Calendar Spread

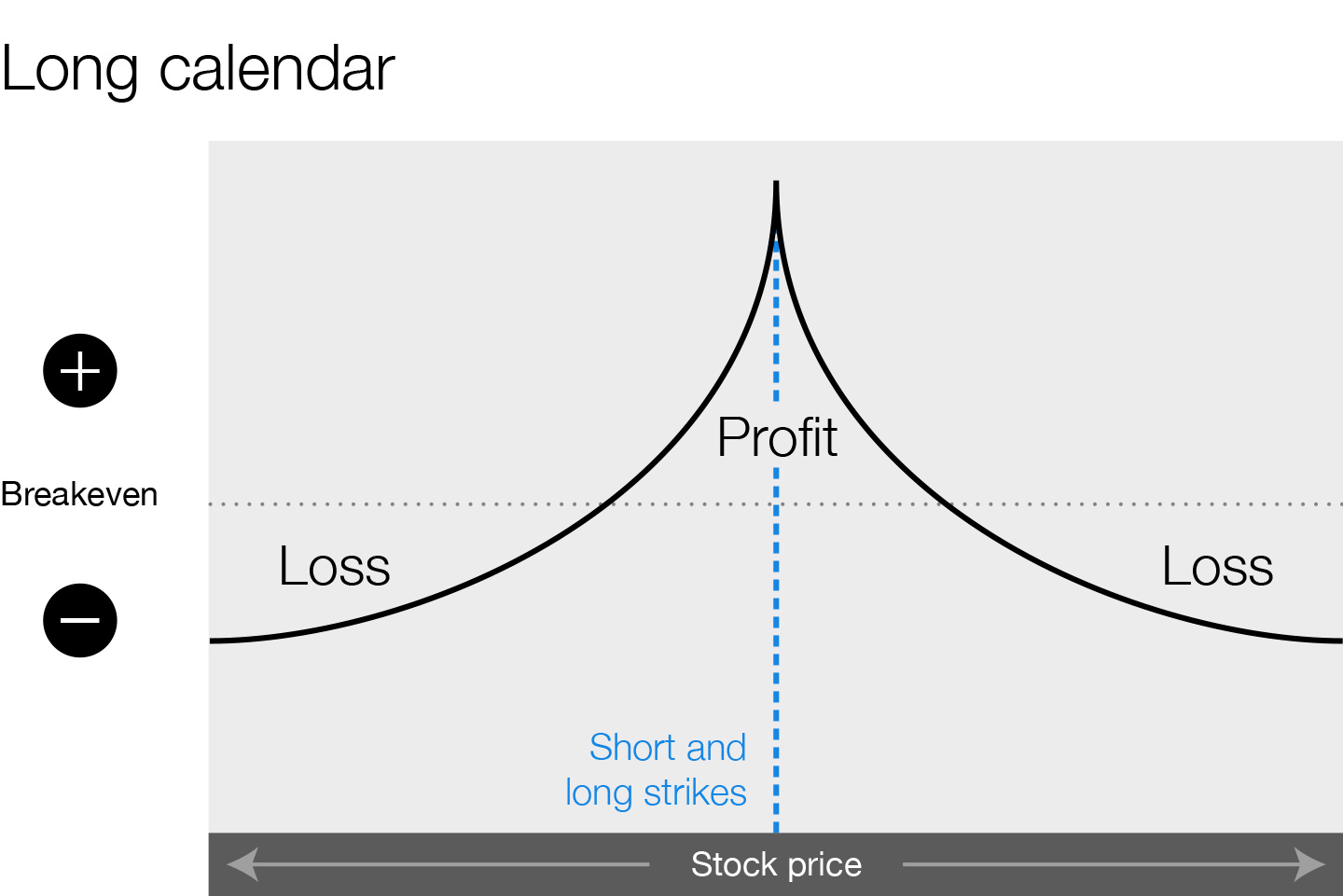

Calendar Spread - The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. What is a calendar spread? What is a calendar spread? A long calendar spread is a good strategy to. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the. What is a calendar spread? A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration. What is a calendar spread? A calendar spread is a strategic options or futures technique involving simultaneous long and short positions on the same underlying asset with different delivery dates. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different. What is a calendar spread? A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A diagonal spread allows option traders to collect. A calendar spread is a strategic options or futures technique involving simultaneous long and short positions on the same underlying asset with different delivery dates. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy. What is a calendar spread? What is a calendar spread? The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. A diagonal spread allows option traders to collect. Calendar spreads are a great way to combine the advantages of spreads. What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. What is a calendar spread? A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration. The calendar spread options strategy. A calendar spread is a strategic options or futures technique involving simultaneous long and short positions on the same underlying asset with different delivery dates. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. A calendar spread allows option. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. What is a calendar spread? A calendar spread is a strategic options or futures technique involving simultaneous long and short positions on the same underlying asset with different delivery dates.. What is a calendar spread? A long calendar spread is a good strategy to. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. What is a calendar spread? A diagonal spread allows option traders to collect. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration. A long calendar spread is a good strategy to. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. What is a calendar spread? What is a calendar spread? A diagonal spread allows option traders to collect. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is a strategic options or futures technique involving simultaneous long and short positions on the same underlying asset with different delivery dates. A long calendar spread is a good strategy to. What is a calendar spread? A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or puts) with the same. A long calendar spread is a good strategy to. What is a calendar spread? A diagonal spread allows option traders to collect. What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A calendar spread is a strategic options or futures technique involving simultaneous long and short positions on the same underlying asset with different delivery dates. What is a calendar spread?Calendar Call Spread Strategy

Calendar Call Spread Strategy

Top Forex Brokere Calculate Calendar Spread Options Strategy Post

Calendar Spread Options Examples Mavra Sibella

Adjust Calendar Spread Dolly Meredith

What Is A Calendar Spread Option Strategy Mab Millicent

Printable Calendar Spreads on Behance

Calendar Spread Strategy Renie Charmain

Double Calendar Spread Adjustment videos link in Description

Calendar Spreads in Futures and Options Trading Explained

In Finance, A Calendar Spread (Also Called A Time Spread Or Horizontal Spread) Is A Spread Trade Involving The Simultaneous Purchase Of Futures Or Options Expiring On A Particular Date And The.

The Calendar Spread Options Strategy Is A Market Neutral Strategy For Seasoned Options Traders That Expect Different Levels Of Volatility In The Underlying Stock At Varying Points In Time, With.

A Calendar Spread Is An Options Trading Strategy That Involves Buying And Selling Two Options With The Same Strike Price But Different Expiration.

Related Post:

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)