Calendar Year Filer

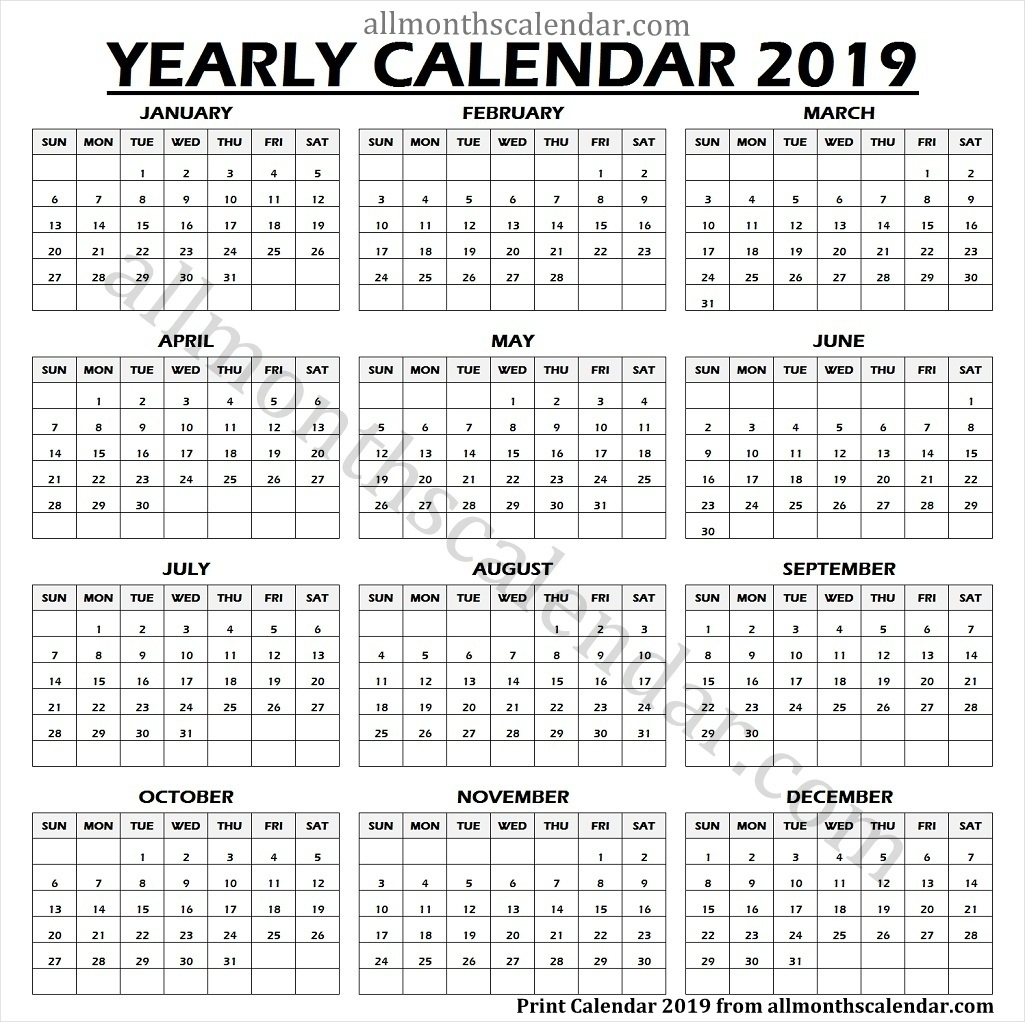

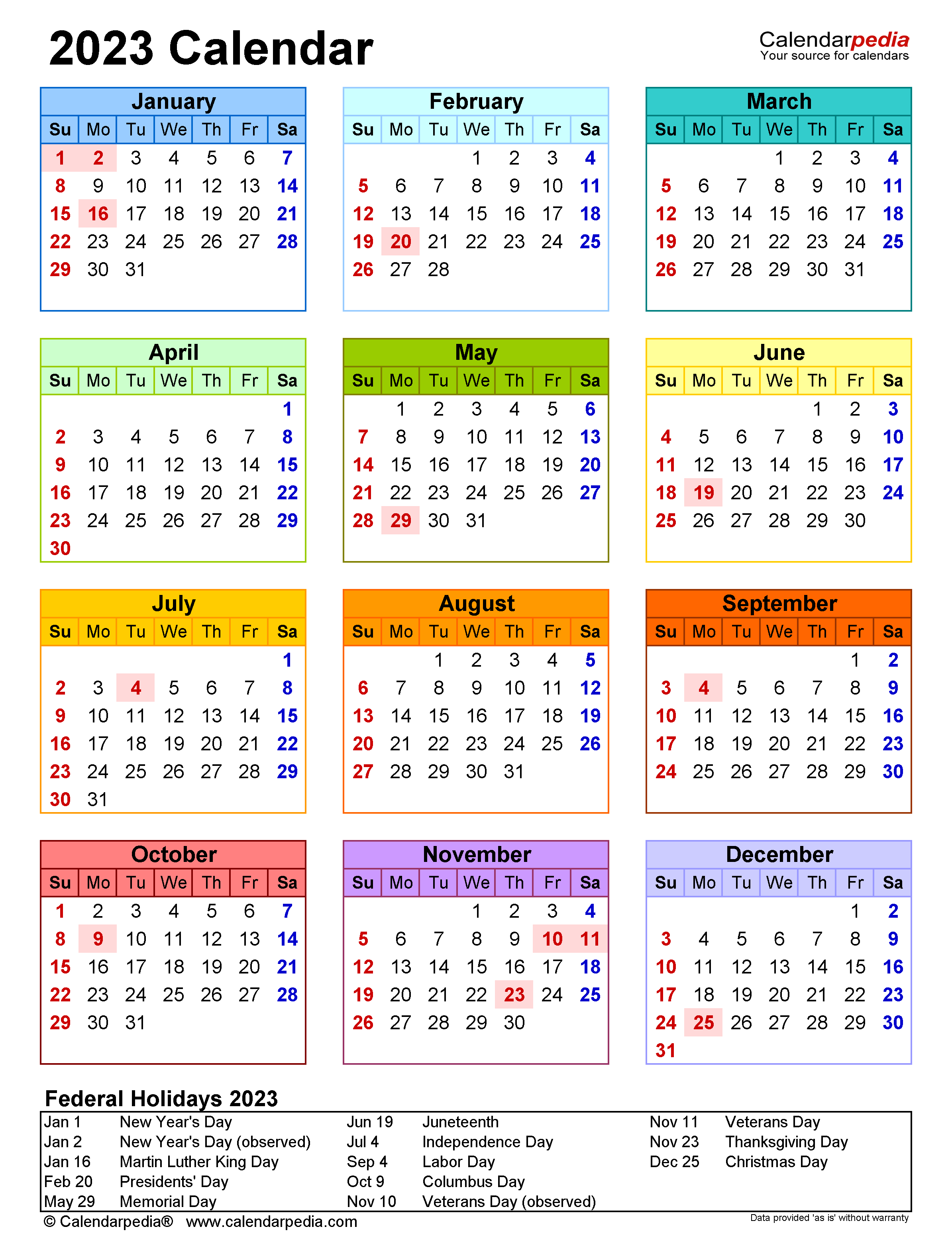

Calendar Year Filer - A calendar year, as you would expect, covers 12 consecutive months, beginning january 1 and ending december 31. Understanding what each involves can help you. A calendar year, as you would expect, covers 12 consecutive months, beginning january 1 and ending december 31. The first time you file a tax return on behalf of your company, you must decide if you intend to report income and deductions based on a traditional calendar year or a fiscal. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A calendar tax year runs from january 1 to december 31. Taxpayers with income of $84,000 or less last year can use irs free file guided tax software now through oct. The 2025 tax season will begin on jan. Others use a fiscal year , which. You may also need to file state taxes. The fourth month after your fiscal year ends, day 15. Tax on a short period tax return is figured differently for each situation. Learn the difference between a fiscal year and calander year and how making the decision can change the way you file taxes. Understanding what each involves can help you. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive months that. Typically use the calendar year, running. The first time you file a tax return on behalf of your company, you must decide if you intend to report income and deductions based on a traditional calendar year or a fiscal. When a company adopts a fiscal year, they also must. Others use a fiscal year , which. The 2025 tax season will begin on jan. A calendar year, as you would expect, covers 12 consecutive months, beginning january 1 and ending december 31. Learn the difference between a fiscal year and calander year and how making the decision can change the way you file taxes. It is commonly used for tax purposes, aligning with the fiscal year for many. Irs free file fillable forms, a. Others use a fiscal year , which. Here are some options to file your 2024 taxes for free. In some cases, we can transfer your data to your state's tool. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive months that. C. Learn the difference between a fiscal year and calander year and how making the decision can change the way you file taxes. After you complete your federal return, direct file will guide you to your state's free filing tool. When a company adopts a fiscal year, they also must. Irs free file fillable forms, a part of this. Typically use. A calendar tax year runs from january 1 to december 31. A short period tax return may be required when you (as a taxable entity): Many companies, especially smaller businesses, choose the calendar year because it aligns with the traditional gregorian calendar. A short tax year is a tax year of less than 12 months. The first time you file. Calendar year filers (most common) file on: Tax on a short period tax return is figured differently for each situation. A short tax year is a tax year of less than 12 months. Others use a fiscal year , which. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal. Calendar year filers (most common) file on: The 2025 tax season will begin on jan. Irs free file fillable forms, a part of this. A short period tax return may be required when you (as a taxable entity): A short tax year is a tax year of less than 12 months. If day 15 falls on a saturday, sunday or legal. Others use a fiscal year , which. After you complete your federal return, direct file will guide you to your state's free filing tool. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Understanding what each involves can. When a company adopts a fiscal year, they also must. After you complete your federal return, direct file will guide you to your state's free filing tool. Here are some options to file your 2024 taxes for free. Irs free file fillable forms, a part of this. It is commonly used for tax purposes, aligning with the fiscal year for. Others use a fiscal year , which. When a company adopts a fiscal year, they also must. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Typically use the calendar year, running. It is commonly used for tax purposes, aligning with the fiscal year for many. In some cases, we can transfer your data to your state's tool. A calendar year spans from january 1 to december 31, following the gregorian calendar. Here are some options to file your 2024 taxes for free. The first time you file a tax return on behalf of your company, you must decide if you intend to report income and. Taxpayers with income of $84,000 or less last year can use irs free file guided tax software now through oct. Typically use the calendar year, running. Calendar year filers (most common) file on: A short period tax return may be required when you (as a taxable entity): A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. You may also need to file state taxes. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. A short tax year is a tax year of less than 12 months. The 2025 tax season will begin on jan. Understanding what each involves can help you. If you're a calendar year filer and your tax year ends on december 31, the due date for filing your federal individual income tax return is generally april 15 of each year. Here are some options to file your 2024 taxes for free. Others use a fiscal year , which. Irs free file fillable forms, a part of this. C corporations that use a fiscal year calendar must file their return by the 15th day of the fourth month following the fiscal year close. When a company adopts a fiscal year, they also must.16 Blank Calendar Template Images Printable Blank Monthly Calendar

Year Calendar On One Page Calendar Printables Free Templates

Yearly Planner Printable, Printable Calendar PDF, Desk Calendar, Yearly

Printable Blank Year Calendar Template by Month Editable Calendar

Yearly Calendar Templates Calendar template, Yearly calendar template

2024 Year at A Glance, INSTANT DOWNLOAD, Yearly Overview, Printable

FREE 12+ Sample Yearly Calendar Templates in Google Docs MS Word

FREE 14+ Sample Printable Yearly Calendar Templates in MS Word PDF

free printable calendars yearly calendar template take printable 2020

2023 Calendar Free Printable Excel Templates Calendarpedia

Many Companies, Especially Smaller Businesses, Choose The Calendar Year Because It Aligns With The Traditional Gregorian Calendar.

A Calendar Tax Year Runs From January 1 To December 31.

Tax On A Short Period Tax Return Is Figured Differently For Each Situation.

A Calendar Year, As You Would Expect, Covers 12 Consecutive Months, Beginning January 1 And Ending December 31.

Related Post: