Calendar Year Vs Fiscal Year

Calendar Year Vs Fiscal Year - The calendar year is also called the civil. A fiscal year and a calendar year are two distinct concepts used for different purposes. 30, it is often different from the calendar year. Fiscal year vs calendar year: A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. Whether you are preparing an individual tax return or financial statements for a business, it is important to understand the difference between financial and calendar years. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. While a fiscal year can run from jan. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year and a calendar year are two distinct concepts used for different purposes. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? Fiscal year vs calendar year: While a fiscal year can run from jan. 30, it is often different from the calendar year. Whether you are preparing an individual tax return or financial statements for a business, it is important to understand the difference between financial and calendar years. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. The calendar year is also called the civil. While a fiscal year can run from jan. Financial reports, external audits, and federal tax filings are based on a. Fiscal year vs calendar year: In contrast, the latter begins on the first of. Whether you are preparing an individual tax return or financial statements for a business, it is important to understand the difference between financial and calendar years. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? While a fiscal year can run from jan. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. 30, it is often. A fiscal year and a calendar year are two distinct concepts used for different purposes. While a fiscal year can run from jan. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. A fiscal year keeps income and expenses together on the. The calendar year is also called the civil. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. Fiscal year vs calendar. While a fiscal year can run from jan. The calendar year is also called the civil. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Should your accounting period be aligned with the regular calendar year, or should you define your own start. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Fiscal year vs calendar year: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A fiscal year keeps income and expenses together on the. In contrast, the latter begins on the first of. Whether you are preparing an individual tax return or financial statements for a business, it is important to understand the difference between financial and calendar years. 30, it is often different from the calendar year. The critical difference between a fiscal year and a calendar year is that the former can. Financial reports, external audits, and federal tax filings are based on a. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. 30, it is often different from the calendar year. In contrast, the latter begins on the first of. Should your accounting period be aligned with the regular. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Financial reports, external audits, and federal tax filings are based on a. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Whether. Whether you are preparing an individual tax return or financial statements for a business, it is important to understand the difference between financial and calendar years. A fiscal year and a calendar year are two distinct concepts used for different purposes. The calendar year is also called the civil. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. While a fiscal year can run from jan. Should your accounting period be aligned with the regular calendar year, or should you define your own start and end dates? A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. In contrast, the latter begins on the first of. Fiscal year vs calendar year: 30, it is often different from the calendar year. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day.Fiscal Year Vs Calendar Year

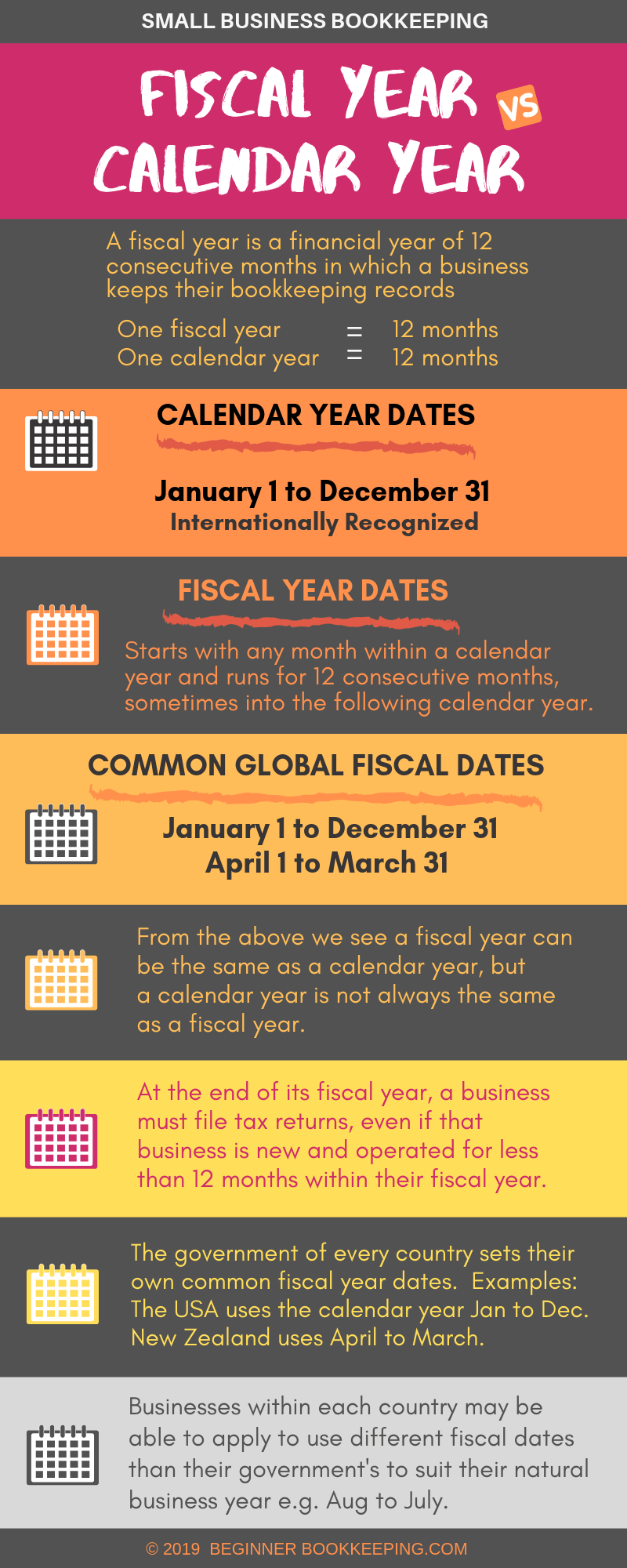

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Fiscal Year vs Calendar Year What's The Difference?

What is a Fiscal Year? Your GoTo Guide

Power BI (DAX) Calendar Year vs Fiscal Year FISCAL Date Table YouTube

Fiscal Year Vs Calendar Year What's Best for Your Business?

Explain The Terms Fiscal Year Calendar Year And Interim Periods Kara

Fiscal Year Definition for Business Bookkeeping

Fiscal Year Vs. Calendar Year Inscription on Blue Keyboard Key Stock

A Fiscal Year Can Cater To Specific Business Needs, Such As Aligning With Seasonal Fluctuations Or Industry Trends, While A Calendar Year Provides A Standardized Framework For.

Using A Different Fiscal Year Than The Calendar Year Lets Seasonal Businesses Choose The Start And End Dates That Better Align With Their Revenue And Expenses.

Financial Reports, External Audits, And Federal Tax Filings Are Based On A.

Related Post: