Fsa Plan Year Vs Calendar Year

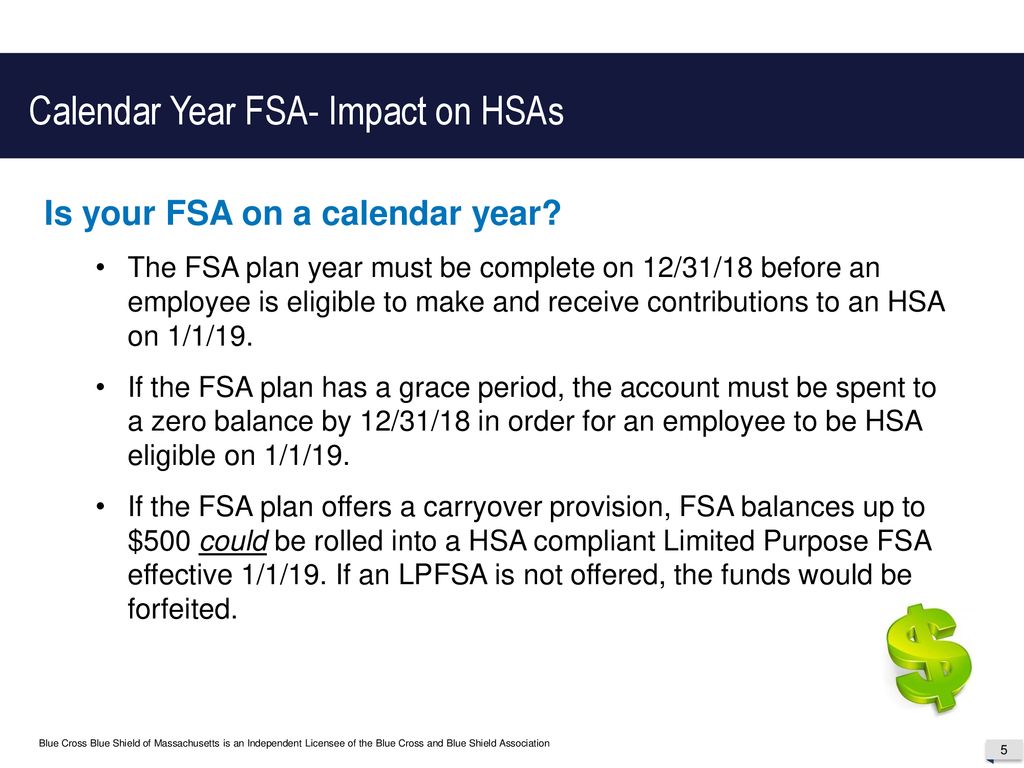

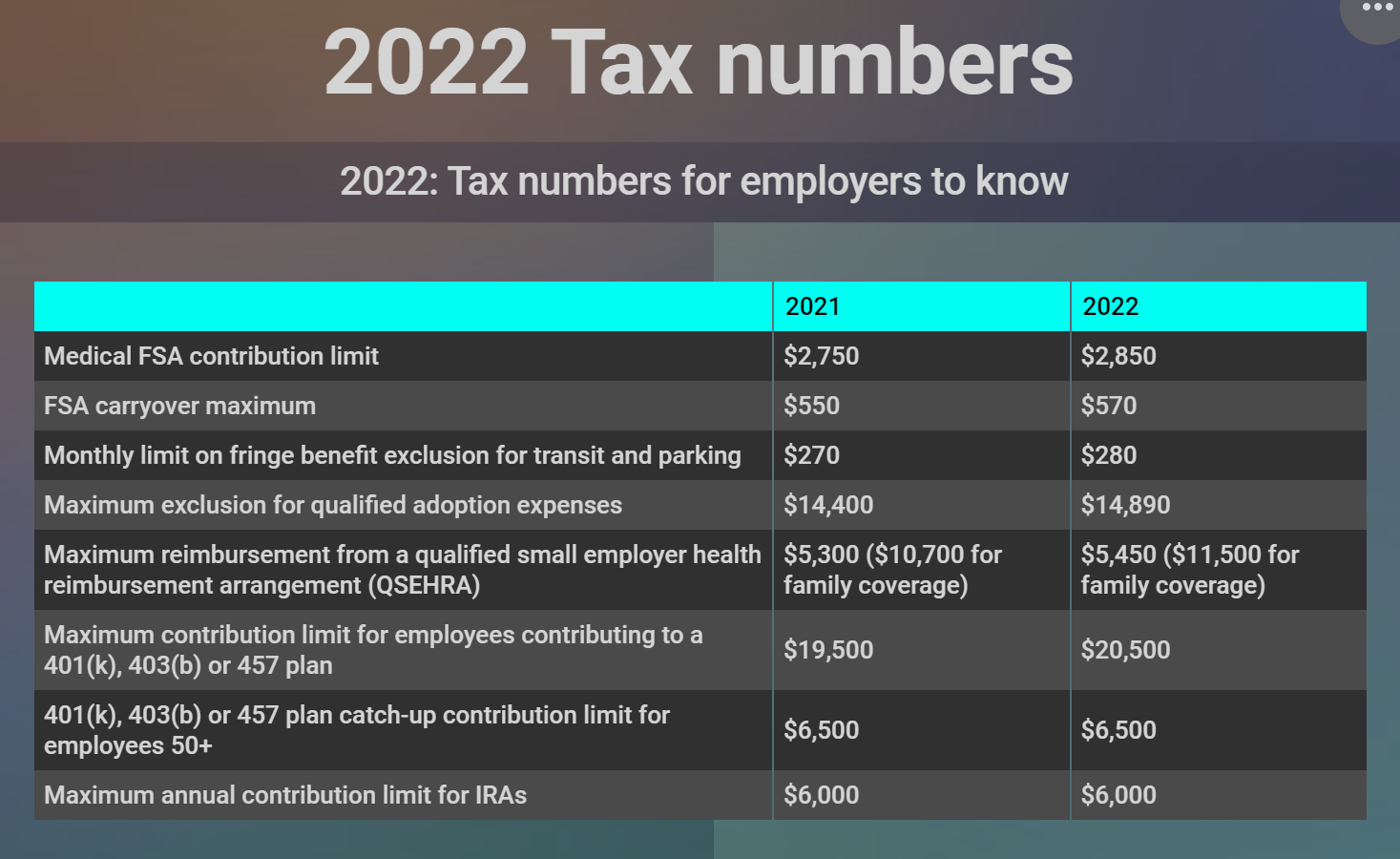

Fsa Plan Year Vs Calendar Year - Do the maximums given by the irs for fsa health care and dependent care apply to the plan year or the calendar year? During 2022 open enrollment i elected to join the dependedent care fsa effective july 1, 2022. With the plan year vs. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. The irs has dependent fsas under a use it or lose. However, if the medical plan has calendar year deductibles,. From an administrative perspective, i think matching the section 125 plan year with the medical renewal works best. This contribution is on a calendar year and. What are the key fsa plan year rules? However, i'm very confused about plan year vs calendar year for taxes and. From an administrative perspective, i think matching the section 125 plan year with the medical renewal works best. “hr teams can improve fsa literacy. The employee chooses no dc fsa benefits for the 2019 plan year. During 2022 open enrollment i elected to join the dependedent care fsa effective july 1, 2022. With the plan year vs. Web calendar year versus plan year — and why it matters for your benefit advantages. The irs sets fsa and hsa limits based on calendar year. The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. The short answer is no, you cannot use current year fsa funds to pay for prior year medical bills. However, i'm very confused about plan year vs calendar year for taxes and. The short answer is no, you cannot use current year fsa funds to pay for prior year medical bills. During 2022 open enrollment i elected to join the dependedent care fsa effective july 1, 2022. With typical local daycare costs ~$900/mo, i'll easily hit the $5k allowable deduction/contribution for a typical year. However, i'm very confused about plan year vs. The key fsa plan year rules dictate. The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. “hr teams can improve fsa literacy. The short answer is no, you cannot use current year fsa funds to pay for prior year medical bills. The employee chooses no dc fsa benefits for the 2019. However, if the medical plan has calendar year deductibles,. Web calendar year versus plan year — and why it matters for your benefit advantages. This contribution is on a calendar year and. Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas Web health savings account (hsa) rules generally apply to calendar years, regardless of. The key fsa plan year rules dictate the start and end dates of the plan year, enrollment periods, and the rollover or grace period. This contribution is on a calendar year and. 2025 flexible spending account (fsa) basics: What are the key fsa plan year rules? Do the maximums given by the irs for fsa health care and dependent care. The employee chooses no dc fsa benefits for the 2019 plan year. The short answer is no, you cannot use current year fsa funds to pay for prior year medical bills. A plan year provides flexibility in coverage start dates,. However, if the medical plan has calendar year deductibles,. This contribution is on a calendar year and. The irs sets fsa and hsa limits based on calendar year. However, if the medical plan has calendar year deductibles,. Do the maximums given by the irs for fsa health care and dependent care apply to the plan year or the calendar year? The short answer is no, you cannot use current year fsa funds to pay for prior year. From an administrative perspective, i think matching the section 125 plan year with the medical renewal works best. However, if the medical plan has calendar year deductibles,. “hr teams can improve fsa literacy. However, i'm very confused about plan year vs calendar year for taxes and. The short answer is no, you cannot use current year fsa funds to pay. We have a plan year that is different than the. The irs has dependent fsas under a use it or lose. This contribution is on a calendar year and. The fsa plan administrator or employer decides when the fsa plan year begins, and often aligns the fsa to match their health plan or fiscal year. “hr teams can improve fsa. The key fsa plan year rules dictate the start and end dates of the plan year, enrollment periods, and the rollover or grace period. “hr teams can improve fsa literacy. Web calendar year versus plan year — and why it matters for your benefit advantages. A plan year provides flexibility in coverage start dates,. The irs has dependent fsas under. The key fsa plan year rules dictate. The employee chooses no dc fsa benefits for the 2019 plan year. However, if the medical plan has calendar year deductibles,. The irs sets fsa and hsa limits based on calendar year. Our benefit year is 10/1 to 9/30. The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. With typical local daycare costs ~$900/mo, i'll easily hit the $5k allowable deduction/contribution for a typical year. Do the maximums given by the irs for fsa health care and dependent care apply to the plan year or the calendar year? A plan year provides flexibility in coverage start dates,. This contribution is on a calendar year and. The irs sets fsa and hsa limits based on calendar year. We have a plan year that is different than the. With the plan year vs. However, i'm very confused about plan year vs calendar year for taxes and. Each year the irs specifies the maximum allowed contribution that employees can make to an employer fsa on a tax preferred basis. From an administrative perspective, i think matching the section 125 plan year with the medical renewal works best. The employee chooses no dc fsa benefits for the 2019 plan year. Web calendar year versus plan year — and why it matters for your benefit advantages. Our benefit year is 10/1 to 9/30. The key fsa plan year rules dictate. Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsasIntegrated Health Savings Accounts ppt download

What are the current IRS limits for FSAs?

Summary of EMPLOYEE Health Benefits ppt download

Plan Year Vs Calendar Year

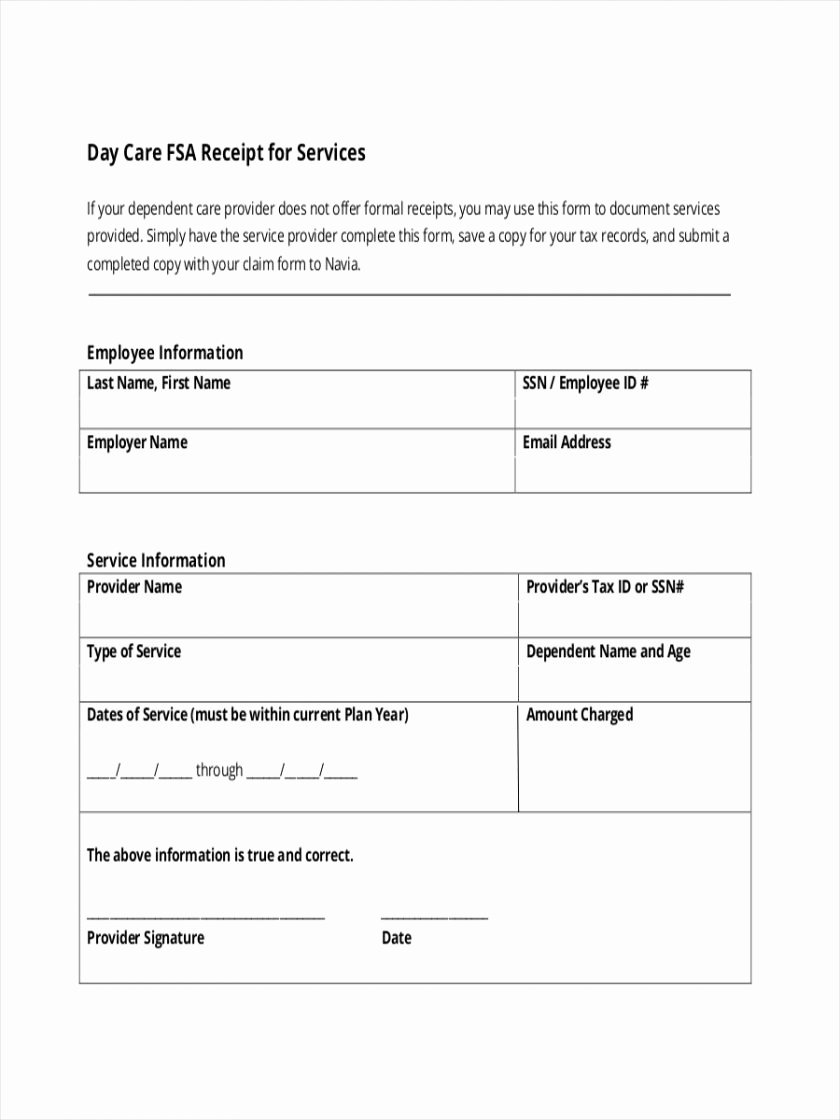

Dependent Care Fsa Plan Year Vs Calendar Year Rene Vallie

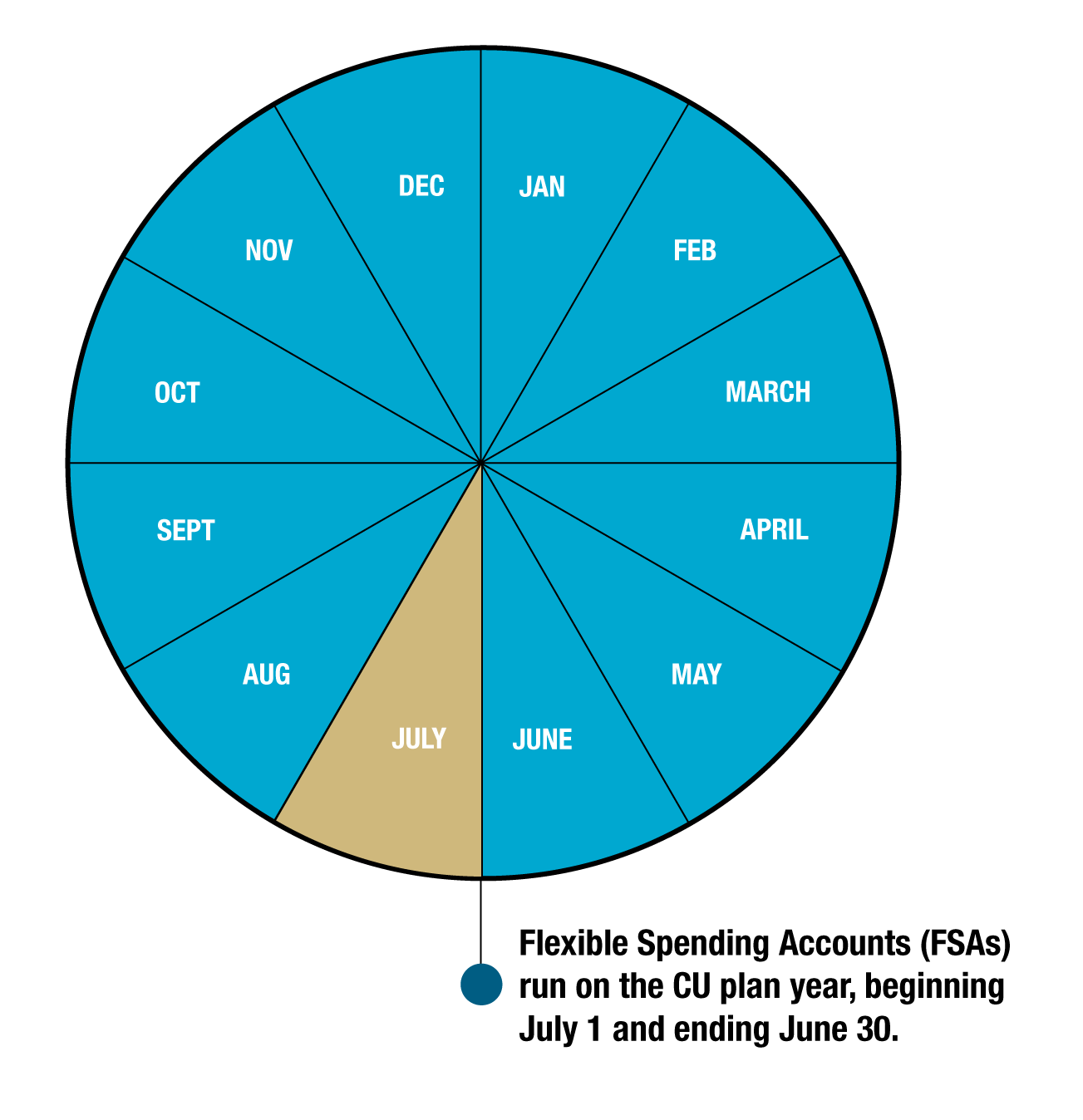

Dependent Care FSA University of Colorado

FSA Maximum Rollover 2025 What You Need To Know 2025 Whole Year Calendar

FSA Maximum Rollover 2025 What You Need To Know 2025 Whole Year Calendar

Fsa Eligibility Requirements 2025 Olivia Inaya

Hsa Plan Year Vs Calendar Year prntbl.concejomunicipaldechinu.gov.co

“Hr Teams Can Improve Fsa Literacy.

The Irs Has Dependent Fsas Under A Use It Or Lose.

However, There Are Some Important Nuances To Understand Regarding This Rule.

What Are The Key Fsa Plan Year Rules?

Related Post:

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)