Diagonal Calendar Spread

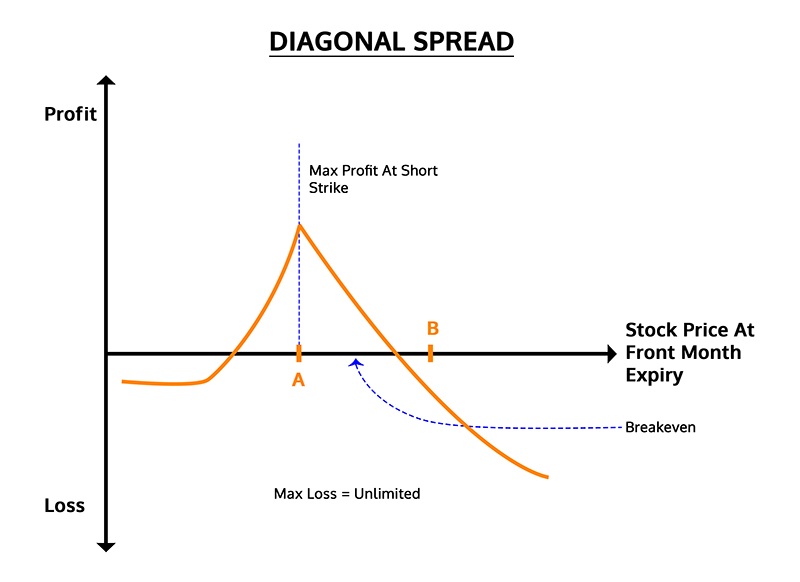

Diagonal Calendar Spread - Here's a screenshot of what would officially be called a calendar spread (and you. A diagonal spread is a modified calendar spread involving different strike prices. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short. Learn how to read this chart. A diagonal spread is established by buying. A diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. After analysing the stock's historical volatility. In this article, we explore diagonal spreads in detail, covering their. Learn how the diagonal call calendar spread helps you make smarter trades and how to properly setup a call calendar spread strategy. Diagonal spreads offer flexibility and potential profitability, but understanding their mechanics is essential. One is neutral, one is not. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short. A diagonal spread is a type of options spread that combines aspects of both horizontal spreads and vertical spreads. They are a modified version of calendar spreads. The diagonal calendar put spread, also known as the put diagonal calendar spread,. It involves simultaneously buying and selling options of the. Here's a screenshot of what would officially be called a calendar spread (and you. A diagonal spread is an options strategy that combines elements of vertical and calendar spreads by buying and selling options of the same. A diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Suppose apple inc (aapl) is currently trading at $145 per share. After analysing the stock's historical volatility. In this article, we explore diagonal spreads in detail, covering their. Diagonal spreads involve two calls or puts with different strikes and expiration dates. A diagonal spread is a modified calendar spread involving different strike prices. Learn how the diagonal call calendar spread helps you make smarter trades and how to properly setup a call calendar spread strategy. A diagonal spread is a modified calendar spread involving different strike prices. The diagonal calendar put spread, also known as the put diagonal calendar spread,. What is a diagonal spread in options? Diagonal spreads offer flexibility and potential. Let’s say that abc corp. The diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock. Here's a screenshot of what would officially be called a calendar spread (and you. Use calendar spreads when you expect minimal price movement and want to benefit from time decay. The. Many traders actually don’t know much about how powerful and. The diagonal calendar put spread, also known as the put diagonal calendar spread,. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. It involves simultaneously buying and selling options of the. Learn more about diagonal spreads and how they work. It is an options strategy established by simultaneously entering into a long and short. A diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of different contract durations in. A diagonal spread is an options trading strategy that combines elements of both vertical and calendar. You think it’s going to stay roughly the. A diagonal spread is an options trading strategy that combines elements of both vertical and calendar spreads. A diagonal spread is a modified calendar spread involving different strike prices. Suppose apple inc (aapl) is currently trading at $145 per share. It involves simultaneously buying and selling options of the. Diagonal spreads are modified calendar spreads involving different strike prices on similar options. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short. You think it’s going to stay roughly the. Let’s say that abc corp. Learn how to read this chart. What is a diagonal spread in options? Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short. Diagonal spreads offer flexibility and potential profitability, but understanding their mechanics is essential. A diagonal spread is an options trading strategy that combines the vertical nature. Diagonal spreads are modified calendar spreads involving different strike prices on similar options. The diagonal calendar put spread, also known as the put diagonal calendar spread,. A diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of different contract durations in. What is a diagonal. Many traders actually don’t know much about how powerful and. Diagonal spreads offer flexibility and potential profitability, but understanding their mechanics is essential. A diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of different contract durations in. One is neutral, one is not. After. Use calendar spreads when you expect minimal price movement and want to benefit from time decay. Both diagonal spreads and calendar spreads are options trading strategies that involve the combination of. A diagonal spread is a modified calendar spread involving different strike prices. One is neutral, one is not. Let’s say that abc corp. Learn how to read this chart. Learn more about diagonal spreads and how they work. How does diagonal calendar put spread work in options trading? By using options with different strike prices and expiration dates, the. Diagonal spreads offer flexibility and potential profitability, but understanding their mechanics is essential. A diagonal spread is established by buying. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short. Learn how to read this chart. In this article, we explore diagonal spreads in detail, covering their. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. It is an options strategy established by simultaneously entering into a long and short.Diagonal Calendar Spread Jonis Mahalia

Trading Calendar and Diagonal Spreads l Options Trading YouTube

The Ultimate Guide to Options Trading Strategies IMS Proschool

DIAGONAL WEEKLY CALENDAR WITH ADJUSTMENTS WEEKLY CALENDAR SPREAD

DOUBLE DIAGONAL CALENDAR SPREAD STRATEGY TRADING PLUS YouTube

Calendar Spread & Diagonal Spread Strategy, Pros & Cons, Real Examples

Diagonal Spread Options Trading Strategy In Python

Option Basics Strategy Ultimate Guide to Calendar & Diagonal

Diagonal Calendar Spread Option Strategy Printable Word Searches

Calendar Spread & Diagonal Spread Strategy, Pros & Cons, Real Examples

Suppose Apple Inc (Aapl) Is Currently Trading At $145 Per Share.

Abc) Is Trading At $110 Per Share.

Here's A Screenshot Of What Would Officially Be Called A Calendar Spread (And You.

What Is A Diagonal Spread?

Related Post: