Long Call Calendar Spread

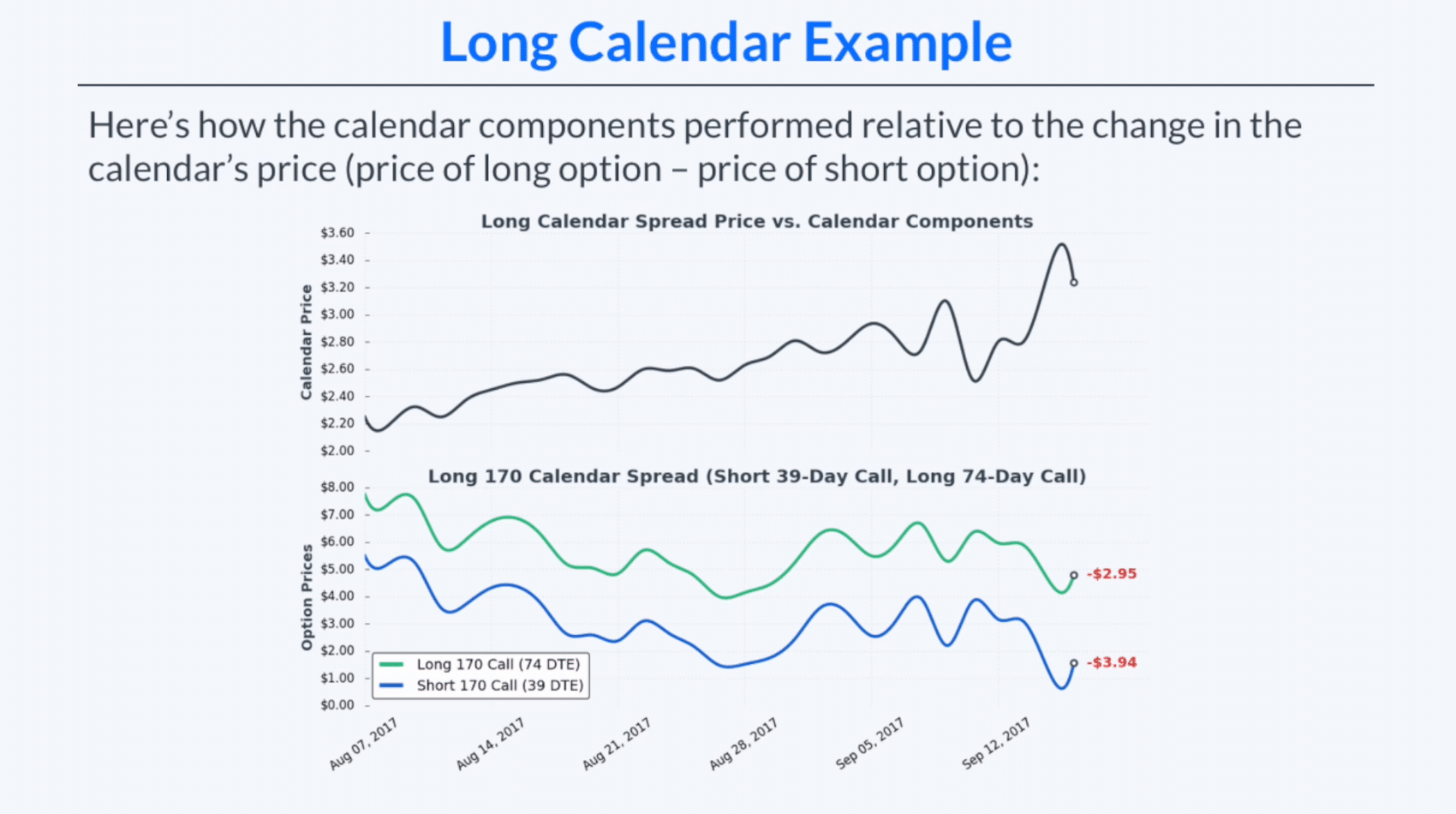

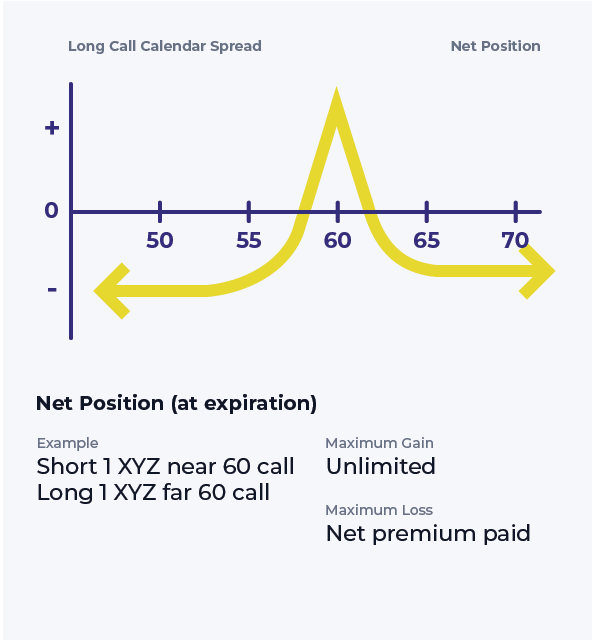

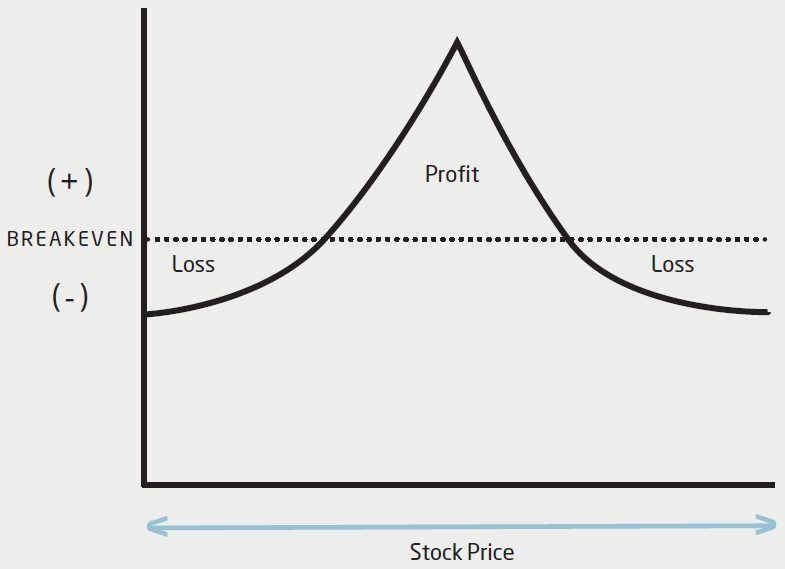

Long Call Calendar Spread - A long call calendar spread is a long call options spread strategy where you expect the underlying security to hit a certain price. After analysing the stock's historical volatility. Suppose apple inc (aapl) is currently trading at $145 per share. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. In vertical spreads, we have different strike prices. What is a long call calendar spread? The strategy most commonly involves calls with the same strike. The strategy involves buying a longer term expiration. The net cost of this spread is. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. The strategy involves buying a longer term expiration. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. A calendar spread involves buying and selling options with the same strike price but different expiration dates to profit from time decay differences. Maximum profit is realized if. After analysing the stock's historical volatility. Long call calendar spread example. A long call calendar spread is a long call options spread strategy where you expect the underlying security to hit a certain price. The net cost of this spread is. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Suppose apple inc (aapl) is currently trading at $145 per share. Long call calendar spread example. The strategy most commonly involves calls with the same strike. It involves purchasing a long call option with a later expiration while simultaneously selling a short call option that has a. Suppose you’re neutral but mildly bullish on company xyz. A calendar spread involves buying and selling options with the same strike price but different. A calendar spread involves buying and selling options with the same strike price but different expiration dates to profit from time decay differences. The strategy most commonly involves calls with the same strike. After analysing the stock's historical volatility. Maximum profit is realized if. In vertical spreads, we have different strike prices. The strategy most commonly involves calls with the same strike. In vertical spreads, we have different strike prices. In both strategies, t he options will still be of the same type. See examples, diagrams, tables, and tips for this options trading technique. The strategy involves buying a longer term expiration. In both strategies, t he options will still be of the same type. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. You enter a long calendar spread with calls when shares of the stock are. Calendar spread examples long call calendar spread. In vertical spreads, we have different strike prices. Calendar spread examples long call calendar spread example. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the strike price. The net cost of this spread is. In calendar spreads, we have options with different expirations; It involves purchasing a long call option with a later expiration while simultaneously selling a short call option that has a. A long call calendar spread consists of two components. Maximum profit is realized if. See examples, diagrams, tables, and tips for this options trading technique. Suppose you’re neutral but mildly bullish on company xyz. In calendar spreads, we have options with different expirations; The strategy most commonly involves calls with the same strike. Suppose you’re neutral but mildly bullish on company xyz. Suppose apple inc (aapl) is currently trading at $145 per share. The net cost of this spread is. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Suppose you’re neutral but mildly bullish on company xyz. A long call calendar spread consists of two components. What is a long call calendar spread? A calendar spread involves buying and selling options with the same strike price but different. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Suppose you’re neutral but mildly bullish on company xyz. A calendar spread involves buying and selling options with the same strike price but different expiration dates to profit from time decay differences. In calendar. Long call calendar spread example. It involves purchasing a long call option with a later expiration while simultaneously selling a short call option that has a. To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. A long. Suppose you’re neutral but mildly bullish on company xyz. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. The strategy most commonly involves calls with the same strike. Suppose apple inc (aapl) is currently trading at $145 per share. The main idea behind this strategy is. In calendar spreads, we have options with different expirations; To execute a bull call spread, the trader might buy a call option with a $100 strike price for $5 and sell a call option with a $110 strike price for $2. Long call calendar spread example. The net cost of this spread is. Calendar spread examples long call calendar spread example. § short 1 xyz (month 1). Maximum profit is realized if. In both strategies, t he options will still be of the same type. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread is a long call options spread strategy where you expect the underlying security to hit a certain price. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the strike price.Long Calendar Spreads for Beginner Options Traders projectfinance

Calendar Call Spread Options Edge

Long Calendar Spreads Unofficed

Long Call Calendar Spread Options Strategy

Calendar Spread Using Calls Kelsy Mellisa

Calendar Call Spread Strategy

Long Call Calendar Spread Explained (Options Trading Strategies For

Investors Education Long Call Calendar Spread Webull

Long Calendar Spread with Calls Strategy With Example

The Long Calendar Spread Explained 1 Options Trading Software

A Calendar Spread Involves Buying And Selling Options With The Same Strike Price But Different Expiration Dates To Profit From Time Decay Differences.

Short One Call Option And Long A Second Call Option With A More Distant Expiration Is An Example Of A Long Call Calendar Spread.

You Enter A Long Calendar Spread With Calls When Shares Of The Stock Are.

See Examples, Diagrams, Tables, And Tips For This Options Trading Technique.

Related Post: