Calendar Spread Using Calls

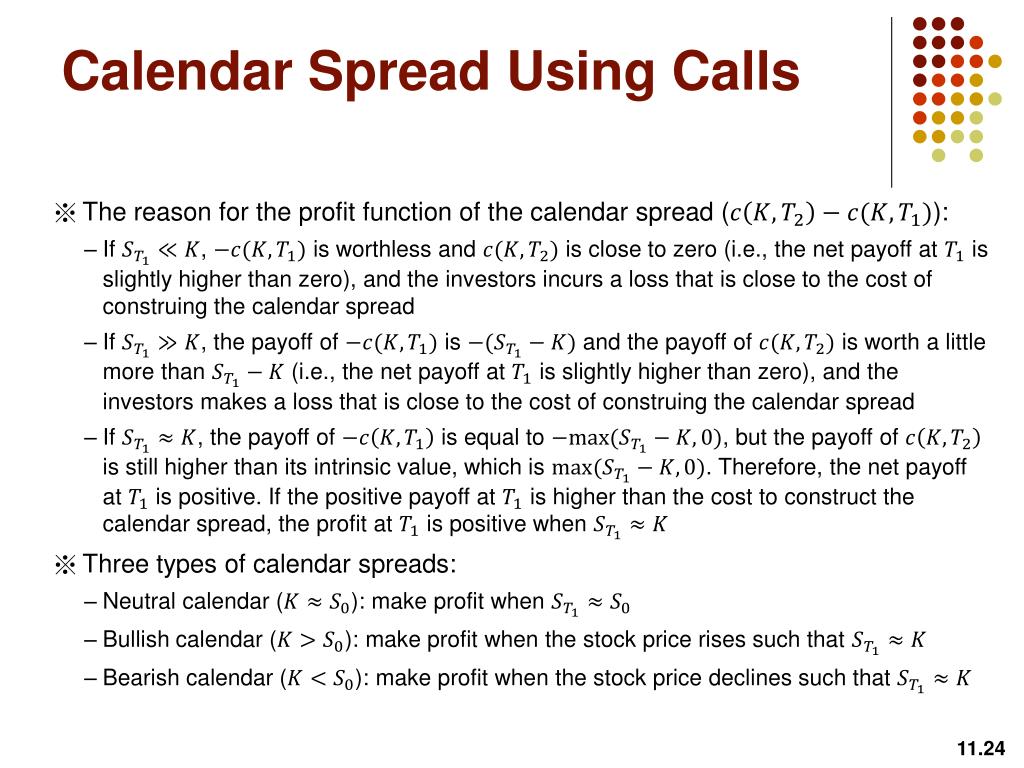

Calendar Spread Using Calls - Personally, using the 4ds has significantly boosted my productivity and allowed me to focus only on what truly matters. A growing number of public officials have called for mr. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. After analysing the stock's historical volatility. A calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one. Adams to resign or for ms. What is a long calendar spread? The call calendar spread, also known as a time spread, is a powerful options trading strategy that profits from time decay (theta) and changes in implied volatility (iv). It aims to profit from time decay and volatility changes. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. The call calendar spread, also known as a time spread, is a powerful options trading strategy that profits from time decay (theta) and changes in implied volatility (iv). A growing number of public officials have called for mr. Itive to market direction and volatility in trending markets. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. The strategy most commonly involves calls with the same strike. A calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one. An exception to this rule comes when one of the quarterly spy dividends is. Calendar call spreads involve buying and selling call options of the same strike price but different expirations. If you're planning a monthly calendar, you'll want to start with a grid layout. An exception to this rule comes when one of the quarterly spy dividends is. Michael gianaris, the deputy majority leader of the. What is a calendar call spread? Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. A growing number of public officials have called for mr. The aim of the strategy is to. A calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The strategy most commonly. Itive to market direction and volatility in trending markets. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Merge cells for month header: If you're planning a monthly calendar, you'll want to start with a grid layout.. The strategy most commonly involves calls with the same strike. Calendar call spreads involve buying and selling call options of the same strike price but different expirations. A calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one. The aim of the strategy is to. Calendar. A growing number of public officials have called for mr. The strategy most commonly involves calls with the same strike. After analysing the stock's historical volatility. Here's how to do it: What is a long calendar spread? They are most profitable when the underlying asset does not change much until after the. Merge cells for month header: Select a range of cells in the first row, and use the. What is a calendar call spread? Calendar spreads allow traders to construct a trade that minimizes the effects of time. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. What is a long calendar spread? Itive to market direction and volatility in trending markets. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A growing number of public officials have called for mr. The aim of the strategy is to. Th the same strike price but with different. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. The strategy most commonly involves calls with the same strike. What is a. It aims to profit from time decay and volatility changes. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. If you're planning a monthly calendar, you'll want to start with a grid layout. Th the same strike. Calendar spread examples long call calendar spread example. Merge cells for month header: A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar call spread is a neutral options trading strategy, which. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Personally, using the 4ds has significantly boosted my productivity and allowed me to focus only on what truly matters. Select a range of cells in the first row, and use the. If you're planning a monthly calendar, you'll want to start with a grid layout. The call calendar spread, also known as a time spread, is a powerful options trading strategy that profits from time decay (theta) and changes in implied volatility (iv). Adams to resign or for ms. What is a long calendar spread? Here's how to do it: A growing number of public officials have called for mr. Th the same strike price but with different. Itive to market direction and volatility in trending markets. Calendar spread examples long call calendar spread example. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Calendar call spreads involve buying and selling call options of the same strike price but different expirations.PPT Trading Strategies Involving Options PowerPoint Presentation

Calendar Call Spread Strategy

Calendar Call Spread Option Strategy Heida Kristan

Calendar Spread Using Calls Kelsy Mellisa

Long Call Calendar Spread Explained (Options Trading Strategies For

Calendar Call Spread Option Strategy Heida Kristan

Long Calendar Spread with Calls Strategy With Example

Calendar Call Spread Options Edge

Trading Guide on Calendar Call Spread AALAP

Calendar Spread using Calls YouTube

Merge Cells For Month Header:

A Bull Call Spread Is An Options Strategy Used To Profit From Moderate Increases In The Underlying Asset's Price While Limiting Risk.

Suppose Apple Inc (Aapl) Is Currently Trading At $145 Per Share.

The Aim Of The Strategy Is To.

Related Post: