Fiscal And Calendar Year

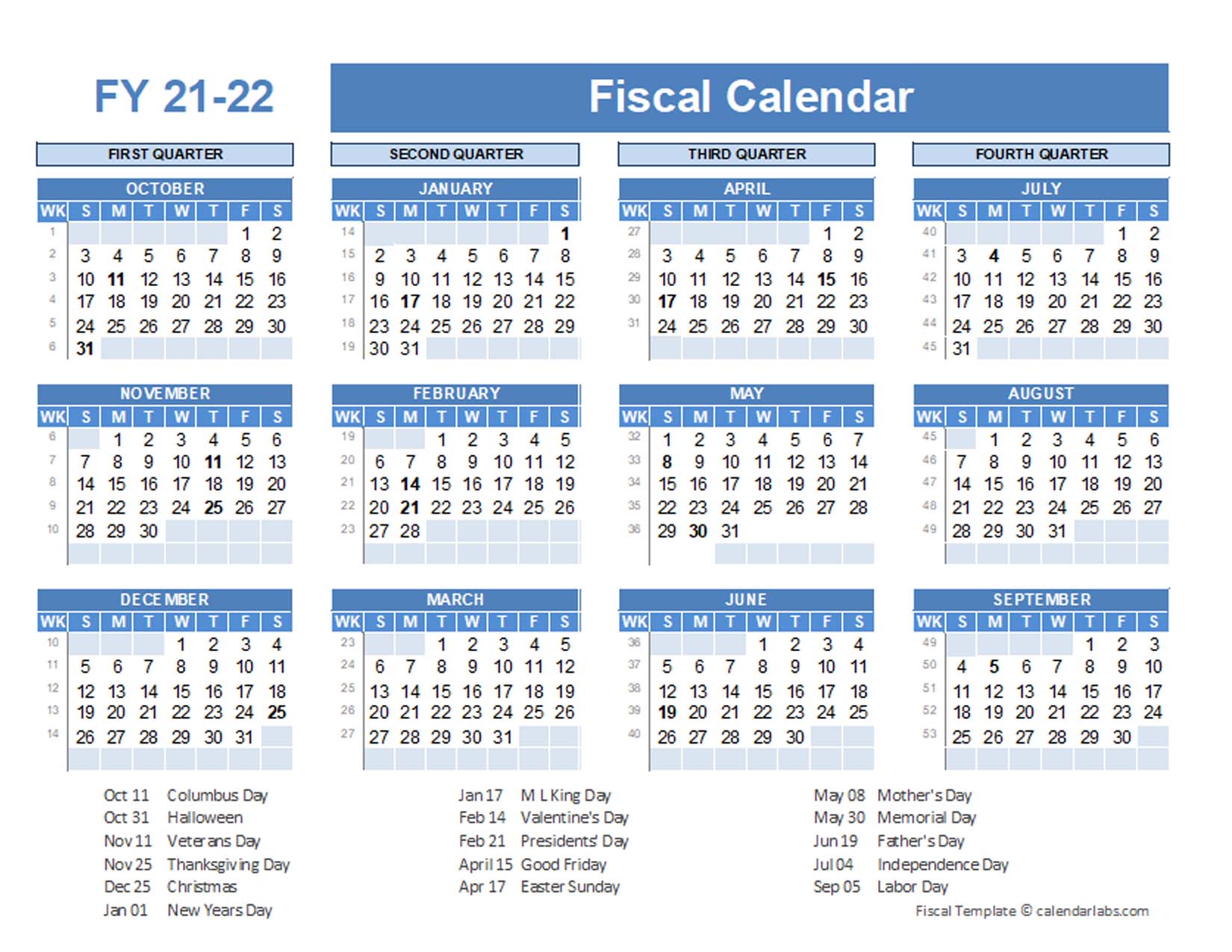

Fiscal And Calendar Year - The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: The fiscal year (fy) is a. Learn the difference between fiscal and calendar years for accounting purposes and how to choose the best option for your business. A fiscal year can cater to specific business needs, such as aligning. The two main types of tax years for an organization are the calendar tax year and the fiscal tax year. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Find out the benefits, requirements and. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. A calendar tax year runs from january 1 to december 31. Let us discuss some of the major key differences between the calendar year vs fiscal year: A fiscal year and a calendar year are two distinct concepts used for different purposes. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. These time frames, primarily fiscal year and calendar year,. This decision can have tax implications,. In this article, we define a fiscal and calendar year, list the benefits of both,. To engage in our ongoing support and. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. A fiscal year is a concept that you will frequently encounter in finance. A calendar tax year runs from january 1 to december 31. Learn. Many companies use a fiscal year that. When you choose fiscal year reporting, all information from your selling season is reported on the same tax return as well as your company books. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. For the fiscal first quarter ended december. These time frames, primarily fiscal year and calendar year,. Understanding what each involves can help you determine which to use for accounting or tax purposes. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. This decision can have tax implications,.. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Understanding what each involves can help you determine which to use for accounting or tax purposes. A fiscal year and a calendar year are two distinct concepts used for different purposes.. Learn the difference between fiscal and calendar years for accounting purposes and how to choose the best option for your business. A fiscal year and a calendar year are two distinct concepts used for different purposes. The fiscal year (fy) is a. The two main types of tax years for an organization are the calendar tax year and the fiscal. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. These time frames, primarily fiscal year and calendar year,. A calendar tax year runs from january 1 to december 31.. These time frames, primarily fiscal year and calendar year,. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. When you choose fiscal year reporting, all information from your selling season is reported on the same tax return as well as your company books. Find out the benefits, requirements and. A fiscal year can cater to. In this article, we discuss the. These time frames, primarily fiscal year and calendar year,. The two main types of tax years for an organization are the calendar tax year and the fiscal tax year. Find out the benefits, requirements and. Learn the difference between fiscal and calendar years for accounting purposes and how to choose the best option for. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Learn the difference between fiscal and calendar years for accounting purposes and how to choose the best option for your business. Understanding what each involves can help you determine which to use for. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. In this article, we discuss the. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Understanding what each involves can. These time frames, primarily fiscal year and calendar year,. To engage in our ongoing support and. The fiscal year (fy) is a. The calendar year, as the name itself, indicates that it is based on the normal. In this article, we discuss the. Let us discuss some of the major key differences between the calendar year vs fiscal year: When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Learn the difference between fiscal and calendar years for accounting purposes and how to choose the best option for your business. Understanding what each involves can help you determine which to use for accounting or tax purposes. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: In this article, we define a fiscal and calendar year, list the benefits of both,. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. In accounting, organizations have different time frames they use to measure and report financial performance. A fiscal year and a calendar year are two distinct concepts used for different purposes. A calendar tax year runs from january 1 to december 31. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way.Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Fiscal Year Definition for Business Bookkeeping

What Is A Fiscal Year Vs Calendar Year Ryann Florence

Fiscal Year And Calendar Year Renie Charmain

Fiscal Year Vs Calendar Year What's Best for Your Business?

Fiscal Year Vs Calendar Year

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year (FY) Meaning, Examples, Why use Fiscal Year?

What is the difference between Calendar and Fiscal Year? YouTube

What is a Fiscal Year? Your GoTo Guide

Find Out The Benefits, Requirements And.

Unlike The Calendar Year That Starts On January 1 And Ends On December 31, A Fiscal Year Can Start And End At Any Point During The Year.

A Fiscal Year Is A Concept That You Will Frequently Encounter In Finance.

The Primary Distinction Between A Fiscal Year And A Calendar Year Lies In The Starting And Ending Dates.

Related Post: