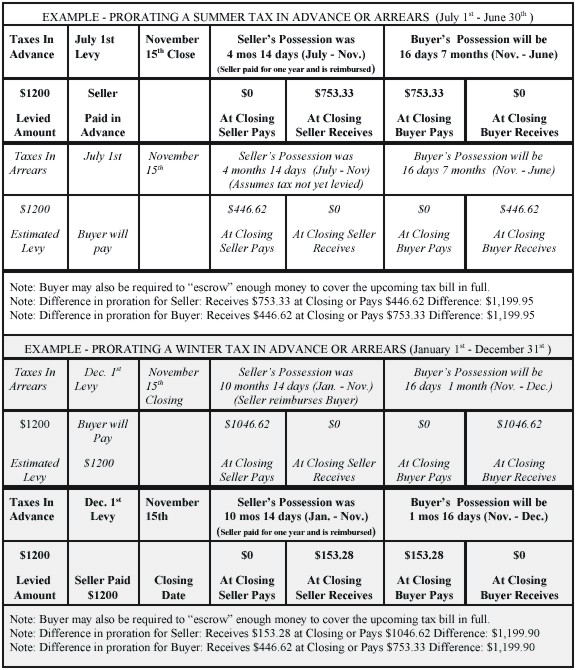

Calendar Year Proration Method

Calendar Year Proration Method - 30 days x 12 months. Closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). Closing is set for june 19, and sue owns the day of closing. The partnership uses a calendar tax year and the proration method. This calculator is designed to estimate the real estate tax proration between the home buyer & seller at closing. The seller, who's responsible for closing costs up to but not including the day of closing, has already paid annual property taxes of. A real estate transaction has a closing date of may 20. The real estate tax proration calculator uses specific inputs to determine the tax obligations of the buyer and seller. These inputs include the sale date, the tax year, the total. There are different methods used to calculate proration in real estate, depending on the local practices and the type of expenses being prorated: Prorate a specified amount over a specified portion of the calendar year. A real estate transaction has a closing date of may 20. Proration is inclusive of both specified dates. Understand proration in finance, its calculation, and its application in real estate, rent, utilities, insurance, and payroll. Using the calendar year proration method (assume that it's not a leap. She has a loan balance of $78,000 at a 4.2% rate, and she's current on her payments. There are different methods used to calculate proration in real estate, depending on the local practices and the type of expenses being prorated: Maurice received an offer of $480,000 for his home. These inputs include the sale date, the tax year, the total. The daily property tax is $1.23 and closing is august 31. Assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing. The seller, who's responsible for closing costs up to but not including the day of closing, has already paid annual property taxes of. Prorated pay is calculated by dividing the annual salary. These inputs include the sale. ($1,350 ÷ 365 = $3.70) 195 days (days from closing until. 30 days x 12 months. She has a loan balance of $78,000 at a 4.2% rate, and she's current on her payments. These inputs include the sale date, the tax year, the total. She prepaid the property taxes ($1,350) and. She prepaid the property taxes ($1,350) and. Prorated pay is calculated by dividing the annual salary. Maurice received an offer of $480,000 for his home. The real estate tax proration calculator uses specific inputs to determine the tax obligations of the buyer and seller. Proration is inclusive of both specified dates. She has a loan balance of $78,000 at a 4.2% rate, and she's current on her payments. Maurice received an offer of $480,000 for his home. Proration is inclusive of both specified dates. She prepaid the property taxes ($1,350) and. ($1,350 ÷ 365 = $3.70) 195 days (days from closing until. ($1,350 ÷ 365 = $3.70) 195 days (days from closing until. Prorated pay is calculated by dividing the annual salary. She prepaid the property taxes ($1,350) and. 30 days x 12 months. The seller, who's responsible for closing costs up to but not including the day of closing, has already paid annual property taxes of. These inputs include the sale date, the tax year, the total. The partnership uses a calendar tax year and the proration method. If you wish to prorate over a period not based on the calendar year. There are different methods used to calculate proration in real estate, depending on the local practices and the type of expenses being prorated: 30. 30 days x 12 months. This proration calculator should be useful for annual, quarterly, and semi. These inputs include the sale date, the tax year, the total. Prorated pay is calculated by dividing the annual salary. Proration is inclusive of both specified dates. Prorate a specified amount over a specified portion of the calendar year. Understand proration in finance, its calculation, and its application in real estate, rent, utilities, insurance, and payroll. 30 days x 12 months. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5%. These inputs include the sale date,. The daily property tax is $1.23 and closing is august 31. ($1,350 ÷ 365 = $3.70) 195 days (days from closing until. She has a loan balance of $78,000 at a 4.2% rate, and she's current on her payments. A real estate transaction has a closing date of may 20. Closing is set for july 31, and the buyers own. A real estate transaction has a closing date of may 20. She has a loan balance of $78,000 at a 4.2% rate, and she's current on her payments. The method consists of the following. Assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing. 30 days x. A real estate transaction has a closing date of may 20. ($1,350 ÷ 365 = $3.70) 195 days (days from closing until. 30 days x 12 months. This calculator is designed to estimate the real estate tax proration between the home buyer & seller at closing. Since the departing partner was present for half the tax year (six months out of 12), he is allocated 5%. If you wish to prorate over a period not based on the calendar year. The method consists of the following. Prorate a specified amount over a specified portion of the calendar year. Understand proration in finance, its calculation, and its application in real estate, rent, utilities, insurance, and payroll. She prepaid the property taxes ($1,350) and. The seller, who's responsible for closing costs up to but not including the day of closing, has already paid annual property taxes of. The real estate tax proration calculator uses specific inputs to determine the tax obligations of the buyer and seller. Prorated pay is calculated by dividing the annual salary. Proration is inclusive of both specified dates. Closing is set for june 19, and sue owns the day of closing. Maurice received an offer of $480,000 for his home.In This Article

360 Day Method (Proration) Real Estate Math Formulas YouTube

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Calendar Method Calculator 2024 Calendar 2024 Ireland Printable

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

How to Calculate Proration

Calendar Year Proration Method Printable Computer Tools

Calendar Year Proration Method prntbl.concejomunicipaldechinu.gov.co

Depreciation Calculation for Table and Calculated Methods (Oracle

She Has A Loan Balance Of $78,000 At A 4.2% Rate, And She's Current On Her Payments.

The Partnership Uses A Calendar Tax Year And The Proration Method.

This Proration Calculator Should Be Useful For Annual, Quarterly, And Semi.

Using The Calendar Year Proration Method (Assume That It's Not A Leap.

Related Post:

.png?1614945017)

(2).webp)