Long Calendar Spread

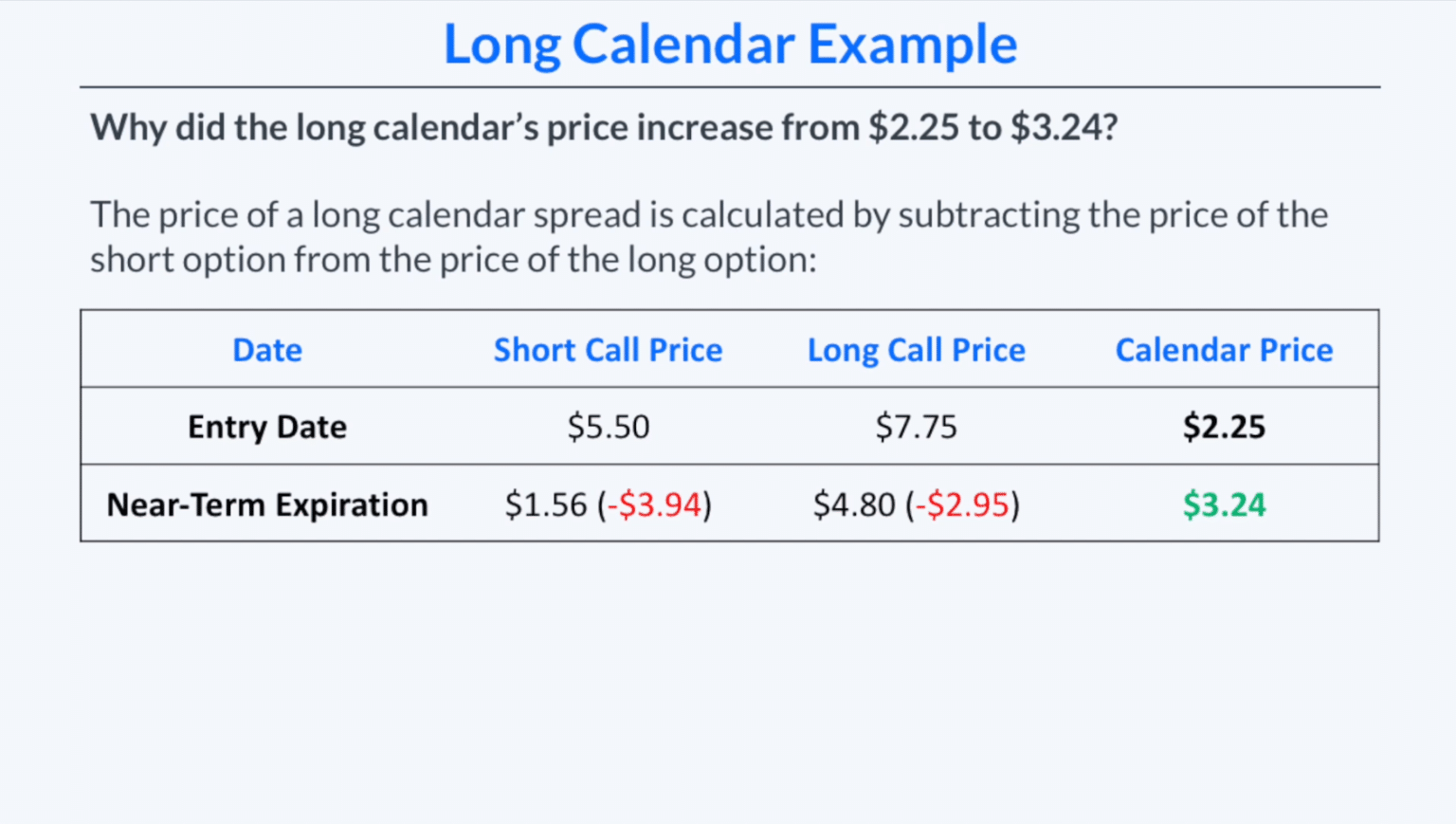

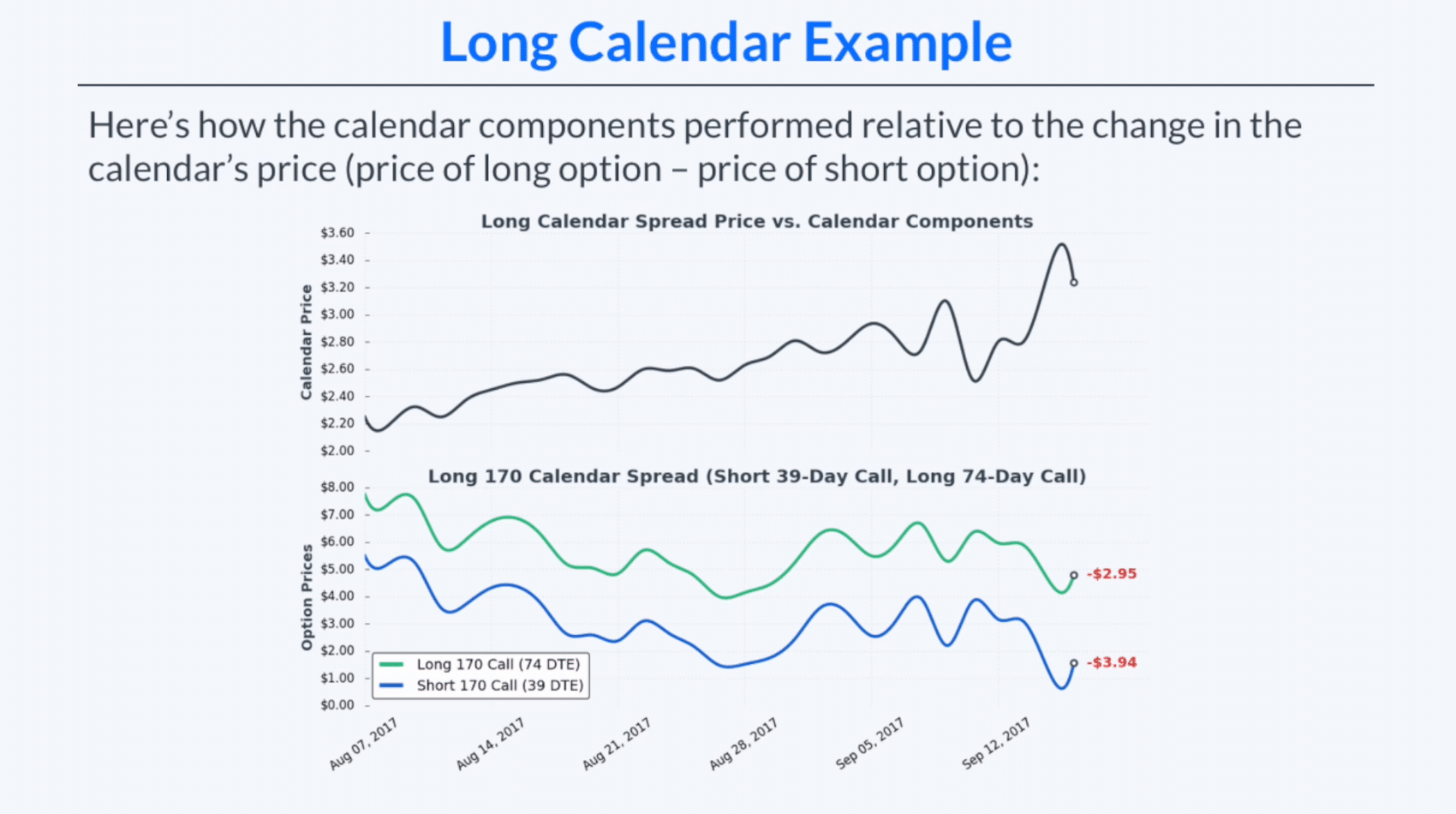

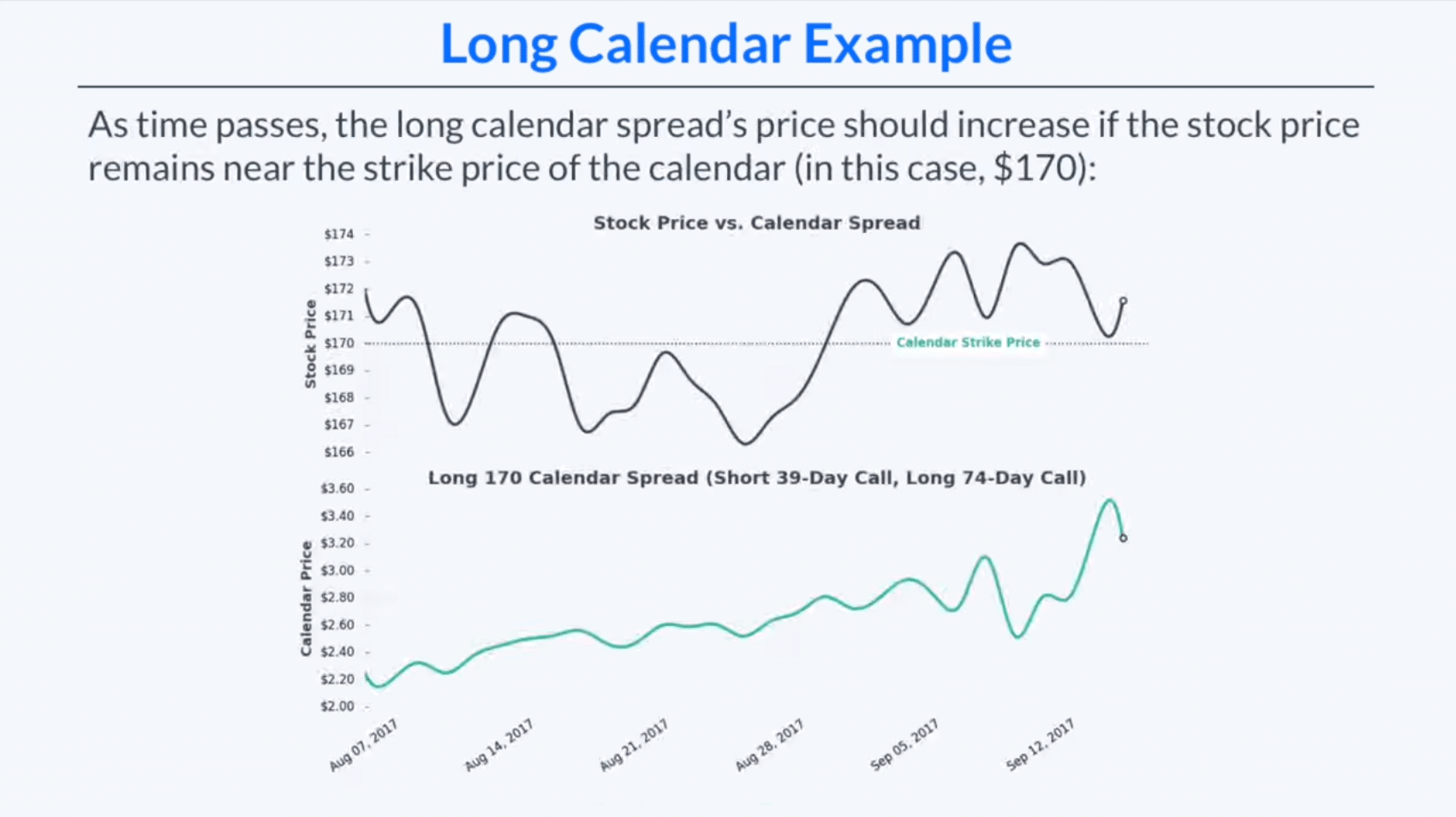

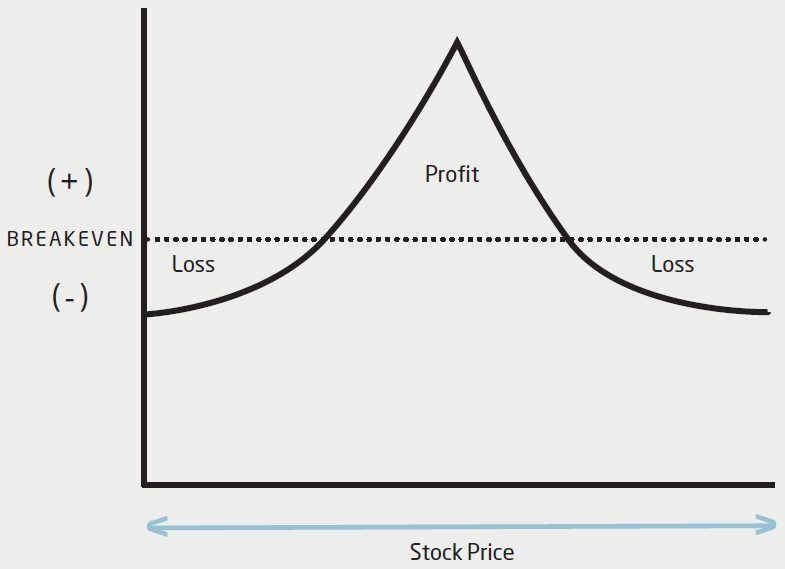

Long Calendar Spread - The idea is that the. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. To initiate a long calendar spread, you sell. The main idea behind this strategy is. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. This strategy aims to profit from time decay and. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.” you can go long or short on your spread. The options are both calls or. A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. The main idea behind this strategy is. A calendar spread involves simultaneous long and short positions on the same underlying asset with different delivery dates. To initiate a long calendar spread, you sell. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Generally short calendar spread is considered effective by traders, this. This strategy aims to profit from time decay and. Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.” you can go long or short on your spread. This strategy aims to profit from time decay and. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. To initiate a long calendar spread, you sell. The idea is that the. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. It aims to profit from time decay and volatility changes. § short 1 xyz (month 1). This strategy profits from the difference in time decay rates,. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. This strategy aims to profit from time decay and. It aims to profit from time decay and volatility changes. To initiate a long. What is a long call calendar spread? This strategy profits from the difference in time decay rates,. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. The main idea behind this strategy is. This strategy aims to profit from time decay and. § short 1 xyz (month 1). This strategy profits from the difference in time decay rates,. It aims to profit from time decay and volatility changes. The main idea behind this strategy is. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. This strategy profits from the difference in time decay rates,. A calendar spread involves simultaneous long and short positions on the same underlying asset with different delivery dates. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract. The idea is that the. Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.” you can go long or short on your spread. What is a long call calendar spread? § short 1 xyz (month 1). Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. This strategy aims to profit from time decay and. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. The options are both calls or. A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits. The options are both calls or. Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.” you can go long or short on your spread. A calendar spread involves simultaneous long and short positions on the same underlying asset with different delivery dates. Generally short calendar spread is considered effective by traders, this. This strategy profits from. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. It aims to profit from time decay and volatility changes. § short 1 xyz (month 1). Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.” you can go long or short on your spread. The options are both calls. Calendar spread options strategy are of two types, long calendar spread, and short calendar spread. This strategy aims to profit from time decay and. What is a long call calendar spread? Generally short calendar spread is considered effective by traders, this. It aims to profit from time decay and volatility changes. A long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time decay. Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.” you can go long or short on your spread. § short 1 xyz (month 1). The main idea behind this strategy is. This strategy profits from the difference in time decay rates,. The long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price.Long Calendar Spread with Puts Strategy With Example

Long Calendar Spreads for Beginner Options Traders projectfinance

Long Calendar Spread with Puts

Long Calendar Spreads for Beginner Options Traders projectfinance

Long Calendar Spreads Unofficed

Long Calendar Spreads for Beginner Options Traders projectfinance

The Long Calendar Spread Explained 1 Options Trading Software

Long Calendar Spread with Calls Strategy With Example

Long Call Calendar Spread Explained (Options Trading Strategies For

Long Calendar Spreads for Beginner Options Traders projectfinance

The Options Are Both Calls Or.

To Initiate A Long Calendar Spread, You Sell.

A Calendar Spread Involves Simultaneous Long And Short Positions On The Same Underlying Asset With Different Delivery Dates.

The Idea Is That The.

Related Post: