Call Calendar

Call Calendar - Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. § short 1 xyz (month 1). Meanwhile, a put calendar spread utilizes two puts. Buying calls and writing calls with the same underlying security and establishing it incurs an upfront cost. It's a relatively straightforward strategy where the losses. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. What is a long call calendar spread? The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. You may go long or short on a call or. It's a relatively straightforward strategy where the losses. A long calendar spread is a good strategy to. Summed up, a call calendar spread utilizes two calls. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. To understand how the long call calendar spread allows you to capture time value, let's look at an example. § short 1 xyz (month 1). What is a call calendar spread? When you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the. The aim of the strategy is to. Stock xyz has been churning around $90 per share for weeks. It's a relatively straightforward strategy where the losses. If so, then you should take a look at the. Stock xyz has been churning around $90 per share for weeks. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Meanwhile, a put calendar spread utilizes two puts. Learn how to use a long call calendar spread to combine a bullish and a. Maximum profit is realized if. Summed up, a call calendar spread utilizes two calls. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. When you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the. To understand. What is a call calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. § short 1 xyz (month 1). Bullish option flow detected in arm (arm) holdings plc with 52,838 calls trading, 1.3x expected, and implied vol increasing over 5 points to 52.94%. The aim. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. What is a long call calendar spread? To understand how. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. Stock xyz has been churning around $90 per share for weeks. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. It's. Stock xyz has been churning around $90 per share for weeks. What is a long call calendar spread? Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the. If so, then you should take a look at the calendar spread strategy. What is a long call calendar spread? Summed up, a call calendar spread utilizes two calls. A short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long. Buying calls and writing calls with the same underlying security and establishing it incurs an upfront cost. What is a long call calendar spread? If so, then you should take a look at the calendar spread strategy. Stock xyz has been churning around $90 per share for weeks. Learn how to use a long call calendar spread to combine a. You may go long or short on a call or. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to. Bullish option flow detected in arm (arm) holdings plc with 52,838 calls trading, 1.3x expected, and implied vol increasing over 5. § short 1 xyz (month 1). Buying calls and writing calls with the same underlying security and establishing it incurs an upfront cost. Meanwhile, a put calendar spread utilizes two puts. The aim of the strategy is to. You may go long or short on a call or. Stock xyz has been churning around $90 per share for weeks. This strategy can profit from stock price movements or volatility changes, but also. Summed up, a call calendar spread utilizes two calls. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. When you invest in a calendar spread, you buy and sell the same type of option (either a call or a put) for the. Bullish option flow detected in arm (arm) holdings plc with 52,838 calls trading, 1.3x expected, and implied vol increasing over 5 points to 52.94%. If so, then you should take a look at the calendar spread strategy.On Call Schedule Template Lovely 9 Call Schedule Template Excel

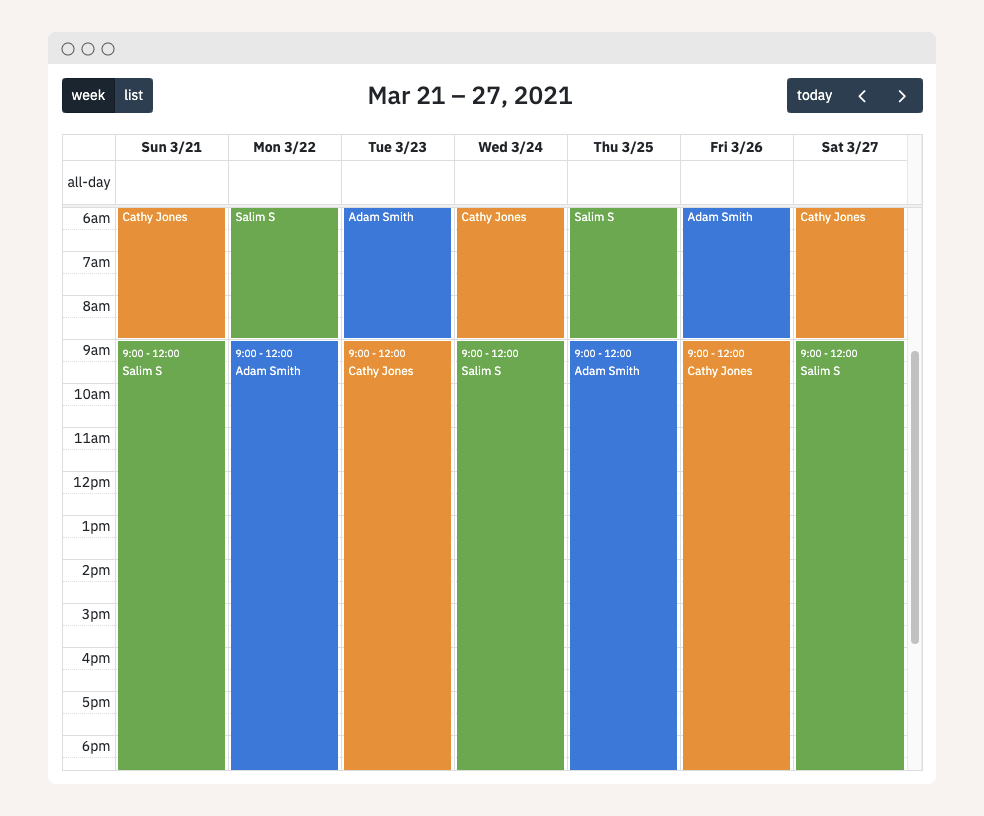

On Call Calendar App Lanna Nerissa

OnCall Calendar Cass Danielle

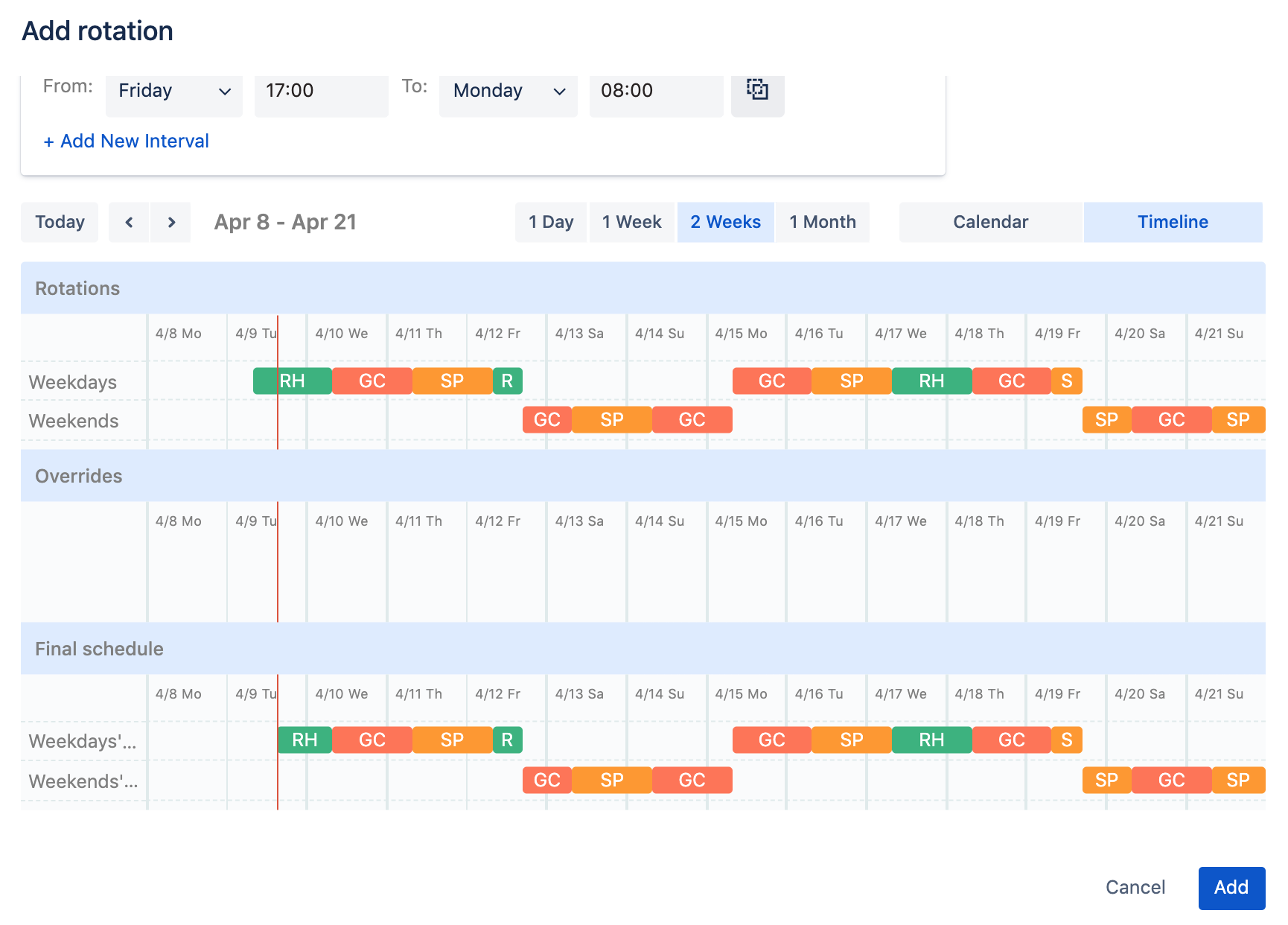

Create an oncall schedule with weekday/weekend rotation Opsgenie

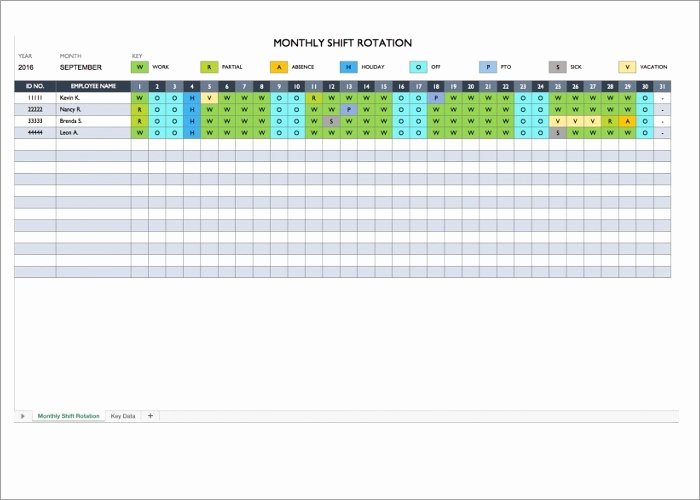

10+ On Call Schedule Templates Creative Templates

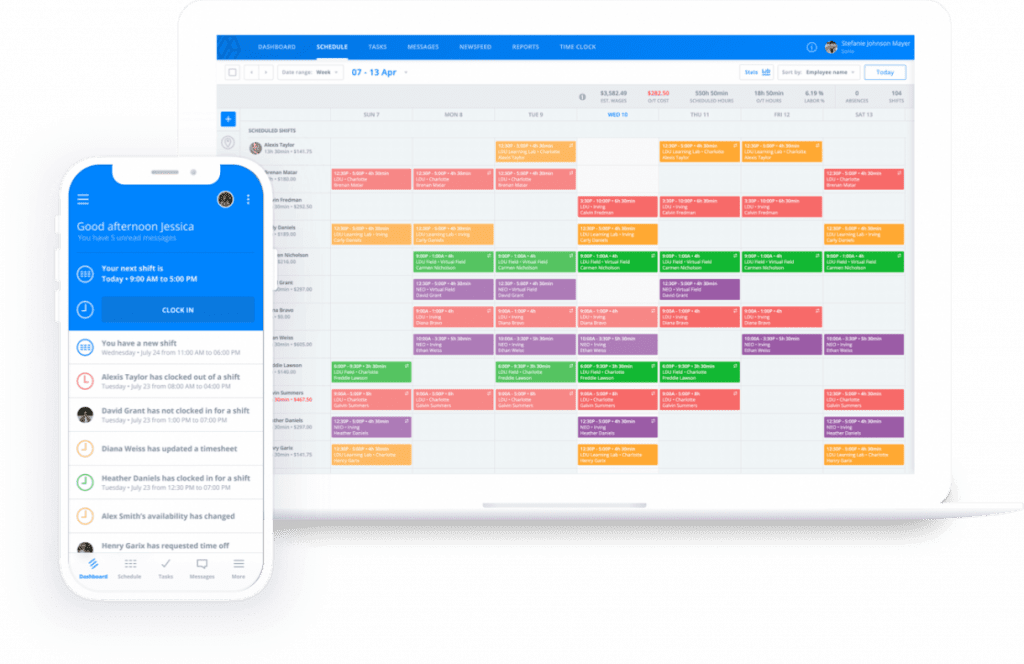

How To Create An OnCall Schedule That Won’t Frustrate Employees Sling

Squid Alerts OnCall Calendars

On Call Schedule Template Venngage

On Call Calendar Template Shooters Journal

On Call Schedule Template Excel SampleTemplatess SampleTemplatess

It's A Relatively Straightforward Strategy Where The Losses.

A Short Calendar Spread With Calls Realizes Its Maximum Profit If The Stock Price Is Either Far Above Or Far Below The Strike Price On The Expiration Date Of The Long Call.

Entering Into A Calendar Spread Simply Involves Buying A Call Or Put Option For An Expiration Month That's Further Out While Simultaneously Selling A Call Or Put Option For A Closer.

Learn How To Use A Long Call Calendar Spread To Combine A Bullish And A Bearish Outlook On A Stock.

Related Post: