Call Calendar Spread

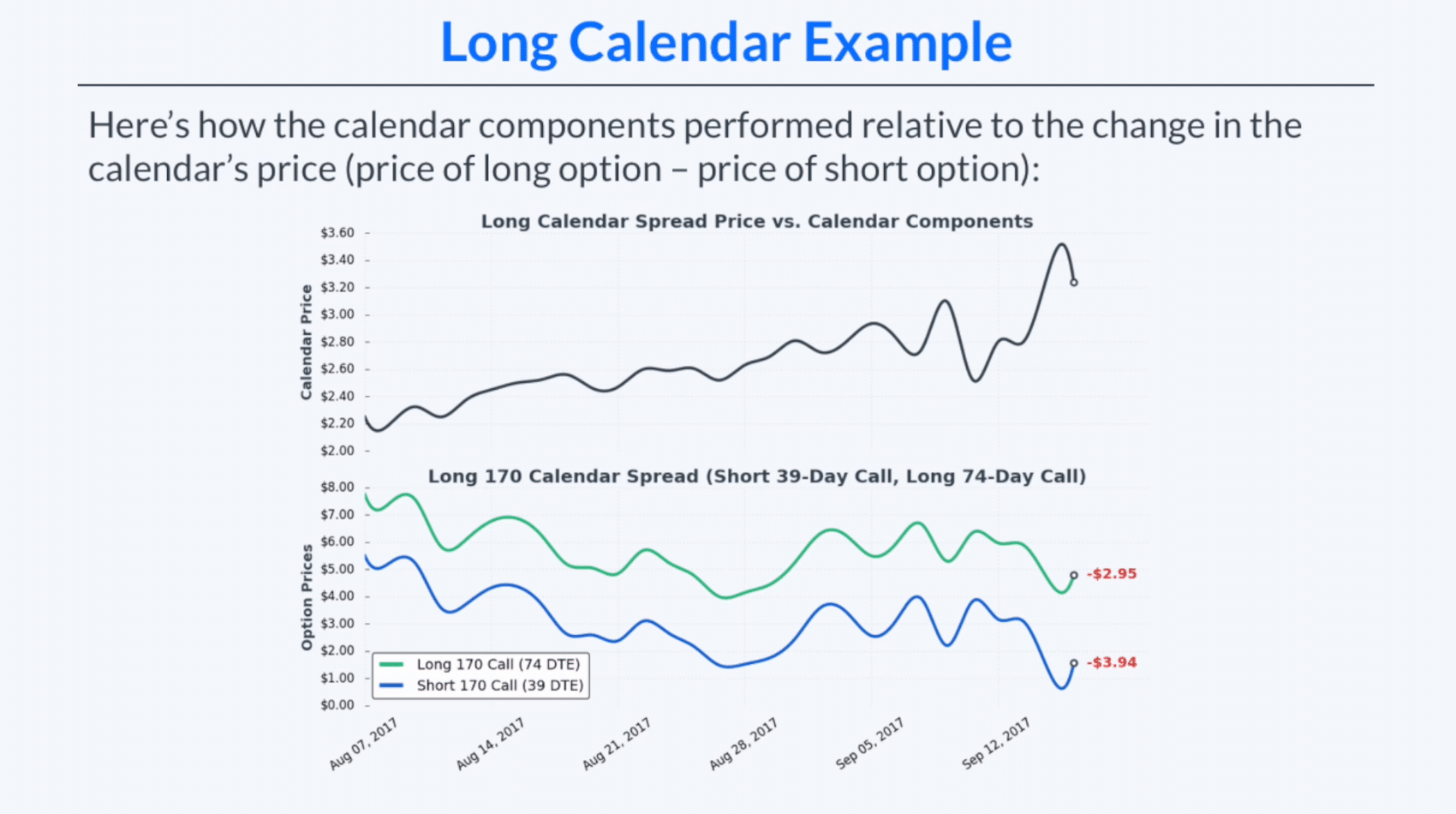

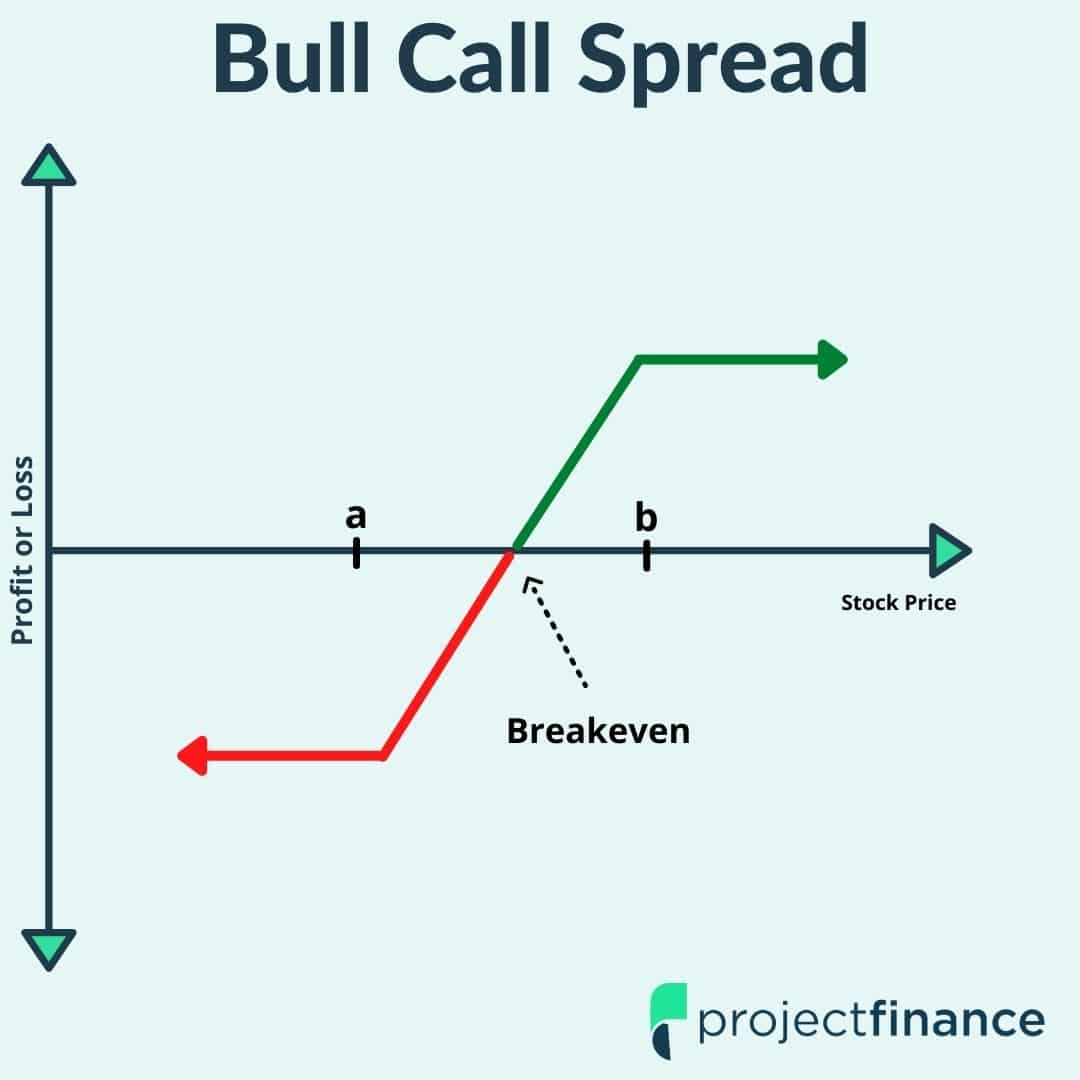

Call Calendar Spread - The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. The aim of the strategy is to. Maximum profit is realized if. What is a calendar call spread? To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. What is a long call calendar spread? They are most profitable when the underlying asset does not change much until after the. They are a great strategy to. A bull call spread is an options strategy used to profit from moderate increases in the underlying asset's price while limiting risk. The position has a maximum loss defined by. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. The net cost of this spread is. Maximum profit is realized if. They are a great strategy to. What is a calendar call spread? They are most profitable when the underlying asset does not change much until after the. Entering a long and short position on the same underlying asset at the same strike price but with different expiration dates is called a calendar spread. § short 1 xyz (month 1). Entering a long and short position on the same underlying asset at the same strike price but with different expiration dates is called a calendar spread. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. The. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Maximum profit is realized if. What is a calendar call spread? A calendar call spread is an options strategy where. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. The aim of the strategy is to. Using a calendar spread is a creative way to adjust your long or short options trades that can reduce your. The aim of the strategy is to. The position has a maximum loss defined by. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A bull call spread is an options strategy used to profit from. A calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one. The call calendar spread, also known as a time spread, is a powerful options trading strategy that profits from time decay (theta) and changes in implied volatility (iv). Calendar spreads allow traders to construct a. Maximum profit is realized if. They are most profitable when the underlying asset does not change much until after the. The position has a maximum loss defined by. What is a calendar call spread? Entering a long and short position on the same underlying asset at the same strike price but with different expiration dates is called a calendar spread. The aim of the strategy is to. The call calendar spread, also known as a time spread, is a powerful options trading strategy that profits from time decay (theta) and changes in implied volatility (iv). § short 1 xyz (month 1). A long call calendar spread involves buying and selling call options for the same underlying security at the same. Using a calendar spread is a creative way to adjust your long or short options trades that can reduce your exposure and maximize your profit potential. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. Maximum profit. Entering a long and short position on the same underlying asset at the same strike price but with different expiration dates is called a calendar spread. The net cost of this spread is. § short 1 xyz (month 1). What is a long call calendar spread? They are most profitable when the underlying asset does not change much until after. The aim of the strategy is to. § short 1 xyz (month 1). The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A calendar call spread is an options strategy where two calls are traded on. What is a long call calendar spread? Entering a long and short position on the same underlying asset at the same strike price but with different expiration dates is called a calendar spread. The net cost of this spread is. They are most profitable when the underlying asset does not change much until after the. The call calendar spread, also known as a time spread, is a powerful options trading strategy that profits from time decay (theta) and changes in implied volatility (iv). § short 1 xyz (month 1). A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Calendar spreads allow traders to construct a trade that minimizes the effects of time. They are a great strategy to. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. Using a calendar spread is a creative way to adjust your long or short options trades that can reduce your exposure and maximize your profit potential. The position has a maximum loss defined by. Maximum profit is realized if.Calendar Spread Using Calls Kelsy Mellisa

Calendar Call Spread Strategy

Calendar Call Spread Option Strategy Heida Kristan

Long Call Calendar Spread Explained (Options Trading Strategies For

Calendar Call Spread Options Edge

Calendar Call Spread Strategy

Calendar Call Spread Strategy

Diagonal Call Calendar Spread Smart Trading

Long Call Calendar Spread Strategy Nesta Adelaide

Trading Guide on Calendar Call Spread AALAP

The Aim Of The Strategy Is To.

What Is A Calendar Call Spread?

A Bull Call Spread Is An Options Strategy Used To Profit From Moderate Increases In The Underlying Asset's Price While Limiting Risk.

A Calendar Call Spread Is An Options Strategy Where Two Calls Are Traded On The Same Underlying And The Same Strike, One Long And One.

Related Post: