Long Atm Calendar Spread Greeks

Long Atm Calendar Spread Greeks - The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. To calculate the greeks of our total position, we subtract our short from our long. In this post we will focus on long calendar spreads. Let’s break down all jargon and explore how. Meaning we sell the closer expiration and buy the further dated expiration. I also buy an atm long put calendar spread (again short april @ $1.00, long may @ $2.00, strike 400) for a net debit of $1.00 per share for the same underlying stock as the call spread. It's called a __calendar spread__. An example of a long calendar spread would be selling aapl jul 150 strike call and buying. Are any thetagangsters smitten with the calendar spread? It's called a __calendar spread__. An example of a long calendar spread would be selling aapl jul 150 strike call and buying. Consider the calendar spread where you go long the atm call expiring in t1 = 3 months and short the atm call expiring in t2 = 1 month. When the underlying moves and the strikes become further out of the money, then the greeks could change. When the calendar spread is atm, the long calendar is 1. An example of a long calendar spread would be selling aapl jul. As time passes, the delta will flatten. The difference in strike prices creates a net delta that can change. Understanding the greeks—delta, gamma, theta, and vega—in the context of a calendar spread is essential for successful options trading. The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. An example of a long calendar spread would be selling aapl jul. When the underlying moves and the strikes become further out of the money, then the greeks could change. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. In this post we will focus on long calendar spreads. I also buy. The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. In particular, if anyone's ever. As time passes, the delta will flatten. Consider the calendar spread where you go long the atm call expiring in t1 = 3 months and short the atm call expiring in t2 = 1 month. Meaning. As time passes, the delta will flatten. I also buy an atm long put calendar spread (again short april @ $1.00, long may @ $2.00, strike 400) for a net debit of $1.00 per share for the same underlying stock as the call spread. An example of a long calendar spread would be selling aapl jul. The difference in strike. Are any thetagangsters smitten with the calendar spread? To calculate the greeks of our total position, we subtract our short from our long. When we are long a calendar spread, we sell the option with fewer dte and buy the option with greater dte. Meaning we sell the closer expiration and buy the further dated expiration. In this post we. Meaning we sell the closer expiration and buy the further dated expiration. Let’s break down all jargon and explore how. In this post we will focus on long calendar spreads. To calculate the greeks of our total position, we subtract our short from our long. In particular, if anyone's ever. In particular, if anyone's ever. Understanding the greeks—delta, gamma, theta, and vega—in the context of a calendar spread is essential for successful options trading. Let’s break down all jargon and explore how. As time passes, the delta will flatten. In this post we will focus on long calendar spreads. An example of a long calendar spread would be selling aapl jul. Consider the calendar spread where you go long the atm call expiring in t1 = 3 months and short the atm call expiring in t2 = 1 month. Meaning we sell the closer expiration and buy the further dated expiration. Option value is purely extrinsic 2. It all. In particular, if anyone's ever. (a) (10 points) compute the price of. To calculate the greeks of our total position, we subtract our short from our long. Understanding the greeks—delta, gamma, theta, and vega—in the context of a calendar spread is essential for successful options trading. It all depends on the specific parameters of the options you use in your. An example of a long calendar spread would be selling aapl jul. When the calendar spread is atm, the long calendar is 1. Let’s break down all jargon and explore how. Consider the calendar spread where you go long the atm call expiring in t1 = 3 months and short the atm call expiring in t2 = 1 month. In. The difference in strike prices creates a net delta that can change. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. These metrics provide valuable insights into how. Consider the calendar spread where you go long the atm call expiring in t1 = 3 months and short the atm call expiring in. It all depends on the specific parameters of the options you use in your calendar spread, what's favourable and unfavourable for your position depends on the net greeks of the calendar. Understanding the greeks—delta, gamma, theta, and vega—in the context of a calendar spread is essential for successful options trading. Are any thetagangsters smitten with the calendar spread? Consider the calendar spread where you go long the atm call expiring in t1 = 3 months and short the atm call expiring in t2 = 1 month. An example of a long calendar spread would be selling aapl jul 150 strike call and buying. A long calendar spread is when you sell the closer expiration and buy the further dated expiration. In this post we will focus on long calendar spreads. The calendar spreads option strategy and its application simply explained at pandemonium, a web warehouse of financial markets knowhow. Option value is purely extrinsic 2. (a) (10 points) compute the price of. When we are long a calendar spread, we sell the option with fewer dte and buy the option with greater dte. As time passes, the delta will flatten. Meaning we sell the closer expiration and buy the further dated expiration. These metrics provide valuable insights into how. I also buy an atm long put calendar spread (again short april @ $1.00, long may @ $2.00, strike 400) for a net debit of $1.00 per share for the same underlying stock as the call spread. Let’s break down all jargon and explore how.Paradigm Insights Save The Date A Comprehensive Overview of the

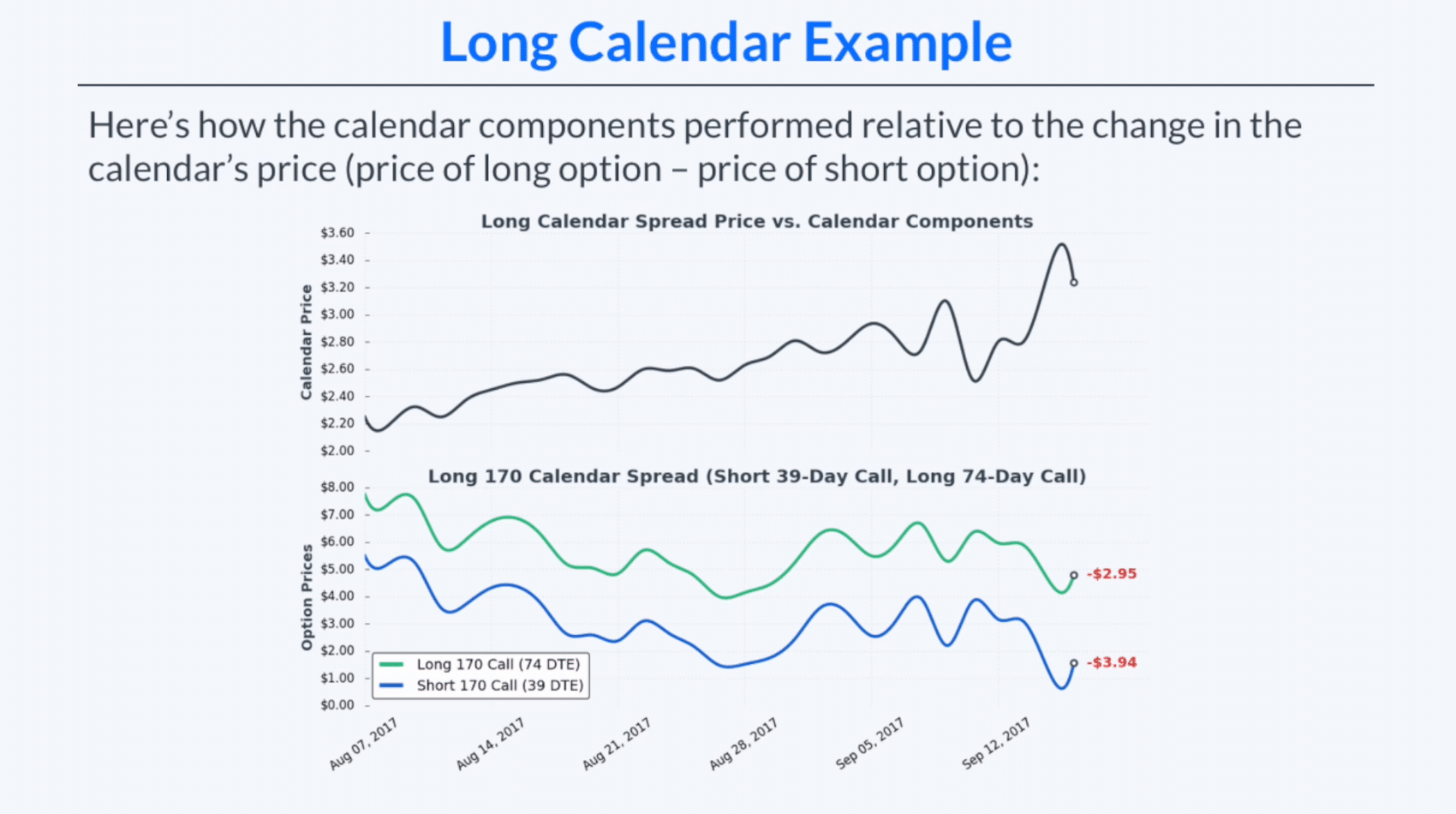

Long Calendar Spreads for Beginner Options Traders projectfinance

How to use OPTION GREEKS to calculate calendar call spreads profit/risk

Option Greeks Explained HubPages

Long Call Calendar Spread PDF Greeks (Finance) Option (Finance)

Options Greeks Cheat Sheet [Free PDF] HowToTrade

Option Credit Spreads Explained The Greeks

Calendar Spread PDF Greeks (Finance) Option (Finance)

Calendars Greeks When to use calendar Spread YouTube

Long Calendar Spreads for Beginner Options Traders projectfinance

When The Underlying Moves And The Strikes Become Further Out Of The Money, Then The Greeks Could Change.

To Calculate The Greeks Of Our Total Position, We Subtract Our Short From Our Long.

When The Calendar Spread Is Atm, The Long Calendar Is 1.

It's Called A __Calendar Spread__.

Related Post:

![Options Greeks Cheat Sheet [Free PDF] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/options-greeks-cheat-sheet-768x543.png)