Roth Ira Calendar Year

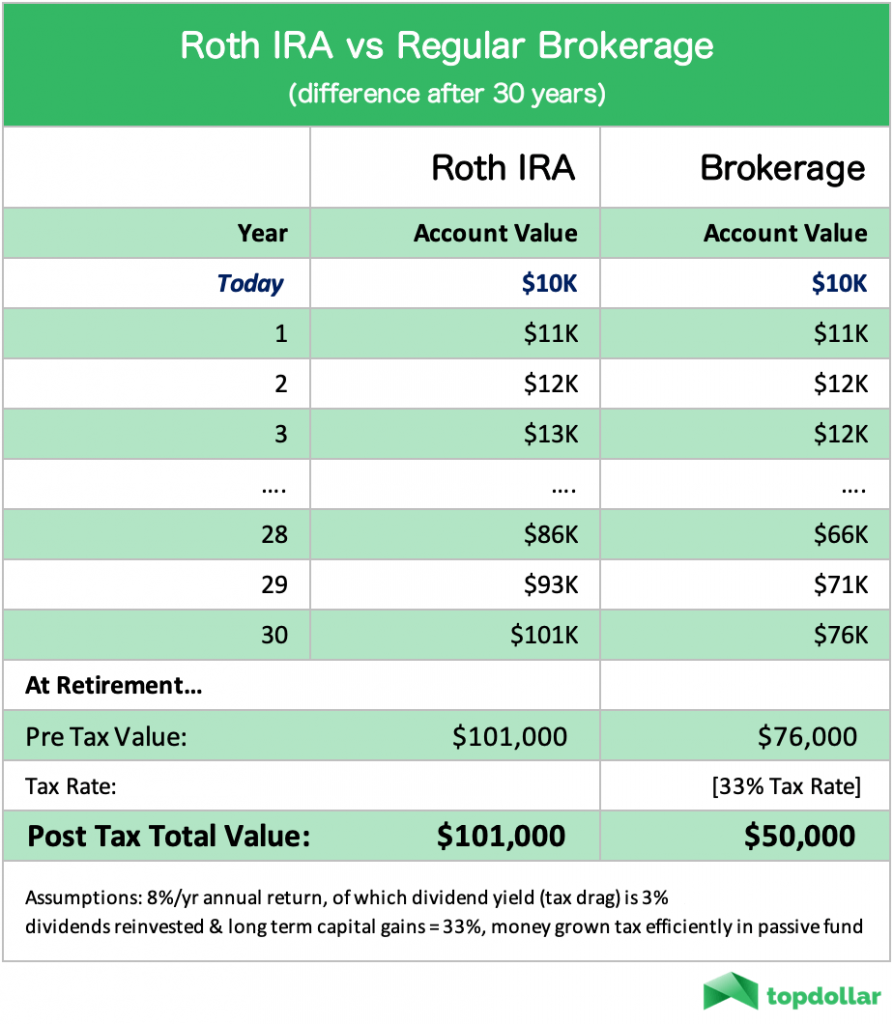

Roth Ira Calendar Year - If you open an ira before the. The irs updates the roth ira income limits every year to account for inflation and other changes. These rules can be complicated, but we break them both down for you with examples. For 2021, the deadline for roth ira contributions is april 15, 2022. You can make a 2024 ira contribution until april. The roth ira contribution limit for 2024 is $7,000 for those under 50,. Use a comparison chart to learn how to save money for your retirement with traditional and roth iras. For the tax year 2024, the roth ira contribution deadline is april 15, 2025. When you open an ira during this calendar year, you have until the income tax filing deadline to make an ira contribution. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. For the tax year 2024, the roth ira contribution deadline is april 15, 2025. The maximum contribution to a traditional ira or roth ira is $7,000 for 2024 and 2025. 27, 2025 how to start investing and saving The roth ira contribution limit for 2024 is $7,000 for those under 50,. Here's what you should know about roth ira contribution limits, and how you can avoid overcontributing. Your total taxable income for that year would be $175,000. Conversions are reported in the calendar. You can contribute up to $7,000 to your. If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2025, to make contributions for the 2024 tax year. You could contribute up to the full contribution limit, or up to 100% of your income, whichever is less. If you file your tax return early, you can. When you open an ira during this calendar year, you have until the income tax filing deadline to make an ira contribution. For 2021, the deadline for roth ira contributions is april 15, 2022. As 2024 comes to a close, here are six deadlines to consider when thinking about your benefits. You can contribute up to $7,000 to your. Conversions are reported in the calendar. If you saved in a 401(k) or ira during the past year, find out if you qualify for the saver's credit. For example, say you earned $75,000 in salary and converted $100,000 to your roth ira in the same calendar year. Here's how to use it. A new calendar year does not mean you. We break down these limits for tax years 2024 and 2025. For the tax year 2024, the roth ira contribution deadline is april 15, 2025. The maximum contribution to a traditional ira or roth ira is $7,000 for 2024 and 2025. The irs sets deadlines and contribution limits for both traditional and. If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2025, to make contributions for the 2024 tax year. Use a comparison chart to learn how to save money for your retirement with traditional and roth iras. The maximum contribution to a traditional ira or roth ira is $7,000 for 2024 and. You can contribute up to $7,000 to your. A new calendar year does not mean you. We break down these limits for tax years 2024 and 2025. If you file your tax return early, you can. These rules can be complicated, but we break them both down for you with examples. 27, 2025 how to start investing and saving A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. These rules can be complicated, but we break them both down for you with examples. If the irs offers an extension for filing taxes, the extension does not apply to. As 2024 comes to a close, here are six deadlines to consider when thinking about your benefits and finances. Here's how to use it. For the tax year 2024, the roth ira contribution deadline is april 15, 2025. These rules can be complicated, but we break them both down for you with examples. The irs updates the roth ira income. The maximum contribution to a traditional ira or roth ira is $7,000 for 2024 and 2025. As 2024 comes to a close, here are six deadlines to consider when thinking about your benefits and finances. Here is how it works. Tori brovet and carole hodorowicz feb 13, 2025. For 2021, the deadline for roth ira contributions is april 15, 2022. You can contribute up to $7,000 to your. If you open an ira before the. If you saved in a 401(k) or ira during the past year, find out if you qualify for the saver's credit. The roth ira contribution limit for 2024 is $7,000 for those under 50,. You can only rollover ira funds once every 12 months. When you open an ira during this calendar year, you have until the income tax filing deadline to make an ira contribution. For the tax year 2024, the roth ira contribution deadline is april 15, 2025. You can only rollover ira funds once every 12 months. We break down these limits for tax years 2024 and 2025. You could contribute. If you have a traditional ira or roth ira, you have until the tax deadline, or april 15, 2025, to make contributions for the 2024 tax year. Here's what you should know about roth ira contribution limits, and how you can avoid overcontributing. For example, say you earned $75,000 in salary and converted $100,000 to your roth ira in the same calendar year. You cannot deduct contributions to a roth ira. 27, 2025 how to start investing and saving If you file your tax return early, you can. The maximum contribution to a traditional ira or roth ira is $7,000 for 2024 and 2025. The irs sets deadlines and contribution limits for both traditional and roth retirement accounts. The roth ira contribution limit for 2024 is $7,000 for those under 50,. With a roth ira, you pay tax now. Your total taxable income for that year would be $175,000. You can contribute up to $7,000 to your. The irs updates the roth ira income limits every year to account for inflation and other changes. For the tax year 2024, the roth ira contribution deadline is april 15, 2025. These rules can be complicated, but we break them both down for you with examples. Each year, the irs sets a contribution limit for your roth ira.Roth Ira Contribution Calendar Year Terry

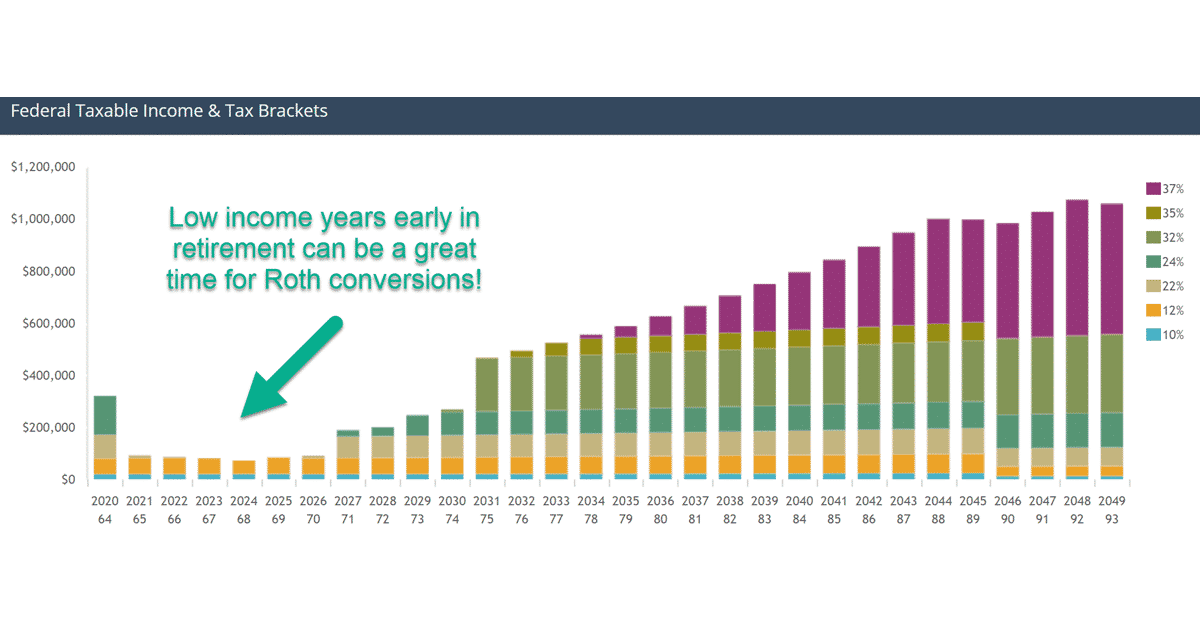

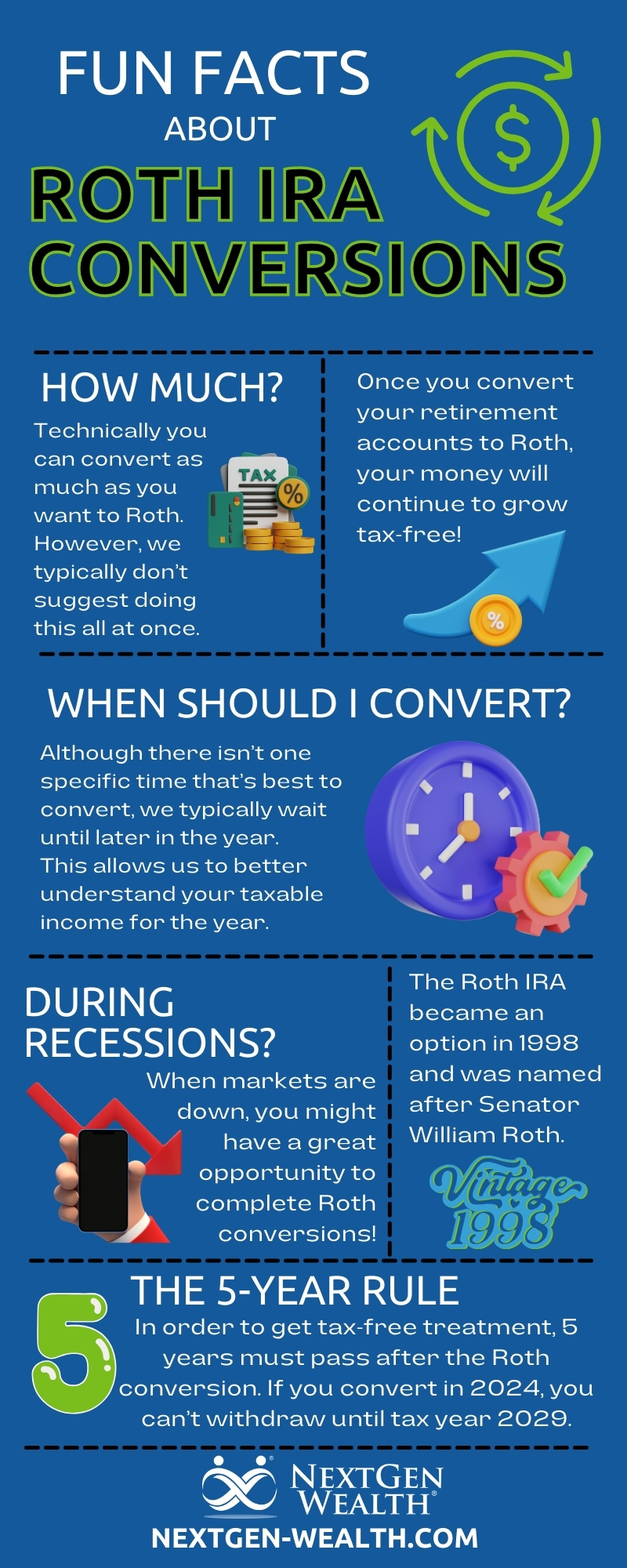

Roth Conversion Calendar Year Naoma Vernice

Roth Ira Contrisifma Settlement Calendar 2024 Britni Savina

Roth Conversion Calendar Year Naoma Vernice

Roth IRA Tracker Yearly Budget Printable Etsy

Roth IRA Tracker Yearly Budget Printable Etsy

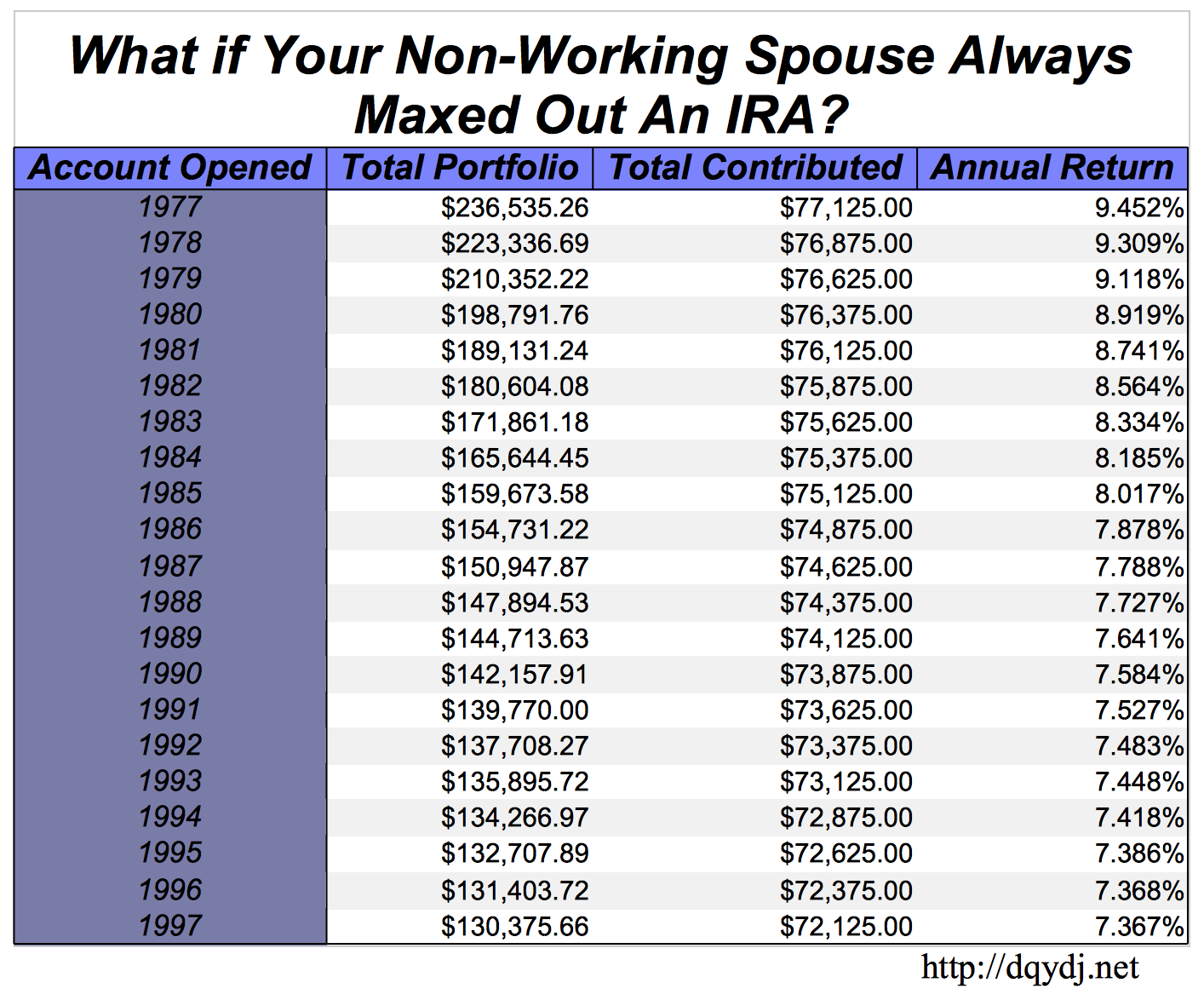

if i max out my roth ira every year how much will i have Choosing

Roth Ira 2025 Per Calendar Year Calculator Star Zahara

2024 Roth Ira Limits 2024 Date Dyanna Devinne

The Best Time of Year for a Roth IRA Conversion

Use This Calendar To Keep Up With All The Stock Market Holidays.

You Have From January 1 Of The Tax Year To April 15 Of The Following Year (When Your Tax Return Is Typically Due) To Fund Your Roth Ira.

Use A Comparison Chart To Learn How To Save Money For Your Retirement With Traditional And Roth Iras.

If You Saved In A 401(K) Or Ira During The Past Year, Find Out If You Qualify For The Saver's Credit.

Related Post: