Calendar Year Tax

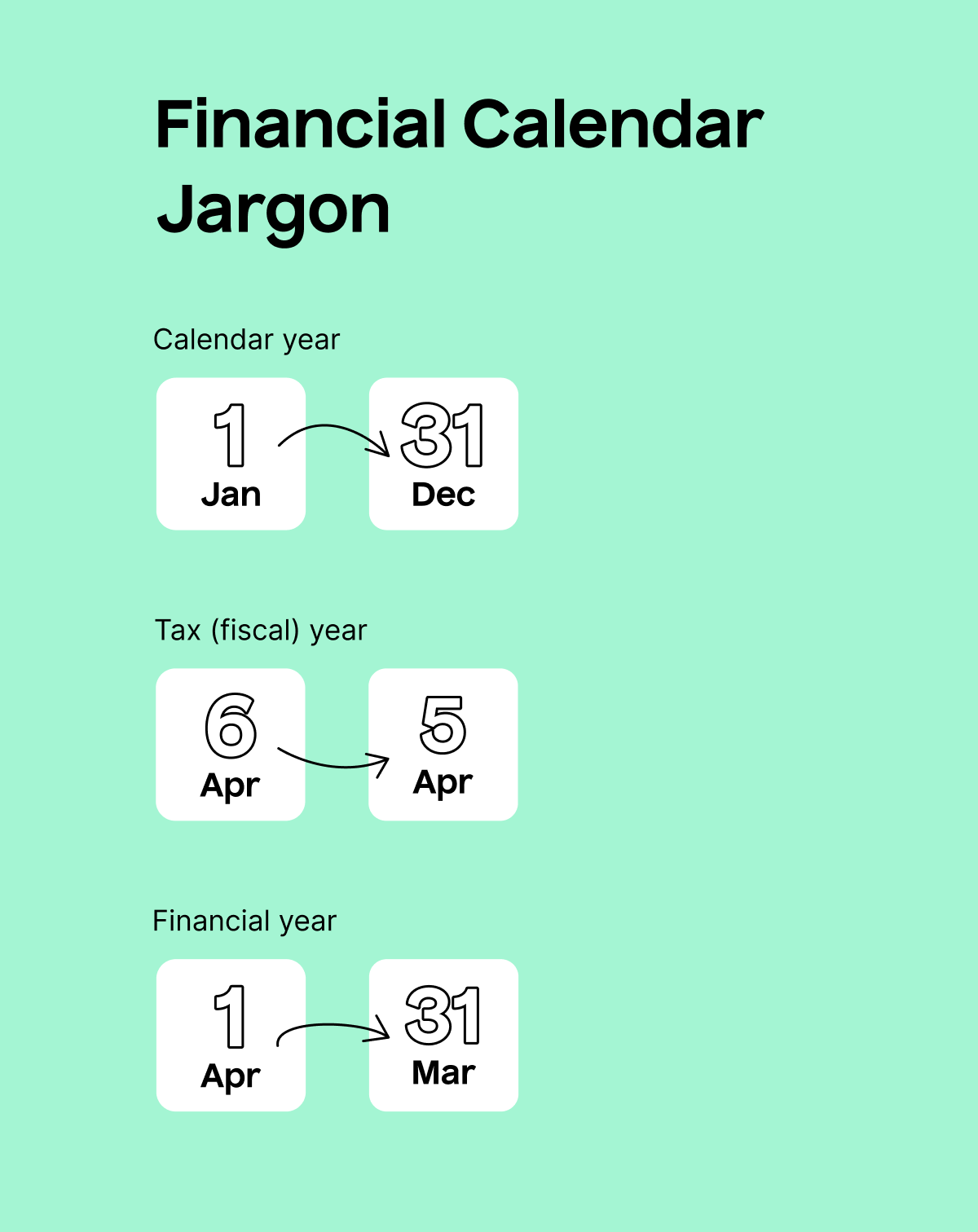

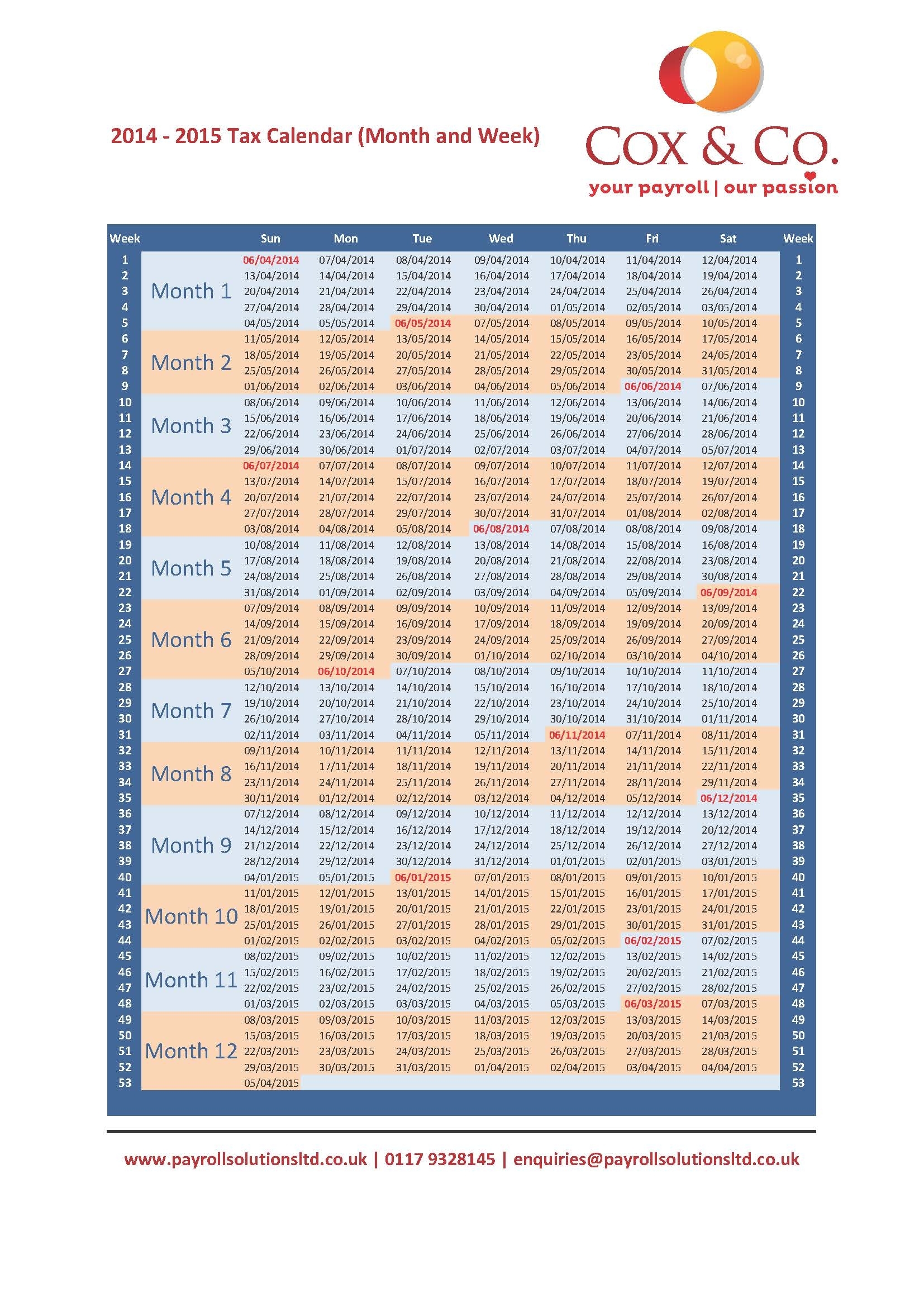

Calendar Year Tax - A short period tax return may be required when you (as a taxable entity): The calendar year is the most common tax year. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. It is commonly used for tax purposes, aligning with the fiscal year for many. For most states, tax day is april 15, 2025. A short tax year is a tax year of less than 12 months. The tax year can end at different times depending on how a business files taxes. Due date for first installment of 2025 estimated tax payments; The tax year for individuals runs from january 1 to december 31. If you do not use a calendar year, your accounting period is a fiscal year. A fiscal year doesn’t always align with its. The calendar year is the most common tax year. Many companies, especially smaller businesses, choose the calendar year because it aligns with the traditional gregorian calendar. In some cases, you might have a bit longer to submit your tax return. Irs tax refunds are $526 bigger this year: The tax period begins on july 1 and ends the following june 30. While there was a discussion for a shift from financial year (april to march) to a calendar year (january to december) to align india's tax framework with other. Most individual tax returns cover a calendar year, the 12 months from january 1 through december 31. A short tax year is a tax year of less than 12 months. A calendar tax year runs from january 1 to december 31. You must pay the full year's tax on all vehicles you have in use during the month of july. Irs tax refunds are $526 bigger this year: Today’s new data shows that the adams administration — for the second year in a row — continued to break records on both creating and connecting new yorkers to affordable. The tax period. The tax year can end at different times depending on how a business files taxes. While there was a discussion for a shift from financial year (april to march) to a calendar year (january to december) to align india's tax framework with other. Due date for first installment of 2025 estimated tax payments; The calendar year is the most common. Due date for first installment of 2025 estimated tax payments; When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. You must pay the full year's tax on all vehicles you have in use during the month of july. How does a business choose whether to operate on a. That is a question i am frequently asked. Tax on the first retail sale of heavy trucks, trailers, and tractors. A fiscal year doesn’t always align with its. Tax on a short period tax return is figured differently for each situation. When you work in the business world, it's important to understand the difference between a fiscal year and a. Are not in existence for an entire tax year, or 2. Many companies, especially smaller businesses, choose the calendar year because it aligns with the traditional gregorian calendar. Manufacturers taxes on the sale or use of a variety of different articles; In 2026 (for tax year 2025), that threshold will drop to $2,500. If you file your taxes yourself and. It is commonly used for tax purposes, aligning with the fiscal year for many. Are not in existence for an entire tax year, or 2. A calendar tax year runs from january 1 to december 31. Understanding what each involves can help you. Typically use the calendar year, running. Manufacturers taxes on the sale or use of a variety of different articles; Tax on a short period tax return is figured differently for each situation. Typically use the calendar year, running. The calendar year is the most common tax year. Tax on the first retail sale of heavy trucks, trailers, and tractors. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Tax on a short period tax return is figured differently for each situation. Most individual tax returns cover a calendar year, the 12 months from january 1 through december 31. In some cases, you might have a bit longer. Manufacturers taxes on the sale or use of a variety of different articles; Today’s new data shows that the adams administration — for the second year in a row — continued to break records on both creating and connecting new yorkers to affordable. How does a business choose whether to operate on a calendar year or a fiscal year? Irs. A calendar tax year runs from january 1 to december 31. How does a business choose whether to operate on a calendar year or a fiscal year? You must pay the full year's tax on all vehicles you have in use during the month of july. It is commonly used for tax purposes, aligning with the fiscal year for many.. Due date for first installment of 2025 estimated tax payments; In some cases, you might have a bit longer to submit your tax return. For most states, tax day is april 15, 2025. If you file your taxes yourself and don’t have an llc, this is probably your tax year. Most individual tax returns cover a calendar year, the 12 months from january 1 through december 31. A short tax year is a tax year of less than 12 months. The filing for an electing entity with a fiscal year is due on or before march 15 following the close of the calendar year in. While there was a discussion for a shift from financial year (april to march) to a calendar year (january to december) to align india's tax framework with other. A calendar year spans from january 1 to december 31, following the gregorian calendar. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. How does a business choose whether to operate on a calendar year or a fiscal year? For tax, accounting, and even budgeting purposes, it’s important to know the difference between a fiscal year vs calendar year. Manufacturers taxes on the sale or use of a variety of different articles; Typically use the calendar year, running. Understanding what each involves can help you. Today’s new data shows that the adams administration — for the second year in a row — continued to break records on both creating and connecting new yorkers to affordable.What is the tax year? TaxScouts

Fiscal Year Vs Calendar Year Tax Abbye Annissa

Calendar Noting Tax Filing is Due April 18 2022 in the USA Stock

What is a Fiscal Year? Your GoTo Guide

Buy 2023 2024 Fiscal Year Wall Planner A2 Size Full Year Tax Wall Home

Fiscal Year, Financial Year, Tax Year, Accounting Year & Calendar Year

2023 Tax Calendar and Deadlines Guide SVA CPA

Tax Calendar 2023 Full list of due dates and activities to be

Tax Year Calendar 2019 2020

22 Year Tax Calendar Hmrc Best Calendar Example

The Tax Period Begins On July 1 And Ends The Following June 30.

It Is Commonly Used For Tax Purposes, Aligning With The Fiscal Year For Many.

Tax On The First Retail Sale Of Heavy Trucks, Trailers, And Tractors.

Every Taxpayer (Individuals, Business Entities, Etc.) Must Figure Taxable Income For An Annual Accounting Period Called A Tax Year.

Related Post: