Long At The Money Calendar Spread Greeks Measured

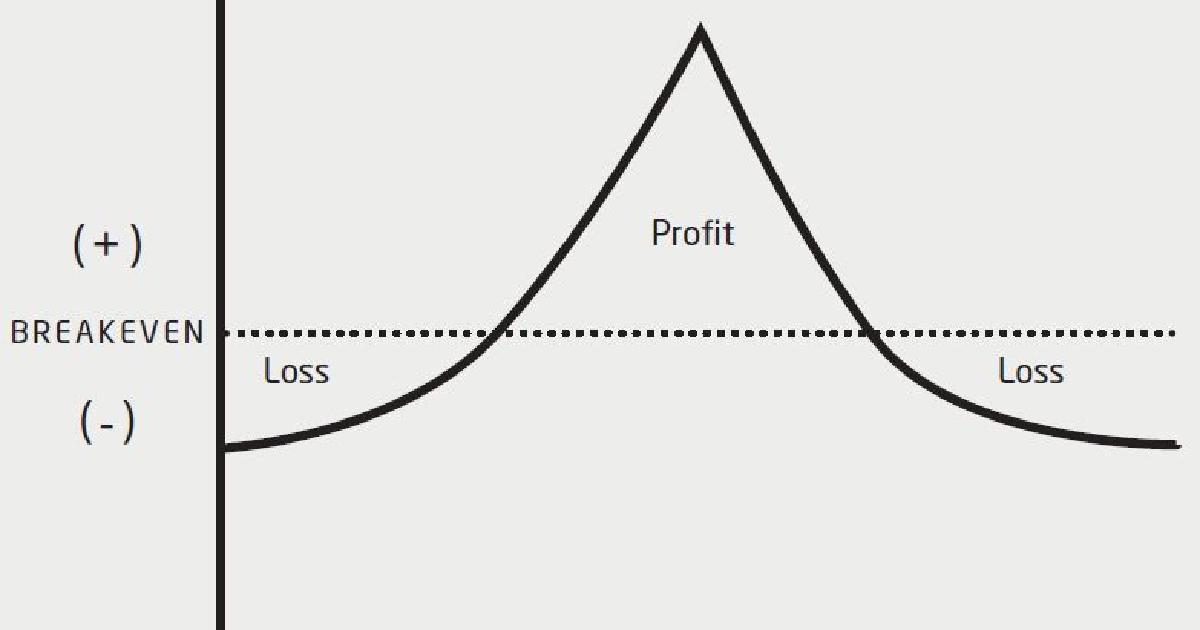

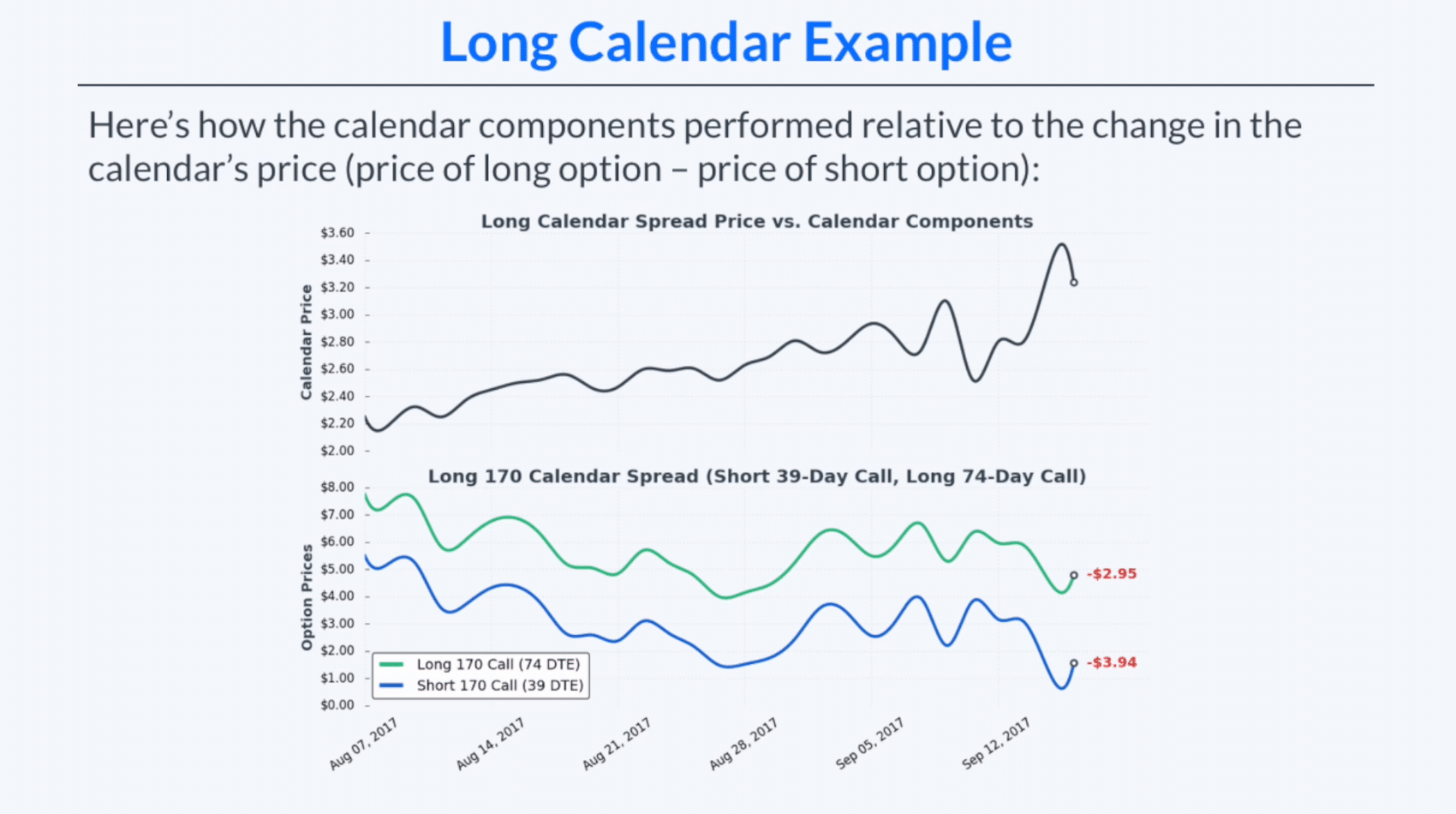

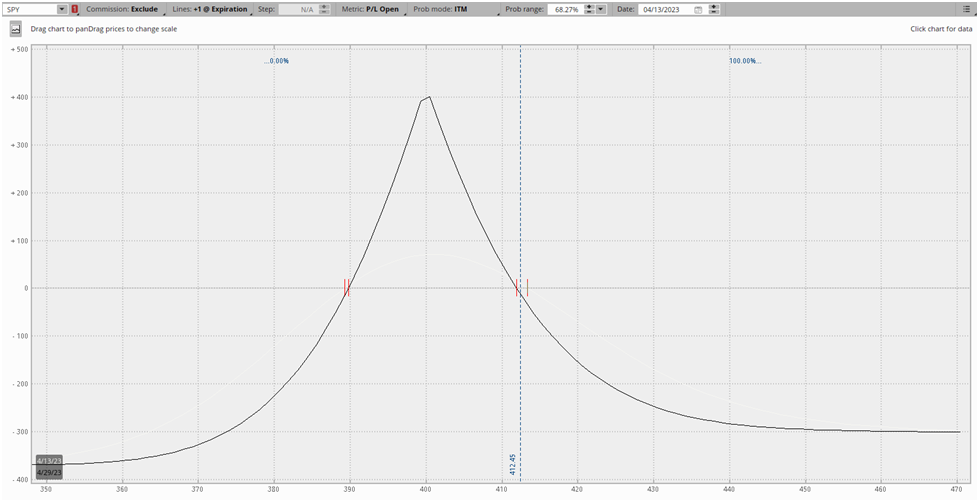

Long At The Money Calendar Spread Greeks Measured - To make the most of theta in your double diagonal and calendar spreads: Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar spread strategy. Long vega, short γ, positive θ m b. If you are long that means the option is sol. This greek measures the sensitivity of an option's price to changes in volatility. Hi to everyone, so here the correct answer is option c, long vega, long gamma and positive theta. Long vega, short gamma, positive theta. After analysing the stock's historical volatility. The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. Long gamma implies you profit when the underlying moves more than predicted and lose when it moves less than. After analysing the stock's historical volatility. In a calendar spread, the delta for the long leg (the option with the later expiration date) will. Long gamma implies you profit when the underlying moves more than predicted and lose when it moves less than. Long vega, short gamma, positive theta. In a calendar spread, you are long vega because you want volatility to increase. Time spreads, also known as calendar or horizontal spreads, can be. Long vega, short gamma, positive theta short vega, short gamma,. This greek measures the sensitivity of an option's price to changes in volatility. Delta measures how sensitive an option's price is to changes in the underlying asset's price. Let’s break down all jargon and explore how. If you are long on an at the money calendar spread, your position would be measured at the following greeks? To make the most of theta in your double diagonal and calendar spreads: After analysing the stock's historical volatility. Long gamma implies you profit when the underlying moves more than predicted and lose when it moves less than. Hi to. If you are long an at the money calendar spread your position would be measured at which of the following greeks? Long vega, short γ, positive θ m b. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar spread strategy. Suppose apple inc (aapl) is currently trading at $145 per share. Time spreads, also. The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar spread strategy. After analysing the stock's historical volatility. If you are long an at the money calendar spread your position would be measured at which of. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar spread strategy. If you are long that means the option is sol. When the long and short strikes have the same maturity one usually speaks of a “call spread” or “put spread”, “horizontal call/put spread” or “bull/bear spread”. Suppose apple inc (aapl) is currently trading. Long vega, short gamma, positive theta short vega, short gamma,. Occasionally checking out the net gamma position lets. Long vega, short γ, positive θ m b. The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. Long vega, short gamma, positive theta m b. Delta measures how sensitive an option's price is to changes in the underlying asset's price. Let’s break down all jargon and explore how. After analysing the stock's historical volatility. When the long and short strikes have the same maturity one usually speaks of a “call spread” or “put spread”, “horizontal call/put spread” or “bull/bear spread”. Time spreads, also known as. Long vega, short gamma, positive theta m b. In a calendar spread, the delta for the long leg (the option with the later expiration date) will. Hi to everyone, so here the correct answer is option c, long vega, long gamma and positive theta. Let’s break down all jargon and explore how. Suppose apple inc (aapl) is currently trading at. When the long and short strikes have the same maturity one usually speaks of a “call spread” or “put spread”, “horizontal call/put spread” or “bull/bear spread”. In particular, if the near term option becomes nearly worthless, then the calendar spread is essentially a long option trade. When the underlying moves and the strikes become further out of the money, then. Suppose apple inc (aapl) is currently trading at $145 per share. In an at the money (atm) calendar spread, the position is typically long vega, short gamma, and has positive theta. Long vega, short gamma, positive theta. Okay, long vega, being long and at the money calendar, money calendar is. In particular, if the near term option becomes nearly worthless,. When the long and short strikes have the same maturity one usually speaks of a “call spread” or “put spread”, “horizontal call/put spread” or “bull/bear spread”. Long vega, short gamma, positive theta m b. Long gamma implies you profit when the underlying moves more than predicted and lose when it moves less than. If you are long on an at. In particular, if the near term option becomes nearly worthless, then the calendar spread is essentially a long option trade. This reflects a strategy that benefits from an increase in. To make the most of theta in your double diagonal and calendar spreads: Gamma measures tend to do the same, which serves to accelerate the change in the net delta position of a calendar spread portfolio. In a calendar spread, the delta for the long leg (the option with the later expiration date) will. In a calendar spread, you are long vega because you want volatility to increase. Calendar spread examples long call calendar spread example. A) long calender spread means buying and selling the option of same strike price but different maturity. This greek measures the sensitivity of an option's price to changes in volatility. After analysing the stock's historical volatility. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar spread strategy. A calendar spread involves options with different expiration dates but the. Time spreads, also known as calendar or horizontal spreads, can be. Occasionally checking out the net gamma position lets. If you are long an at the money calendar spread your position would be measured at which of the following greeks? When the underlying moves and the strikes become further out of the money, then the greeks could change.Long Calendar Spreads for Beginner Options Traders projectfinance

Long Calendar Spread with Calls Strategy With Example

The Long Calendar Spread Explained Options Cafe

Long Calendar Spread Strategy Ursa Adelaide

Making Money with Calendar Spreads (How Does it Work) Tradersfly

Calendar Call Spread Option Strategy Heida Kristan

Long Calendar Spreads for Beginner Options Traders projectfinance

Calculating Greeks on Option Spreads R YouTube

Calendar Spread Options Strategy Steady Options

How to use OPTION GREEKS to calculate calendar call spreads profit/risk

Hi To Everyone, So Here The Correct Answer Is Option C, Long Vega, Long Gamma And Positive Theta.

Suppose Apple Inc (Aapl) Is Currently Trading At $145 Per Share.

Long Vega, Short Gamma, Positive Theta M B.

Let’s Break Down All Jargon And Explore How.

Related Post: