Fiscal Vs Calendar

Fiscal Vs Calendar - Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. Creating a fiscal year calendar in excel might sound like a project for financial wizards or spreadsheet gurus, but it’s more accessible than you might think. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. In this article, we define a fiscal and calendar year, list the benefits of both,. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. A calendar year is defined as january 1 through. In summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of. Understanding what each involves can help you determine which to use for accounting or tax purposes. While many businesses operate on a standard 12. Trustees must submit form 1128, detailing the trust’s. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. That is a question i am frequently asked. Fiscal 2025 vs fiscal 2024 research and development expenses increased to $5.7 million from $1.7 million selling, general and. A fiscal year and a calendar year are two distinct concepts used for different purposes. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. How does a business choose whether to operate on a calendar year or a fiscal year? Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Trustees must submit form 1128, detailing the trust’s. In this article, we define a fiscal and calendar year, list the benefits of both,. Trustees must submit form 1128, detailing the trust’s. Guide to calendar year vs fiscal year. In this article, we define a fiscal and calendar year, list the benefits of both,. In summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of. More specifically, a fiscal year is often differentiated from a calendar year. Failing to take the differences between a fiscal and a calendar year into account can therefore result in accounting mistakes. Fiscal 2025 vs fiscal 2024 research and development expenses increased to $5.7 million from $1.7 million selling, general and. A fiscal year is a year as determined by individual businesses, while a calendar year is the normal year, from. A. How does a business choose whether to operate on a calendar year or a fiscal year? A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. Guide to calendar year vs fiscal year. Trustees must submit form 1128, detailing the trust’s. Getting a. What is the difference between fiscal year and calendar year? Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. A fiscal year and a calendar year are two distinct concepts used for different purposes.. That is a question i am frequently asked. A calendar year is defined as january 1 through. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. What is the difference between fiscal year and calendar year? While many businesses operate on a. A fiscal year and a calendar year are two distinct concepts used for different purposes. A calendar year is defined as january 1 through. Creating a fiscal year calendar in excel might sound like a project for financial wizards or spreadsheet gurus, but it’s more accessible than you might think. In financial planning and accounting, the structure of a fiscal. While many businesses operate on a standard 12. That is a question i am frequently asked. In summary, the fiscal year focuses on financial matters, while the calendar year is a broader measure of. Income tax returns in many countries are based on the calendar year. A fiscal year is a year as determined by individual businesses, while a calendar. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. A fiscal year is. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Failing to take the differences between a fiscal and a calendar year into account can therefore result in accounting. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Creating a fiscal year calendar in excel might sound like a project for financial wizards or spreadsheet gurus, but it’s more accessible than you might think. Fiscal 2025 vs fiscal 2024. More specifically, a fiscal year is often differentiated from a calendar year for accounting purposes. A fiscal year is a year as determined by individual businesses, while a calendar year is the normal year, from. How does a business choose whether to operate on a calendar year or a fiscal year? Creating a fiscal year calendar in excel might sound like a project for financial wizards or spreadsheet gurus, but it’s more accessible than you might think. In this article, we define a fiscal and calendar year, list the benefits of both,. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Income tax returns in many countries are based on the calendar year. Failing to take the differences between a fiscal and a calendar year into account can therefore result in accounting mistakes. What is the difference between fiscal year and calendar year? Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Trustees must submit form 1128, detailing the trust’s. A fiscal year and a calendar year are two distinct concepts used for different purposes. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. Understanding what each involves can help you determine which to use for accounting or tax purposes. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table.PPT Accounting PowerPoint Presentation, free download ID1511483

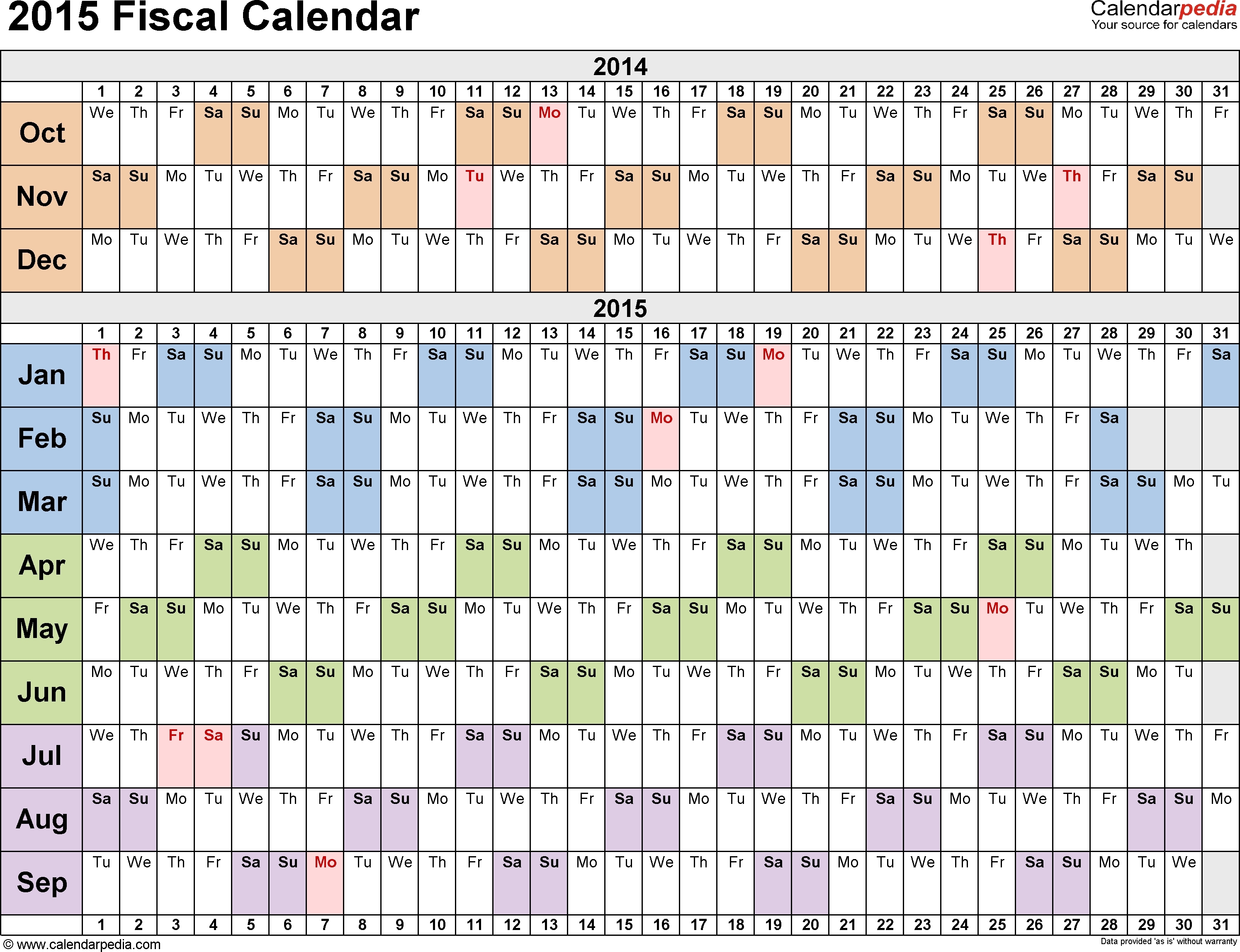

Calendar Year Definition Accounting Month Calendar Printable

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Fiscal Year Vs Calendar Year Tax Abbye Annissa

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

Fiscal Year Vs. Calendar Year Inscription on Blue Keyboard Key Stock

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year Vs Calendar Year Template Calendar Design

Fiscal Year vs. Calendar Year Key Differences by Blogwaly Oct

Fiscal Year Vs Calendar Year What's Best for Your Business?

That Is A Question I Am Frequently Asked.

While Many Businesses Operate On A Standard 12.

Fiscal 2025 Vs Fiscal 2024 Research And Development Expenses Increased To $5.7 Million From $1.7 Million Selling, General And.

A Fiscal Year Can Cater To Specific Business Needs, Such As Aligning With Seasonal Fluctuations Or Industry Trends, While A Calendar Year Provides A Standardized Framework For.

Related Post: