Sales Tax Calendar

Sales Tax Calendar - The next upcoming due date for each filing schedule is marked in. The cdtfa assigns a filing frequency (quarterly prepay, quarterly, monthly, fiscal yearly, yearly) based on your reported sales tax or your anticipated taxable sales at the time of registration. Effective january 1, 2025, retailers previously obligated to collect and remit illinois use tax (ut) on retail sales sourced outside of illinois and made to illinois customers are now subject to. Texas comptroller sales tax holiday. On this page we have compiled a calendar of all sales tax due dates for pennsylvania, broken down by filing frequency. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. On this page we have compiled a calendar of all sales tax due dates for illinois, broken down by filing frequency. The calendar below details the dates for each exemption period. If the due date falls on a weekend or holiday, the report and. Proponents like brooke lierman, the maryland state comptroller, say consumers use sales tax holidays to keep more money in their wallets and stimulate the economy. Instructions are available at floridarevenue.com/forms for. Sales tax regulations and obtaining resale certificates to legally. With varying due dates, staying organized can be challenging. The next upcoming due date for each filing schedule is marked in. Meeting sales tax deadlines is crucial for ecommerce businesses to avoid fines and penalties. 4 beds, 3 baths ∙ 3312 n california st, chicago, il 60618 ∙ $550,000 ∙ mls# 12288092 ∙ this enchanting home in the avondale neighborhood boasts a delightful. On this page we have compiled a calendar of all sales tax due dates for new york, broken down by filing frequency. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. The next upcoming due date for each filing schedule is marked in green. The 2024 florida legislature passed, and governor desantis signed into law, four sales tax holidays. Use the irs tax calendar to view filing deadlines and actions each month. With varying due dates, staying organized can be challenging. Prepayments are due by the 20th of the current month, and returns for the period are due on or by the 20th of the following month. On this page we have compiled a calendar of all sales tax. State sales tax rates range from 0% to over 7%, with local jurisdictions often imposing additional taxes that can substantially increase the total. On this page we have compiled a calendar of all sales tax due dates for illinois, broken down by filing frequency. Access the calendar online from your mobile device or desktop. Proponents like brooke lierman, the maryland. The next upcoming due date for each filing schedule is marked in. Proponents like brooke lierman, the maryland state comptroller, say consumers use sales tax holidays to keep more money in their wallets and stimulate the economy. On this page we have compiled a calendar of all sales tax due dates for pennsylvania, broken down by filing frequency. Washington —. Direct file available starting jan. Texas comptroller sales tax holiday. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. On this page we have compiled a calendar of all sales tax due dates for illinois, broken down by filing. With varying due dates, staying organized can be challenging. Meeting sales tax deadlines is crucial for ecommerce businesses to avoid fines and penalties. The next upcoming due date for each filing schedule is marked in green. 4 beds, 3 baths ∙ 3312 n california st, chicago, il 60618 ∙ $550,000 ∙ mls# 12288092 ∙ this enchanting home in the avondale. With varying due dates, staying organized can be challenging. Sales tax collections for local governments and other local taxing entities in new york state totaled $23.4 billion in calendar year 2024, up 1.6 percent (or nearly $376 million). On this page we have compiled a calendar of all sales tax due dates for new york, broken down by filing frequency.. Sales tax regulations and obtaining resale certificates to legally. On this page we have compiled a calendar of all sales tax due dates for texas, broken down by filing frequency. On this page we have compiled a calendar of all sales tax due dates for new york, broken down by filing frequency. Effective january 1, 2025, retailers previously obligated to. On this page we have compiled a calendar of all sales tax due dates for texas, broken down by filing frequency. If the due date falls on a weekend or holiday, the report and. Meeting sales tax deadlines is crucial for ecommerce businesses to avoid fines and penalties. If you only make payments electronically, review the filing deadlines in the. Washington — the internal revenue service today. 4 beds, 3 baths ∙ 3312 n california st, chicago, il 60618 ∙ $550,000 ∙ mls# 12288092 ∙ this enchanting home in the avondale neighborhood boasts a delightful. Meeting sales tax deadlines is crucial for ecommerce businesses to avoid fines and penalties. The calendar below details the dates for each exemption period. This. The next upcoming due date for each filing schedule is marked in green. The next upcoming due date for each filing schedule is marked in. Free file program now open; The next upcoming due date for each filing schedule is marked in green. Washington — the internal revenue service today. 4 beds, 3 baths ∙ 3312 n california st, chicago, il 60618 ∙ $550,000 ∙ mls# 12288092 ∙ this enchanting home in the avondale neighborhood boasts a delightful. Sales tax collections for local governments and other local taxing entities in new york state totaled $23.4 billion in calendar year 2024, up 1.6 percent (or nearly $376 million). On this page we have compiled a calendar of all sales tax due dates for texas, broken down by filing frequency. To verify your new combined sales tax rate (i.e., state 1 and local sales taxes), go to the mytax illinois tax rate finder at mytax.illinois.gov and select rates for january 2025. The 2024 florida legislature passed, and governor desantis signed into law, four sales tax holidays. On this page we have compiled a calendar of all sales tax due dates for illinois, broken down by filing frequency. This tax calendar has the due dates for 2025 that most taxpayers will need. Effective january 1, 2025, retailers previously obligated to collect and remit illinois use tax (ut) on retail sales sourced outside of illinois and made to illinois customers are now subject to. The next upcoming due date for each filing schedule is marked in green. If the due date falls on a weekend or holiday, the report and. Meeting sales tax deadlines is crucial for ecommerce businesses to avoid fines and penalties. Prepayments are due by the 20th of the current month, and returns for the period are due on or by the 20th of the following month. Access the calendar online from your mobile device or desktop. Free file program now open; Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. If you only make payments electronically, review the filing deadlines in the instructions for your specific tax or fee return or report.How to Calculate Sales Tax in Excel Tutorial YouTube

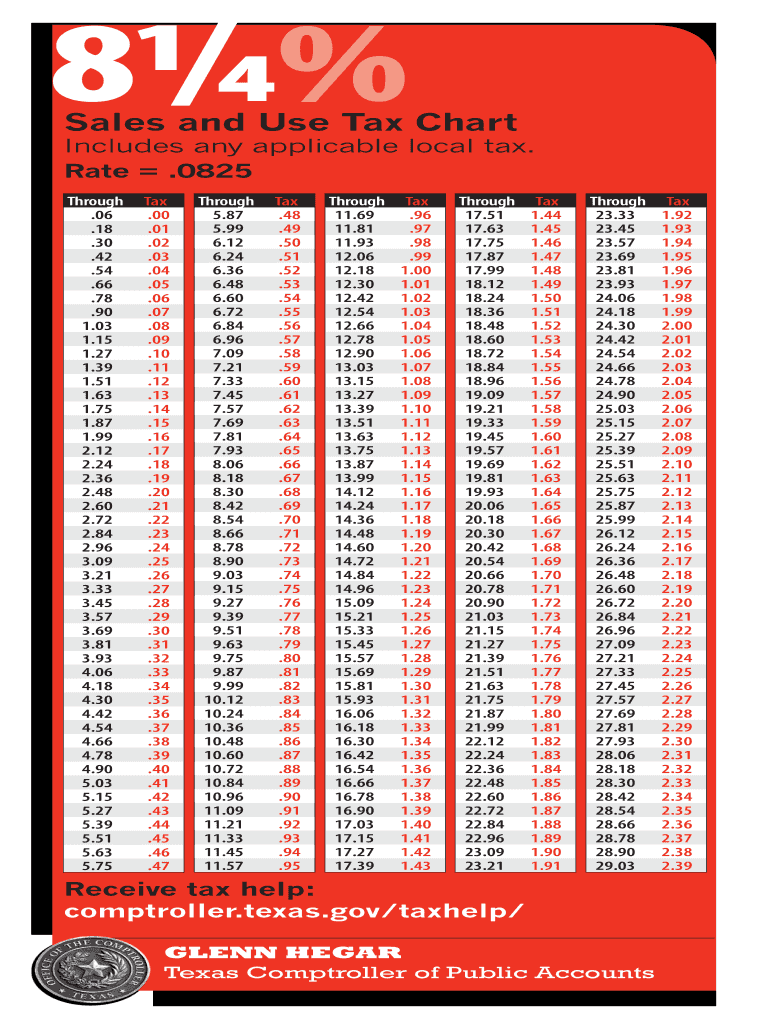

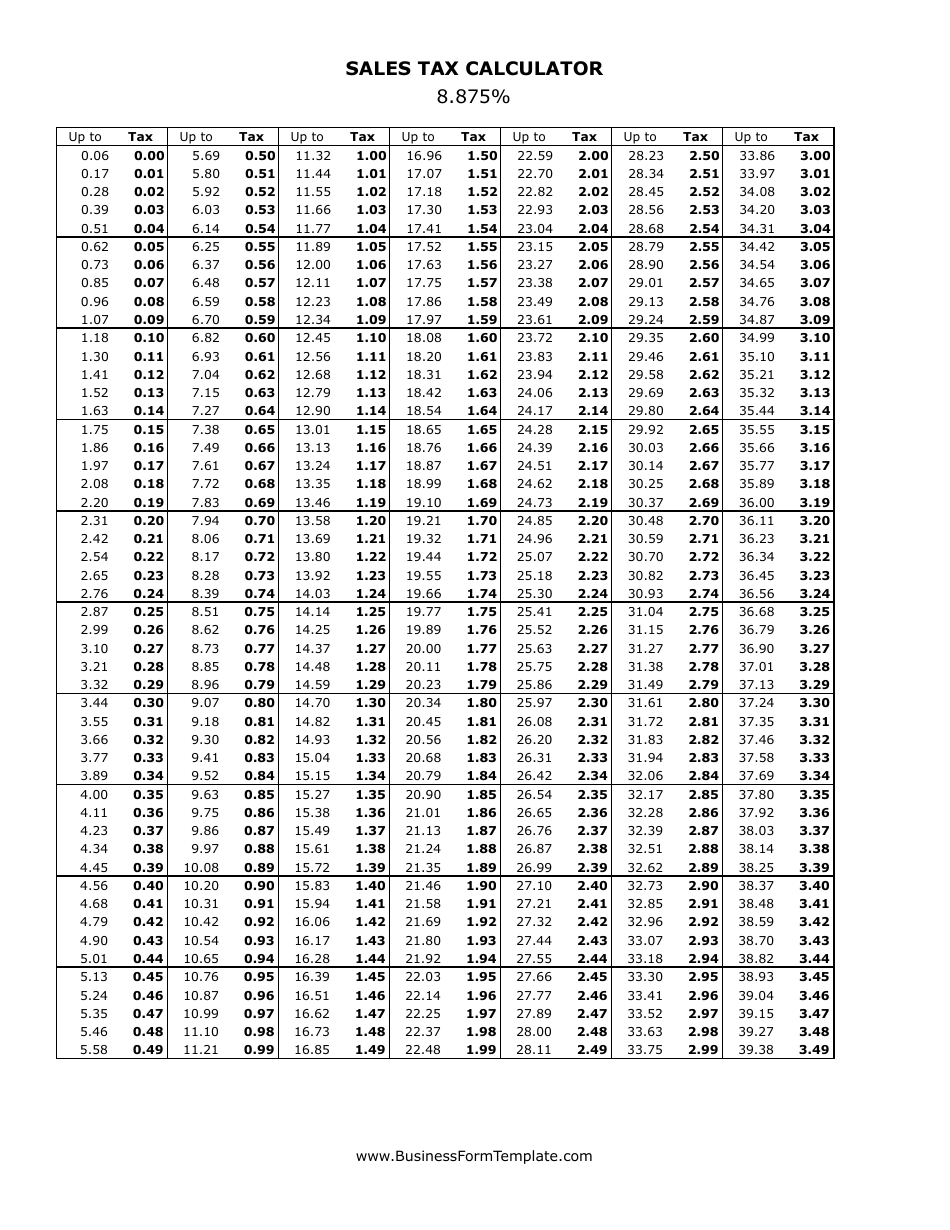

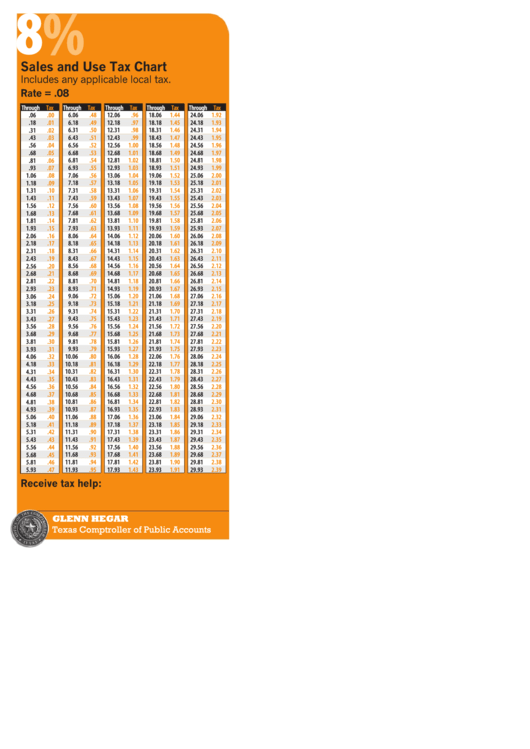

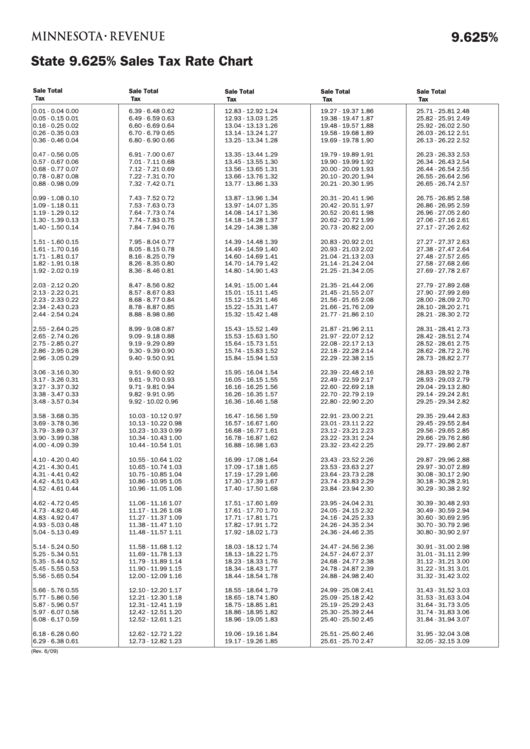

Printable Sales Tax Chart

Sales Tax Chart Printable

Printable Sales Tax Chart Printable Calendars AT A GLANCE

Sales Tax Due Dates 2024 Tildi Constanta

Sales Tax Spreadsheet Templates —

Printable Sales Tax Chart

Sales Tax Chart Printable

Printable Sales Tax Chart

Printable Sales Tax Chart

Proponents Like Brooke Lierman, The Maryland State Comptroller, Say Consumers Use Sales Tax Holidays To Keep More Money In Their Wallets And Stimulate The Economy.

The Next Upcoming Due Date For Each Filing Schedule Is Marked In Green.

Instructions Are Available At Floridarevenue.com/Forms For.

Washington — The Internal Revenue Service Today.

Related Post: