Short Put Calendar Spread

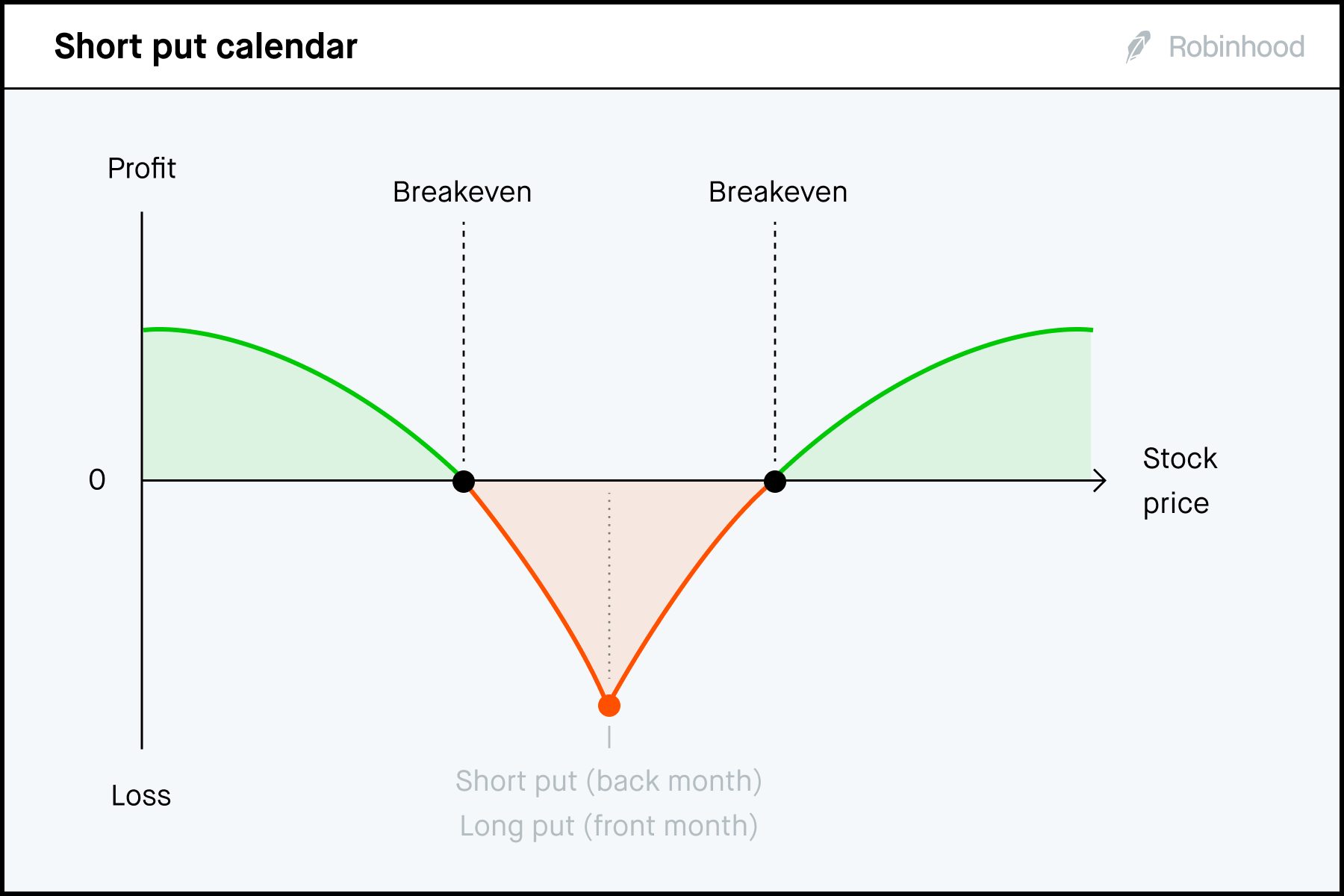

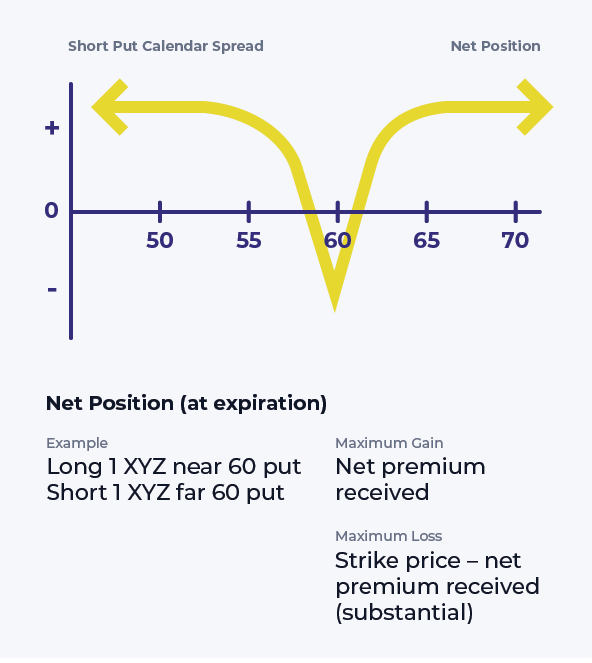

Short Put Calendar Spread - Follow these steps to implement the. You think it’s going to stay roughly the same in the short term so you decide to open a calendar spread. When to apply a short calendar put spread? Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. The differences between the two strategies. Short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date. Both the diagonal calendar put spread and the horizontal calendar put spread makes their maximum profit when the underlying stock closes at the strike price of the short put options. A short put calendar spread is another type of spread that uses two different put options. The put calendar spread is ideal for traders who expect the underlying stock to stay near the strike price in the short term but anticipate a potential increase in volatility or price movement. Long put calendar spreads profit from a slightly lower move down in the underlying stock. Suppose amazon (amzn) is trading at $3,300 per share and you anticipate significant volatility due to an antitrust investigation. Short put calendar spread example. You start by selling next month’s $110 call option for $2.95. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. It is best suited for low to moderate volatility market. The strategy most commonly involves puts with the. The differences between the two strategies. A short call calendar spread involves selling a call option with a longer expiration date while buying a call option with a shorter expiration date at. The strategy most commonly involves puts with the. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. You think it’s going to stay roughly the same in the short term so you decide to open a calendar spread. The typical calendar spread trade involves the sale of an option (either a call or put). With a short put calendar spread, the two options have the same strike price but. The complex options trading strategy, known as the. A short call calendar spread involves selling a call option with a longer expiration date while buying a call option with a shorter expiration date at. The calendar put spread involves buying and selling put options with different expirations but the same strike price. A short put calendar spread is another type of spread that uses two different put options.. Short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Short put calendar spread example. Follow these steps to implement the. To profit. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Selling an option contract you don’t yet own creates a “short” position. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and. This strategy profits from an increase in price movement. With a short put calendar spread, the two options have the same strike price but. Selling an option contract you don’t yet own creates a “short” position. A short call calendar spread involves selling a call option with a longer expiration date while buying a call option with a shorter expiration. The typical calendar spread trade involves the sale of an option (either a call or put). Follow these steps to implement the. Short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date. You think it’s going to stay roughly the same in the short term so you. The strategy most commonly involves puts with the. When to apply a short calendar put spread? A short put calendar spread is another type of spread that uses two different put options. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. You start by selling. Follow these steps to implement the. Suppose amazon (amzn) is trading at $3,300 per share and you anticipate significant volatility due to an antitrust investigation. When to apply a short calendar put spread? Long put calendar spreads profit from a slightly lower move down in the underlying stock. It is best suited for low to moderate volatility market. Selling an option contract you don’t yet own creates a “short” position. Short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both puts have the same expiration date. The put calendar spread is ideal for traders who expect the underlying stock to stay near the strike price in the short term but anticipate. You think it’s going to stay roughly the same in the short term so you decide to open a calendar spread. This strategy profits from an increase in price movement. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. It is best suited for low. With a short put calendar spread, the two options have the same strike price but. Long put calendar spreads profit from a slightly lower move down in the underlying stock. Both the diagonal calendar put spread and the horizontal calendar put spread makes their maximum profit when the underlying stock closes at the strike price of the short put options. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. It is best suited for low to moderate volatility market. This strategy profits from an increase in price movement. Suppose amazon (amzn) is trading at $3,300 per share and you anticipate significant volatility due to an antitrust investigation. You think it’s going to stay roughly the same in the short term so you decide to open a calendar spread. The short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price, but you aren't. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. The strategy most commonly involves puts with the. Selling an option contract you don’t yet own creates a “short” position. The strategy most commonly involves puts with the. The typical calendar spread trade involves the sale of an option (either a call or put). You start by selling next month’s $110 call option for $2.95. A short put calendar spread is another type of spread that uses two different put options.Advanced options strategies (Level 3) Robinhood

Short Put Calendar Short put calendar Spread Reverse Calendar

Options Trading Made Easy Ratio Put Calendar Spread

Short Put Calendar Spread Printable Calendars AT A GLANCE

Short Put Calendar Spread Option Samurai Blog

Short Put Calendar Spread Options Strategy

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Short Calendar Put Spread Staci Elladine

Put Calendar Spread Printable Word Searches

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The Calendar Put Spread Involves Buying And Selling Put Options With Different Expirations But The Same Strike Price.

The Put Calendar Spread Is Ideal For Traders Who Expect The Underlying Stock To Stay Near The Strike Price In The Short Term But Anticipate A Potential Increase In Volatility Or Price Movement.

The Complex Options Trading Strategy, Known As The Put Calendar Spread, Is A Type Of Calendar Spread That Seizes Opportunities From Time Decay And Volatility Disparities Instead Of Focusing.

A Short Call Calendar Spread Involves Selling A Call Option With A Longer Expiration Date While Buying A Call Option With A Shorter Expiration Date At.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://cdn.prod.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)