Fiscal Year Versus Calendar Year

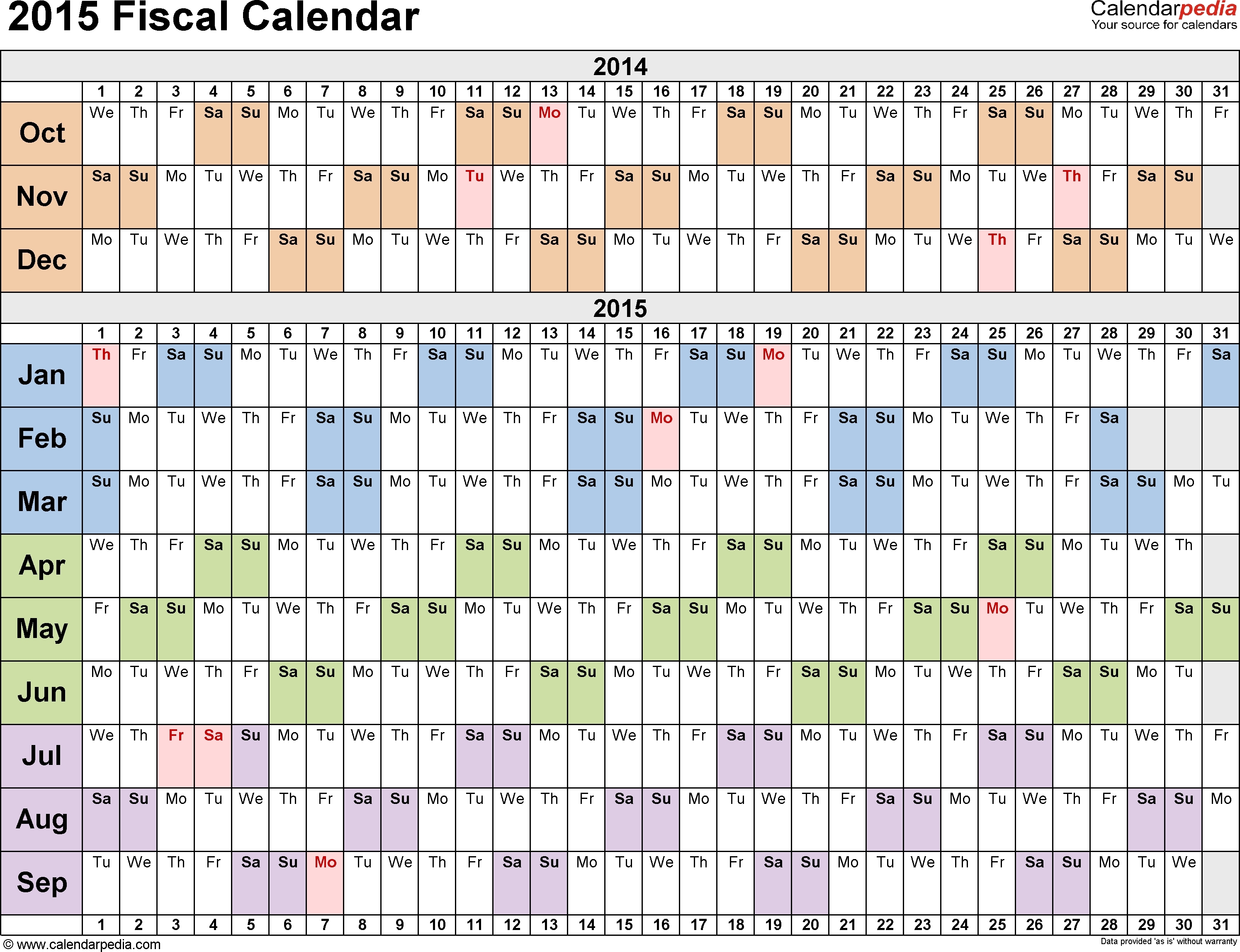

Fiscal Year Versus Calendar Year - That’s correct of course—but it’s not the only correct. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Companies may want to have their. What is a fiscal year vs. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. In this article, we define a fiscal and calendar year, list the benefits of both,. Although following a calendar year is often simpler and more common among businesses, a fiscal year can show a more accurate picture of how a company is performing. Many companies use a fiscal year that. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Guide to calendar year vs fiscal year. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. A fiscal year and a calendar year are two distinct concepts used for different purposes. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. Understanding what each involves can help you determine which to use for accounting or tax purposes. Guide to calendar year vs fiscal year. What is a fiscal year vs. Ask someone to define a year and they’ll probably say january 1 to december 31. This period is designated by the calendar year in. In this article, we define a fiscal and calendar year, list the benefits of both,. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. A calendar year, obviously, runs from january 1 to december 31, just like the calendar on your wall. A fiscal year and a calendar year are two distinct concepts used for different purposes. Guide to calendar year vs fiscal year. What is a fiscal year. This connection limits the feasibility of electing a fiscal year for revocable trusts. Guide to calendar year vs fiscal year. Although following a calendar year is often simpler and more common among businesses, a fiscal year can show a more accurate picture of how a company is performing. In this article, we discuss the. In this article, we define a. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can. What is a fiscal year vs. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. Although following a calendar year is often simpler and more common among businesses, a fiscal year can show a more accurate picture of how. Understanding what each involves can help you determine which to use for accounting or tax purposes. Many companies use a fiscal year that. What is a fiscal year vs. A fiscal year and a calendar year are two distinct concepts used for different purposes. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can. A fiscal year is a year as determined by individual businesses, while a calendar year is the normal year, from january 1 to december 31. A fiscal year and a calendar year are two distinct concepts used for different purposes. This connection limits the feasibility of electing a fiscal year for revocable trusts. What is a fiscal year vs. A. In this article, we define a fiscal and calendar year, list the benefits of both,. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. A fiscal year and a calendar year are two distinct concepts used for different purposes. In the united. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Choosing to use a calendar year or a fiscal. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. Understanding. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. Although following a calendar year is often simpler and more common among businesses, a fiscal year can show a more accurate picture of how a company is performing. Getting a. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Getting a handle on the difference between a fiscal year and a calendar year is crucial for small business owners as you tackle your taxes and financial game plan. In this article, we discuss the. Both options have their advantages and disadvantages, and it is important to understand the differences between the two in order to make an informed decision about which option is best. What is a fiscal year vs. This period is designated by the calendar year in. Guide to calendar year vs fiscal year. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Many companies use a fiscal year that. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. A fiscal year can cater to specific business needs, such as aligning with seasonal fluctuations or industry trends, while a calendar year provides a standardized framework for. A calendar year, obviously, runs from january 1 to december 31, just like the calendar on your wall. In this article, we define a fiscal and calendar year, list the benefits of both,. Companies may want to have their. Although following a calendar year is often simpler and more common among businesses, a fiscal year can show a more accurate picture of how a company is performing.What is a Fiscal Year? Your GoTo Guide

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year Vs Calendar Year What's Best for Your Business?

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Fiscal Year Definition for Business Bookkeeping

Fiscal Year vs Calendar Year What's The Difference?

Fiscal Year Vs Calendar Year Template Calendar Design

Fiscal Year vs. Calendar Year Key Differences by Blogwaly Oct

Fiscal Year End Vs Calendar Year End Megan May

Fiscal Year vs Calendar Year What is the Difference?

Ask Someone To Define A Year And They’ll Probably Say January 1 To December 31.

A Fiscal Year And A Calendar Year Are Two Distinct Concepts Used For Different Purposes.

This Connection Limits The Feasibility Of Electing A Fiscal Year For Revocable Trusts.

Choosing To Use A Calendar Year Or A Fiscal Year For Accounting And Bookkeeping Purposes Can Impact Your Organization In More Than One Way.

Related Post: