Rolling Calendar Year For Fmla

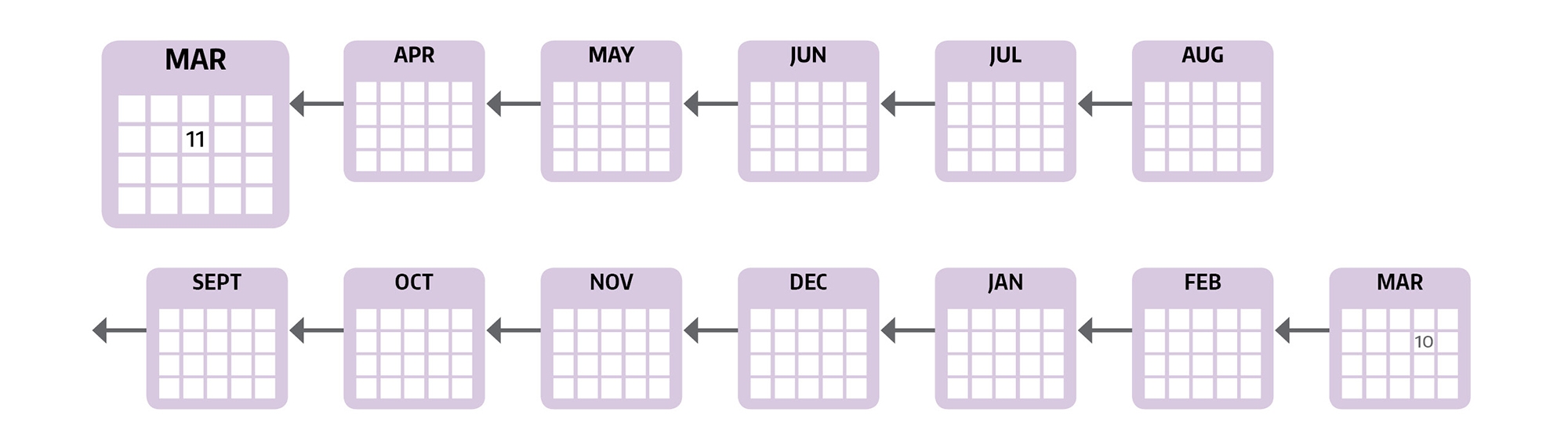

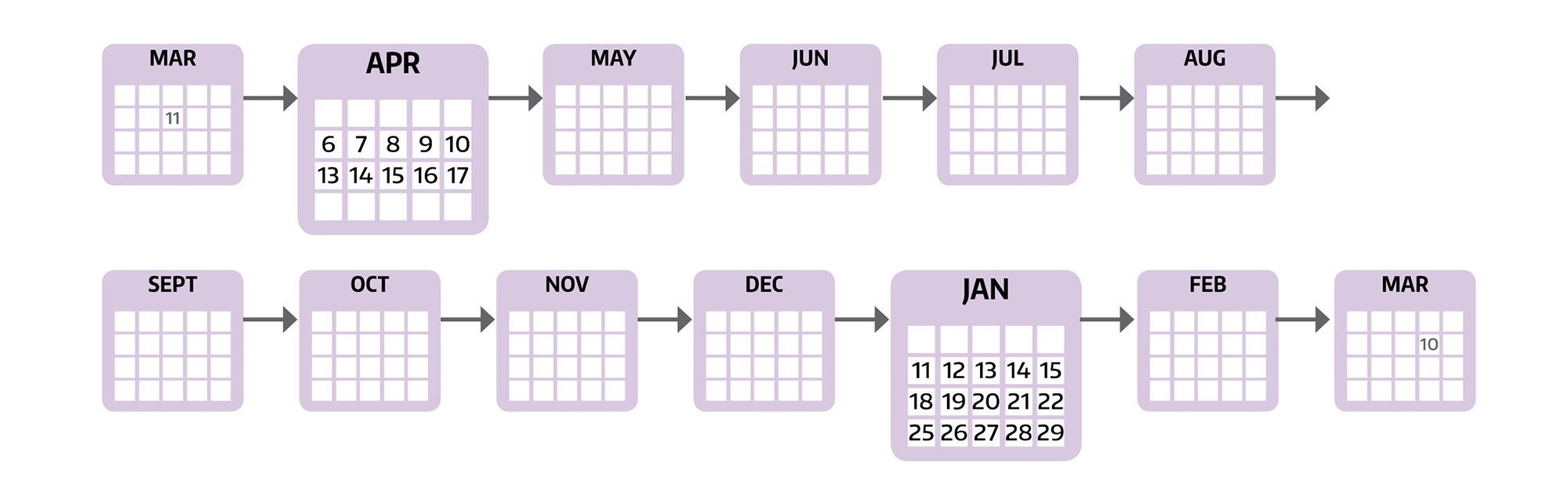

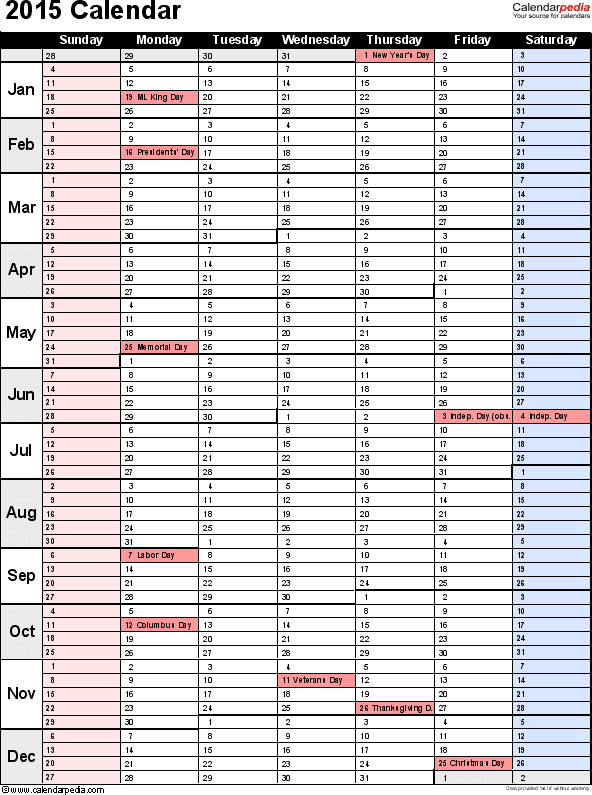

Rolling Calendar Year For Fmla - 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. The employee is eligible for up to. Navigating the fmla leave year options requires careful consideration for both employers and employees. Employers generally get to choose. Section 825.200 (b) of the regulations states that employers. The calendar year option is straightforward. Understanding the nuances of each method, from the calendar year to the rolling. This rolling method is more complex, but also more popular. Not surprisingly, most employers with savvy hr departments use. All employees who are eligible for fmla leave may use up to 12 workweeks of fmla leave from january 1st through december 31st. Navigating the fmla leave year options requires careful consideration for both employers and employees. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. Employers generally get to choose. Understanding the nuances of each method, from the calendar year to the rolling. Not surprisingly, most employers with savvy hr departments use. Section 825.200(b) of the regulations states that employers. Section 825.200 (b) of the regulations states that employers. If the employer doesn’t choose a calendaring method, the employer must. 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. Understanding the nuances of each method, from the calendar year to the rolling. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling. Section 825.200(b) of the regulations states that employers. This rolling method is more complex, but also more popular. Employers generally get to choose. Section 825.200 (b) of the regulations states that employers. All employees who are eligible for fmla leave may use up to 12 workweeks of fmla leave from january 1st through december 31st. Navigating the fmla leave year options requires careful consideration for both employers and employees. All employees who are eligible for fmla leave may use up to 12 workweeks of fmla leave from january 1st through december 31st. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. If the employer. 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. Section 825.200 (b) of the regulations states that employers. Employers generally. The employee is eligible for up to. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. All employees who are eligible for fmla leave may use up to 12 workweeks of fmla leave from january 1st through december 31st. 15, 2025 — the irs today issued guidance on the. The employee is eligible for up to. 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. Understanding the nuances of each method, from the calendar year to the rolling. The only leave year calculation that doesn't allow employees to stack. 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. The calendar year option is straightforward. Section 825.200 (b) of the regulations states that employers. If the employer doesn’t choose a calendaring method, the employer must. The only leave year calculation. The calendar year option is straightforward. Understanding the nuances of each method, from the calendar year to the rolling. Section 825.200 (b) of the regulations states that employers. Employers generally get to choose. If the employer doesn’t choose a calendaring method, the employer must. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. This rolling method is more complex, but also more popular. The calendar year option is straightforward. If the employer doesn’t choose a calendaring method, the employer must. Section 825.200 (b) of the regulations states that employers. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. The calendar year option is straightforward. If the employer doesn’t choose a calendaring method, the employer must. Section 825.200 (b) of the regulations states that employers. All employees who are eligible for fmla leave may use up to 12 workweeks. Understanding the nuances of each method, from the calendar year to the rolling. The calendar year option is straightforward. The employee is eligible for up to. Employers generally get to choose. If the employer doesn’t choose a calendaring method, the employer must. Navigating the fmla leave year options requires careful consideration for both employers and employees. 15, 2025 — the irs today issued guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and. All employees who are eligible for fmla leave may use up to 12 workweeks of fmla leave from january 1st through december 31st. The only leave year calculation that doesn't allow employees to stack their leave rights is called the rolling year method. This rolling method is more complex, but also more popular.Fmla Rolling Calendar Tracking Spreadsheet —

Fmla Calendar Year Vs Rolling Year Lilla Patrice

Fmla Rolling Calendar Tracking Spreadsheet with Fmla Rolling Calendar

Fmla Rolling Calendar Tracking Spreadsheet Google Spreadshee fmla

Fmla Calendar Year Vs Rolling Year Lilla Patrice

Fmla Calendar Year Vs Rolling Year Lilla Patrice

Fmla Calendar Year Or Rolling Abbye Annissa

Fmla Rolling Calendar Tracking Spreadsheet pertaining to Fmla Tracking

Fmla Rolling Calendar Tracking Spreadsheet Google Spreadshee fmla

Fmla Rolling Calendar Tracking Spreadsheet Google Spreadshee fmla

Section 825.200(B) Of The Regulations States That Employers.

Section 825.200 (B) Of The Regulations States That Employers.

Not Surprisingly, Most Employers With Savvy Hr Departments Use.

Related Post: