Calendar Year Vs

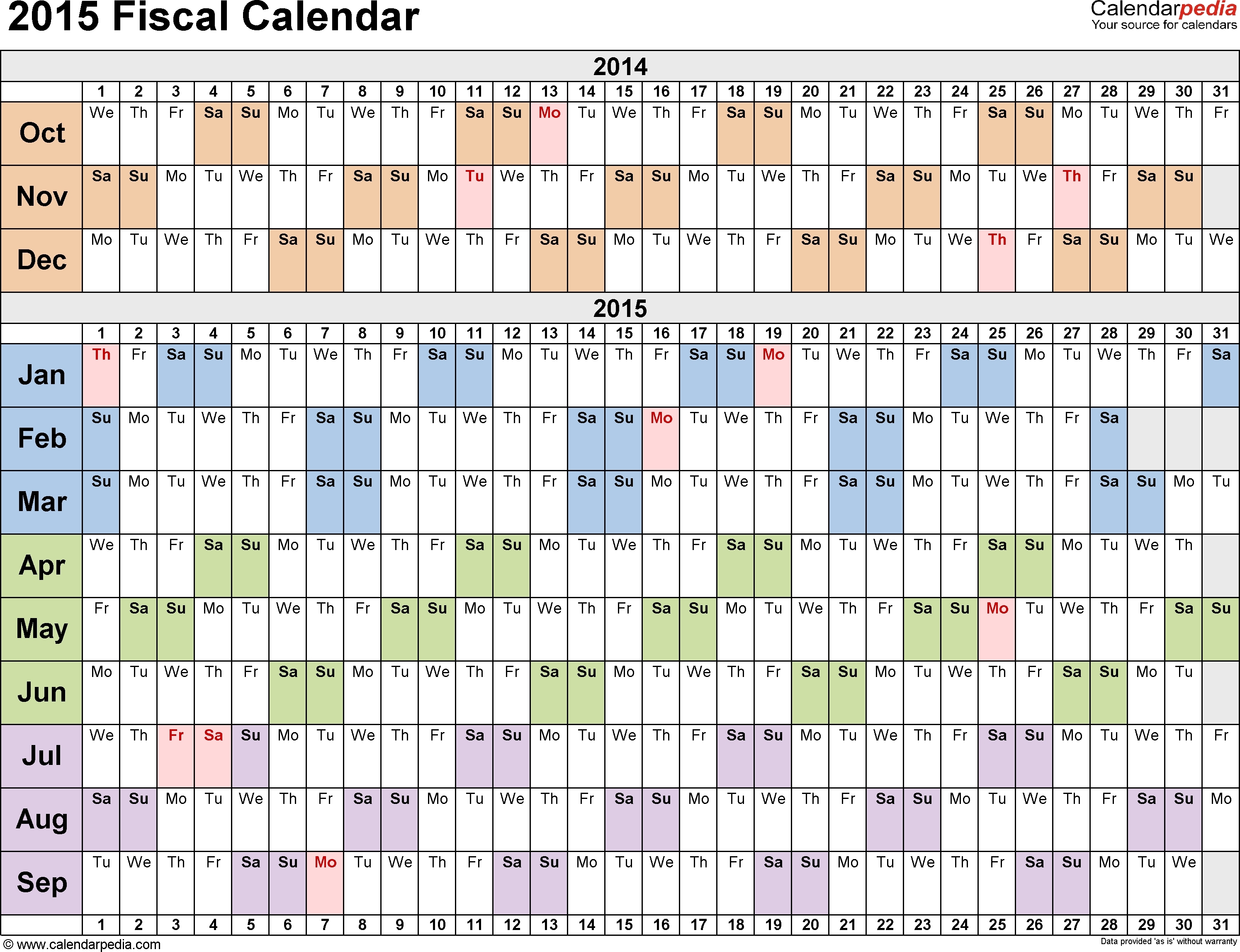

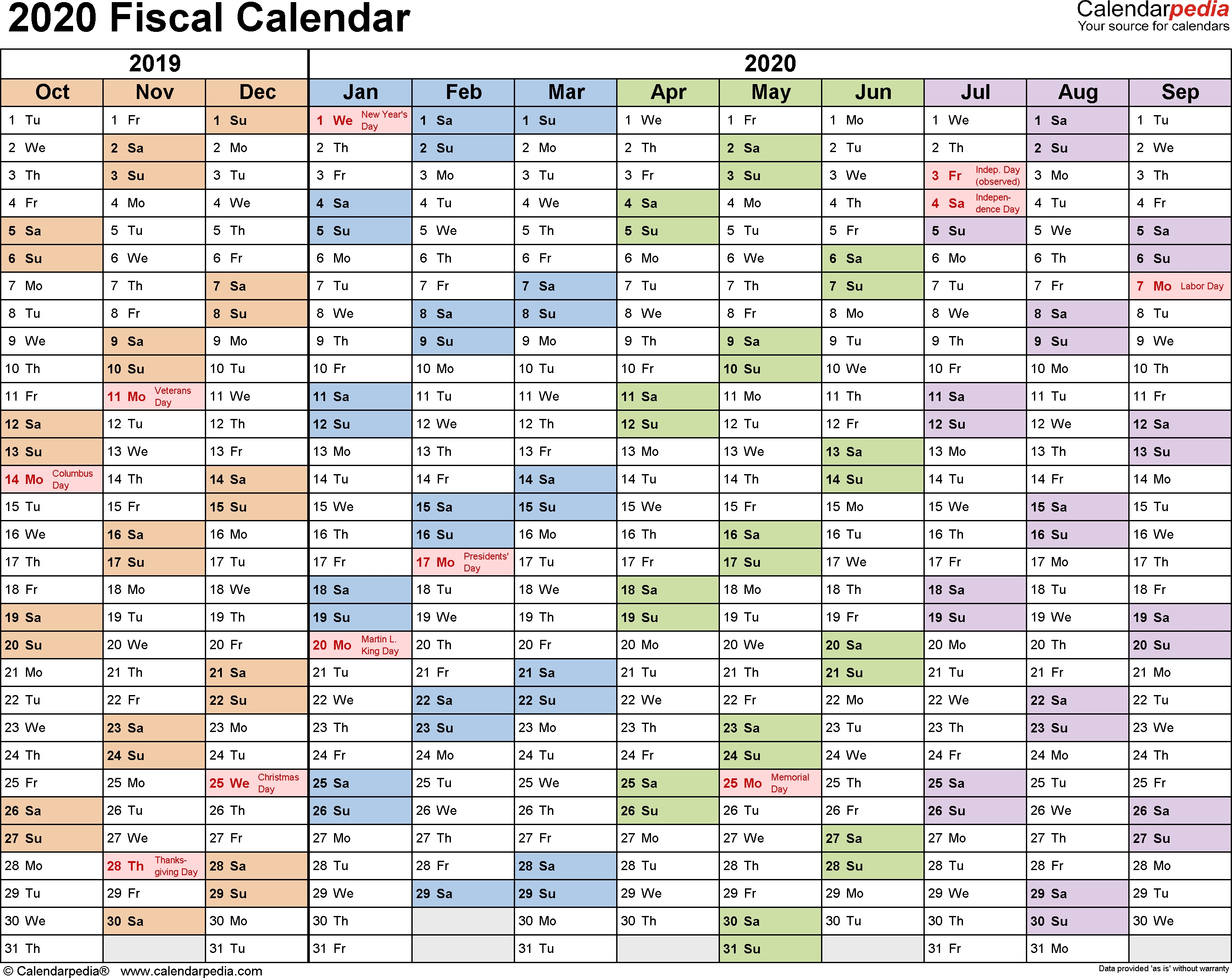

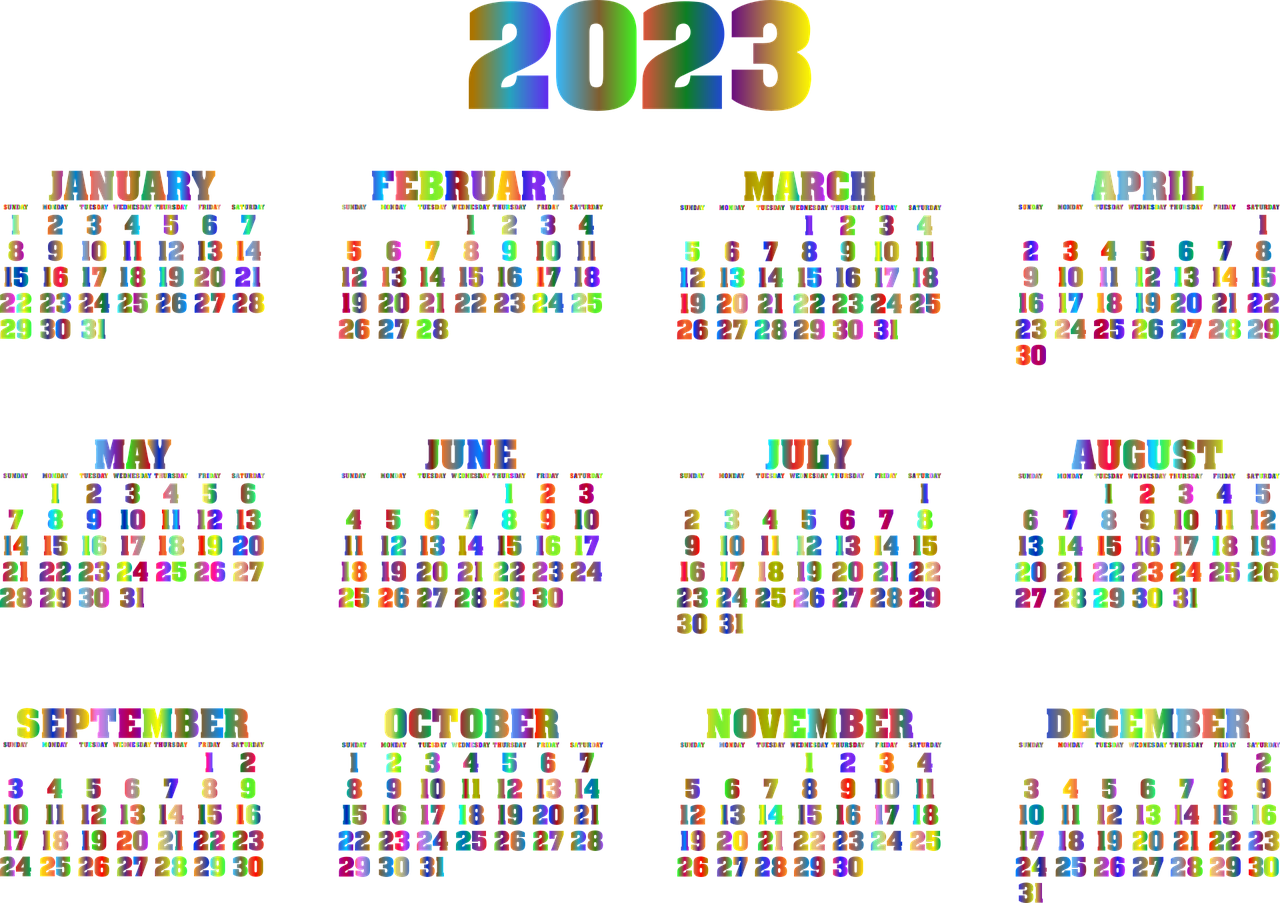

Calendar Year Vs - The choice is made easy but its intuitiveness and tends to line up. A fiscal year and a calendar year are two distinct concepts used for different purposes. The fiscal year (fy) is a. Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. A calendar year, obviously, runs from january 1 to december 31, just like the calendar on your wall. For instance, if a grantor trust generates income, that income is reported on the. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: A fiscal year can cater to specific business needs, such as aligning. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. In this article, we discuss the. A fiscal year and a calendar year are two distinct concepts used for different purposes. This effectively ties the trust’s tax year to the grantor’s personal tax year, typically the calendar year. The fiscal year (fy) is a. A fiscal year is a concept that you will frequently encounter in finance. “as expected, sensient ( sxt ) delivered strong performance in 2024, driven by solid volume growth and sales wins,. The key difference is their alignment with the calendar: The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. Annually simply means once a year, while calendar year specifically. Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. A calendar year, obviously, runs from january 1 to december 31, just like the calendar on your wall. Reports q4 revenue $376.4m vs. The choice is made. A fiscal year can cater to specific business needs, such as aligning. Many of the sport's biggest names already have fights on the 2025 calendar, including several. Guide to calendar year vs fiscal year. The new year has a growing number of events set for the first few months. Reports q4 revenue $376.4m vs. For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally comprises all of the year's financial. They're just different metrics for gauging that time. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. For instance, if a. They're just different metrics for gauging that time. A fiscal year is a concept that you will frequently encounter in finance. The key difference is their alignment with the calendar: This effectively ties the trust’s tax year to the grantor’s personal tax year, typically the calendar year. For instance, if a grantor trust generates income, that income is reported on. Guide to calendar year vs fiscal year. The new year has a growing number of events set for the first few months. They're just different metrics for gauging that time. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best.. For instance, if a grantor trust generates income, that income is reported on the. Many of the sport's biggest names already have fights on the 2025 calendar, including several. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. It is common for organizations to use a calendar year, as opposed to. Understanding what each involves can help you. Guide to calendar year vs fiscal year. A fiscal year is a concept that you will frequently encounter in finance. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. “as expected, sensient ( sxt ) delivered strong performance. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. This effectively ties the trust’s tax year to the grantor’s personal tax year, typically the calendar year. A fiscal year can cater to specific business needs, such as aligning. The primary distinction between a fiscal year. A fiscal year can cater to specific business needs, such as aligning. Reports q4 revenue $376.4m vs. Many of the sport's biggest names already have fights on the 2025 calendar, including several. Understanding what each involves can help you. The key difference is their alignment with the calendar: The new year has a growing number of events set for the first few months. “as expected, sensient ( sxt ) delivered strong performance in 2024, driven by solid volume growth and sales wins,. They're just different metrics for gauging that time. A fiscal year and a calendar year are two distinct concepts used for different purposes. A fiscal year. A fiscal year can cater to specific business needs, such as aligning. In this article, we discuss the. Reports q4 revenue $376.4m vs. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. A fiscal year and a calendar year are two distinct concepts used for different purposes. The choice is made easy but its intuitiveness and tends to line up. Guide to calendar year vs fiscal year. For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally comprises all of the year's financial. A fiscal year is a concept that you will frequently encounter in finance. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Understanding what each involves can help you. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. A calendar year, obviously, runs from january 1 to december 31, just like the calendar on your wall. A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar. Annually simply means once a year, while calendar year specifically. The new year has a growing number of events set for the first few months.Fiscal Year Vs Calendar Year Template Calendar Design

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

What Is The Difference Between Plan Year And Calendar Year Jessica

Fiscal Year vs Calendar Year What is the Difference?

Fiscal Year Vs Calendar Year

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year vs Calendar Year Difference and Comparison

Plan Year Vs. Calendar Year Decent

This Is The Difference Between Calendar And Financial Year Easy The WFY

Fiscal Year Vs Calendar Year What's Best for Your Business?

They're Just Different Metrics For Gauging That Time.

It Is Common For Organizations To Use A Calendar Year, As Opposed To A Fiscal Year, As The Tax Year Calendar For Their Company.

Here We Discuss Calendar Year Vs Fiscal Year Key Differences With Infographics, And Comparison Table.

“As Expected, Sensient ( Sxt ) Delivered Strong Performance In 2024, Driven By Solid Volume Growth And Sales Wins,.

Related Post: