Money Calendar Savings

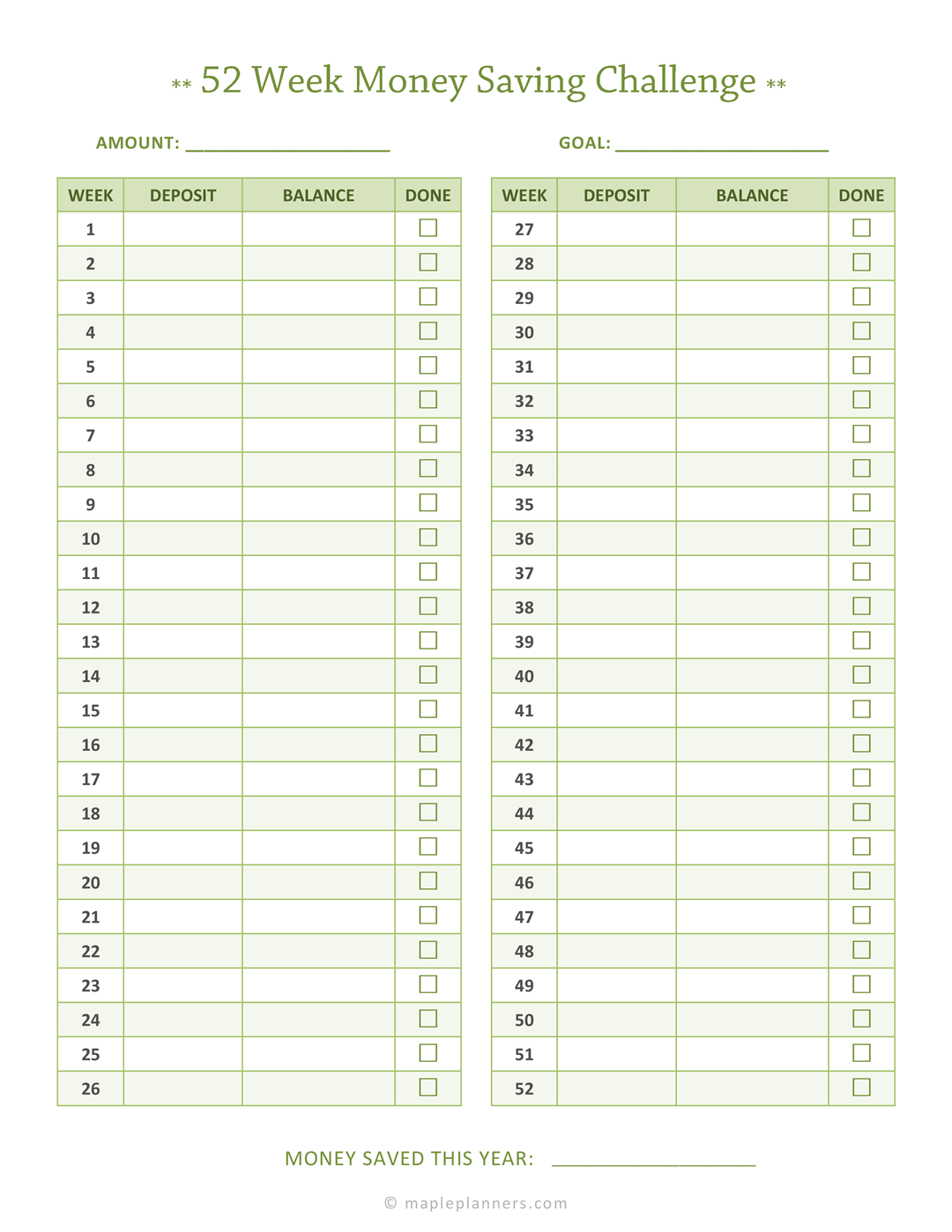

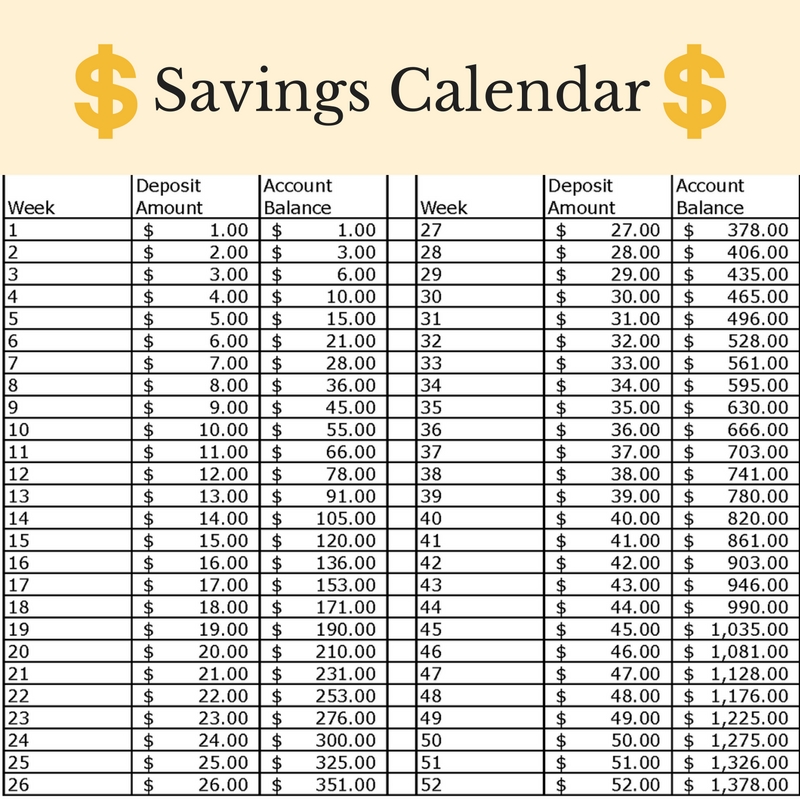

Money Calendar Savings - The weekly income, saving & expenses (wise) money management calendar is a financial management tool for you and your family. The idea is to begin. These challenges will give you the little nudge. The drawback is you generally can’t tap into that money until you’re at least 59 ½ years old, which means if you save too much, you could face an expensive liquidity crisis. Declare your independence from writing checks and visiting your bank or credit. Now that we are coming to the end of 2024, it is time to say goodbye to the old year and start planning for 2025. Read my tips and trick on how to save money now. This should include any side hustles or additional ways you make money. 27 rows use the form below to customize your weekly savings chart for any date range. If you'd like, try out our online money saving challenge so you can easily track. Now that we are coming to the end of 2024, it is time to say goodbye to the old year and start planning for 2025. The idea is to begin. Adding money regularly helps your savings grow because every deposit increases the amount that earns interest. Using this free printable savings tracker is an easy way to set aside $2025 by the end of the year! These challenges will give you the little nudge. 27 rows use the form below to customize your weekly savings chart for any date range. Use the irs required minimum distribution. Use the calculator to see how small adjustments to your. This should include any side hustles or additional ways you make money. Watch your savings grow with each contribution, turning numbers into a visual journey of achievement. And at the end of the year, you’ll have $1,378. The drawback is you generally can’t tap into that money until you’re at least 59 ½ years old, which means if you save too much, you could face an expensive liquidity crisis. Declare your independence from writing checks and visiting your bank or credit. This should include any side hustles. Herrera suggests your essentials like food, housing. Using this free printable savings tracker is an easy way to set aside $2025 by the end of the year! If you'd like, try out our online money saving challenge so you can easily track. See how americans are making it work in 2025—what’s trending, what’s tanking and how to stay financially unbothered.. This should include any side hustles or additional ways you make money. Watch your savings grow with each contribution, turning numbers into a visual journey of achievement. And at the end of the year, you’ll have $1,378. Read my tips and trick on how to save money now. Declare your independence from writing checks and visiting your bank or credit. Declare your independence from writing checks and visiting your bank or credit. Adding money regularly helps your savings grow because every deposit increases the amount that earns interest. If you'd like, try out our online money saving challenge so you can easily track. Use the calculator to see how small adjustments to your. Washington — being optimistic about the future. Use the wise calendar throughout the. Now that we are coming to the end of 2024, it is time to say goodbye to the old year and start planning for 2025. Use the irs required minimum distribution. It links to your bank, credit cards and investment accounts, giving you a clear. Herrera suggests your essentials like food, housing. If you'd like, try out our online money saving challenge so you can easily track. Watch your savings grow with each contribution, turning numbers into a visual journey of achievement. Declare your independence from writing checks and visiting your bank or credit. Washington — being optimistic about the future may help people save more money, and the effect appears strongest. And at the end of the year, you’ll have $1,378. Use the calculator to see how small adjustments to your. Use the irs required minimum distribution. Money’s tight, debt’s climbing and saving feels impossible. The weekly income, saving & expenses (wise) money management calendar is a financial management tool for you and your family. 27 rows use the form below to customize your weekly savings chart for any date range. Now that we are coming to the end of 2024, it is time to say goodbye to the old year and start planning for 2025. Money calendar is the best for managing personal expenses, but it can also work for simple business income and. Money calendar is the best for managing personal expenses, but it can also work for simple business income and expenses. Use the irs required minimum distribution. This should include any side hustles or additional ways you make money. Using this free printable savings tracker is an easy way to set aside $2025 by the end of the year! Washington —. Use the wise calendar throughout the. Declare your independence from writing checks and visiting your bank or credit. Money calendar is the best for managing personal expenses, but it can also work for simple business income and expenses. Rocket money, formerly truebill, offers a comprehensive suite of budgeting and savings tools. Read my tips and trick on how to save. Read my tips and trick on how to save money now. Use the wise calendar throughout the. Rocket money, formerly truebill, offers a comprehensive suite of budgeting and savings tools. Adding money regularly helps your savings grow because every deposit increases the amount that earns interest. Money’s tight, debt’s climbing and saving feels impossible. Find out how to save money by using a calendar to track your savings and expenses. Now that we are coming to the end of 2024, it is time to say goodbye to the old year and start planning for 2025. Use the calculator to see how small adjustments to your. Use the irs required minimum distribution. 27 rows use the form below to customize your weekly savings chart for any date range. The weekly income, saving & expenses (wise) money management calendar is a financial management tool for you and your family. Herrera suggests your essentials like food, housing. Using this free printable savings tracker is an easy way to set aside $2025 by the end of the year! Watch your savings grow with each contribution, turning numbers into a visual journey of achievement. If you'd like, try out our online money saving challenge so you can easily track. Money calendar is the best for managing personal expenses, but it can also work for simple business income and expenses.52 Week Money Saving Challenge Template How to Save Money

How to Save 5000 in 26 Weeks A Simple Biweekly Savings Plan Money

Free Printable 52 Week Money Saving Challenge

10000 Money Saving Challenge Chart Printable

Money Saving Calendar Printable Calendars AT A GLANCE

52 Week Savings Challenge 2024 Printable

Money Saving Challenge Printable Save 1000 in 30 Days Savings Tracker

This Money Challenge Will Help You Save Over 1,300 A Year

52 Week Savings Challenge Printable Pdf Free

Printable Savings Tracker Sheets

It Links To Your Bank, Credit Cards And Investment Accounts, Giving You A Clear.

Declare Your Independence From Writing Checks And Visiting Your Bank Or Credit.

These Challenges Will Give You The Little Nudge.

The Drawback Is You Generally Can’t Tap Into That Money Until You’re At Least 59 ½ Years Old, Which Means If You Save Too Much, You Could Face An Expensive Liquidity Crisis.

Related Post: