Financial Year Vs Calendar Year

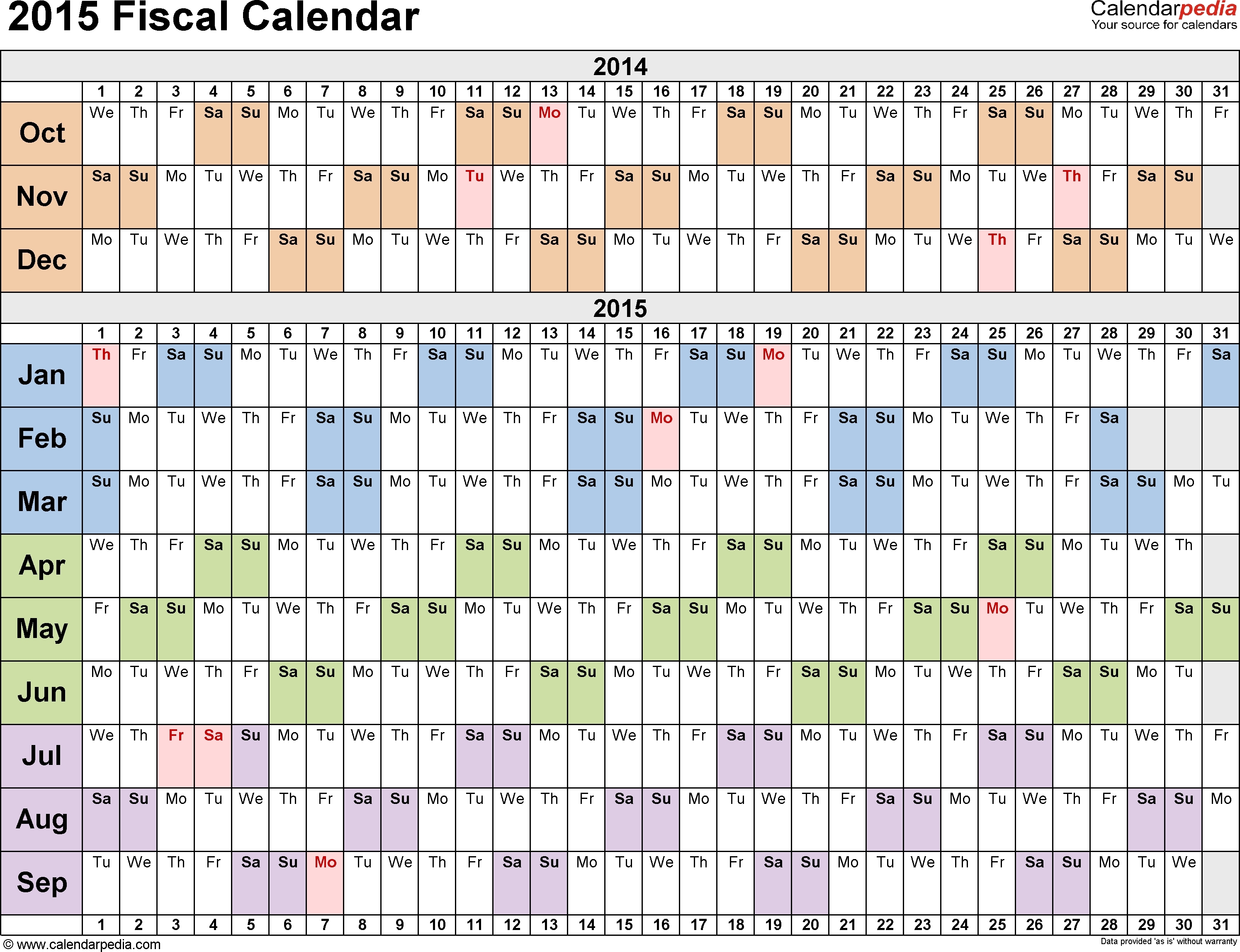

Financial Year Vs Calendar Year - While a calendar year end is simple and more common, a fiscal year can present a more accurate picture of a company’s performance. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Dividend for fiscal year 2024, a dividend2 payment of €2.90 per share will be proposed to the shareholders’ vote at the annual general meeting on may 22, 2025. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. For example, the fiscal year for schools is usually july 1 to june 30. More specifically, a fiscal year is often differentiated from a calendar year for accounting purposes. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. They're just different metrics for gauging that time. As per the draft income tax bill 2025, the tax. This often is the case with seasonal. Understanding the difference between a calendar and fiscal year is important to file taxes and manage your investment portfolio. More specifically, a fiscal year is often differentiated from a calendar year for accounting purposes. Dividend for fiscal year 2024, a dividend2 payment of €2.90 per share will be proposed to the shareholders’ vote at the annual general meeting on may 22, 2025. They're just different metrics for gauging that time. What is the difference between a fiscal year and calendar year? Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. This connection limits the feasibility of electing a fiscal year for revocable trusts. As per the draft income tax bill 2025, the tax. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed. Many companies use a fiscal year that. For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally comprises all of the year's financial. As per the draft income tax bill 2025, the tax. Dividend for fiscal year 2024, a dividend2 payment of €2.90 per share will be proposed to the shareholders’ vote. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. A calendar year, january 1 to december 31, is the most popular choice for. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start. Let us discuss some of the major key differences between the calendar year vs fiscal year: Understanding the difference between a calendar and fiscal year is important to file taxes and manage your investment portfolio. As per the draft income tax bill 2025, the tax. For example, the fiscal year for schools is usually july 1 to june 30. They're. What is the difference between a fiscal year and calendar year? This connection limits the feasibility of electing a fiscal year for revocable trusts. Let us discuss some of the major key differences between the calendar year vs fiscal year: Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners. This connection limits the feasibility of electing a fiscal year for revocable trusts. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Let us discuss some of the major key differences between the calendar year vs fiscal year: A fiscal year can. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. A calendar year, january 1 to december 31, is the most popular choice for. The calendar year, as the name itself, indicates that it is based on the normal. Unlike. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Many companies use a fiscal year that. This often is the case with seasonal. The calendar year, as the name itself, indicates that it is based on the normal. Both options. A calendar year, january 1 to december 31, is the most popular choice for. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally comprises. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Using a different fiscal. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. As per the draft income tax bill 2025, the tax. More specifically, a fiscal year is often differentiated from a calendar year for accounting purposes. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. Understanding the difference between a calendar and fiscal year is important to file taxes and manage your investment portfolio. This often is the case with seasonal. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Many companies use a fiscal year that. This connection limits the feasibility of electing a fiscal year for revocable trusts. The calendar year, as the name itself, indicates that it is based on the normal. Dividend for fiscal year 2024, a dividend2 payment of €2.90 per share will be proposed to the shareholders’ vote at the annual general meeting on may 22, 2025. Let us discuss some of the major key differences between the calendar year vs fiscal year: A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. A calendar year, january 1 to december 31, is the most popular choice for. For example, the fiscal year for schools is usually july 1 to june 30. You’ll also need to choose between using a calendar year or fiscal year.What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year vs. Calendar Year Key Differences by Blogwaly Oct

What Is A Fiscal Year Vs Calendar Year Ryann Florence

Fiscal Year Vs Calendar Year Template Calendar Design

Fiscal Year vs Calendar Year What's The Difference?

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Fiscal Year Vs Calendar Year What's Best for Your Business?

Calendar Year Vs Fiscal Year Gayle Johnath

Fiscal Year vs Calendar Year What is the Difference?

What is a Fiscal Year? Your GoTo Guide

They're Just Different Metrics For Gauging That Time.

Unlike The Calendar Year That Starts On January 1 And Ends On December 31, A Fiscal Year Can Start And End At Any Point During The Year.

What Is The Difference Between A Fiscal Year And Calendar Year?

The Internal Revenue Service (Irs) Defines A Fiscal Year As 12 Consecutive Months Ending On The Last Day.

Related Post: