Payroll Tax Calendar

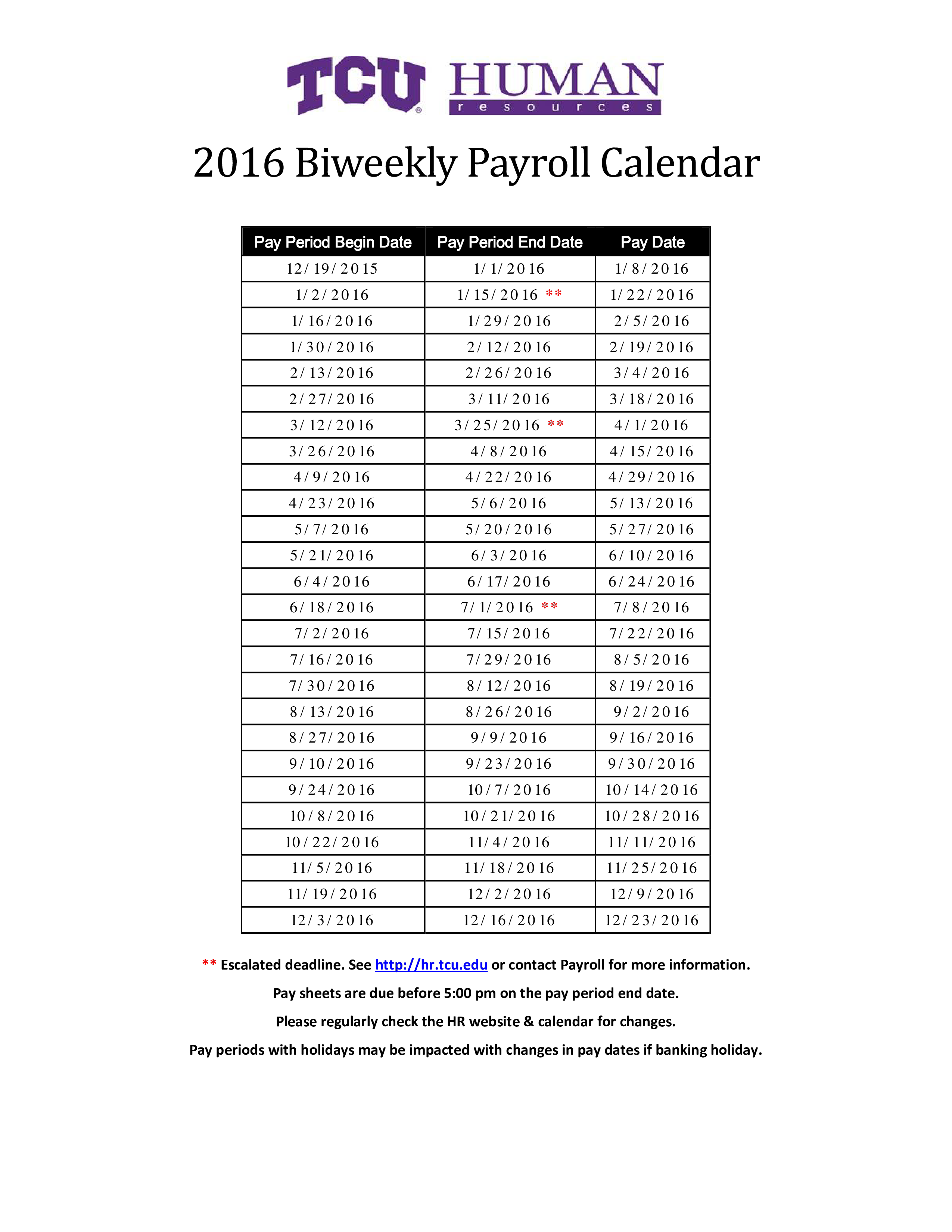

Payroll Tax Calendar - Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. Add the gsa payroll calendar to your individual calendar. Payroll professionals need to keep track of a dizzying number of federal tax reporting and withholding deadlines, as well as reporting requirements, throughout the year. Payroll tax calendar and tax due dates searching for a deposit due date or filing deadline? What they are, who is responsible for paying each one, the maximum amount you might need to pay, and other. Washington — the internal revenue service today. Never miss a critical deadline. Free file program now open; Below, we’ll cover the two types of payroll tax in illinois: Use the irs tax calendar to view filing deadlines and actions each month. For 2025, the “lookback period” is july 1, 2023, through june 30, 2024. It helps streamline the payroll process, keeping everything. Download the gsa payroll calendar ics file. April 15 is the deadline to file your federal income tax return for 2024 unless you request an extension.it's also the deadline to pay any taxes. Add the gsa payroll calendar to your individual calendar. Irs refunds can be issued as early as february 18. The universal calendar format, ics, is used by. This information is meant to be a general article. Friday for amounts withheld on the preceding. Employers and persons who pay excise taxes should also use the employer's tax. Download our 2025 payroll calendar to streamline payroll planning and help you ensure a smooth, predictable process for you and your employees. It helps streamline the payroll process, keeping everything. Never miss a critical deadline. The total tax reported on forms 941 during the “lookback period” is more than $50,000. See the employment tax due dates page for filing and. Free file program now open; It helps streamline the payroll process, keeping everything. Depending on the industry, the company size and the service offered, businesses can consider these four. Watch your mailboxes and check your bank accounts: Friday for amounts withheld on the preceding. Download our free 2025 calendar of important hr dates designed to help you stay on top of payroll and tax compliance. The calendar gives specific due dates for: From taxes and rti submissions to reporting like the gender pay gap, there are a lot of key payroll dates and tasks for your team to keep up with. The universal calendar. However, most federal tax refunds take longer. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. 27 for taxpayers in 25 states. It helps streamline the payroll process, keeping everything. The universal calendar format, ics, is used by. Depending on the industry, the company size and the service offered, businesses can consider these four. For more information on depositing and filing these forms, refer to publication 15, employer’s tax. Free file program now open; A payroll cutoff date is the deadline by which an employer needs to run payroll so that it can be processed by payday. This. For 2025, the “lookback period” is july 1, 2023, through june 30, 2024. Watch your mailboxes and check your bank accounts: Download our free 2025 calendar of important hr dates designed to help you stay on top of payroll and tax compliance. This information is meant to be a general article. All taxpayers are assigned to one of two payment. For 2025, the “lookback period” is july 1, 2023, through june 30, 2024. See the employment tax due dates page for filing and depositing due dates. Access the calendar online from your mobile device or desktop. Free file program now open; Below, we’ll cover the two types of payroll tax in illinois: Direct file available starting jan. For more information on depositing and filing these forms, refer to publication 15, employer’s tax. • filing tax forms, • paying taxes, and • taking other actions required by federal tax law. Access the calendar online from your mobile device or desktop. From taxes and rti submissions to reporting like the gender pay gap, there. Free file program now open; Download our free 2025 calendar of important hr dates designed to help you stay on top of payroll and tax compliance. See the employment tax due dates page for filing and depositing due dates. April 15 is the deadline to file your federal income tax return for 2024 unless you request an extension.it's also the. For more information on depositing and filing these forms, refer to publication 15, employer’s tax. This is the big one. Depending on the industry, the company size and the service offered, businesses can consider these four. Withholding income tax credits information and worksheets. From taxes and rti submissions to reporting like the gender pay gap, there are a lot of. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. Never miss a critical deadline. Use the irs tax calendar to view filing deadlines and actions each month. See the employment tax due dates page for filing and depositing due dates. Employers and persons who pay excise taxes should also use the employer's tax. This information is meant to be a general article. Free file program now open; This also depends on what pay date you use and the pay frequency. Payroll professionals need to keep track of a dizzying number of federal tax reporting and withholding deadlines, as well as reporting requirements, throughout the year. Withholding income tax credits information and worksheets. Download the gsa payroll calendar ics file. The total tax reported on forms 941 during the “lookback period” is more than $50,000. All taxpayers are assigned to one of two payment due date schedules: April 15 is the deadline to file your federal income tax return for 2024 unless you request an extension.it's also the deadline to pay any taxes. The universal calendar format, ics, is used by. The compliance calendar contains important payroll filing dates and information every payroll professional needs to know during the current calendar year such as:Biweekly Payroll Calendar Templates at

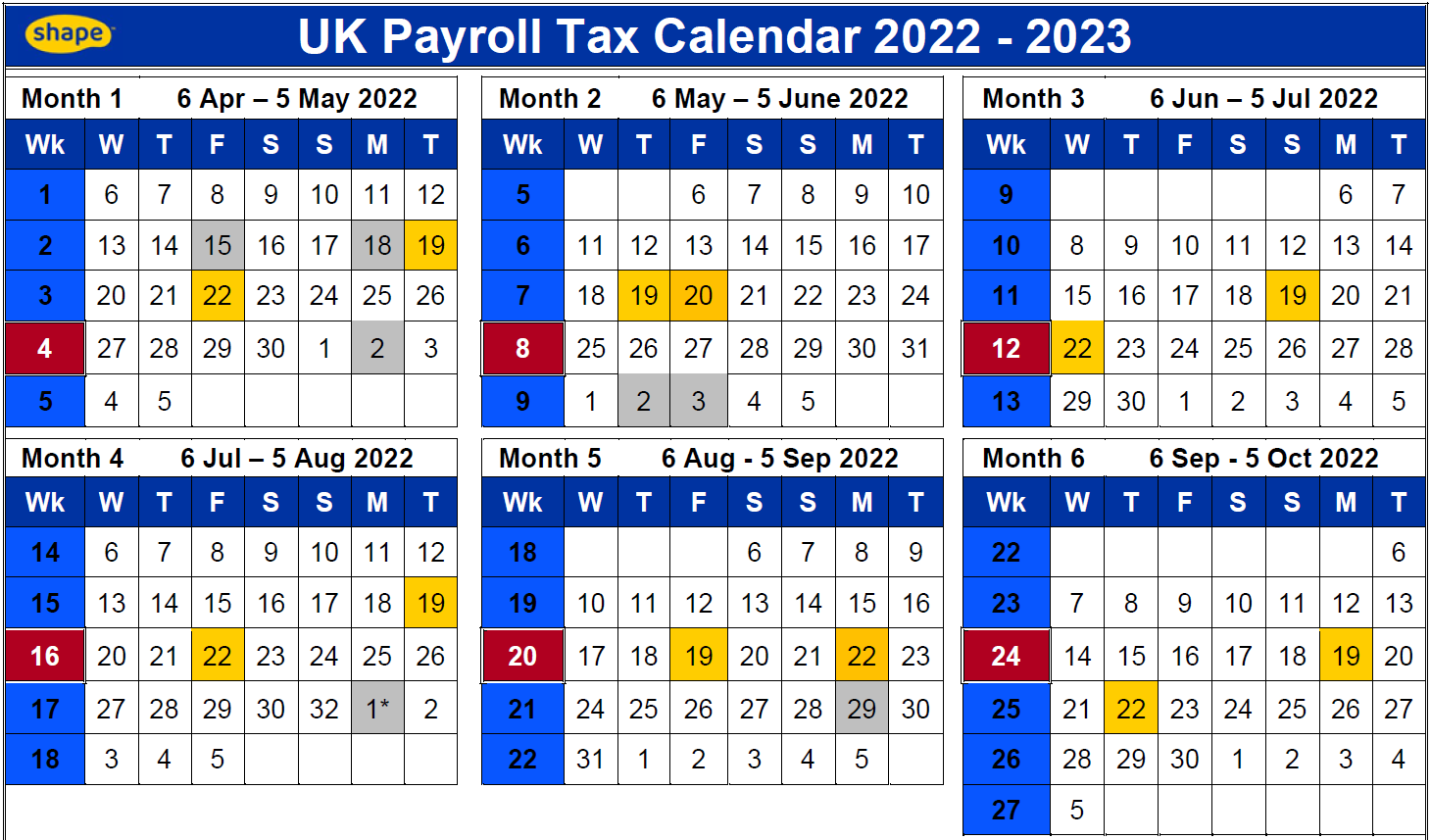

UK Payroll Tax Calendar 20222023 Shape Payroll

Biweekly Pay Schedule Template Awesome Payroll Calendar Template 10

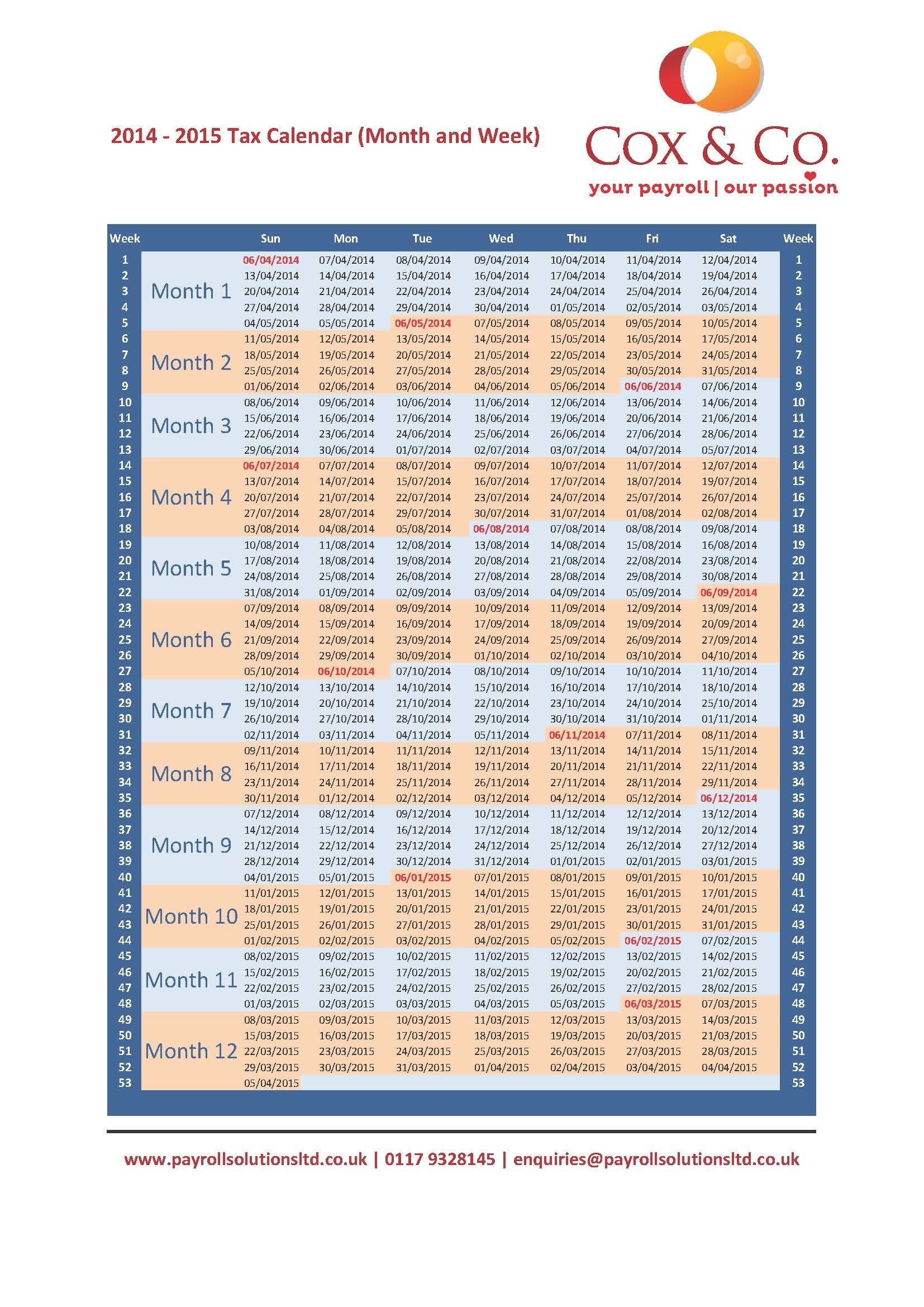

22 Year Tax Calendar Hmrc

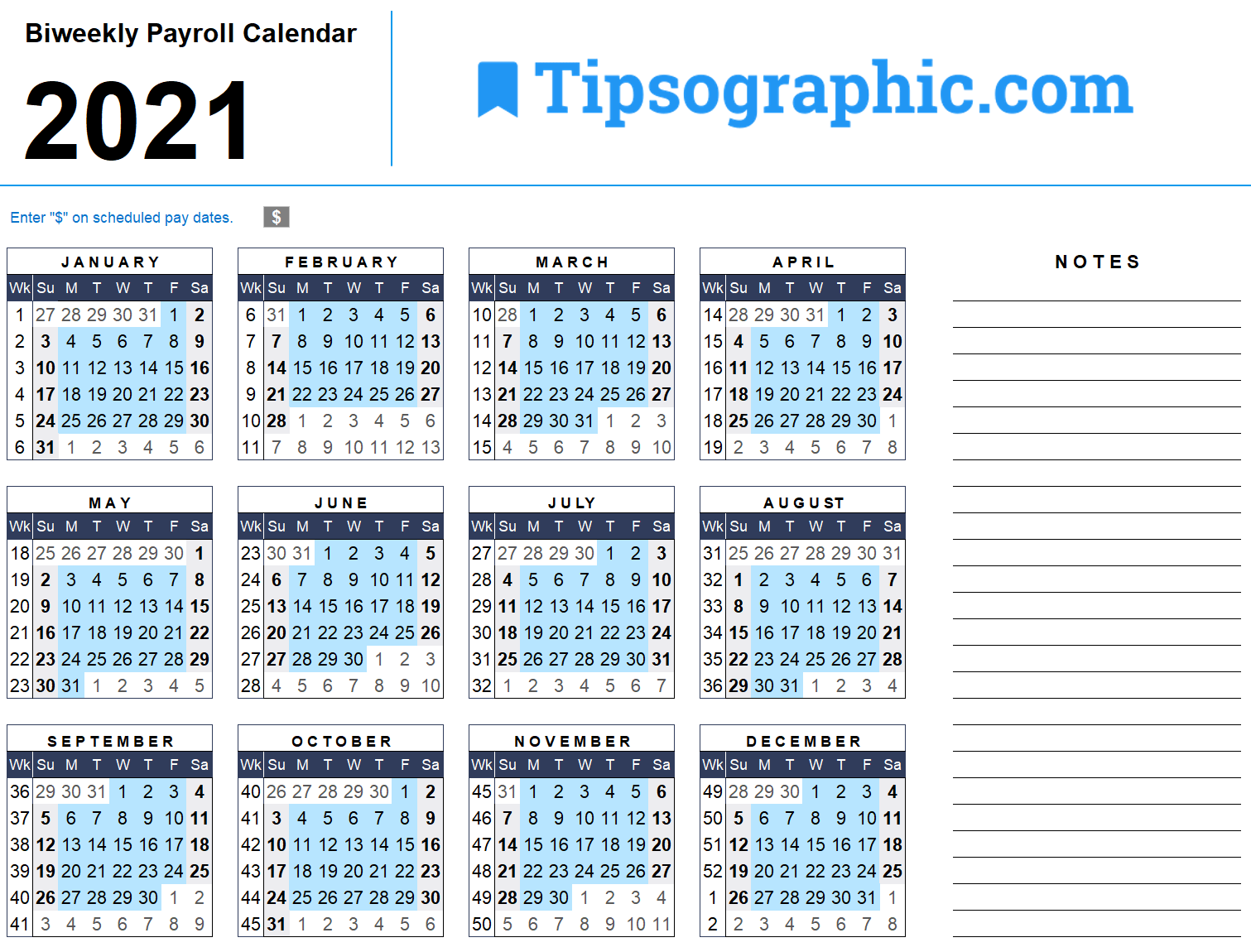

Bimonthly payroll calendar templates for 2021 QuickBooks

A payroll tax calendar that takes you month by month through the

Payroll Tax Calendar 20212022 Shape Payroll

Biweekly Payroll Tax Table 2021 Federal Withholding Tables 2021

2021 Pay Periods Federal

Payroll Tax Calendar 20252026 Robyn Christye

From Taxes And Rti Submissions To Reporting Like The Gender Pay Gap, There Are A Lot Of Key Payroll Dates And Tasks For Your Team To Keep Up With.

Irs Refunds Can Be Issued As Early As February 18.

Add The Gsa Payroll Calendar To Your Individual Calendar.

This Tax Calendar Has The Due Dates For 2025 That Most Taxpayers Will Need.

Related Post: