Futures Calendar Spread

Futures Calendar Spread - They consider it one of the safer ways to try and profit from the commodity market. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. It is beneficial only when a day trader expects the derivative to have a price trend ranging from neutral to medium rise. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. Calendar spreads combine buying and selling two contracts with different expiration dates. Explore the strategic use of calendar spreads in trading, focusing on expiration differences, volatility, and financial implications. With calendar spreads, time decay is your friend. Abc) is trading at $110 per share. You may set a custom date. Many traders prefer futures spread trading as an arbitrage strategy. Options and futures traders mostly use the calendar spread. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the. Calendar spreads, sometimes referred to as intramarket spreads, are when a. In g5 currency pairs, there are three. Calendar spreads are a good technique to participate in the futures markets if you have the resources. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts. What is a calendar spread? A scalping futures strategy focuses on making quick, small profits through rapid trades in the futures market. With calendar spreads, time decay is your friend. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Spreads are. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A calendar spread is a trading strategy in.. Calendar spread trading exploits price differences between futures contracts of the same commodity with different delivery months. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the. Options and futures traders mostly use the calendar spread. Calendar spreads. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. This article covers the crucial aspects of. Explore the strategic use of calendar spreads in trading, focusing on expiration differences, volatility, and financial implications. What is a calendar spread? In g5 currency. They consider it one of the safer ways to try and profit from the commodity market. Let’s say that abc corp. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. This strategy focuses on profiting from changes in. What contract months can be traded in. A calendar spread is an options strategy that entails buying and selling a long and short position on the same stock with the same strike price but different. Let’s say that abc corp. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. A calendar spread. Calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. This strategy focuses on profiting from changes in. It is beneficial only when a day trader expects the derivative to have a price trend ranging from neutral to medium rise. A calendar spread is a strategy used in options and futures trading:. With calendar spreads, time decay is your friend. What is a calendar spread? Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is a strategy used in options and futures trading: In this guide, we will help. A scalping futures strategy focuses on making quick, small profits through rapid trades in the futures market. Calculate the daily historic difference between the two. Learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Options and futures traders mostly use the calendar spread. You think it’s going to stay roughly the. Calendar spread trading exploits price differences between futures contracts of the same commodity with different delivery months. You can go either long or. Calendar spreads are a good technique to participate in the futures markets if you have the resources. A calendar spread is a strategy used in options and futures trading: Since they maintain the same strike price and contract. What is a calendar spread? What contract months can be traded in a spread? Abc) is trading at $110 per share. What is a calendar spread? This article covers the crucial aspects of. Calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Calendar spreads combine buying and selling two contracts with different expiration dates. Options and futures traders mostly use the calendar spread. You can go either long or. Calendar spreads are a good technique to participate in the futures markets if you have the resources. With calendar spreads, time decay is your friend. You think it’s going to stay roughly the. They consider it one of the safer ways to try and profit from the commodity market. A scalping futures strategy focuses on making quick, small profits through rapid trades in the futures market.Futures Spread Trading TradeSafe, LLC

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

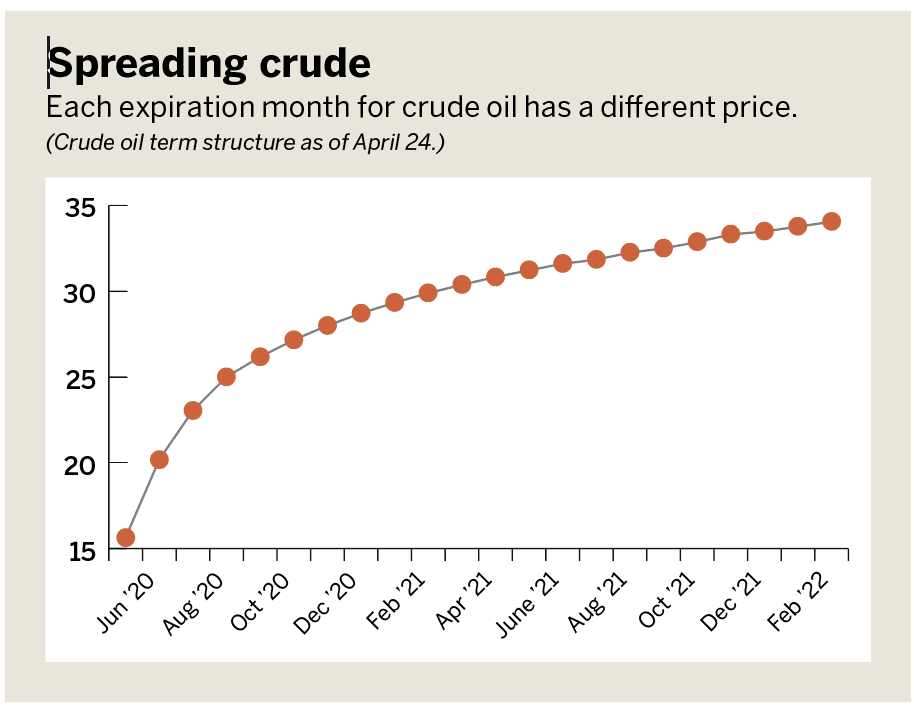

Leg Up on Futures Calendar Spreading luckbox magazine

Futures Calendar Spread Trading Strategies Gizela Miriam

Futures Calendar Spread Trading Strategies Gizela Miriam

CBOE Volatility Index Futures Reverse Calendar Spreads

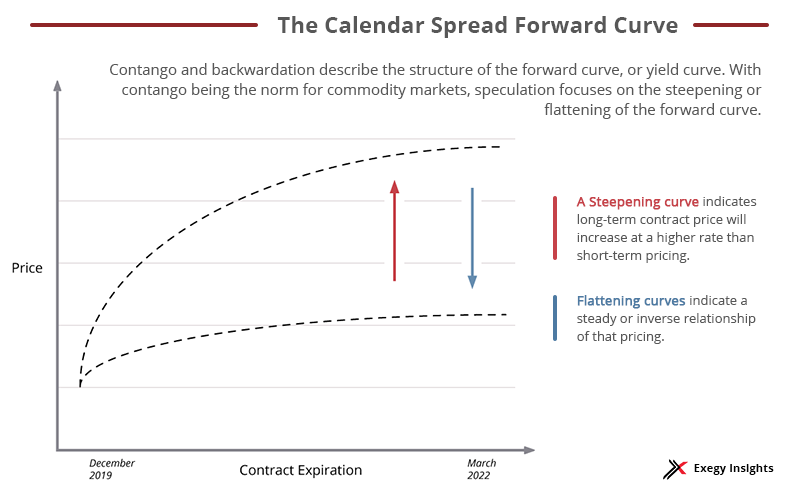

Getting Started with Calendar Spreads in Futures Exegy

Futures Calendar Spread

Calendar Spreads, Sometimes Referred To As Intramarket Spreads, Are When A.

Calendar Spread Trading Exploits Price Differences Between Futures Contracts Of The Same Commodity With Different Delivery Months.

It Is Beneficial Only When A Day Trader Expects The Derivative To Have A Price Trend Ranging From Neutral To Medium Rise.

Start With Downloading The Continuous Futures Closing Prices Of The Stock For Both Near Month And Next Month Contracts.

Related Post: