterfly. Calendar spread compared to other options strategies. Calendar spreads are intricate financial structures. Calendar spreads offer distinct strategic approaches based on market outlook and volatility expectations. Calendar spread trading involves buying and selling options with different expiration dates but. You can go either long or. Calendar spread compared to other options strategies. Calendar spread options strategy is generally involves simultaneously holding long and short positions in two options with different. Calendar spread examples long call calendar spread example. It’s limited risk because the most that you can lose is. Suppose apple inc (aapl) is currently trading at $145 per share. Option trading strategies offer traders and investors the opportunity to profit in ways not available to those who only buy or sell short the underlying security. Typically, you’ll start by. Calendar spreads offer distinct strategic approaches based on market outlook and volatility expectations. You can go either long or. Calendar spread examples long call calendar spread example. It’s limited risk because the most that you can lose is. Suppose apple inc (aapl) is currently trading at $145 per share. Calendar spreads offer distinct strategic approaches based on market outlook and volatility expectations. Calendar spread options strategy is generally involves simultaneously holding long and short positions in two options with different. Calendar spread trading involves buying and selling options with different expiration dates but. You can go either long or. What is a calendar spread? Calendar spreads offer distinct strategic approaches based on market outlook and volatility expectations. Calendar spreads are intricate financial structures. Calendar spreads combine buying and selling two contracts with different expiration dates. What is a calendar spread? It aims to profit from time decay and volatility changes. Strategies, tips, and best practices. To execute a debit spread strategy, you’ll need to work with an options broker to simultaneously place orders for contracts on your chosen underlying asset. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Option trading strategies offer traders and investors the opportunity to profit in ways. What is a calendar spread options strategy? Strategies, tips, and best practices. A calendar spread offers limited risk and possibly limited return. A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. Calendar spread strategy is a popular trading technique used in the stock market. Calendar spread options strategy is generally involves simultaneously holding long and short positions in two options with different. Learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with. This strategy involves buying and selling options with different expiration dates, resulting in a. To execute a debit spread strategy, you’ll need to work with an options broker to simultaneously place orders for contracts on your chosen underlying asset. I implement these strategies through careful position structuring and precise. This is a similar p/l to the short iron butterfly. Option trading strategies offer traders and investors the opportunity to profit in ways not available to those who only buy or sell short the underlying security. It aims to profit from time decay and volatility changes. A calendar spread, also called an “intramarket spread,” is a more advanced trading strategy.The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Calendar Call Spread Option Strategy Heida Kristan

Calendar Spread Options Strategy Forex Systems, Research, And Reviews

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Calendar Spread Options Trading Strategy In Python

Long Calendar Spreads for Beginner Options Traders projectfinance

Calendar Spread and Long Calendar Option Strategies Market Taker

Long Calendar Spread with Puts Strategy With Example

What Is Calendar Spread Option Strategy Manya Ruperta

It’s Limited Risk Because The Most That You Can Lose Is.

Calendar Spreads Are Intricate Financial Structures.

Suppose Apple Inc (Aapl) Is Currently Trading At $145 Per Share.

Calendar Spread Trading Involves Buying And Selling Options With Different Expiration Dates But The Same Strike Price.

Related Post: