Put Calendar Spread

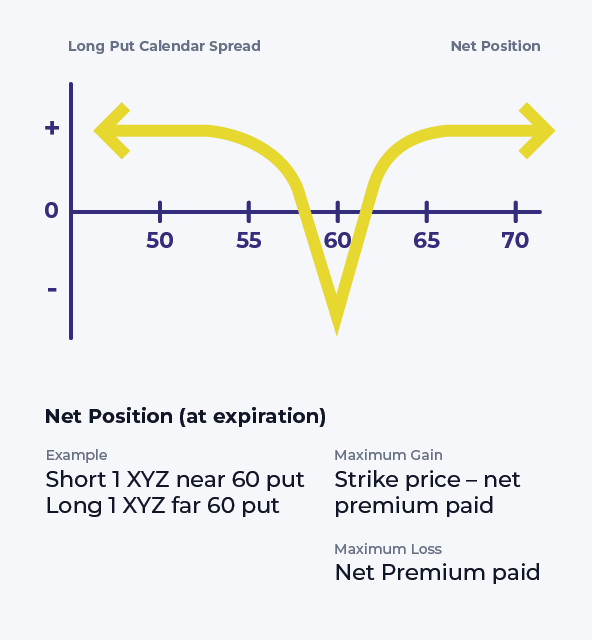

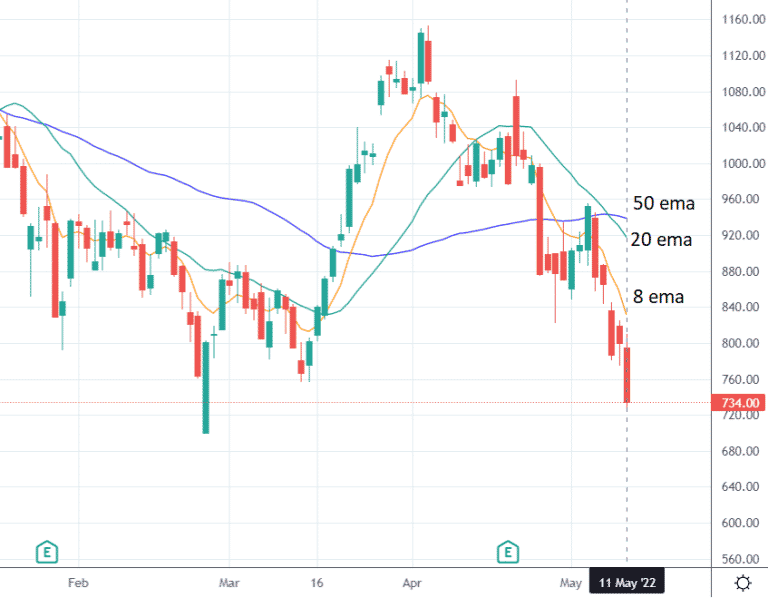

Put Calendar Spread - A short calendar spread with puts is created by. A bull put spread is an options strategy where you sell a put option at a higher price and buy one at a lower price for the same asset and expiration date. Long calendar spread with puts. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing. The put calendar spread, also known as a time spread, is a strategic options trading approach designed to profit from time decay (theta) and changes in implied volatility (iv). It is best suited for low to moderate volatility market. You will want the stock to hover around the strike. Learn how it works, when to use it, and. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. This is a short volatility strategy. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. First you use the sell to open order to write puts based on the particular security that you believe won't move in price. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing. A bull put spread is an options strategy where you sell a put option at a higher price and buy one at a lower price for the same asset and expiration date. Learn how it works, when to use it, and. The put calendar spread, also known as a time spread, is a strategic options trading approach designed to profit from time decay (theta) and changes in implied volatility (iv). Long calendar spread with puts. The calendar put spread involves buying and selling put options with different expirations but the same strike price. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. They are most profitable when the underlying asset does not change much until after the. Calendar spreads allow traders to construct a trade that minimizes the effects of time. First you use the sell to open order to write puts based on the particular security that you believe won't move in price. You will want the stock to hover around the strike. A put calendar spread is an options strategy that combines a short put. You will want the stock to hover around the strike. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. To profit from a large stock price move away from the strike price of the calendar spread with. First you use the sell to open order to write puts based on the particular security that you believe won't move in price. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. Learn how to use it.. A put calendar spread is an options strategy that combines a short put and a long put with the same strike price, at different expirations. It is best suited for low to moderate volatility market. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Calendar spreads allow traders to construct a trade. Learn how it works, when to use it, and. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar put spread, being one of the. A short calendar spread with puts is created by. Long calendar spread with puts. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing. First you use the sell to open order to write puts based on the particular security that. The calendar put spread involves buying and selling put options with different expirations but the same strike price. Learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. It is best suited for low to moderate volatility market. A short calendar spread with puts is created by. A put calendar spread is an options strategy that combines a short put and a long put with the. This is a short volatility strategy. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. The calendar put spread involves buying and selling put options with different expirations but the same strike price. It aims to profit. It aims to profit from time decay and volatility changes. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities instead of focusing. Learn how it works, when to use it, and. A bull put spread allows traders to earn income with managed risk,. The calendar put spread involves buying and selling put options with different expirations but the same strike price. The calendar put spread, being one of the three popular forms of calendar spreads (the other 2 being the calendar call spread and ratio calendar spread), is a neutral options strategy that. Learn how to use a long put calendar spread to combine a bearish and a bullish outlook on a stock. A short calendar spread with puts is created by. A bull put spread is an options strategy where you sell a put option at a higher price and buy one at a lower price for the same asset and expiration date. You will want the stock to hover around the strike. First you use the sell to open order to write puts based on the particular security that you believe won't move in price. The put calendar spread, also known as a time spread, is a strategic options trading approach designed to profit from time decay (theta) and changes in implied volatility (iv). They are most profitable when the underlying asset does not change much until after the. Learn how it works, when to use it, and. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. It is best suited for low to moderate volatility market. A bull put spread allows traders to earn income with managed risk, which can be a suitable strategy for moderately bullish markets. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Learn how to use it. This is a short volatility strategy.Calendar Spread Options Trading Strategy In Python

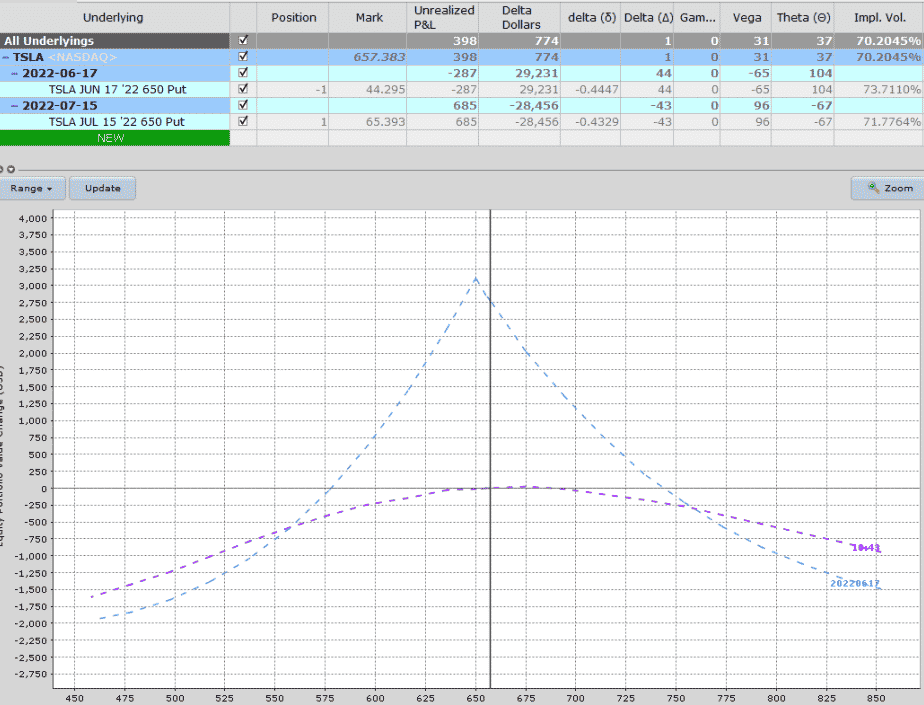

Put Calendar Spread Option Alpha

Bearish Put Calendar Spread Option Strategy Guide

Long Put Calendar Spread (Put Horizontal) Options Strategy

Put Calendar Spread Printable Word Searches

Bearish Put Calendar Spread Option Strategy Guide

Long Calendar Spread with Puts Strategy With Example

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Long Calendar Spread With Puts.

Use This Strategy When You’re Anticipating Minimal Movement On The Stock Within A Specific Time Frame.

The Complex Options Trading Strategy, Known As The Put Calendar Spread, Is A Type Of Calendar Spread That Seizes Opportunities From Time Decay And Volatility Disparities Instead Of Focusing.

It Aims To Profit From Time Decay And Volatility Changes.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://cdn.prod.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)