Double Calendar

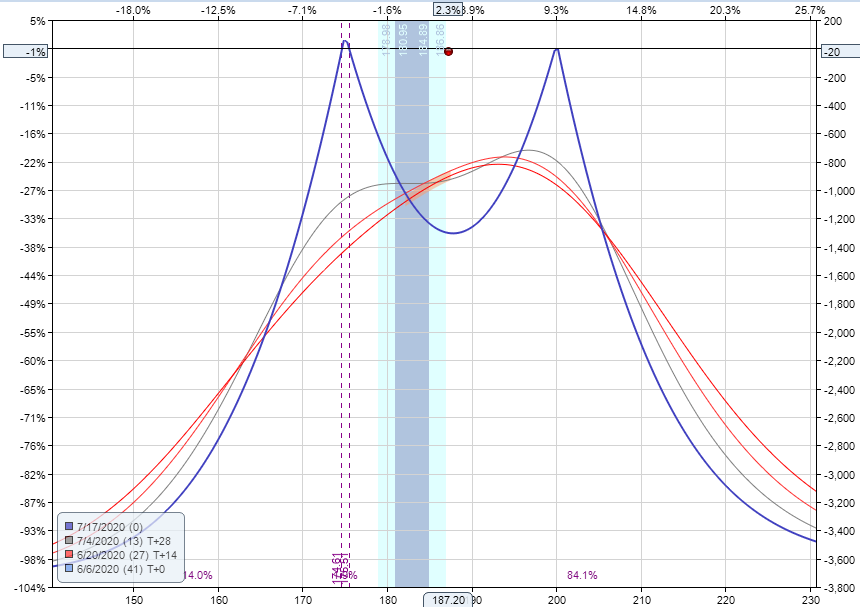

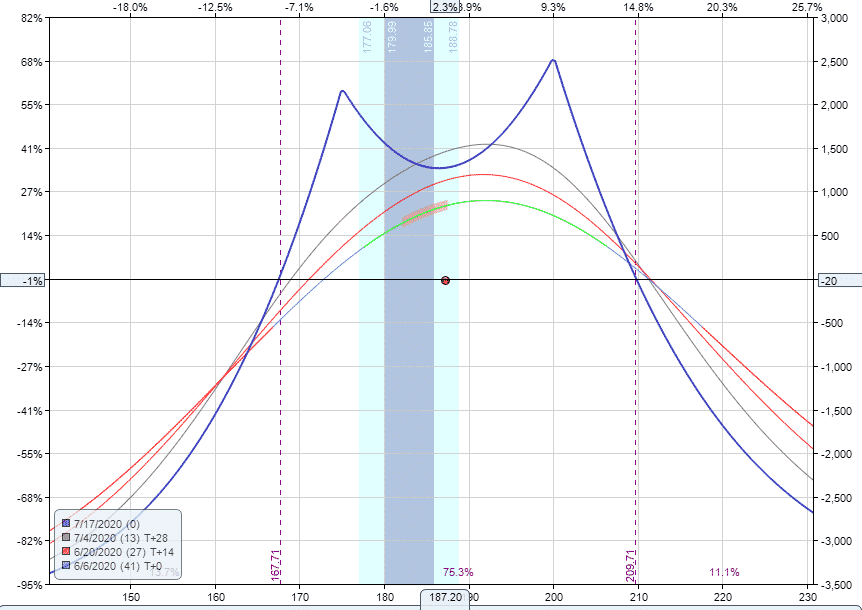

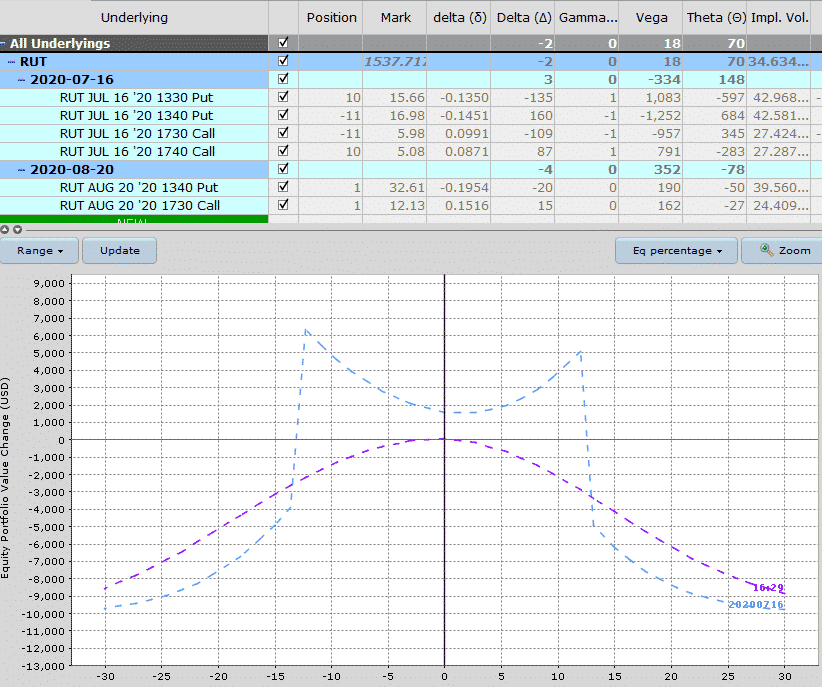

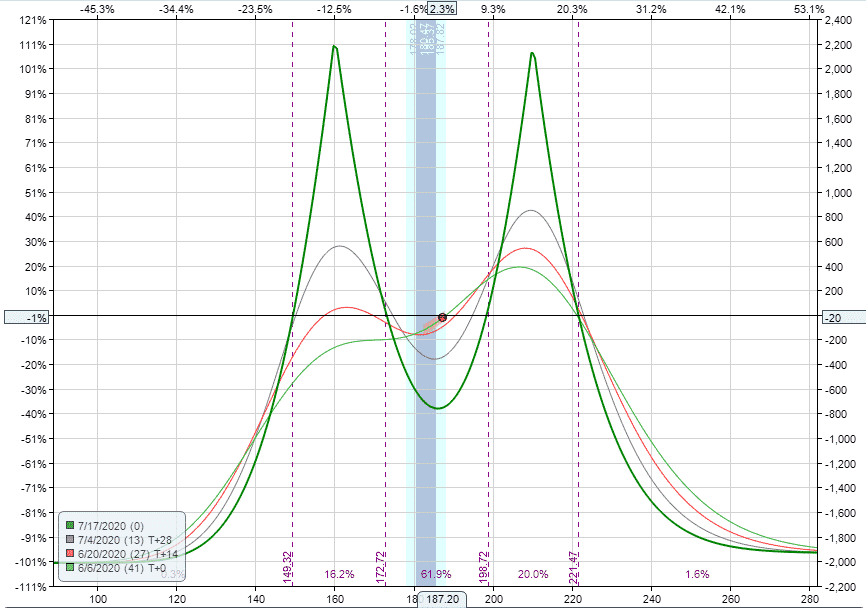

Double Calendar - Calendars are long vega trades and theoretically make money if iv increases. It involves selling near expiry calls and puts and buying further expiry calls and puts with the. Traders can use technical and. Calculate potential profit, max loss, chance of profit, and more for double calendar options and over 50 more strategies. This allows you to make money on your long options while most of the time value. In this article, i will explain how to set up, and when to use a double calendar spread. This spread is established by selling the front month options with the juiced iv and buying longer dated. While this spread is fairly advanced, it’s also relatively. It is an option strategy where current month. Ultimately, you want the earnings reaction to end near one of the strikes without going past by expiration. In a double diagonal, the strikes of the long contracts are placed farther otm than. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. In the case of double calendars, the strikes of the short and long contracts are identical. In this article, i will explain how to set up, and when to use a double calendar spread. Discover how a savvy investor used the double calendar spread strategy during boeing’s earnings season, gaining over 10% in one week. A double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset. What are double calander spreads? Learn how to effectively trade double calendars with my instructional video series; This allows you to make money on your long options while most of the time value. While this spread is fairly advanced, it’s also relatively. Calculate potential profit, max loss, chance of profit, and more for double calendar options and over 50 more strategies. This allows you to make money on your long options while most of the time value. While this spread is fairly advanced, it’s also relatively. A double calendar spread is a trading strategy used to exploit time differences in the volatility. Calculate potential profit, max loss, chance of profit, and more for double calendar options and over 50 more strategies. In this article, i will explain how to set up, and when to use a double calendar spread. This allows you to make money on your long options while most of the time value. Ultimately, you want the earnings reaction to. The trade structure we will use is that of the “double calendar spread”. This spread is established by selling the front month options with the juiced iv and buying longer dated. A double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset. Calendars are long vega trades and theoretically make money. In a double diagonal, the strikes of the long contracts are placed farther otm than. In the case of double calendars, the strikes of the short and long contracts are identical. It is an option strategy where current month. It involves selling near expiry calls and puts and buying further expiry calls and puts with the. Double calendar spreads are. Double calendar spreads are a complex trading strategy that involves multiple options positions and can provide traders with a way to potentially profit from stable prices in. In the case of double calendars, the strikes of the short and long contracts are identical. As the name suggests, a double calendar spread is created by using two calendar spreads. In a. Discover how a savvy investor used the double calendar spread strategy during boeing’s earnings season, gaining over 10% in one week. In this article, i will explain how to set up, and when to use a double calendar spread. This spread is established by selling the front month options with the juiced iv and buying longer dated. Calendars are long. Discover how a savvy investor used the double calendar spread strategy during boeing’s earnings season, gaining over 10% in one week. It is an option strategy where current month. What are double calander spreads? In the case of double calendars, the strikes of the short and long contracts are identical. As the name suggests, a double calendar spread is created. A double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset. As the name suggests, a double calendar spread is created by using two calendar spreads. Discover how a savvy investor used the double calendar spread strategy during boeing’s earnings season, gaining over 10% in one week. What strikes, expiration's and. A double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset. In this article, i will explain how to set up, and when to use a double calendar spread. This allows you to make money on your long options while most of the time value. It is an option strategy where. In the case of double calendars, the strikes of the short and long contracts are identical. In this article, i will explain how to set up, and when to use a double calendar spread. Calculate potential profit, max loss, chance of profit, and more for double calendar options and over 50 more strategies. Ultimately, you want the earnings reaction to. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. A double calendar spread is a trading strategy used to exploit time differences in the volatility of an underlying asset. As the name suggests, a double calendar spread is created by using two calendar spreads. In the case of double calendars, the strikes of the short and long contracts are identical. Calendars are long vega trades and theoretically make money if iv increases. This allows you to make money on your long options while most of the time value. In this article, i will explain how to set up, and when to use a double calendar spread. The strategy is most commonly known as the double calendar spread, which, as you might guess, involves establishing multiple positions in an effort to increase the probability of a profitable. Learn how to effectively trade double calendars with my instructional video series; What are double calander spreads? The trade structure we will use is that of the “double calendar spread”. Calculate potential profit, max loss, chance of profit, and more for double calendar options and over 50 more strategies. It is an option strategy where current month. It involves selling near expiry calls and puts and buying further expiry calls and puts with the. This spread is established by selling the front month options with the juiced iv and buying longer dated. Traders can use technical and.Double Calendar Spread Strategy Printable Word Searches

Double Calendar Spreads Ultimate Guide With Examples

Double Calendar Spreads Ultimate Guide With Examples

Printable Double Calendar

Double Calendar Spreads Ultimate Guide With Examples

Double Calendar Spread Adjustment videos link in Description

Double Calendar Spreads Ultimate Guide With Examples

Double Month Printable Calendar 2025 CALENDAR PRINTABLE

Double Calendar Spreads Ultimate Guide With Examples

Double Calendars Order a Unique Double Calendar Online

Discover How A Savvy Investor Used The Double Calendar Spread Strategy During Boeing’s Earnings Season, Gaining Over 10% In One Week.

Double Calendar Spreads Are A Complex Trading Strategy That Involves Multiple Options Positions And Can Provide Traders With A Way To Potentially Profit From Stable Prices In.

In A Double Diagonal, The Strikes Of The Long Contracts Are Placed Farther Otm Than.

Ultimately, You Want The Earnings Reaction To End Near One Of The Strikes Without Going Past By Expiration.

Related Post: