Calendar Vs Fiscal Year

Calendar Vs Fiscal Year - The calendar year is also called the civil. While a fiscal year can run from jan. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. A fiscal year and a calendar year are two distinct concepts used for different purposes. Fiscal year vs calendar year: Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Here we discuss top differences between them with a case study, example, & comparative table. Guide to fiscal year vs. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? 30, it is often different from. Guide to fiscal year vs. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. A fiscal year and a calendar year are two distinct concepts used for different purposes. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Here we discuss top differences between them with a case study, example, & comparative table. 30, it is often different from. The calendar year is also called the civil. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Here we discuss top differences between them with a case study, example, &. A fiscal year is used for accounting purposes and for preparing annual financial statements. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. Fiscal year vs calendar year: 30, it is often different from. Here we discuss top differences between them with a case study, example, & comparative table. While a fiscal year can run from jan. A fiscal year is used for accounting purposes and for preparing annual financial statements. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A fiscal year and a calendar year are two. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. A fiscal year can cater to specific business needs, such as aligning. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the. Here we discuss top differences between them with a case study, example, & comparative table. A fiscal year can cater to specific business needs, such as aligning. Fiscal year vs calendar year: Guide to fiscal year vs. A fiscal year and a calendar year are two distinct concepts used for different purposes. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. A fiscal year is used for accounting purposes and for preparing annual financial statements. The calendar year is also called the civil. While a fiscal year can run from jan. Guide to fiscal year. Here we discuss top differences between them with a case study, example, & comparative table. A fiscal year is used for accounting purposes and for preparing annual financial statements. 30, it is often different from. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year is. The calendar year is also called the civil. A fiscal year can cater to specific business needs, such as aligning. Guide to fiscal year vs. A fiscal year and a calendar year are two distinct concepts used for different purposes. 30, it is often different from. A fiscal year can cater to specific business needs, such as aligning. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. A fiscal year and a calendar year are two distinct concepts used for different purposes. 30, it is. Guide to fiscal year vs. A fiscal year can cater to specific business needs, such as aligning. While a fiscal year can run from jan. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Using a different fiscal year than. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. A fiscal year and a calendar year are two distinct concepts used for different purposes. Guide to fiscal year vs. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? Here we discuss top differences between them with a case study, example, & comparative table. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive. A fiscal year is used for accounting purposes and for preparing annual financial statements. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. 30, it is often different from. While a fiscal year can run from jan. A fiscal year can cater to specific business needs, such as aligning.What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year Vs Calendar Year

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

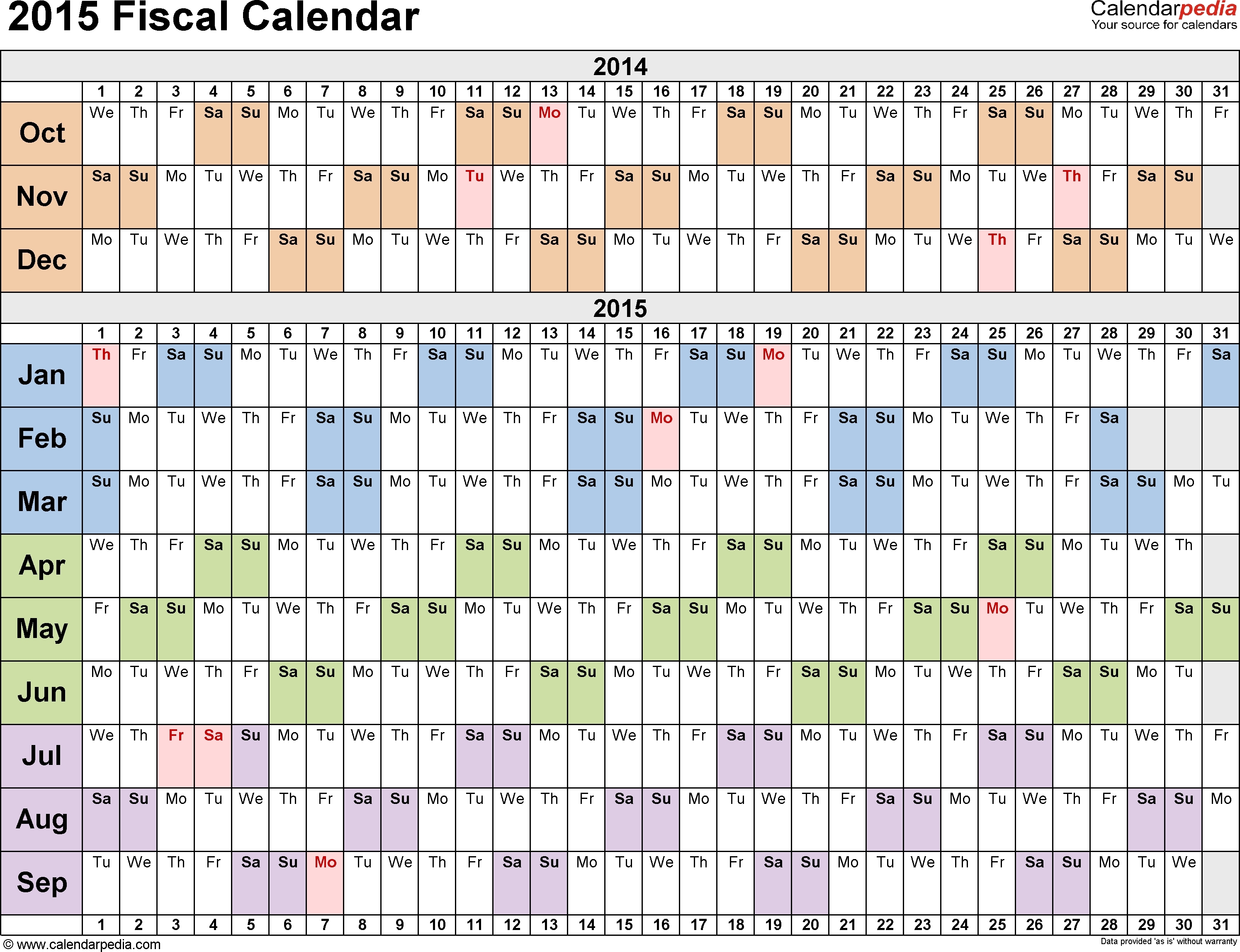

Fiscal Year Vs Calendar Year Template Calendar Design

Fiscal Year Vs. Calendar Year Inscription on Blue Keyboard Key Stock

What is a Fiscal Year? Your GoTo Guide

Calendar Year Definition Accounting Calendar Printables Free Templates

Fiscal Year Vs Calendar Year What's Best for Your Business?

What Is The Difference Between Fiscal And Calendar Year Leese

Fiscal Year Definition for Business Bookkeeping

Fiscal Year Vs Calendar Year:

The Calendar Year Is Also Called The Civil.

Using A Different Fiscal Year Than The Calendar Year Lets Seasonal Businesses Choose The Start And End Dates That Better Align With Their Revenue And Expenses.

Related Post: