Calendar Year Benefit Maximum

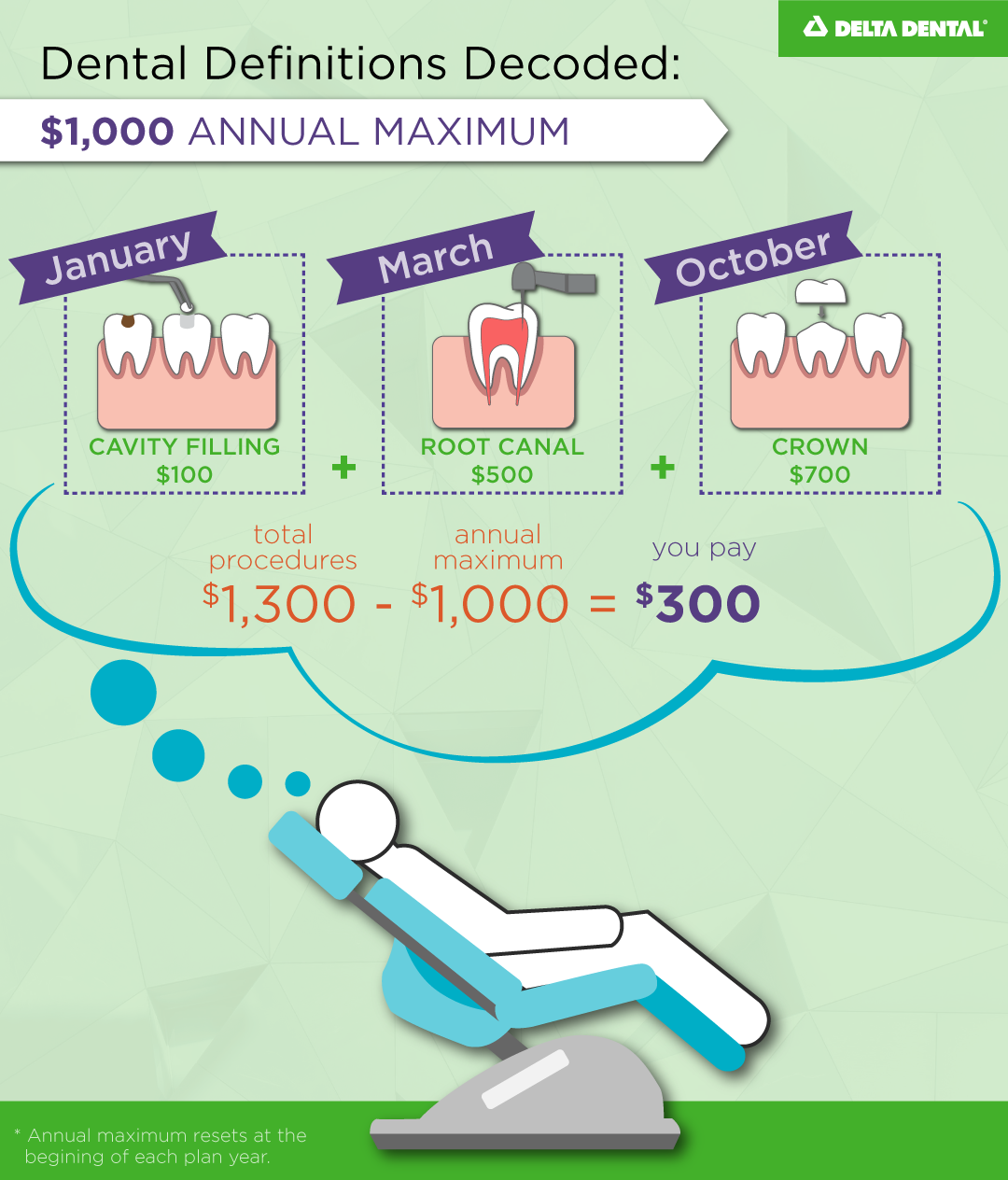

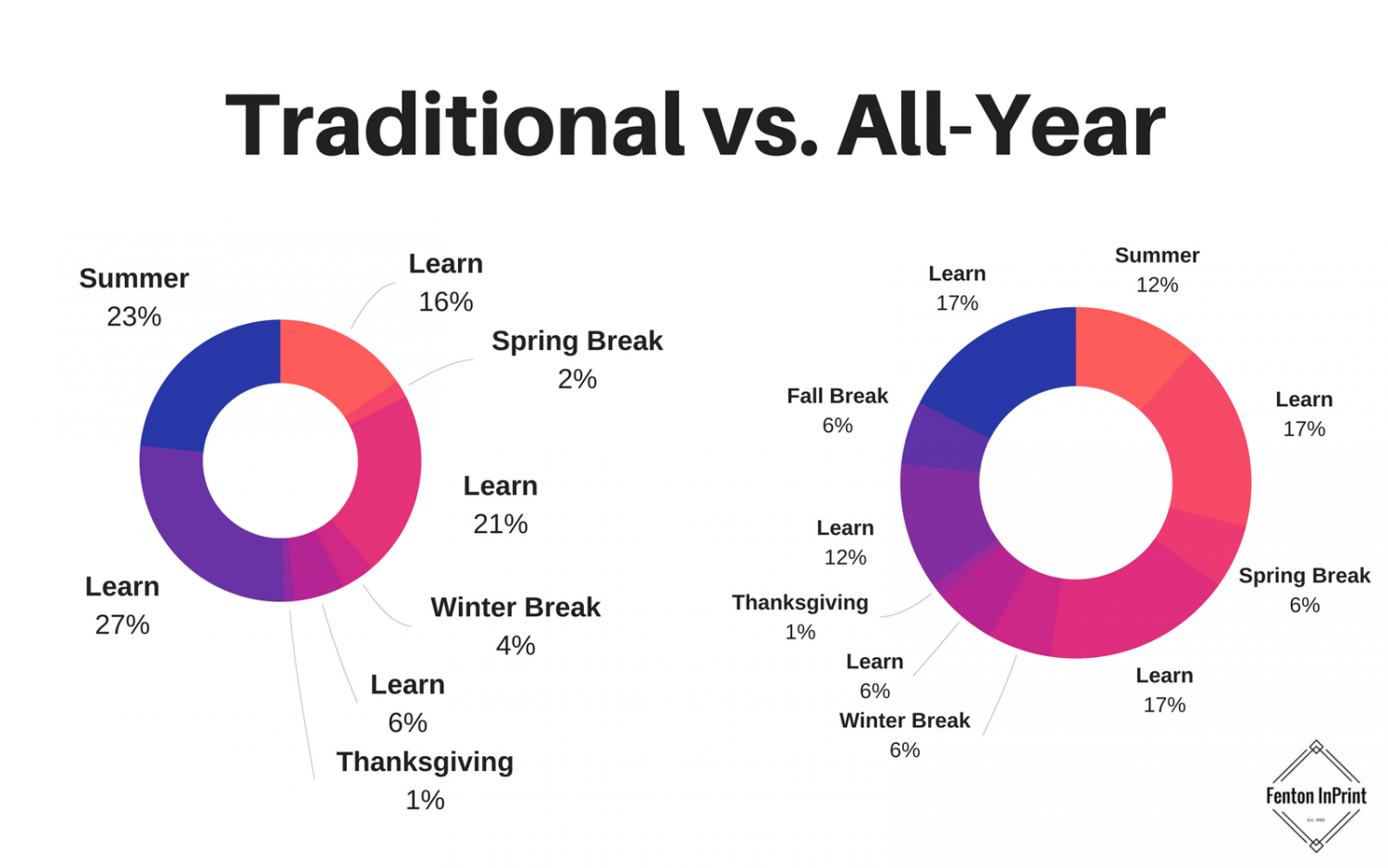

Calendar Year Benefit Maximum - For 2025, the yearly earnings cap increases to $62,160. It all depends on the. The maximum taxable income amount. The maximum social security benefit changes each year and you are eligible if you earned a maximum taxable income for at least 35 years. The ssa reduces your benefit amount by $1 for every $3 exceeding the yearly. Let's look at an example of how this maximum annual. For now, we’ll assume your plan’s benefit period is the calendar year. The annual income limit nearly triples. Find out how to use your benefits wisely and what to do if you reach yo… This is the money that the insurance company offers. The maximum dollar amount a dental insurance carrier will. Let's look at an example of how this maximum annual. That would mean the annual maximum for your plan’s year applies to january through december. For now, we’ll assume your plan’s benefit period is the calendar year. Many dental insurance plans come with an annual maximum. Learn what an annual maximum is on a dental plan and how it affects your coverage. This money goes toward dental treatments that are done over a. Some reset on your one year anniversary of having the plan, others will reset at the beginning of a new calendar year, on january 1st. It refers to the total amount of money a plan will provide in any given policy year, also. Let’s assume that right now, your benefit period is following the calendar year—your benefits start in january and end in december. Some reset on your one year anniversary of having the plan, others will reset at the beginning of a new calendar year, on january 1st. For 2025, the yearly earnings cap increases to $62,160. The maximum dollar amount a dental insurance carrier will. However, some plans may have a higher or lower maximum benefit. The ssa reduces your benefit amount. Approximately 90 percent of private dental plans sold in the. A “maximum benefit” is a cap on how much an insurance plan will spend on covered dental care during a year. Learn what an annual maximum is on a dental plan and how it affects your coverage. What does calendar year maximum mean insurance? That would mean the annual maximum. Many dental insurance plans come with an annual maximum. However, some plans may have a higher or lower maximum benefit. It refers to the total amount of money a plan will provide in any given policy year, also. What does calendar year maximum mean insurance? A “maximum benefit” is a cap on how much an insurance plan will spend on. A “maximum benefit” is a cap on how much an insurance plan will spend on covered dental care during a year. Learn what an annual maximum is on a dental plan and how it affects your coverage. The maximum taxable income amount. It refers to the total amount of money a plan will provide in any given policy year, also.. Some reset on your one year anniversary of having the plan, others will reset at the beginning of a new calendar year, on january 1st. For now, we’ll assume your plan’s benefit period is the calendar year. That would mean the annual maximum for your plan’s year applies to january through december. An annual maximum benefit, or “maximum benefit” as. Every plan has an “annual maximum,” which is the amount of money a dental benefits provider offers. For 2025, the yearly earnings cap increases to $62,160. An annual maximum benefit, or “maximum benefit” as we prefer to call it, is a feature typically associated with dental ppo insurance and dental indemnity plans. Approximately 90 percent of private dental plans sold. It refers to the total amount of money a plan will provide in any given policy year, also. The annual maximum is the maximum amount of money that your dental insurance plan will pay for covered dental services within a specific time period, usually a. So, if your annual maximum limit is. The annual income limit nearly triples. This is. This money goes toward dental treatments that are done over a. This means you must have earned the maximum taxable income amount (your contribution and benefit base) every year for 35 years. This is the money that the insurance company offers. It refers to the total amount of money a plan will provide in any given policy year, also. That. It will go toward qualifying dental treatments you receive over a benefit period,. Learn what an annual maximum is on a dental plan and how it affects your coverage. To receive the highest social security benefits, you'll have to earn at least the maximum taxable amount annually. The maximum dollar amount a dental insurance carrier will. The ssa reduces your. However, some plans may have a higher or lower maximum benefit. Let’s assume that right now, your benefit period is following the calendar year—your benefits start in january and end in december. The annual maximum is the maximum amount of money that your dental insurance plan will pay for covered dental services within a specific time period, usually a. So,. It all depends on the. To receive the highest social security benefits, you'll have to earn at least the maximum taxable amount annually. The ssa reduces your benefit amount by $1 for every $3 exceeding the yearly. It refers to the total amount of money a plan will provide in any given policy year, also. The maximum taxable income amount. The maximum social security benefit changes each year and you are eligible if you earned a maximum taxable income for at least 35 years. This is the money that the insurance company offers. This means you must have earned the maximum taxable income amount (your contribution and benefit base) every year for 35 years. The annual maximum is the maximum amount of money that your dental insurance plan will pay for covered dental services within a specific time period, usually a. A calendar year maximum is a type of limit that may be applied to dental insurance benefits. Find out how to use your benefits wisely and what to do if you reach yo… The maximum dollar amount a dental insurance carrier will. A “maximum benefit” is a cap on how much an insurance plan will spend on covered dental care during a year. What does calendar year maximum mean insurance? Some reset on your one year anniversary of having the plan, others will reset at the beginning of a new calendar year, on january 1st. An annual maximum benefit, or “maximum benefit” as we prefer to call it, is a feature typically associated with dental ppo insurance and dental indemnity plans.Calendar Year Maximum For Dental

What Is Calendar Year Maximum For Dental Insurance Apps.hellopretty.co.za

SCT Healthcare UPdates ppt download

SCT Healthcare UPdates ppt download

Calendar Year Deductible And Out Of Pocket Maximum Month Calendar

Dental Benefits Explained What is an Annual Maximum

Medicare's Calendar Year & Benefit Periods Explained MedicareFAQ

Calendar Year Vs Benefit Year Bobby Nicoli

Calendar Year Maximum Benefit Printable Word Searches

Calendar Year Maximum Per Person Month Calendar Printable

It Will Go Toward Qualifying Dental Treatments You Receive Over A Benefit Period,.

For 2025, The Yearly Earnings Cap Increases To $62,160.

Every Plan Has An “Annual Maximum,” Which Is The Amount Of Money A Dental Benefits Provider Offers.

That Would Mean The Annual Maximum For Your Plan’s Year Applies To January Through December.

Related Post: