How Does A Calendar Call Around Earnings Work

How Does A Calendar Call Around Earnings Work - Good morning or good afternoon. How does a calendar spread work? What is an earnings calendar? One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading. After the presentation, there will be a. This utility company delivered a negative earnings surprise of 2.09% in the last reported quarter. It empowers investors to create an informed investment strategy that takes into. For a true long volatility calendar spread, you could try selling the expiration before an er event, and buying the expiration after. A calendar spread profits from the time decay of options. Trading earnings reports with option calendar spreads. This utility company delivered a negative earnings surprise of 2.09% in the last reported quarter. 2 weeks before earnings announcement; An earnings calendar is a vital financial tool that tracks when companies release their quarterly financial reports, helping investors anticipate market movements and make. Good morning or good afternoon. A calendar spread profits from the time decay of options. What is an earnings calendar? After the presentation, there will be a. Just hoping you could talk a little bit about the tax credits the first time. Lastly, we plan to report our first quarter earnings and host a conference call on may 1, 2025. What is a call calendar spread? It empowers investors to create an informed investment strategy that takes into. One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading. I'm starting to try double calendar spreads around earnings, and one thing i've noticing is that for lower priced stocks, the cost of the double. It empowers investors to create an informed investment strategy that takes into. Find earnings, economic, stock splits and ipo calendars to track upcoming financial events from yahoo finance. One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading. I'm starting to try double calendar spreads around earnings,. Thank you for standing by, and welcome to amwell's fourth quarter 2024 earnings conference call. Double calendar spreads are a short vol play and are typically used around earnings to take advantage of a vol crush. What is a reverse calendar call spread? The usual setup is to sell the front month options and buy the back. That way iv. It empowers investors to create an informed investment strategy that takes into. How does a calendar spread work? In essence, an earnings calendar turns a slew of scattered data into an organized, digestible format. How does a calendar spread work? Time spreads are initiated on a stock reporting earnings tonight or the next morning and consists of selling this weeks. What is a reverse calendar call spread? This utility company delivered a negative earnings surprise of 2.09% in the last reported quarter. 2 weeks before earnings announcement; Just hoping you could talk a little bit about the tax credits the first time. How does a calendar spread work? Just hoping you could talk a little bit about the tax credits the first time. An earnings calendar is a schedule that lists the dates when publicly traded companies will release their quarterly earnings reports. One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading. Double calendar. An earnings calendar is a vital financial tool that tracks when companies release their quarterly financial reports, helping investors anticipate market movements and make. One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading. An earnings calendar is a schedule that lists the dates when publicly traded. I'm starting to try double calendar spreads around earnings, and one thing i've noticing is that for lower priced stocks, the cost of the double calendar spread is very low, sometimes is low as. Lastly, we plan to report our first quarter earnings and host a conference call on may 1, 2025. Double calendar spreads are a short vol play. After the presentation, there will be a. Lastly, we plan to report our first quarter earnings and host a conference call on may 1, 2025. It empowers investors to create an informed investment strategy that takes into. For a true long volatility calendar spread, you could try selling the expiration before an er event, and buying the expiration after. Good. Trading earnings reports with option calendar spreads. Due to the high number of covering. What is a call calendar spread? For a true long volatility calendar spread, you could try selling the expiration before an er event, and buying the expiration after. At least i remember hearing about it. In essence, an earnings calendar turns a slew of scattered data into an organized, digestible format. Just hoping you could talk a little bit about the tax credits the first time. This utility company delivered a negative earnings surprise of 2.09% in the last reported quarter. One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading. I'm starting to try double calendar spreads around earnings, and one thing i've noticing is that for lower priced stocks, the cost of the double calendar spread is very low, sometimes is low as. Let’s break it down with a simple example: Double calendar spreads are a short vol play and are typically used around earnings to take advantage of a vol crush. We will now transition to the q&a part of the call. Time spreads are initiated on a stock reporting earnings tonight or the next morning and consists of selling this weeks at the money call (or put) and buying next weeks at the money call (or. An earnings calendar is a vital financial tool that tracks when companies release their quarterly financial reports, helping investors anticipate market movements and make. Good morning or good afternoon. That way iv only increases on your long option. What is a reverse calendar call spread? At least i remember hearing about it. How does a calendar spread work? How does a calendar spread work?What Is An Earnings Calendar? Academy

What Is An Earnings Calendar? Academy

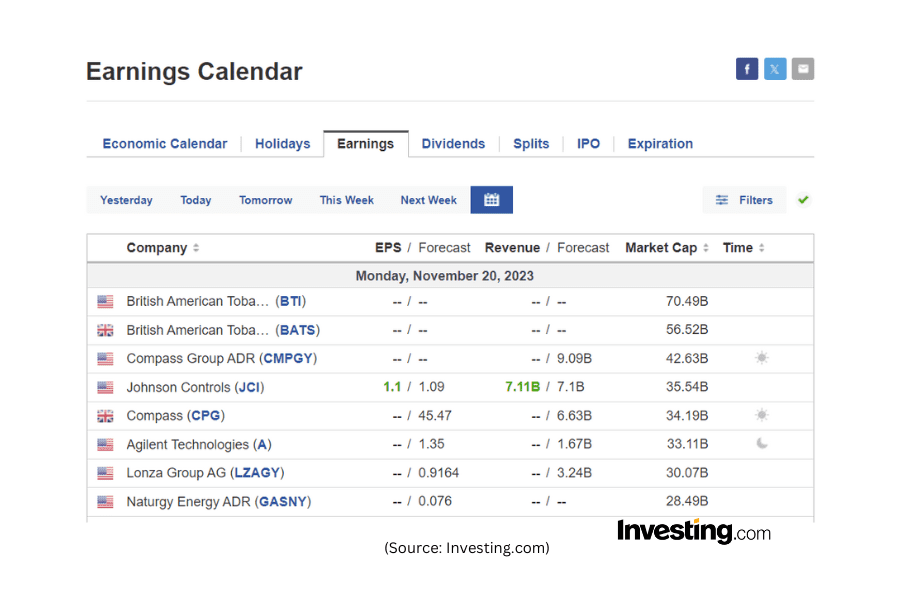

Calendars for Economics, Earnings, and Dividends Tutorial YouTube

Calendar Call Definition, Purpose, Advantages, and Disadvantages

Calendar Call Definition, Purpose, Advantages, and Disadvantages

Calendar Call Spread Strategy

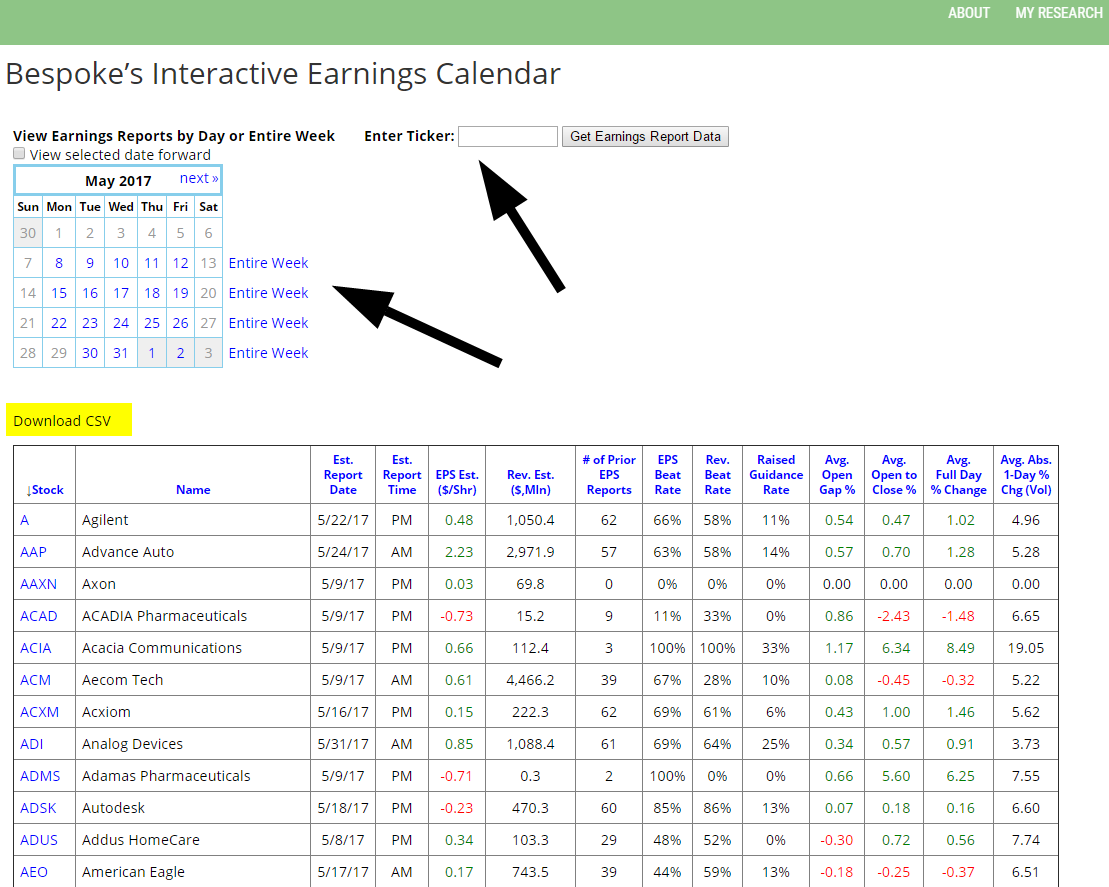

Bespoke’s Interactive Earnings Calendar Demo Bespoke Investment Group

Making Money with Calendar Spreads (How Does it Work) Tradersfly

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Bespoke’s Interactive Earnings Calendar Demo Bespoke Investment Group

It Empowers Investors To Create An Informed Investment Strategy That Takes Into.

For A True Long Volatility Calendar Spread, You Could Try Selling The Expiration Before An Er Event, And Buying The Expiration After.

Thank You For Standing By, And Welcome To Amwell's Fourth Quarter 2024 Earnings Conference Call.

Trading Earnings Reports With Option Calendar Spreads.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)