Fiscal Year Vs Calendar

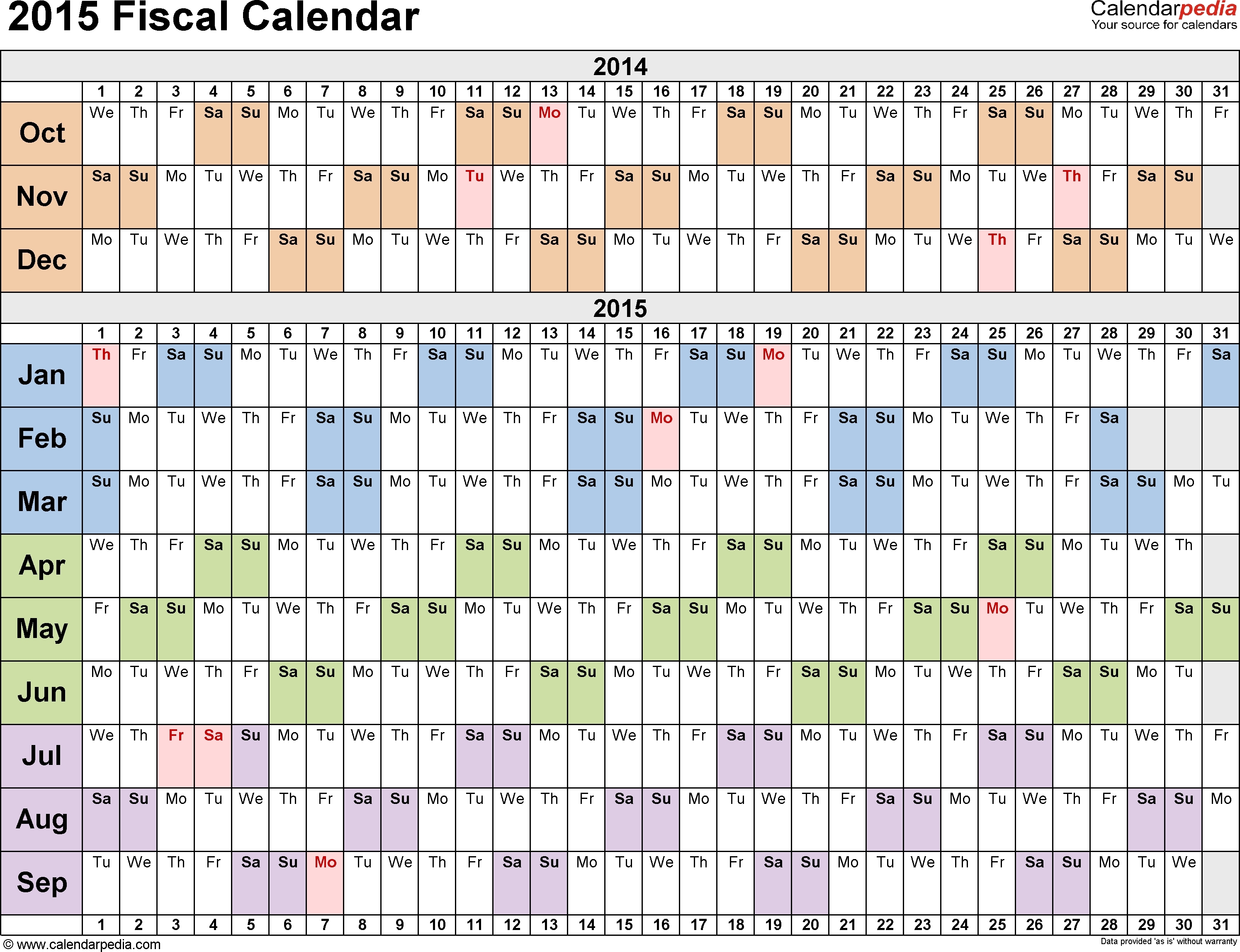

Fiscal Year Vs Calendar - A calendar year, january 1 to december 31, is the most popular choice for. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. What is a fiscal year? Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. You’ll also need to choose between using a calendar year or fiscal year. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. What is the difference between a fiscal year and calendar year? A calendar year, january 1 to december 31, is the most popular choice for. A calendar year always runs from january 1 to december 31. A fiscal year is a year as determined by individual businesses, while a calendar year is the normal year, from. Companies typically set their fiscal years according to the nature of their businesses and when revenues. A fiscal year and a calendar year are two distinct concepts used for different purposes. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. Reports q3 revenue $11.7m vs. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. What is the difference between fiscal year and calendar year? “fiscal q3 was a milestone quarter for perfect moment with the launch of our first retail stores in new york and london,”. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. This connection limits the feasibility of electing a fiscal year. A fiscal year can cater to specific business needs, such as aligning. Reports q3 revenue $11.7m vs. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table. This year can differ from the traditional. Companies typically set their fiscal years according to the nature of their businesses and when revenues. A fiscal year is a year as determined by individual businesses, while a calendar year is the normal year, from. A fiscal year can cater to specific business needs, such as aligning. A fiscal year is the 12 months that a company designates as. A fiscal year and a calendar year are two distinct concepts used for different purposes. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. This connection limits the feasibility of electing a fiscal year for revocable trusts. Reports q3 revenue $11.7m vs. This year can. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. A fiscal year keeps income and expenses together on the same tax return, while a calendar. Many companies use a fiscal year that. “fiscal q3 was a milestone quarter for perfect moment with the launch of our first retail stores in new york and london,”. A fiscal year and a calendar year are two distinct concepts used for different purposes. A company that starts its fiscal year on january 1 and ends it on december 31. Many companies use a fiscal year that. Reports q3 revenue $11.7m vs. In this article, we discuss the. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. What is a fiscal year? This period is designated by the calendar year in. “fiscal q3 was a milestone quarter for perfect moment with the launch of our first retail stores in new york and london,”. A calendar year, obviously, runs from january 1 to december 31, just like the calendar on your wall. This year can differ from the traditional. A calendar year always. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. A calendar year, january 1 to december 31, is the most popular choice for.. Using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and expenses. In this article, we discuss the. Choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your organization in more than one way. A company that starts. A calendar year always runs from january 1 to december 31. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. A calendar year, january 1 to december 31, is the most popular choice for. Guide to calendar year vs fiscal year. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. In this article, we discuss the. You’ll also need to choose between using a calendar year or fiscal year. Many companies use a fiscal year that. This connection limits the feasibility of electing a fiscal year for revocable trusts. A fiscal year can cater to specific business needs, such as aligning. A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. A fiscal year and a calendar year are two distinct concepts used for different purposes. This period is designated by the calendar year in. Companies typically set their fiscal years according to the nature of their businesses and when revenues. “fiscal q3 was a milestone quarter for perfect moment with the launch of our first retail stores in new york and london,”. Here we discuss calendar year vs fiscal year key differences with infographics, and comparison table.Fiscal Year Vs Calendar Year Template Calendar Design

What is a Fiscal Year? Your GoTo Guide

Fiscal Year Definition for Business Bookkeeping

Fiscal Year Vs Calendar Year What's Best for Your Business?

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year vs Calendar Year What is the Difference?

Difference Between Fiscal Year and Calendar Year Difference Between

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Fiscal Year Vs Calendar Year Tax Abbye Annissa

Fiscal Year vs. Calendar Year Key Differences by Blogwaly Oct

In The United States, The Federal Government’s Fiscal Year Begins On October 1 And Ends On September 30 Of The Following Year.

How Each Company Defines Its Accounting Year Is Called A Fiscal Year.

Reports Q3 Revenue $11.7M Vs.

What Is The Difference Between A Fiscal Year And Calendar Year?

Related Post: