Short Calendar Spread

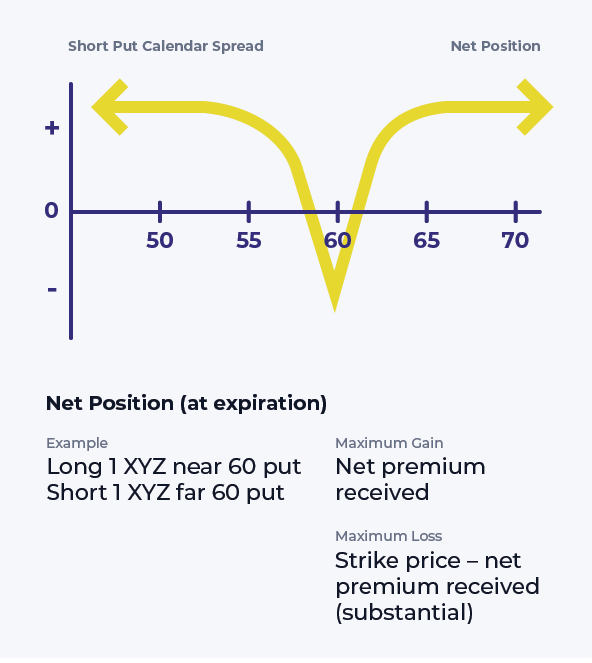

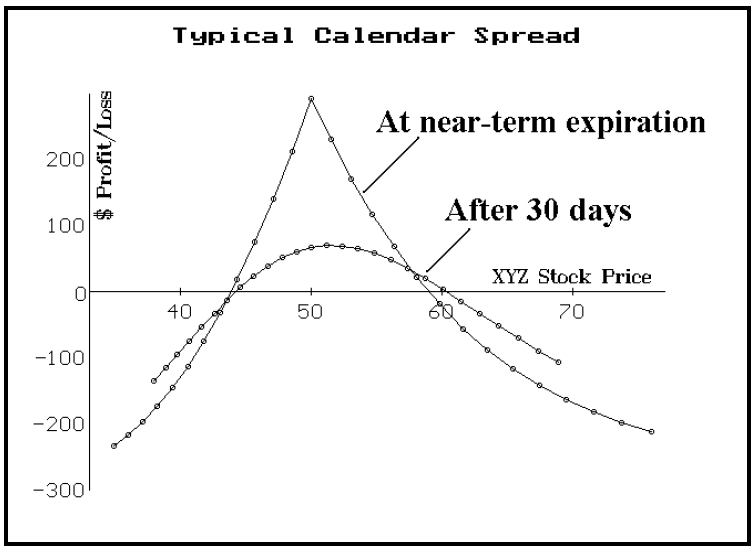

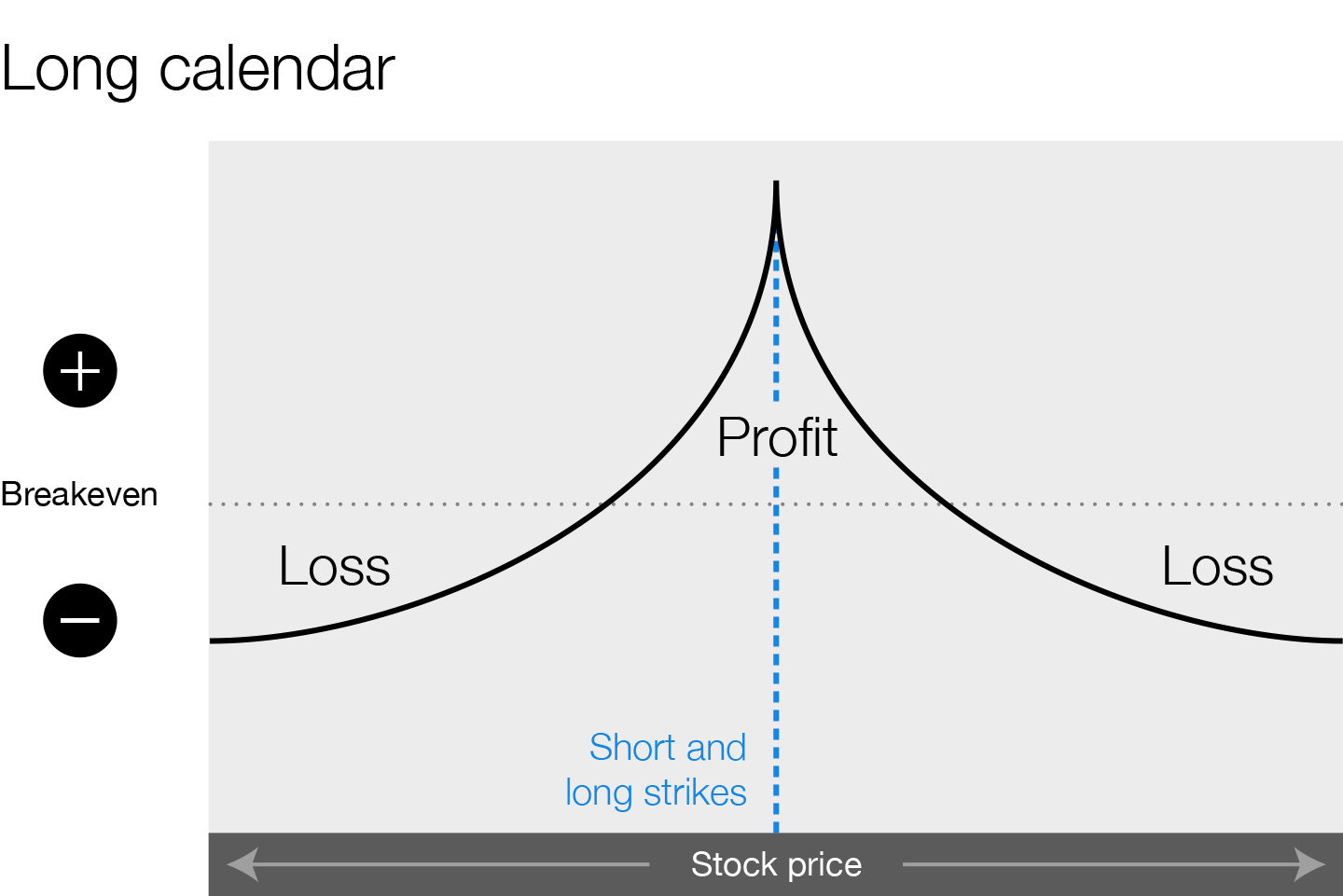

Short Calendar Spread - Buy 1 tsla $720 call expiring in 30 days for $25 Read on to learn more about how to build calendar spreads and when to use them. Initialize initialize method, set the start date, end date, cash, and option universe. We’ll also discuss the maximum profit potential and maximum risk of these options strategies so. A call calendar spread is an options strategy that consists of: Calendar spreads are a fantastic option trade as you’re about to find out. Trading in high implied volatility environments; Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. This strategy allows traders to profit from time decay in the short option while maintaining long exposure for potential price movement. Imagine tesla (tsla) is trading at $700 per share and you expect significant price movement in either direction due to an upcoming earnings report. So, you select a strike price of $720 for a short call calendar spread. Imagine tesla (tsla) is trading at $700 per share and you expect significant price movement in either direction due to an upcoming earnings report. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Initialize initialize method, set the start date, end date, cash, and option universe. Calendar spreads are a fantastic option trade as you’re about to find out. The short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will move. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. The typical calendar spread trade involves the sale of an option (either a call or put) with a. What is a call calendar spread? Selling an option contract you don’t yet own creates a “short” position. So, you select a strike price of $720 for a short call calendar spread. The strategy involves two options contracts: It aims to profit from time decay and volatility changes. Buy 1 tsla $720 call expiring in 30 days for $25 Read on to learn more about how to build calendar spreads and when to use them. Read on to learn more about how to build calendar spreads and when to use them. In this article, we’ll explain the ins and outs of short call calendar spreads, from what they are to how you can use them to generate profits. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price.. You place the following trades: Imagine tesla (tsla) is trading at $700 per share and you expect significant price movement in either direction due to an upcoming earnings report. Trading in high implied volatility environments; This guide covers types of calendar spreads, setup methods, and risk management tips. The strategy involves two options contracts: A key distinction within this group of strategies is between long and short calendar spread options. It aims to profit from time decay and volatility changes. The typical calendar spread trade involves the sale of an option (either a call or put) with a. Imagine tesla (tsla) is trading at $700 per share and you expect significant price movement in. It’s an excellent way to combine the benefits of directional trades and spreads. The short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will move. You can go either long or. One major strategy is the calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or. How does the short calendar spread work, and what are the potential benefits and risks? To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Imagine tesla (tsla) is trading at $700 per share and you expect significant price movement in either. The strategy most commonly involves calls with the same strike (horizontal spread), but can also be done with different strikes (diagonal spread). Short call calendar spread example. Follow these steps to implement the short call calendar spread strategy: Initialize initialize method, set the start date, end date, cash, and option universe. You can go either long or short with this. For example, you can buy a call option at the $200 strike price that expires after 20 weeks for a $15 premium. Short call calendar spread example. You place the following trades: Follow these steps to implement the short call calendar spread strategy: Buy 1 tsla $720 call expiring in 30 days for $25 Calendar spreads are a fantastic option trade as you’re about to find out. How does the short calendar spread work, and what are the potential benefits and risks? Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Initialize initialize method, set the start date, end date, cash,. Imagine tesla (tsla) is trading at $700 per share and you expect significant price movement in either direction due to an upcoming earnings report. Calendar spreads combine buying and selling two contracts with different expiration dates. Calendar spread trading involves buying and selling options with different expiration dates but the same strike price. Both options have the same strike price but different expiration dates. The strategy involves two options contracts: To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A calendar spread is a strategy used in options and futures trading: How does the short calendar spread work, and what are the potential benefits and risks? A call calendar spread is an options strategy that consists of: Selling an option contract you don’t yet own creates a “short” position. You can go either long or short with this strategy. So, you select a strike price of $720 for a short call calendar spread. We’ll also discuss the maximum profit potential and maximum risk of these options strategies so. Looking for negative theta positions The short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but you are unsure in which direction it will move. A key distinction within this group of strategies is between long and short calendar spread options.Short Put Calendar Spread Options Strategy

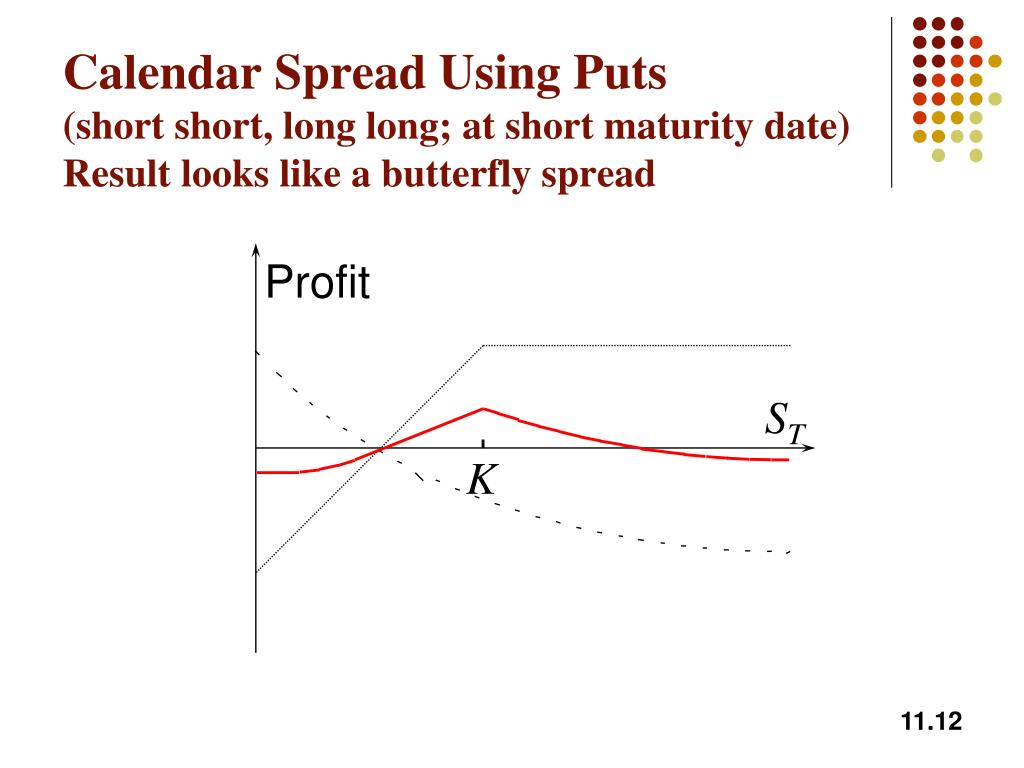

PPT Trading Strategies Involving Options PowerPoint Presentation

Short Calendar Put Spread Staci Elladine

Calendar Call Spread Option Strategy Heida Kristan

Calendar Spread Options Trading Strategy In Python

How to Profit with a Short Calendar Spread Options Cafe

Short Calendar Spread Printable Word Searches

Calendar Spreads Option Trading Strategies Beginner's Guide to the

What Is A Calendar Spread Option Strategy Mab Millicent

Short Put Calendar Spread Printable Calendars AT A GLANCE

I Employ This Approach When:

When You Trade A Long Calendar Spread, It Is A Debit Position So The Maximum Amount You Can Lose Is The Amount That You Paid.

Here Is An Example Of What A Basic Long Calendar Spread Looks Like:

In This Article, We’ll Explain The Ins And Outs Of Short Call Calendar Spreads, From What They Are To How You Can Use Them To Generate Profits.

Related Post: