Fiscal Year Calendar Year

Fiscal Year Calendar Year - A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. Such a fiscal year would start on may 1 of the. While both periods last for 365 days or. It is a fixed time. This decision can have tax implications,. The fiscal year (fy) is a. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. A fiscal year and a calendar year are two distinct concepts used for different purposes. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Understanding what each involves can help you determine which to use for accounting or tax purposes. The fiscal year (fy) is a. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. The fiscal year is a period of 12 consecutive months, and businesses can choose their start date as per their preference. Whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. Understanding what each involves can help you determine which to use for accounting or tax purposes. Such a fiscal year would start on may 1 of the. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. In this article, we define a fiscal and calendar year, list the benefits of both,. A fiscal year may end on april 30, for instance. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. In the united states, the federal government’s fiscal year begins on october 1 and ends. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. In this article, we define a fiscal and calendar year, list the benefits of both,. Getting a. A fiscal year and a calendar year are two distinct concepts used for different purposes. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. In this article, we define a fiscal and calendar year, list the benefits of both,. In the united states, the federal government’s fiscal year begins on october 1 and ends on. The fiscal year is a period of 12 consecutive months, and businesses can choose their start date as per their preference. A fiscal year and a calendar year are two distinct concepts used for different purposes. It is a fixed time. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. A fiscal year can cater. Whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. This decision. This period is designated by the calendar year in. It is a fixed time. Whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. What exactly is a fiscal year? This decision can have tax implications,. Whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. Such a fiscal year would start on may 1 of the. What exactly is a fiscal year? The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics:. This decision can have tax implications,. The fiscal year is a period of 12 consecutive months, and businesses can choose their start date as per their preference. Such a fiscal year would start on may 1 of the. A fiscal year may end on april 30, for instance. This period is designated by the calendar year in. It can be any date as long as the fiscal year is 52 or 53 weeks. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. While. The fiscal year (fy) is a. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. The fiscal year is a period of 12 consecutive months, and businesses can choose their start date as per their preference. Such a fiscal year would start on may 1 of the. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. It is a fixed time. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: A fiscal year and a calendar year are two distinct concepts used for different purposes. What exactly is a fiscal year? In this article, we define a fiscal and calendar year, list the benefits of both,. Whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. This period is designated by the calendar year in.Fiscal Year And Calendar Year Renie Charmain

Fiscal Year Vs Calendar Year What's Best for Your Business?

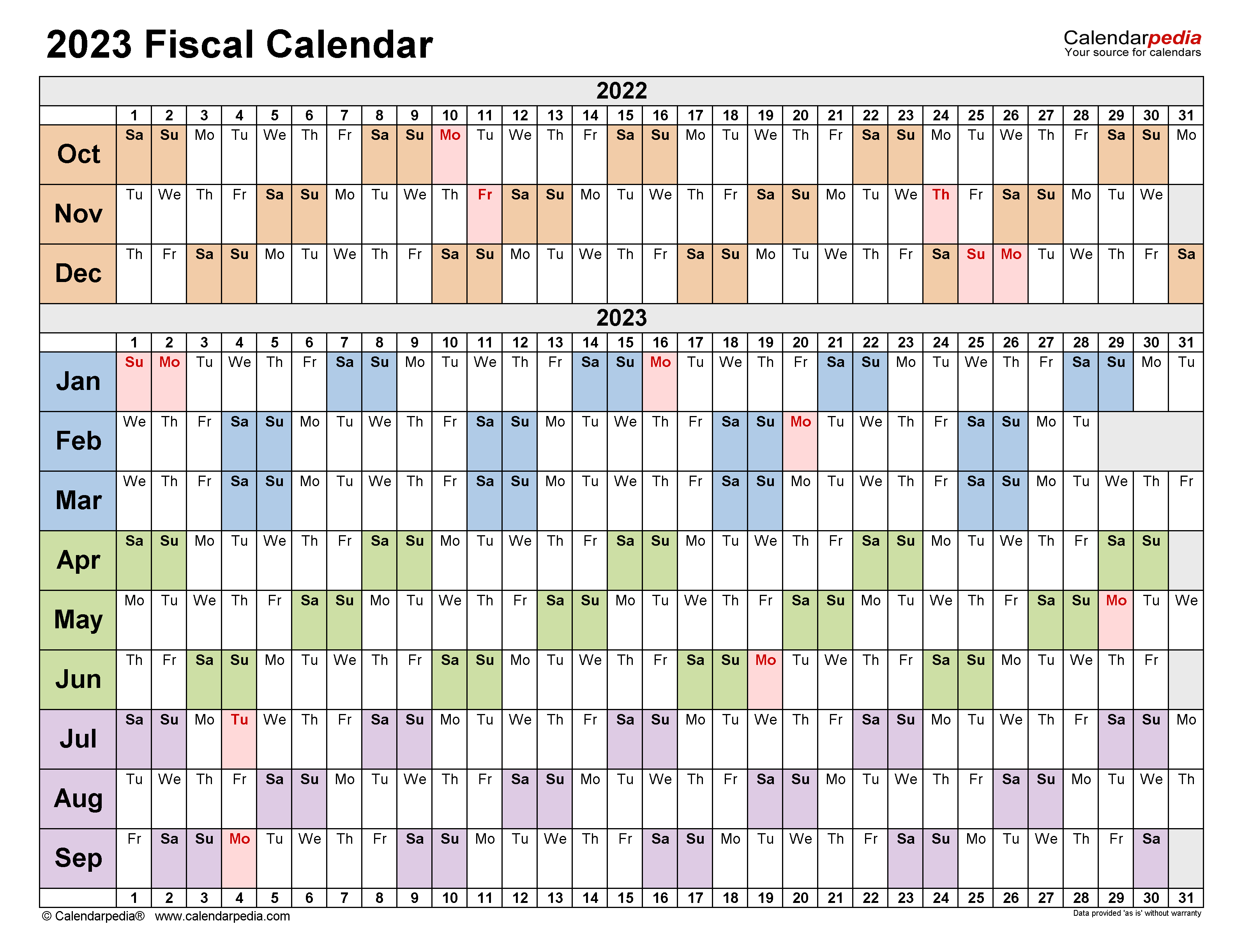

2023 Fiscal Year Calendar Printable Calendars AT A GLANCE

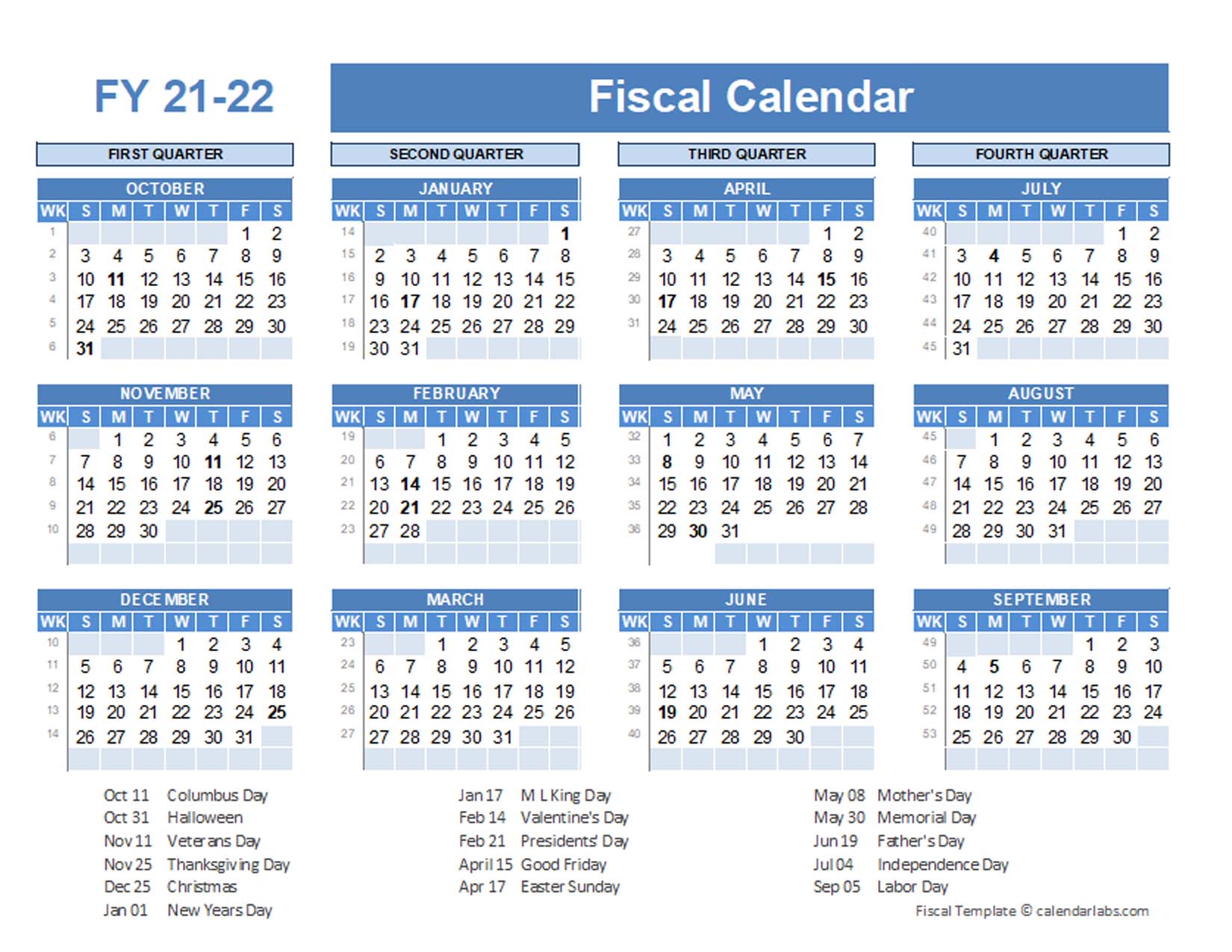

Download Printable Fiscal Year Calendar Template PDF

What is a Fiscal Year? Your GoTo Guide

What Is A Fiscal Year Vs Calendar Year Ryann Florence

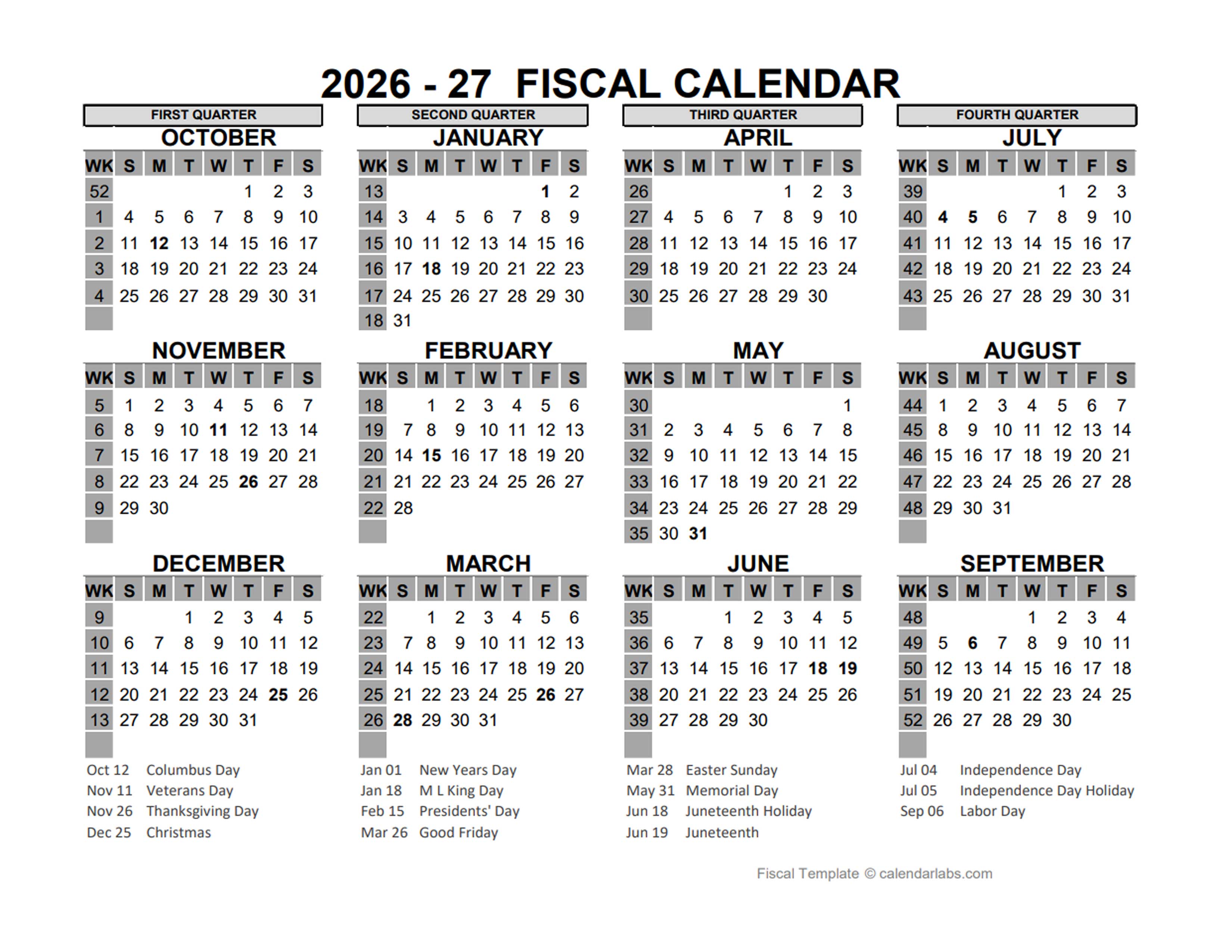

2026 US Fiscal Year Template Free Printable Templates

What is the Difference Between Fiscal Year and Calendar Year

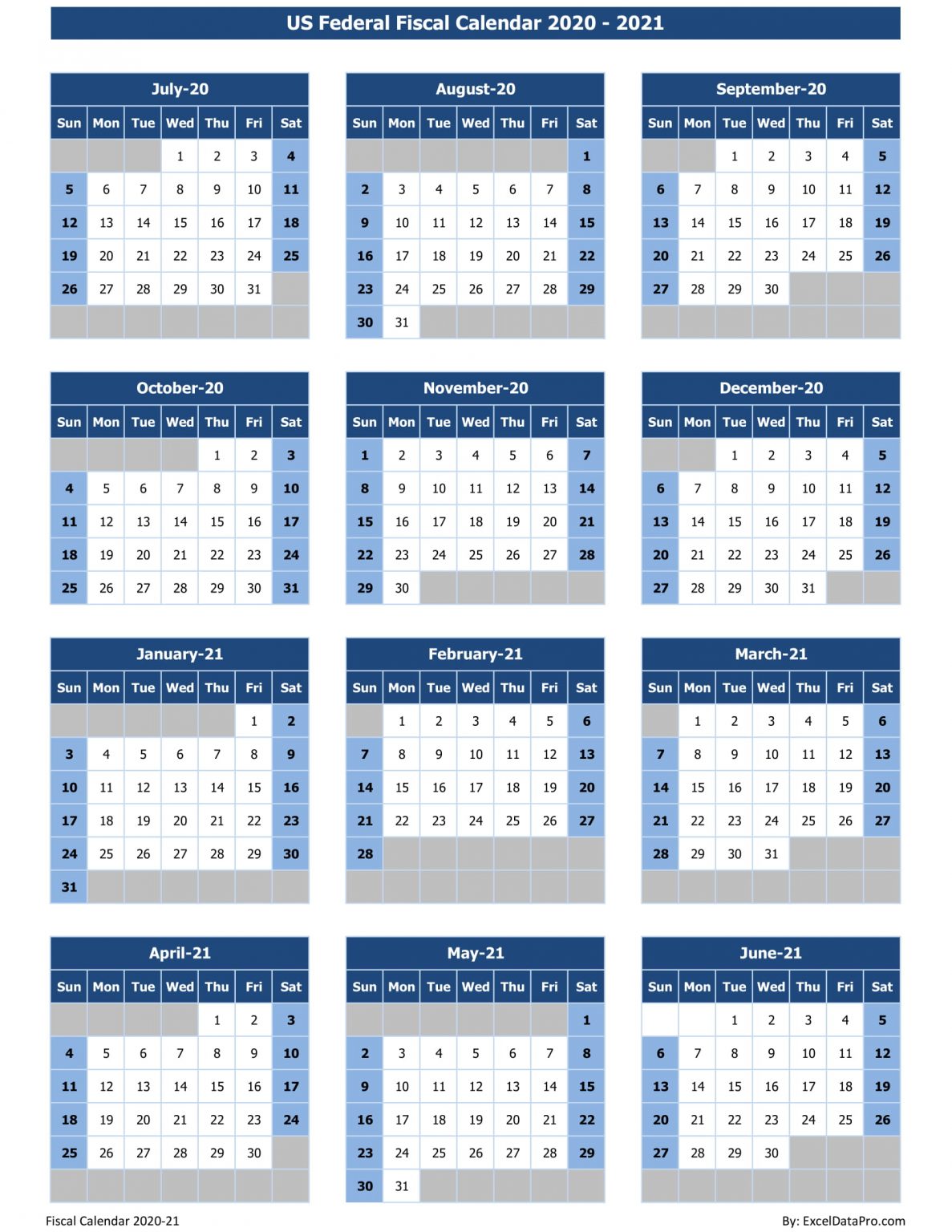

Download US Federal Fiscal Calendar 202021 Excel Template ExcelDataPro

Fiscal Calendars 2023 Free Printable Word templates

While Both Periods Last For 365 Days Or.

Understanding What Each Involves Can Help You Determine Which To Use For Accounting Or Tax Purposes.

Getting A Handle On The Difference Between A Fiscal Year And A Calendar Year Is Crucial For Small Business Owners As You Tackle Your Taxes And Financial Game Plan.

This Decision Can Have Tax Implications,.

Related Post: