Fiscal Year Calender

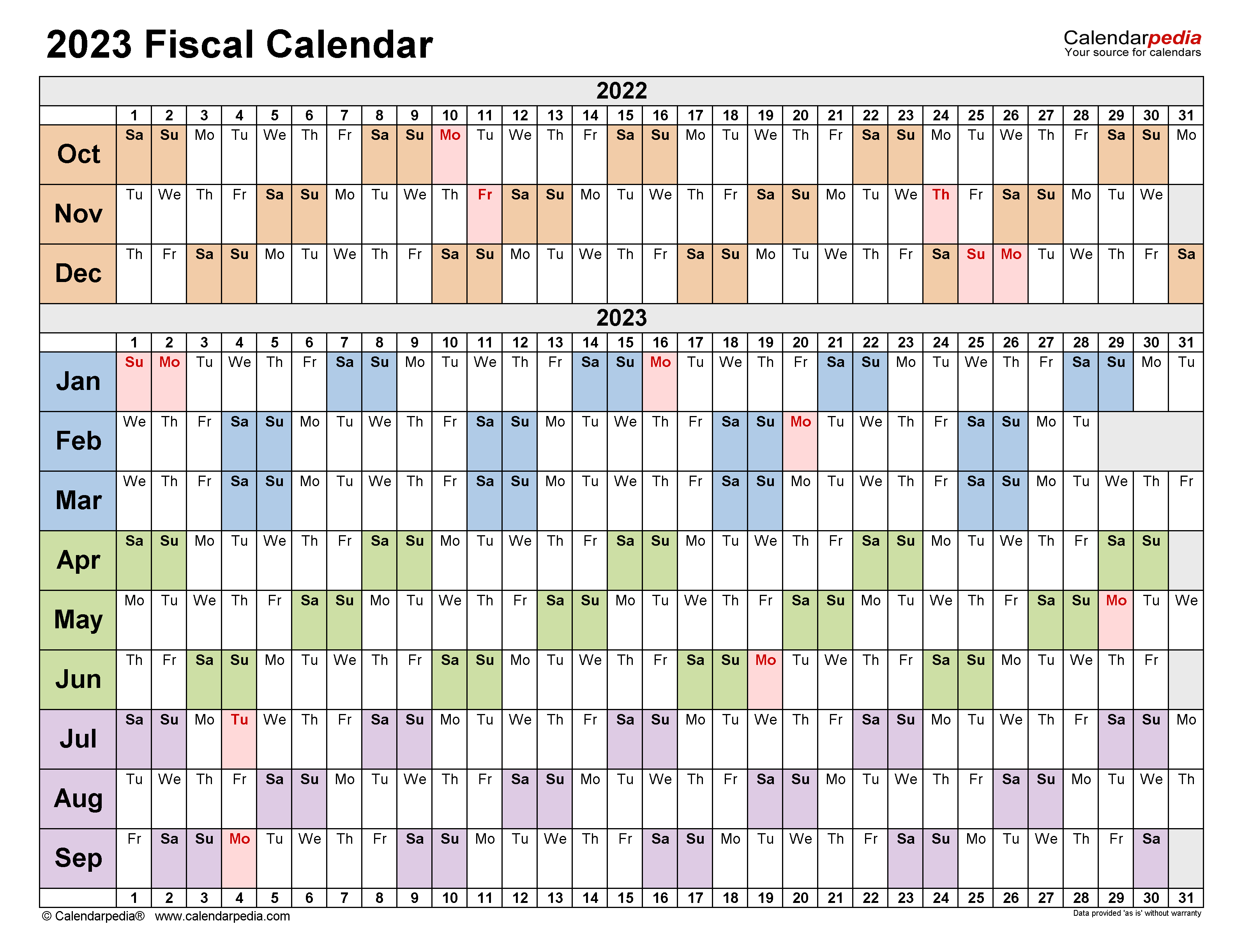

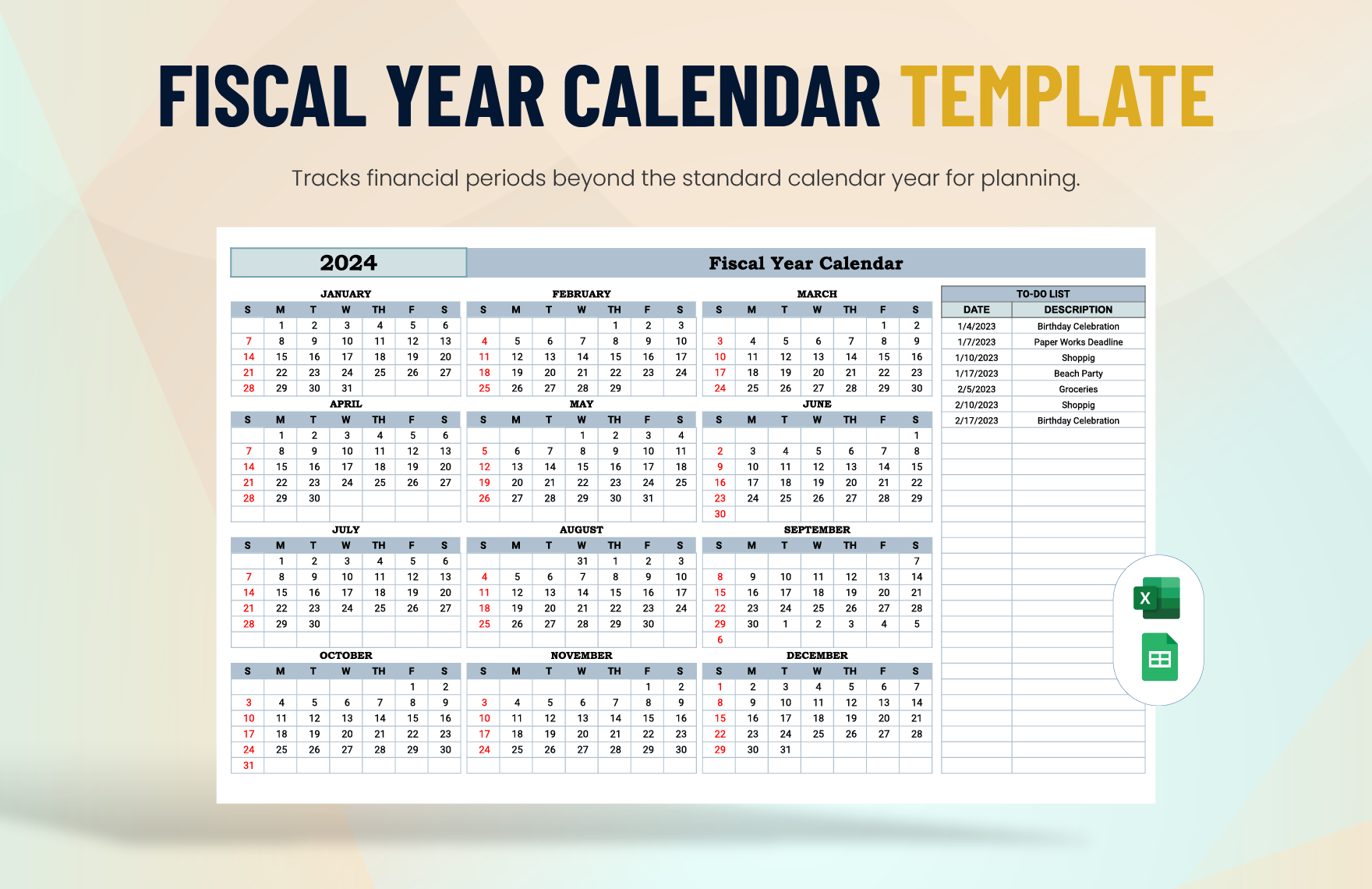

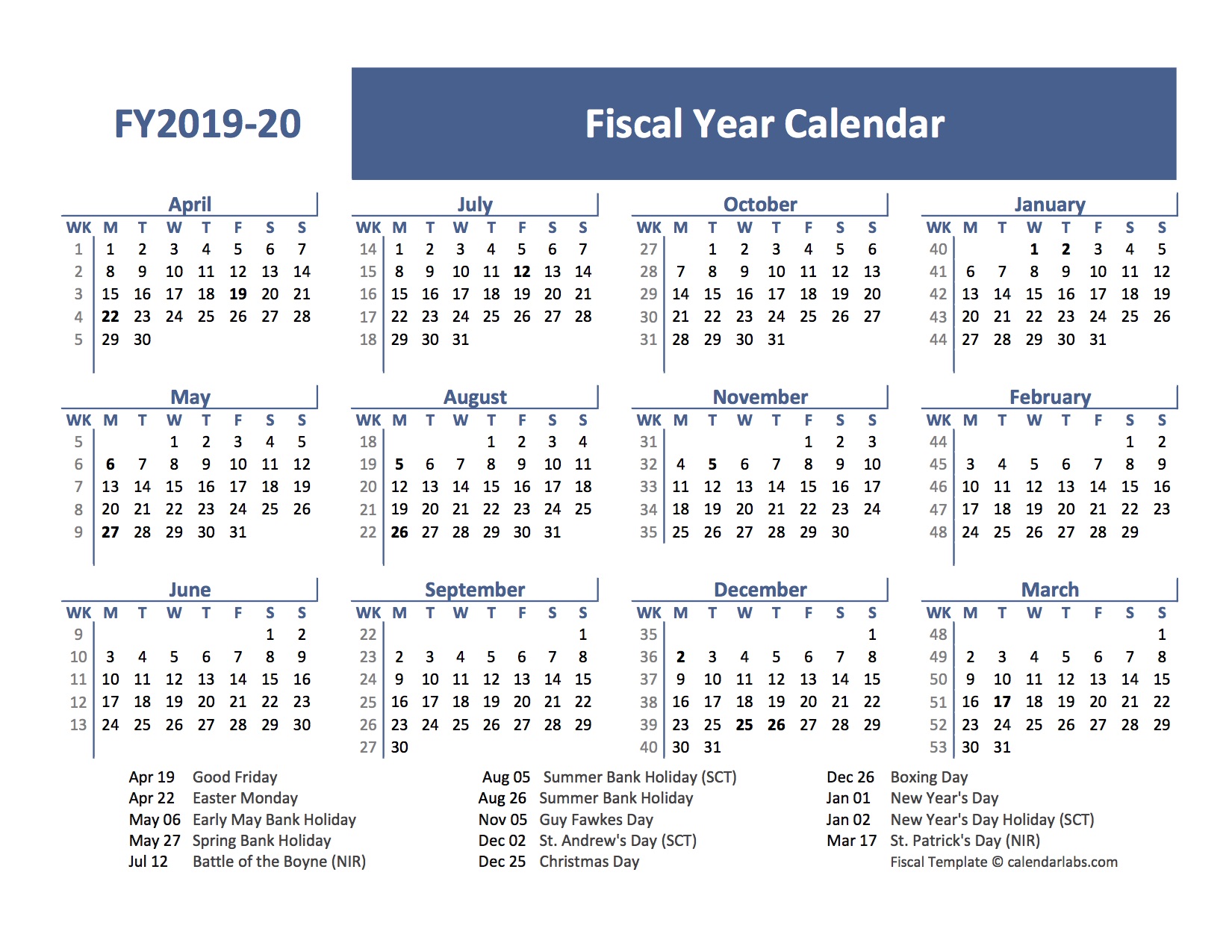

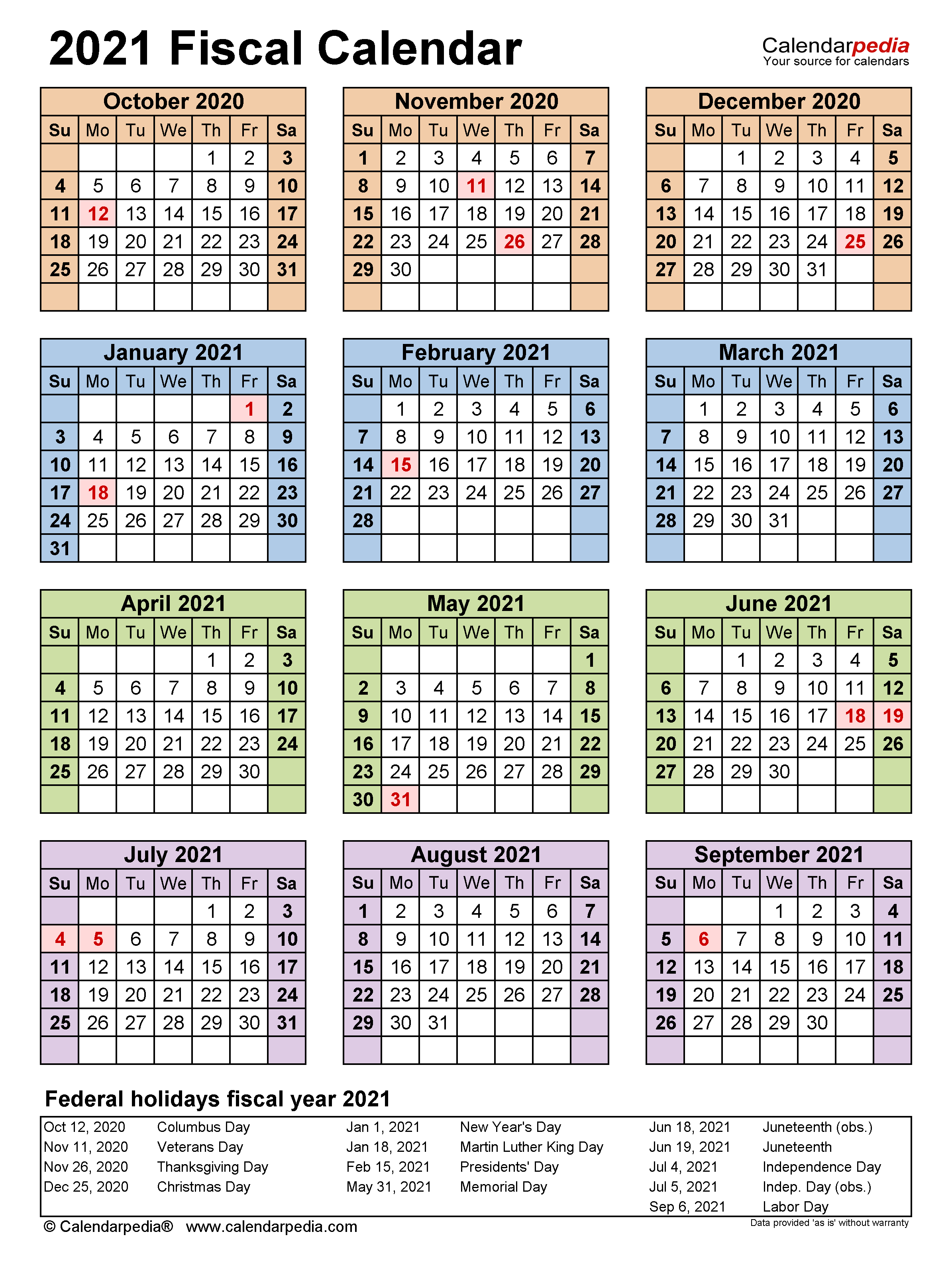

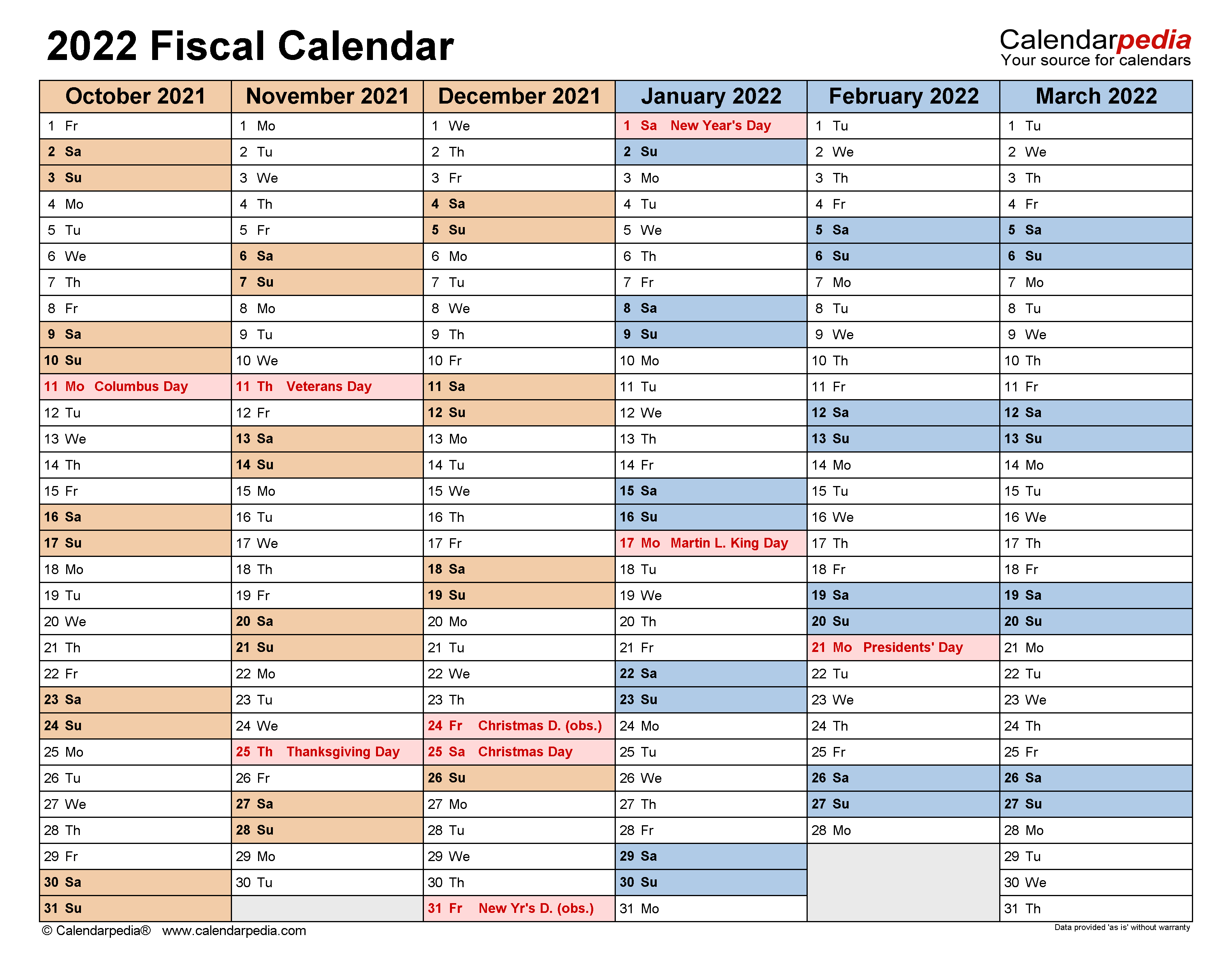

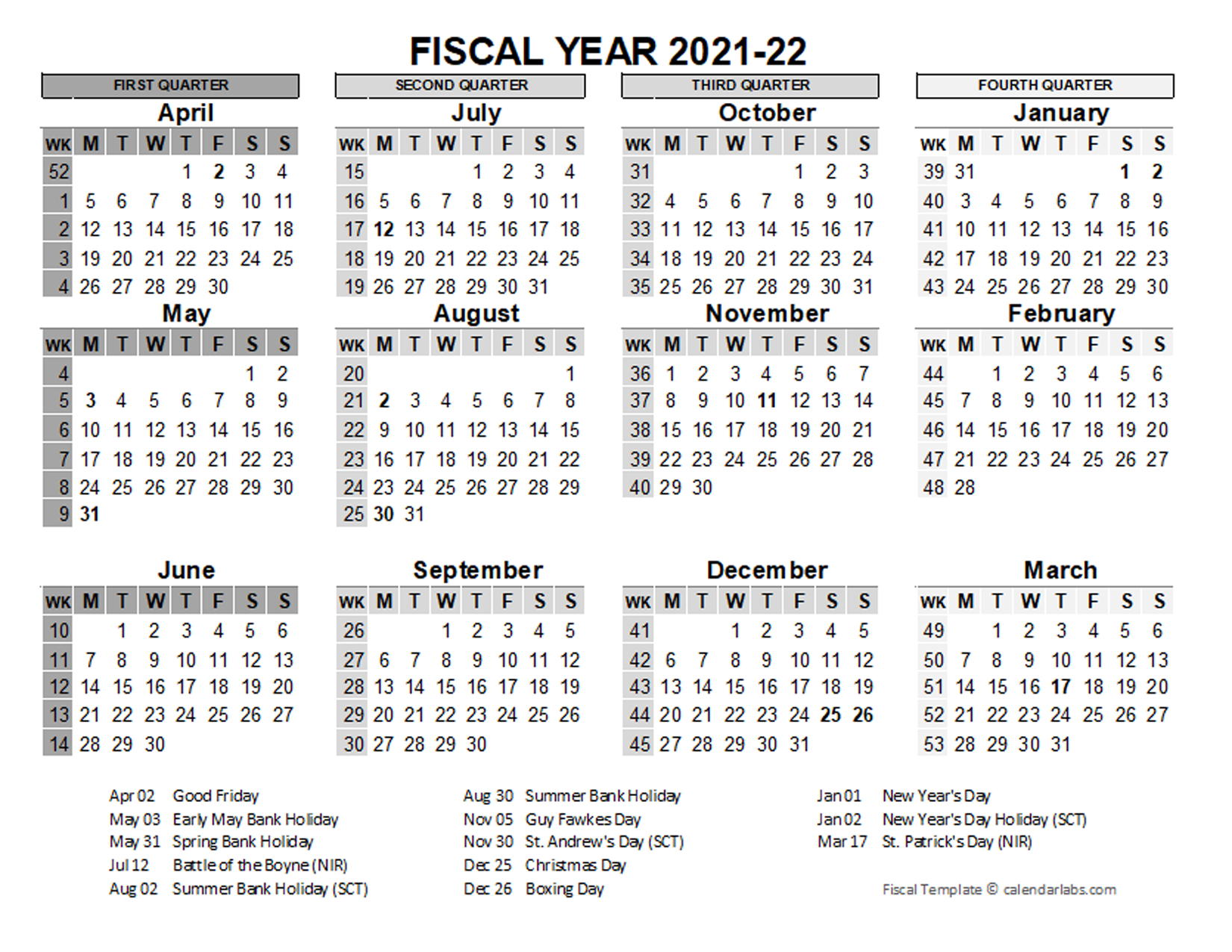

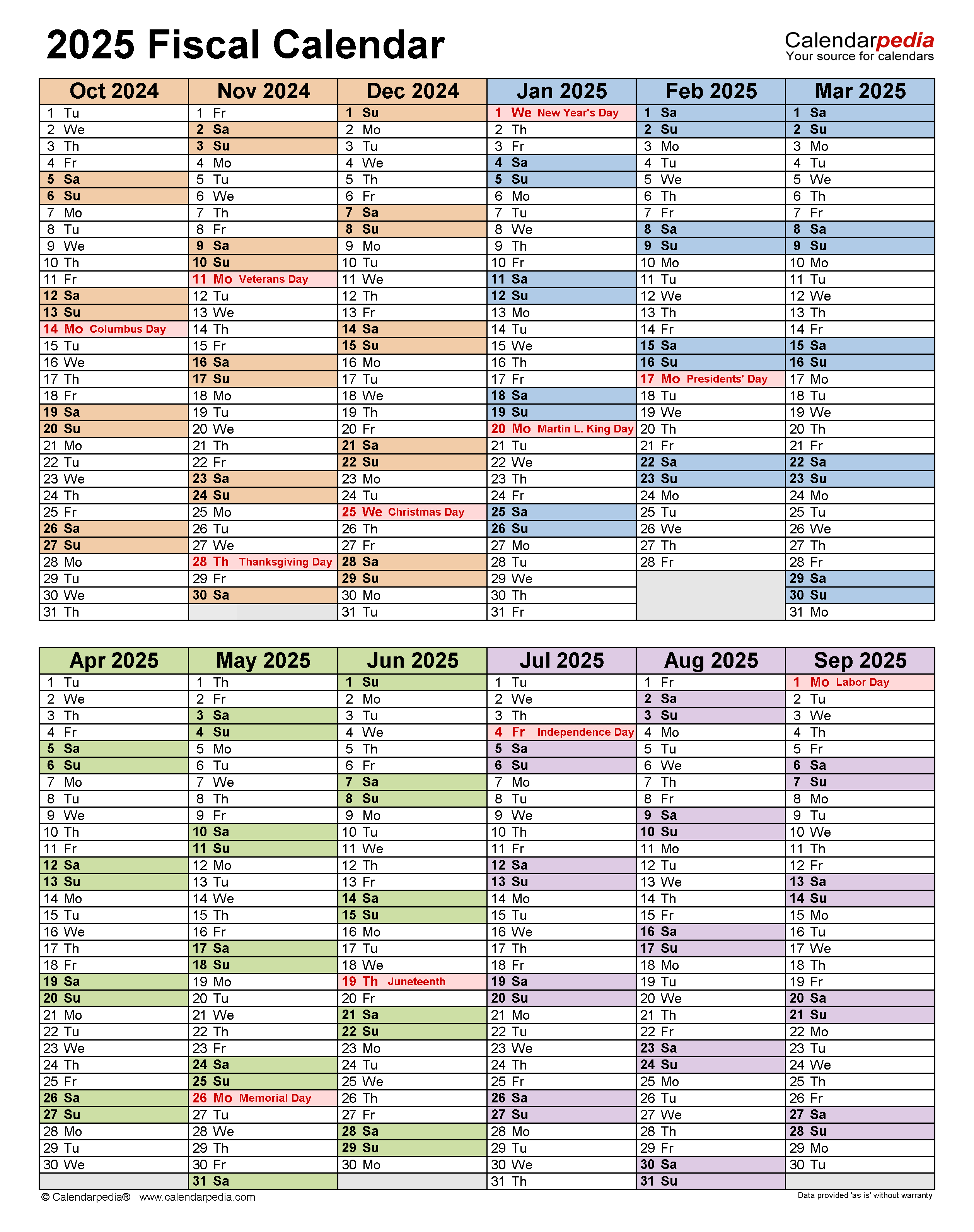

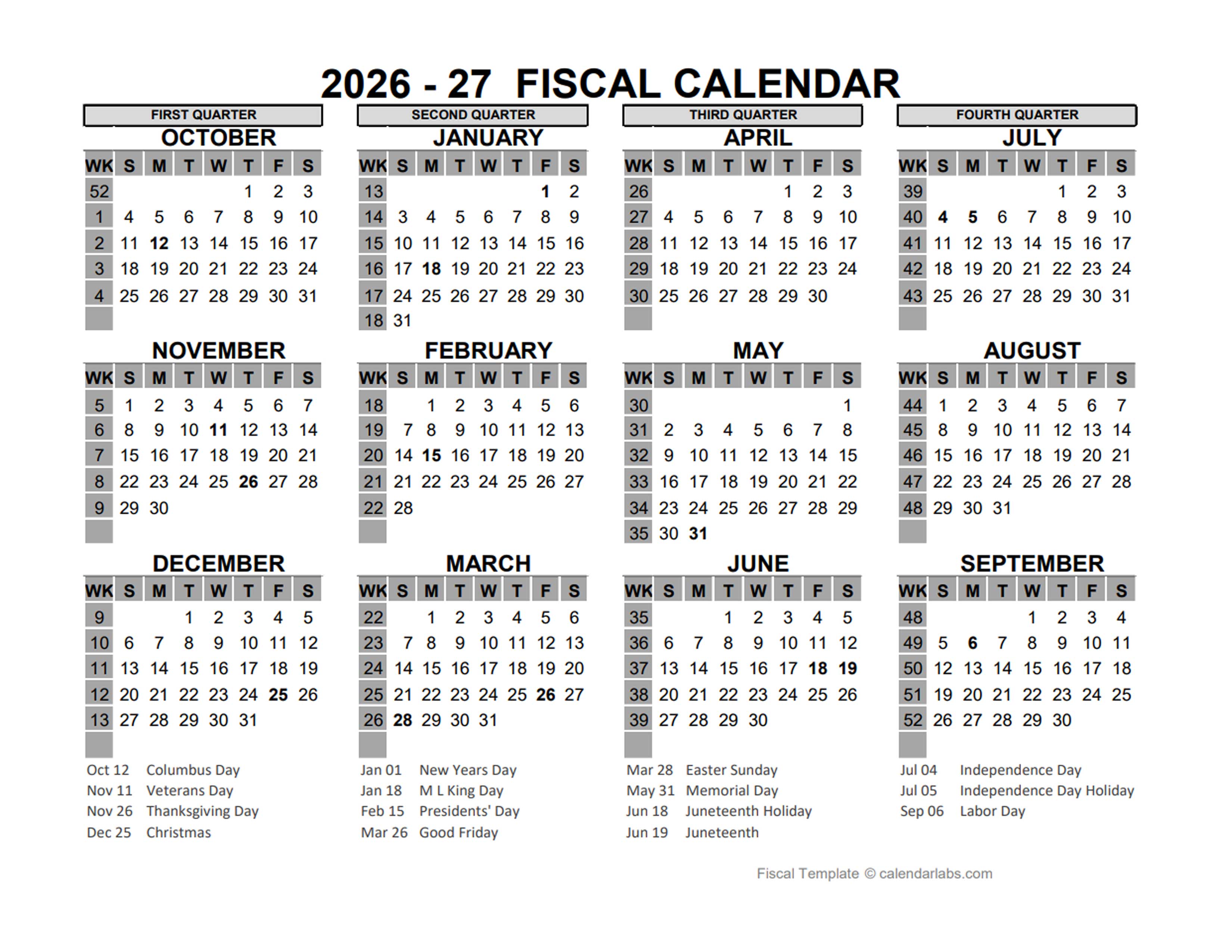

Fiscal Year Calender - A fiscal year and a calendar year are two distinct concepts used for different purposes. This year can differ from the traditional. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to. Draftkings is raising the midpoint of its fiscal year 2025 revenue guidance and now expects revenue in the range of $6.3 billion to $6.6 billion, compared to its previous guidance. The federal fiscal year is the time period. Deficit for the first four months of fiscal 2025, which started on october 1. Big bank jpmorgan chase (jpm), whose quarterly financial. Most public companies choose a financial year that ends on december 31, putting it in alignment with a calendar year. Trustees must submit form 1128, detailing the trust’s. Both years have 365 days, but the starting and ending periods differ. The fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Deficit for the first four months of fiscal 2025, which started on october 1. Industries that don't have much seasonality have little reason to depart from the. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. It's used differently by the government and businesses, and does need to correspond to a calendar year. In 1974, title v of the congressional budget act was signed into law and changed the fiscal year to begin on october 1st of each year. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. That was up 58% or $308 billion from a year earlier,. This year can differ from the traditional. The treasury reported a record $840 billion u.s. Deficit for the first four months of fiscal 2025, which started on october 1. What is a fiscal year? Industries that don't have much seasonality have little reason to depart from the. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to. Draftkings is raising the midpoint of its. Trustees must submit form 1128, detailing the trust’s. Companies use a fiscal year to mark the start and end of their revenue and earnings for a set timeframe, which can then be used for reporting, analysis, comparisons, and. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year.. Big bank jpmorgan chase (jpm), whose quarterly financial. Most public companies choose a financial year that ends on december 31, putting it in alignment with a calendar year. Companies use a fiscal year to mark the start and end of their revenue and earnings for a set timeframe, which can then be used for reporting, analysis, comparisons, and. What is. Big bank jpmorgan chase (jpm), whose quarterly financial. The federal fiscal year is the time period. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. In the united states, the federal government’s fiscal year begins on october 1 and ends. Draftkings is raising the midpoint of its fiscal year 2025 revenue guidance and now expects revenue in the range of $6.3 billion to $6.6 billion, compared to its previous guidance. Learn more about a fiscal year and calendar year, their benefits, how they differ and how to determine which you should use. The fiscal year and the calendar year are. This period is designated by the calendar year in. In 1974, title v of the congressional budget act was signed into law and changed the fiscal year to begin on october 1st of each year. The treasury reported a record $840 billion u.s. The federal fiscal year is the time period. Draftkings is raising the midpoint of its fiscal year. Trustees must submit form 1128, detailing the trust’s. Deficit for the first four months of fiscal 2025, which started on october 1. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. In 1974, title v of the congressional budget act was signed into law and changed the. The fiscal year (fy) is a. In 1974, title v of the congressional budget act was signed into law and changed the fiscal year to begin on october 1st of each year. Trustees must submit form 1128, detailing the trust’s. Most public companies choose a financial year that ends on december 31, putting it in alignment with a calendar year.. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Draftkings is raising the midpoint of its fiscal year 2025 revenue guidance and now expects revenue in the range of $6.3 billion to $6.6 billion, compared to its previous guidance. This year can differ from the traditional. What. The treasury reported a record $840 billion u.s. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to. Most public companies choose a financial year that ends on december 31, putting it in alignment with a calendar year. Both years have 365 days, but the starting and ending periods. This period is designated by the calendar year in. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. It's used differently by the government and businesses, and does need to correspond to a calendar year. In 1974, title v of the congressional budget act was signed into law and changed the fiscal year to begin on october 1st of each year. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to. The federal fiscal year is the time period. Industries that don't have much seasonality have little reason to depart from the. What exactly is a fiscal year? Big bank jpmorgan chase (jpm), whose quarterly financial. This year can differ from the traditional. Companies use a fiscal year to mark the start and end of their revenue and earnings for a set timeframe, which can then be used for reporting, analysis, comparisons, and. The treasury reported a record $840 billion u.s. That was up 58% or $308 billion from a year earlier,. Trustees must submit form 1128, detailing the trust’s. Most publicly traded companies use the calendar year for their fiscal year, which makes sense.Retail Fiscal Calendar 2022

Fiscal Year Calendar Template in Excel, Google Sheets Download

Is Fiscal Year The Same As Calendar Year Corina Cherilyn

Fiscal Year Calendar Renie Charmain

Fiscal Year Calendar 2022 Template Nofiscal22y20 Free Printable

Download US Federal Fiscal Calendar 202021 With Notes Excel Template

Fiscal Year Quarters 2025 Dates Gonzalo Nash

Tax Year Calendar 2025/25 Ibby Norina

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive

2023 Fiscal Year Calendar Printable Calendars AT A GLANCE

What Is A Fiscal Year?

Getting A Handle On The Difference Between A Fiscal Year And A Calendar Year Is Crucial For Small Business Owners As You Tackle Your Taxes And Financial Game Plan.

Learn More About A Fiscal Year And Calendar Year, Their Benefits, How They Differ And How To Determine Which You Should Use.

A Fiscal Year And A Calendar Year Are Two Distinct Concepts Used For Different Purposes.

Related Post: